3 Trends That Could Push Gold Higher in 2018

Commodities / Gold and Silver 2018 Jan 23, 2018 - 03:44 PM GMTBy: GoldSilver

There were some curious developments in the gold sector last year, most of which have flown under the radar of mainstream press reports. And the more they ignore what’s happening, the greater the surprise to the upside will be. It could indeed be very exciting for those of us that are overweight precious metals and have stayed the course.

While stocks and cryptos dominated last year’s headlines, check out these developments in the lonely gold industry (these are in addition to the other developments we reported).

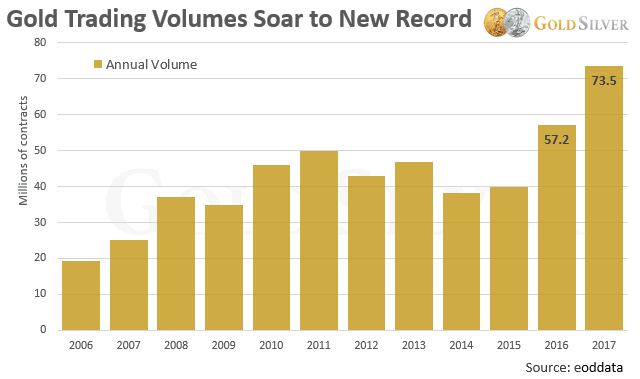

1) COMEX Gold Trading Volumes Hit All-Time High

Unbeknownst to most investors, gold trading volumes on the COMEX hit a record high last year.

With no fanfare, the amount of gold contracts traded on the COMEX soared to a new record. Higher than 2011 when the gold price was on fire, and higher than when traders dumped their holdings in 2013. More than triple the levels of 2006.

In other words…

• Interest in gold trading has never been higher

To be clear, this data measures “trading” activity, so it includes both buys and sells. But the jump in volume over the past two years is bullish because prices were rising (it would be bearish if prices were falling). Gold was up 8.1% in 2016, and 12.1% in 2017.

Despite the drop in bullion sales, traders at the world’s biggest futures market are buying more gold contracts than they’re selling, a staunch base-building indicator.

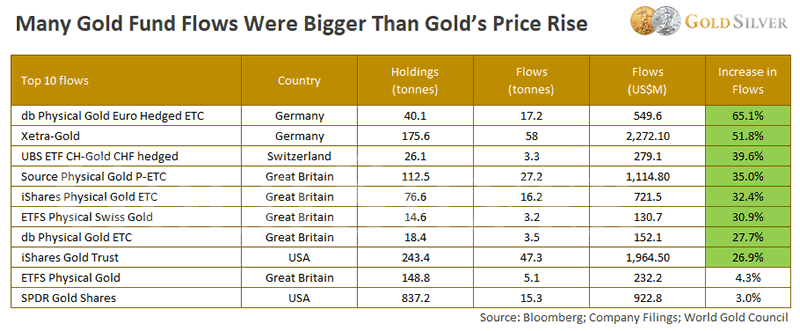

2) Gold ETF Inflows Were Greater Than Gold’s Rise

The World Gold Council is not a US-centric agency, and those of us that live and work in North America may not be aware of exactly what’s happening elsewhere around the globe. Their recent report on global gold ETFs was very interesting.

This table shows the activity of the top 10 gold-backed ETFs in 2017. You and I don’t buy paper gold products, but the activity here can measure interest. Check out that last column, which shows the percentage increase in holdings—the ones I highlighted in green saw holdings rise more than the price of gold.

You can see that holdings in eight separate funds jumped anywhere from two to over five times more than the gold price!

German funds accounted for 35% of total net inflows last year. Xetra-Gold alone added 58 tonnes, a 52% increase worth a whopping $2.2 billion.

While not all countries saw this level of growth, it’s clear that many investors see a pressing need to add more gold to their portfolios. This once again shows that when fear is high, investors seek the safe haven of gold.

• Investors in Europe, Great Britain, and even the US continue to buy gold to shield against the elevated risks they see

What is it they see coming? There are lots of potential events that would send the gold price sharply higher, including a stock market crash or the fallout from soaring debt levels, but the point is they are buying because they see something coming that gold can insure them against.

3) Silk Road Demand Exceeds Global Production

Our friend Nick Laird at Goldchartsrus tracks gold demand from the “Silk Road” countries—China, Russia, India, and Turkey. You can see from his latest chart that demand from these four nations has exploded over the past 10 years.

Check out the bottom part of the chart, though…except for three months last year, demand was greater than total global production.

This trend obviously can’t last. It explains why we continually see exports from developed world countries to these nations, especially China. At some point, the demand for physical metal will exceed what is readily available in investment form and will push prices higher on its own.

But it’s the message behind these elevated buying levels that is most important. Just like ETF buyers, regardless of the reasons, these four emerging countries see the need to continue to accumulate huge amounts of bullion.

• Silk Road countries continue to hoard massive amounts of gold

And this level of buying isn’t about to let up. You’ve probably heard about the “One Belt, One Road” project, which will link China, Central Asia, and Europe. It is probably the biggest infrastructure project ever attempted by mankind. And the World Gold Council says this will have significant implications for the gold industry; demand will jump due to improvements in efficiency and access.

Again, there are multiple potential reasons for this level of buying. Mike has warned about many of them before. But if these countries see the need to keep buying gold, well, maybe we should, too.

These three developments are staunchly bullish indicators. They clearly signal that many investors around the world see a pressing need to hold gold. I encourage you to stay the course and make sure you own enough physical metal to withstand the type of events and crises that, like us, these investors see coming.

Source: https://goldsilver.com/blog/gold-trends-to-push-prices-in-2018/

© 2018 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.