This Bitcoin Price Rally Might Be a Fake One

Currencies / Bitcoin Apr 11, 2014 - 05:15 PM GMTBy: Mike_McAra

Cutting right to the chase: we still don’t support any short-term positions in the market.

Cutting right to the chase: we still don’t support any short-term positions in the market.

Yesterday, we wrote that Chinese Bitcoin exchanges BTC100 and BTCTrade were ordered by the Chinese government to close their bank accounts used to receive customer deposits. Today, Reuters reported that another exchange, Huobi.com, issued a statement that the bank handling their account would close them by Apr. 18.

Reuters wrote:

In December the central bank, the People's Bank of China (PBOC), banned financial institutions from trading in bitcoin, saying the government would act to prevent money laundering risks from the digital currency. It did not ban trading by individuals.

Since the ban, some media have reported that the PBOC had instructed domestic lenders to close the accounts of bitcoin exchanges by April 15. However the central bank said in a notice on their official Weibo micro-blogging website on March 21 that it has not issued such notices to banks.

Following the central bank ban on financial institutions trading in the digital currency, bitcoin exchange platform BTC China said it had stopped taking Chinese yuan deposits after a third-party payment provider abruptly cut off service.

Chinese Business News reported that the government had asked third-party payment services to stop handling bitcoin transactions.

It would seem that the Chinese authorities are making some kind of move against the currency in spite of what the PBOC claims. Yesterday, in our Bitcoin commentary, we wrote about the move to close bank accounts of Bitcoin exchanges:

This is one in a long string of attempts to limit the use of Bitcoin in the country. The main concern of the Chinese government is that Bitcoin might be used to pull money out of China, which falls under capital controls imposed by the Chinese authorities.

The situation is getting tougher for Bitcoin users in China. Right now it seems that local Bitcoin exchanges might be forced to look for other options to continue operations, such as setting up shop outside of the country.

Now, let’s have a look at the charts and see what’s changed since yesterday.

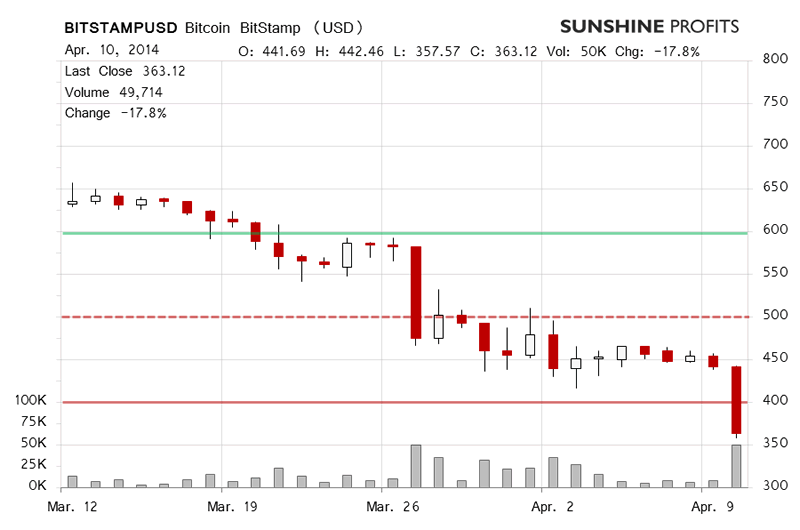

Bitcoin declined heavily on BitStamp yesterday. It went 17.8% down compared with the previous day’s close and there was a more than 6-fold increase in volume. This was a classic slump, the situation became extremely bearish and the fact that the price tanked made opening short positions particularly tempting. There was, however, the possibility that we could see a move up. We highlighted this risk of going short in our Bitcoin commentary yesterday:

The action later in the day today and the beginning of yesterday’s session will be crucial in determining the short-term outlook here. If Bitcoin closes today below $400 or moves below this level on strong volume tomorrow in the early hours, we’ll likely consider going short.

On the other hand, if we see recovery today or tomorrow, it might be a short-lived counter-trend rally. As trading such moves is relatively risky, we’ll most likely remain on the sidelines if this scenario materializes and will wait for more signs of depreciation.

As it turns out, our reluctance to go short in spite of the strong move down was justified. Today, Bitcoin has gone up 15.9%, recovering most of yesterday’s losses (this is written after 11:00 a.m. EDT). The volume has been significant (already more than BTC35,000). There’s definitely a lot going on in the market. But does this mean that the short-term situation is bullish now? Not necessarily, in our opinion.

We are prepared to see more appreciation in the next couple of days but our guess is that Bitcoin will move lower afterwards. It is also possible that the decline will resume tomorrow. Tomorrow’s close will most probably tell us whether further appreciation is to be expected.

Either way, going long seems particularly risky at this time. If we see more weakness tomorrow or a move higher on declining volume, we might consider going short based on the possible move down. A move below $400 could be such an indication.

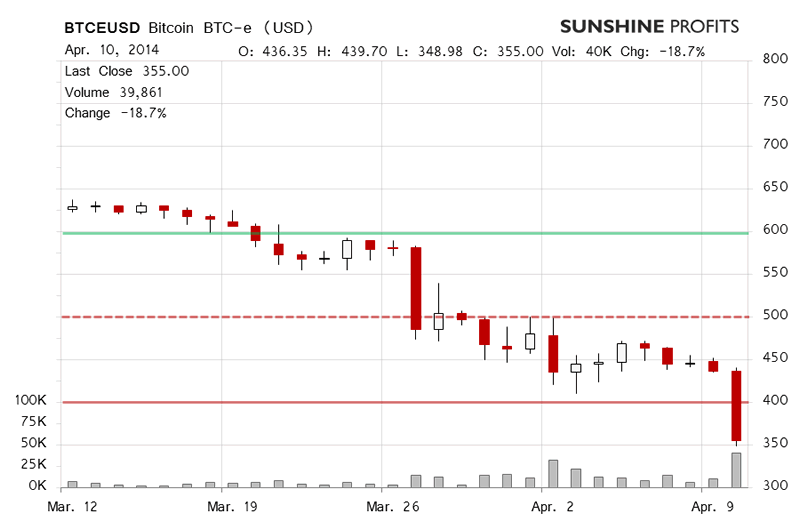

On BTC-e, the situation developed yesterday pretty much similarly as it did on BitStamp. Bitcoin went 18.7% down. There was a 4-fold increase in volume, weaker than on BitStamp but strong by itself.

Today, Bitcoin has appreciated 17.7% and the volume will most probably end up being higher than yesterday. We are currently above $400 and we might see more appreciation in the next day or days but our bet is that such appreciation would be followed by further declines. It is also possible that we’ll see another slump tomorrow. Tomorrow’s close might clear up things and suggest if declines will follow immediately or after a few days of appreciation.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market at this time. Going long seems particularly risky at this time.

Trading position (short-term, our opinion): no positions. We might see more appreciation before a move down. Tomorrow’s close might give us hints what to expect.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.