Prospects for Crude Oil Recovery During 2009

Commodities / Crude Oil Jan 17, 2009 - 09:53 AM GMTBy: Q1_Publishing

Last Sunday 60 Minutes posed the question, “Did speculation fuel oil price swings?”

Last Sunday 60 Minutes posed the question, “Did speculation fuel oil price swings?”

The news show's investigative team naturally delved into the personal story of how a small-town heating oil company can't predict the oil prices. Although I'm sure they left out his solution of charging a very high premium to his customers to ensure he doesn't get left holding the bag.

And, of course, it included the hapless government regulator whose hands were tied because of lobbying efforts. Even Enron was brought up as a scapegoat (hint: if anything ever goes wrong in the energy markets, no one is going to stand up and defend Enron).

So the answer they arrived at was a resounding “yes”.

Here's the thing that really surprised me though. 60 Minutes earned its highest ratings in a long time. Last Sunday's oil expose increased the show's ratings by almost 20%. It was vaulted into the top 10 shows for the week. It was right there just below American Idol and the Golden Globe Awards (that's saying quite a lot for a nation where Britney Spears and Paris Hilton are normally the big draws for TV).

But that's the past. As investors, we've got to focus on the future. While everyone else is looking at the past and blaming this person or that person for buying something and hoping to sell it at a higher price in the future (really, that's what it boils down to), we have an opportunity to look forward. It's the only way to stay a few steps ahead.

Right now, I'm actually interested in oil because fundamentals matter once again. You can now use rationale and research to beat the market. The speculators are out of the market for the most part. Many of them were hit hard on the way down and won't be back. And the big banks' and hedge funds' trading capital is significantly reduced. They don't have the power over prices they once did. The fundamentals are back and we can get to work.

As you'll soon see, over the short and medium-terms (the next one to five years), there's not much to get excited about oil. We'll also take a look at the long-term. There could be an opportunity, but not for reasons anyone else is talking about right now.

Rational Expectations

The oil markets have been as violent as ever lately. Oil prices fell to just above five year lows of $33 a barrel on the NYMEX earlier this week. Despite the regular drops many are still betting (hoping is probably a better term) on a rebound in oil prices.

Goldman Sachs calls for $30 oil due to “weak underlying economic fundamentals.” Yet still says it expects oil to average $45 a barrel this year and close out 2009 at $65 a barrel. Merrill Lynch is expecting oil to average $50 a barrel and average $70 in 2010.

Everything from between $20 a barrel to $100 a barrel has been thrown out there lately. A lot of pundits cite the cost of production of a barrel of oil at $60 a barrel and anything less than that is “unsustainable” (we'll take a look at why this propaganda gem is very misleading).

Our question remains, how low can oil really go and how long can it stay there? As usual, it all comes down to fundamentals.

It's Supply and Demand

On the demand side, the U.S. Energy Information Administration's (EIA) latest Short-Term Energy Outlook stated U.S. oil consumption fell 5.7% in 2008. The EIA went on to predict oil consumption will continue to fall in 2009 by 2.0% and expects a modest uptick of 0.8% in 2010 ( view chart ).

Those are pretty rosy predictions considering the EIA is expecting a 0.6% increase in GDP this year and 3.0% in 2010.

It's not just the U.S. though. The entire world is suffering through this downturn and oil demand is dropping by the month. The EIA lowered its 2009 forecast for global oil consumption to decline by 800,000 barrels per day (bpd) in 2009. That's 400,000 bpd lower than its December estimate and shows this forecast could fall even further.

We all know the demand side of the equation will get pinched - global recession, financial crisis, etc. It's the supply side which the market is reacting to now.

OPEC: Takes Credit Sometimes, Works None of the Time

As oil prices slide, we'd expect production to drop as well. Adam Smith's “invisible hand” would naturally go to work, right?

It has, to a point. OPEC, has announced a cutback of more than 4 million bpd. Despite OPEC's relative ineffectiveness (combination of the OPEC cartel's inability to move quickly and inability to prop prices up), Saudi Arabia has confirmed they cut production by 300,000 barrels a day. So far other members have stuck to the OPEC quotas – more or less.

Meanwhile, U.S. domestic oil production is increasing rapidly. In fact, domestic oil production will probably increase in 2009 for the first time since 1991. Domestic production is expected to increase production by 300,000 bpd to 5.25 million bpd - a 6% increase. In 2009, domestic oil production will likely increase by another 50,000 barrels.

All of this production coming on line is what has so many oil traders concerned. The groundwork for this growth was actually laid years ago.

Remember when Hurricane Katrina knocked out all of those oil rigs? Well, here we are two years later, and they're coming back on line. For instance, BP's (NYSE:BP) Thunder Horse platform is on line and started producing 200,000 bpd a few weeks ago. BP expects Thunder Horse to further increase its production in 2009.

It took a few years, but the oil industry is reaching the final stages of recovery from Katrina.

The Marginal Cost of Production

The final thing is the cost of production. After all, when the market price is below the cost of production for any commodity, it's usually a good time to buy (i.e. uranium at $7 per pound in the 90's while production costs were $15 to $20 a pound – it had to go up).

So if the cost of production of every new barrel is $65 a barrel, it would have to go up. Oil would be an easy win from here, right?

Not exactly. At the peak the world was consuming between 85 and 86 million bpd. That included the Canadian oil sands projects (whose cost of production is between $60 and $80 depending largely on natural gas prices) and marginal, deepwater offshore projects where the cost of finding and producing a barrel of oil can run as high as $60.

But hey, those are the marginal oil producers. They are needed for the 85 and 86 millionth bpd of oil. The costs are much, much lower to produce the 80 millionth bpd.

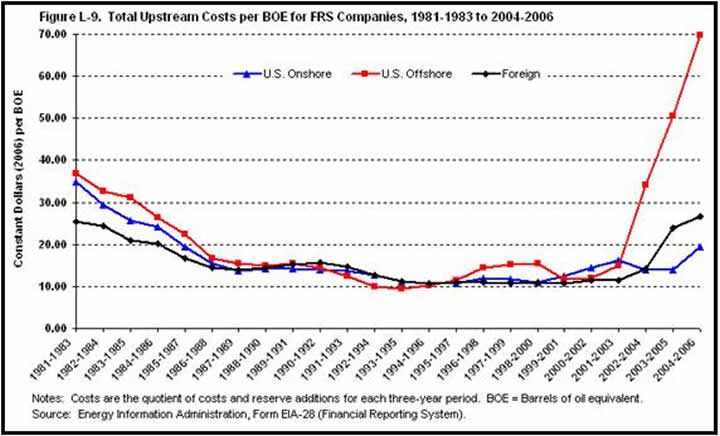

Take a look at the chart below:

The costs of production for the two main sources of U.S. oil are still very, very low. As of 2006, the cost of production were about $25 per barrel for foreign oil (remember Saudi Arabia can still produce at around $2 to $3 a barrel) and just under $20 per barrel for U.S. onshore oil.

Remember when oil was down around $10 a barrel in the late 90's? The world oil consumption was only about 75 million bpd and Exxon and the oil majors were still profitable at that time, although much less so.

The Short and Long Term Reality

My take on oil remains the same as it was in “ A Slippery Slope Ahead for Oil ”:

I just can't think of many good reasons to buy oil or oil stocks right now. Massive stockpiles are building up. The oil production projects made during the oil bubble are still in place. Oil demand continues to drop as, for the first time in decades, Japan, Europe, and North America will all be in a recession at the same time.

The only real reason to go “all in” on oil stocks now is if you expect a sudden rebound in the global economy or expect Wall Street to take the long-term view. I wouldn't bet on either happening anytime soon.

In the past few months we watched OPEC cut its production faster than any other time in history, Russia engage Ukraine in the latest round of “Gas Wars,” a cold December in the Northeastern U.S., and Israel take a hard line offensive against Hamas. Despite it all, oil prices fell by more than 20%.

The chances of a “V” forming in the oil price chart ahead are very slim. And with every mortgage which falls “under water,” each mall shop that shuts its doors, every Chinese factory which closes down, and each dollar that is taken away from a profitable business to give to a hopelessly unprofitable one, the odds get lower and lower.

Over the long-term, it's easy to build both bullish and bearish cases for oil.

On the bear side, there's a real possibility oil prices won't come back - ever. It's no secret Obama will be pumping big bucks into the alternative energy sector. If the world economy stays down long enough and the world's governments pump enough “investment” (using the term loosely – private sector investments are usually based on some sort of expected return – the government, not so much) cash into alternative energy, the world's addiction to crude could subside greatly.

The recent collapse in oil prices was due in part to an anticipated 2% decline in consumption in 2009. Just think about what a 10% or 20% reduction in crude consumption over the next decade would do?

If the U.S. and the world are headed for a Japan-like economic malaise for a decade, it's a very real possibility.

On the bull side, we have all the old arguments – peak oil, rising consumption, decline of new major discoveries, conspiracy theories about oil reserve figures from the Middle East, etc. But the one big consideration which is rarely talked about is the crisis in human capital which could rock the industry within the next decade.

As it stands, there will be a shortage of oil engineers in the world. Put yourself in the shoes of a recent high school graduate. You're about to go to college and you'll have to choose a major soon. If you want to make good money, there aren't many options now.

Geology was a hot area of study and you'd have no problem finding a job. At the peak, mining companies were offering five-figure bonuses and $60K+ to start just to lure junior geology students to the workforce before they even graduated. That isn't happening anymore.

Then when you look at the world's oil engineers, with an average age of 55, and you've got the makings of a human capital crunch hitting the energy industry over the next decade. That will play a huge role if the alternative energy investments don't pay off.

At this point, we're in the middle of the road for the energy sector. There are a lot of risks and there could be an opportunity. We're not at an extreme where prices have to go up and you get the combination of relative safety and huge upside potential (the combination successful investors are always looking for).

There's one more consideration to make though and it has to do with how bubbles work. More specifically, the impact of what's left over after bubbles burst.

Bubble Lessons Learned

The oil bubble has burst and, as we've seen with every other speculative bubble in history, it takes a long, long time to come back. For better or worse, oil bubbles always leave something behind.

• The tech bubble left behind miles and miles of fiber optic lines. We've since been able to turn them into the nation's broadband backbone. It was a good bubble.

• The real estate bubble has left behind thousands of homes, malls, and other buildings. Some will be put to use, others will go down as a complete waste. Miami condos and homes in Arizona suburbs will get used one day. Detroit suburbs will not. The real estate bubble will probably go down as a bad bubble which led to lots of waste and limited benefits.

• The oil bubble left a lot too. During the boom years the average capital investment into finding, developing, and producing more oil averaged about $250 billion a year.

• The U.S. government debt bubble will leave behind a treasure trove of “what not to do” lessons to future nations.

There have been good bubbles and bad bubbles. There are benefits and there are costs. Despite it all, the best bet for long-term oil investors is still the sidelines. There's no guarantee oil prices will come back…ever.

There are too many unanswered questions and uncertainty about the future of oil. As a result, it's highly unlikely oil stocks will run away from us and this is “the last time to buy.” For my safe money, I'd rather miss the first 10% to 15% of a rally in oil stocks and avoid the risk of getting caught up in another big decline if (and when) the big economic bailout plans don't work.

On top of that, too many people are watching oil right now and waiting for a recovery. As we've looked at before in the Prosperity Dispatch , our 100% Free e-Letter, true, sustainable rallies rarely come when so many people are watching.

I'd much rather focus on opportunities the free-spending U.S. government isn't doing its best to eliminate. Opportunities in India, farmland, and healthcare won't attract big ratings on TV, but that's where you're going to make most of your money over the next decade.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.