Prospecting For Silver During Recessions

Commodities / Gold & Silver 2019 Sep 04, 2019 - 04:10 PM GMTBy: Kelsey_Williams

I am continually amazed at how every turn in the numbers and the economy seems to present new information that is bullish for gold and silver. The train of logic becomes downright laughable at times.

I am continually amazed at how every turn in the numbers and the economy seems to present new information that is bullish for gold and silver. The train of logic becomes downright laughable at times.

Other than entertaining in a perverse sort of way, the various proclamations and conclusions end up sooner or later in confliction with each other.

One of the more glaring examples involves buying gold and silver because of the possibility of a recession. Why?

A recession is an economic event; a slowdown in economic activity that is not associated with conditions that would lead to higher prices for the metals. Those slowdowns are normally associated with a lessening in the effects of inflation and a stronger US dollar, at least relatively so.

If the conditions are bad enough, they could lead to a depression which would be accompanied by actual deflation. Deflation is an increase in purchasing power for the dollar, and results in lower prices for goods and services. Your dollars would buy more, not less. There would be significantly less dollars available but they would be worth more per unit. During the Great Depression, the price of silver fell.

Expecting higher prices for gold and silver under those conditions would be counterintuitive. And, the argument is more negative for silver.

That is because silver is primarily an industrial metal. Industrial production slows during recessions, so one should not expect higher silver prices.

So how did silver fare in previous recessions? Let’s take a look.

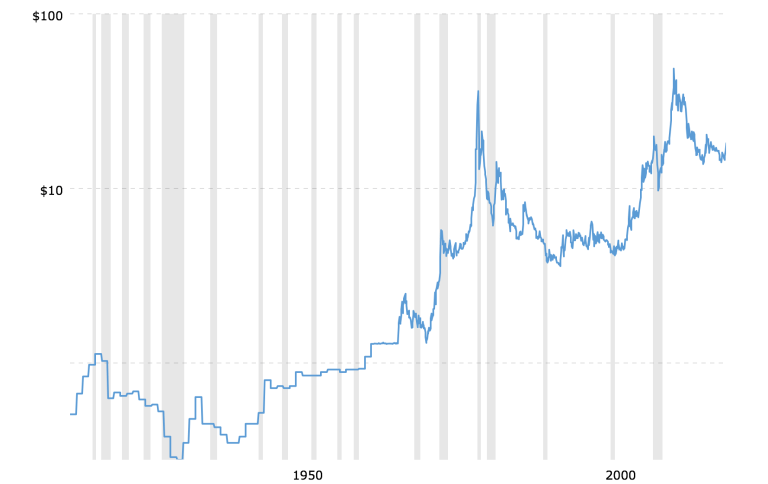

Below is a 100-year history of silver prices. Recessions are indicated by the shaded gray areas…

(source)

During the past fifty years, there have been seven recessions…

Recession #1 – The first of those began in November 1969. At that time, silver was just under $2.00 per ounce. One year later, in November 1970, silver traded just below $1.60 per ounce – a decline of twenty percent during the recession.

Since silver had hit an all-time high of near $2.50 per ounce in mid-1968, and was in the midst of a decline that continued until it reached $1.30 per ounce in October 1971, we might not be inclined to attach much significance to its decline during the recession. That decline of twenty percent referenced in the paragraph above came within the context of a much bigger move that shaved nearly fifty percent from silver’s price. So, let’s reserve judgement until we see more data.

Recession #2 – The next recession began in February 1974, right as silver was peaking at $6.80 per ounce. Fourteen months later, April 1975, marked the end of the recession. At that point silver was trading at $4.35 per ounce, a decline of thirty-six percent.

Even though silver was in a sizable uptrend during which it had increased in price more than five-fold over the previous couple of years, it seemed to turn on a dime as the recession unfolded. And, as in our previous example, silver continued to decline after the recession ended. Its low came in March 1976, two years after the recession ended. By that time silver was trading under $4.00 per ounce, and its total decline from peak to trough was close to forty-five percent.

Recession #3 – A recession began in January 1980. It was short and lasted only 6 months. Silver dropped during that time frame from its peak of $50.00 per ounce to a low of $15.00 per ounce by July 1980. The chart above shows a peak average price of $36.00 per ounce and an average monthly price of $18.00 per ounce when the recession ended. Depending on which set of numbers you use, the decline amounted to either seventy percent or fifty percent. And silver’s price continued to decline after the recession ended.

Recession #4 – Fourteen months later, June 1981 marked the onset of the next recession. Silver was down to $8.75 per ounce by then. By the end of that recession a year later, silver traded as low as $4.90 per ounce, a further decline of forty-four percent.

Recession #5 – A subsequent rebound and renewed decline in silver prices took it back down to about $5.00 per ounce nine years later, in June 1990, and the beginning of the next recession. Just before the recession ended, silver hit a low price of $3.75 per ounce, a decline of twenty-five percent.

Recession #6 – Ten years later, in January 2001, silver was trading just under $5.00 per ounce as the next recession began. Before it ended a year later silver had traded as low as $4.00 per ounce, a decline of twenty percent.

Recession #7 – The last recession began in January 2008. That same month silver traded as high as $17.00 per ounce. Ten months later it was below $10.00 per ounce, which is a decline of more than forty percent.

After the recession ended, silver renewed its climb to the $50.00 summit where it then gave up the ghost and returned to the land of the dead. It reached a low point of $14.00 per ounce in December 2015, and again in August 2018.

Here is what we know about silver’s price performance during recessions:

- Every recession (a total of seven) in the past fifty years has seen declines in the price of silver varying from 20% to as much as 70%.

- This is true regardless of whatever trend was indicated by silver’s price action before the recession began. Bullish or bearish momentum, trend direction, etc., didn’t alter the pattern of lower prices for silver during every recession.

- In five of the seven previous recessions, silver’s price continued to decline after the recession had ended.

Lets suppose that a recession were to begin today and we use silver’s recent high of $18.60 per ounce as our point of reference. A twenty percent decline would take silver down to $14.88. A fifty percent decline would take it to $9.80.

If you are buying silver because you expect a recession will take its price higher, you are skating on thin ice. The expectation is fundamentally flawed and there is nothing historically to support the expectation for higher silver prices during recessions.

Read more about silver: Silver’s Next Big Move and Gold-Silver Ratio: Debunking The Myth

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2019 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.