AI Revolution and NVDA: Why Tough Going May Be Ahead

Companies / Nvidia Apr 07, 2024 - 04:17 AM GMTBy: EWI

"These things could get more intelligent than us"

The topic with all the buzz these days is Artificial Intelligence (AI) and its future.

The potential benefits include automating repetitive tasks, enhancing productivity, data analysis, assisting in medical applications -- and more.

Then there's the possible downside. Some of the major worries include the elimination of jobs, privacy violations, unclear legal regulations and the potential for AIs to go rogue as the goals of AI become misaligned with the goals of humans.

In an interview with NPR in 2023, computer scientist Geoffrey Hinton, who is known as the godfather of AI, said:

These things could get more intelligent than us and could decide to take over, and we need to worry now about how we prevent that happening.

However, right now, the mood surrounding AI is way more optimistic than pessimistic.

Just think about how investors have bid up the price of AI-related stock Nvidia Corp., which has a market capitalization of around $2 trillion. That's more than the GDP of Australia or South Korea. Indeed, if Nvidia was a country, it would rank just outside the top ten largest economies on Earth.

Yet -- a word of caution: Trends generally don't go up or down in straight lines without significant interruptions.

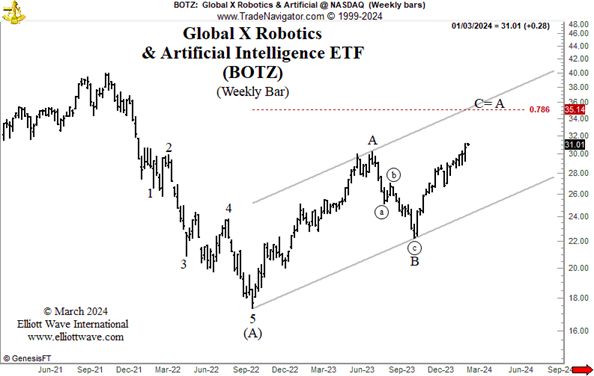

Indeed, the March Global Rates & Money Flows, one of Elliott Wave International's newest services, which covers global fixed income markets, stocks, currencies and more, shows this chart of an AI exchange-traded fund and says:

BOTZ, the ticker for the Global X Robotics & Artificial Intelligence ETF, sports a clear five-wave decline from 2021 to 2022. Since then, a corrective rally appears to be in operation with wave C advancing now. ... [The] evidence suggests that the AI revolution may be off to a false start.

But what about the price pattern of Nvidia? -- you may ask.

Know that our Senior Global Strategist, Murray Gunn, also provides Elliott wave analysis of Nvidia in the March Global Rates & Money Flows.

If you're unfamiliar with Elliott wave analysis, read Frost & Prechter's definitive text on the topic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic:

Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as [Charles] Collins put it, "a disciplined form of technical analysis." [Hamilton] Bolton used to say that one of the hardest things he had to learn was to believe what he saw. If you do not believe what you see, you are likely to read into your analysis what you think should be there for some other reason. At this point, your count becomes subjective and worthless.

How can you remain objective in a world of uncertainty? It is not difficult once you understand the proper goal of your analysis.

Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott's highly specific rules reduce the number of valid alternatives to a minimum.

If you'd like to learn about the "highly specific rules" of the Wave Principle, know that you can gain complimentary access to the entire online version of Elliott Wave Principle: Key to Market Behavior for free.

Just follow the link and you can have the Wall Street bestseller on your computer in moments: Elliott Wave Principle: Key to Market Behavior -- get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.