US Housing Market - Only One Sub-prime cockroach?

Housing-Market / US Housing Mar 29, 2007 - 11:24 AM GMTBy: Hans_Wagner

One of the Trading Rules identified by Dennis Gartman of The Gartman Letter states that there is never only just one cockroach. If you see one, you know more are hiding in the walls and behind the counters. Investors who seek to beat the market should carefully consider this principle when they are considering investments in sectors that are experiencing trouble. They also might want to read Ahead of the Curve: A Commonsense Guide to Forecasting Business and Market Cycles ![]() by Joe Ellis is an excellent book on how to predict macro moves of the market.

by Joe Ellis is an excellent book on how to predict macro moves of the market.

Well, as I mentioned in earlier commentaries, the problems in the sub-prime mortgage market are going to become more significant over time. Where there is one cockroach, there will be many more. For example, www.lenderimplode.com lists 39 sub-prime mortgage firms that have either shut down or been taken over so far.

New Century Financial, one of the largest sub-prime mortgage lenders, stopped taking new loan applications, and they are no longer continuing the origination or funding of mortgage loans. New Century is experiencing a wave of lenders who are demanding that they take back the mortgages they sold. The market is betting that they will be unable to do so. Nor will they be able to sell any of their current mortgages they originated, as no one would buy them. All lenders that have generated some sub-prime mortgages are facing the same problem. Those with sufficient capital will be able to absorb the losses. Those that are undercapitalized or have much larger exposure to the sub-prime market will likely go under. As a result many of the buyers of the Mortgage Backed Securities are going to lose some money.

As I mentioned before, sub-prime mortgages are pooled and then divided into different risk tranches. The most risky of these tranches are the equity portion of the pools, typically about 4%. These equity portions are again put into pools with 80% of these equity portions now getting investment-grade ratings. It is these pools of mortgage backed securities that are losing money for their investors.

As the problem grows the rating agencies are going to encounter problems due to their failure to properly identify the risks of these securities. Watch out for the lawyers as they make their case.

So how did this happen. Maybe a brief story will help present the case. In the past when many of us obtained our mortgages, we went through what seemed like an exhaustive process providing our lender all our financial details including income, assets, savings, debit history, tax returns etc. All this documentation helped to assure that each of us had the means to afford the payments and were likely to meet our obligations.

Then along came the more aggressive mortgage companies that found they could sell the loans they generated to lenders who packaged them into the Mortgage Backed Securities mentioned earlier. These mortgage firms were able to generate substantial volumes of loans without all the formal documentation that characterized earlier mortgage applications. With the low rates provided by the Federal Reserve it was easy to get borrowers to commit to loans they may not be able to afford.

Let's look at a hypothetical, example that is based on facts from real circumstances. John worked as a laborer making about $30,000 per year and he was current on his payments on his two credit cards with limits of $2,000 and $4,000. He bought a new house in 2005 for $400,000 with the builder picking up the closing costs. He found a mortgage company that offered to help him buy his first home with no money down and an 80/20 loan. This means that he did not have to pay any money into his first house. Further, he does not have to pay PMI or mortgage insurance. John pays on the 80% first loan, meaning he is not paying down the mortgage, but rather increasing his debt. The negative amortization loan helps him afford the payments.

So after a couple of years John owes more than $420,000 on his house. He also realizes that he has overpaid for the house and it hasn't appreciated in value like he thought. In fact he probably owes more than $100,000 than the house is worth. There are also a number of other houses for sale in his neighborhood all for sale at much less than he owes on his mortgage.

So what are John's options? He can try to refinance, but with the tighter mortgage requirements now, he cannot get a loan. He cannot keep up with the payments, so that won't work. If he can sell the house, he will owe the difference between what he gets from the sale and his outstanding mortgage, leaving him still in debt. That one is hard to take for a first time home buyer. Or he can walk away and let the house go into foreclosure. Those holding the mortgage will then lose money. Likely they will also look for ways to recover their investment by hiring a lawyer. Not a good situation for anyone, except maybe the lawyers. Oh, and John no longer owns a home and is facing bankruptcy.

Recently a special committee to the Federal Reserve warned to expect a rise in the number of foreclosures. In fact sub-prime mortgages represent about 20% of the total market with more than 50% of these loans ending up in foreclosure. Expect the trend to continue to rise.

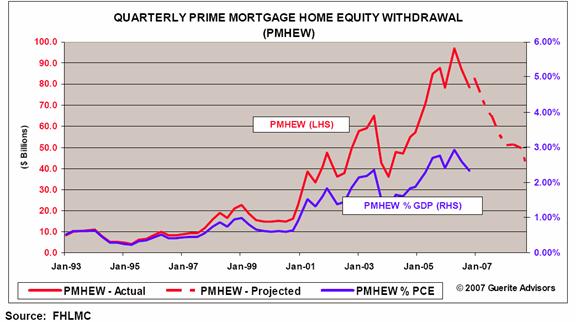

This problem is expanding into the prime mortgage market as well. Hugh Moore of Guerite Research uses what he calls Prime Mortgage Home Equity Withdrawals (PMHEW):

"Based on data from FHLMC (Freddie Mac), PMHEW grew from an average 0.55% of GDP between 1993 and 2000 to an average 1.93% between 2001 and 2006. It reached an astonishing 2.93% of GDP in the second quarter of 2006. However, Freddie Mac is projecting that PMHEW will decline 20% in 2007 and an additional 30% in 2008; 43% below 2006 levels. Such a drop could reduce GDP by 1% to 2% over a two-year period of time. The decline in PMHEW is due to the fact that the mortgages most likely to be refinanced in 2007, 2008 (and 2009) were originated in 2004 and 2005 and housing prices have appreciated little since then. In short, those homeowners most likely to refinance are running out of excess equity."

The chart below shows that Freddie Mac expects PMHEW to drop by more than 50%. Keep in mind that this is based on current housing valuations.

The bottom line is that consumers are going to have less to spend, causing further downward pressure on the U.S. economy. Will this cause the U.S. to go into a recession? Only time will tell. This situation should put upward pressure on long term rates as funding institutions tighten up their credit standards and borrowing criteria. It is also likely to help slow the economy as new home construction slows due to the growing inventory of new and existing homes for sale. There will also be pressure from Congress to do something about this terrible situation. This means the market will be closely watching the housing numbers over the next few weeks to see if the problem is getting worse. Something we all must monitor.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.