Gold and Gold Stocks Corrective Action Continues Despite Dovish Federal Reserve

Commodities / Gold and Silver 2016 Sep 24, 2016 - 12:49 PM GMTBy: Jordan_Roy_Byrne

There were some hopes that a non-move by the Fed would end the current correction in precious metals and spark a move to new highs. Unfortunately, the Federal Reserve cannot override the supply and demand component of the market. Gold and gold stocks popped higher but less than two days later the sector (and specifically the miners) has given those gains back. That tells us plenty of sellers remain and this sector needs more time and perhaps lower prices before this correction ends.

There were some hopes that a non-move by the Fed would end the current correction in precious metals and spark a move to new highs. Unfortunately, the Federal Reserve cannot override the supply and demand component of the market. Gold and gold stocks popped higher but less than two days later the sector (and specifically the miners) has given those gains back. That tells us plenty of sellers remain and this sector needs more time and perhaps lower prices before this correction ends.

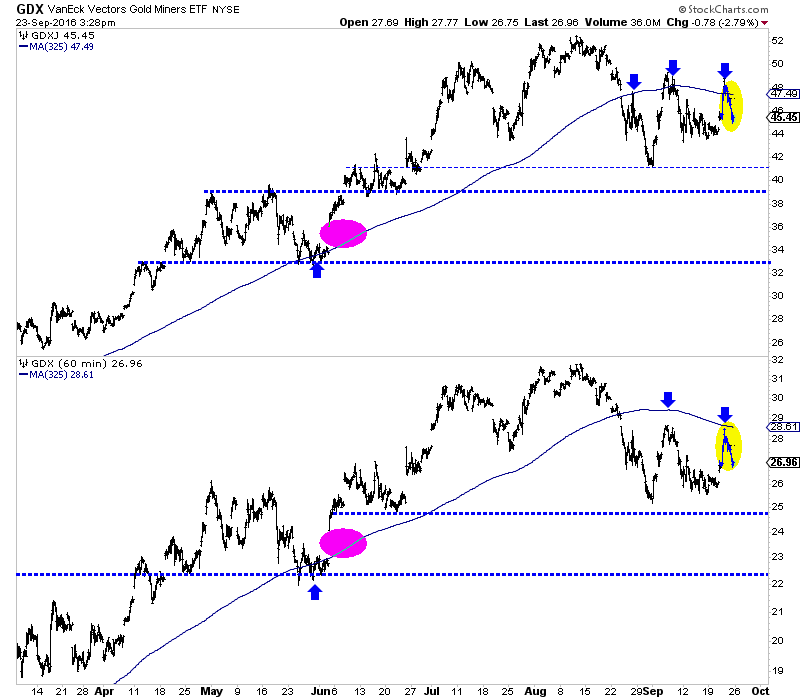

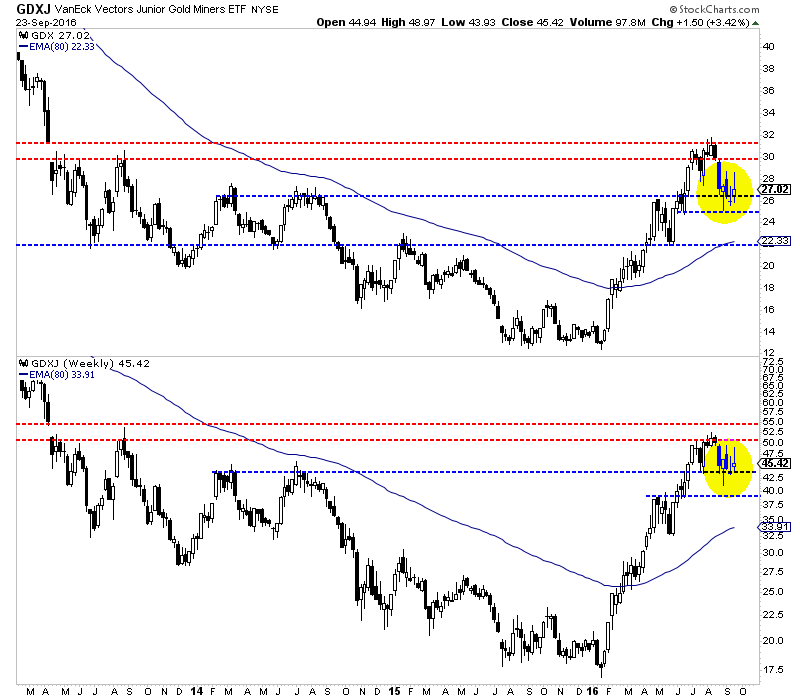

The hourly charts, seen below show the miners selling off after testing their 50-day moving averages. GDX showed a bit more strength on this pop as it reached its 50-dma before retreating. GDXJ nearly touched $49, which is within 10% of the recent high before reversing those gains quickly. The miners could test recent lows before retesting their 50-day moving averages.

The weekly charts indicate the correction can be deemed bearish consolidation. The candles from the past three weeks have not been remotely bullish. The miners had one solid down week followed by two weeks in which the market failed to hold its gains. GDX (top) has key support at $25 while GDXJ (bottom) is trying to hold above $44. Weekly closes below $26 and $44 could usher in more losses in the short-term.

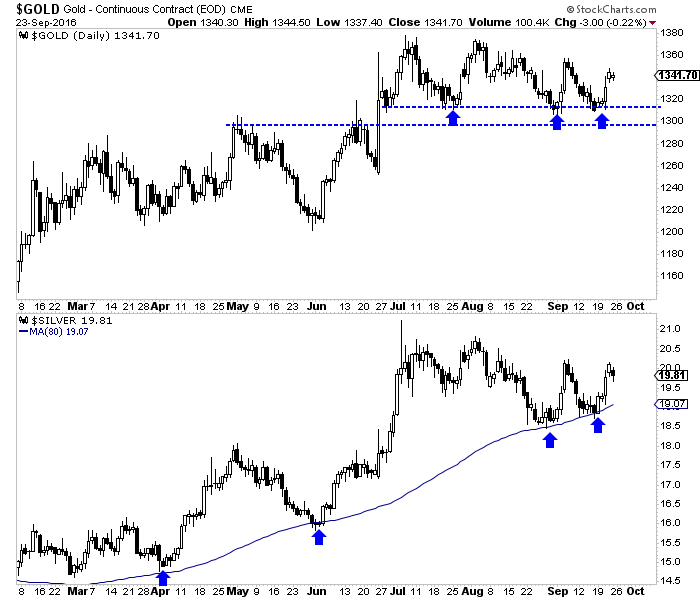

Turning to the metals, we find more encouraging signs as Gold and Silver have maintained support quite well. The daily candle charts for Gold and Silver can be seen below. For the third time in the past few months Gold was able to hold support at $1300-$1310. Meanwhile, Silver held its August low and has shown more strength than Gold recently. That is positive.

The precious metals sector remains in correction mode but the longer the sector can hold and digest recent gains without significant price deterioration then the more likely a bullish outcome becomes. The strength in the metals is a healthy sign but the relative weakness in the miners and failure to hold gains is a signal that the correction will definitely continue in terms of time. Traders and investors should wait for either this market to become oversold or the correction to mature. In the meantime, focus on the opportunities scattered amongst individual companies rather than the sector itself.

For professional guidance in riding the uptrend in Gold, consider learning more about our premium service including our favorite junior miners which we expect to outperform in the second half of 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.