Technical Speculator Model Growth Portfolios Update

Portfolio / Exchange Traded Funds May 15, 2007 - 11:21 PM GMTBy: Donald_W_Dony

May 2007 marks the fourth anniversary of these mainly exchange traded fund-driven portfolios. The performance continues to show good returns. The Canadian-dollar portfolio has averaged 32.40% annually and the U.S.-dollar portfolio at 23.97%.

May 2007 marks the fourth anniversary of these mainly exchange traded fund-driven portfolios. The performance continues to show good returns. The Canadian-dollar portfolio has averaged 32.40% annually and the U.S.-dollar portfolio at 23.97%.

The annual performance results are as follows. In the Canadian portfolio;

2003-----------23.84%

2004-----------29.19%

2005-----------49.59%

2006-----------28.79%

In the U.S.-dollar portfolio, the annual returns have been;

2003-----------21.90%

2004-----------20.47%

2005-----------23.32%

2006-----------31.19%

This return on capital has been achieved with no options, leveraging or short-term trading but utilizing only eight securities in each portfolio and focusing on long-term trends. The basic structure is based on a top down investment approach followed by security selection utilizing relative strength. Exchange traded funds (ETFs) allow the investor to hold fewer security positions within their portfolio yet still maintains excellent diversification. This reduction of holdings provides better account management with no loss of protection.

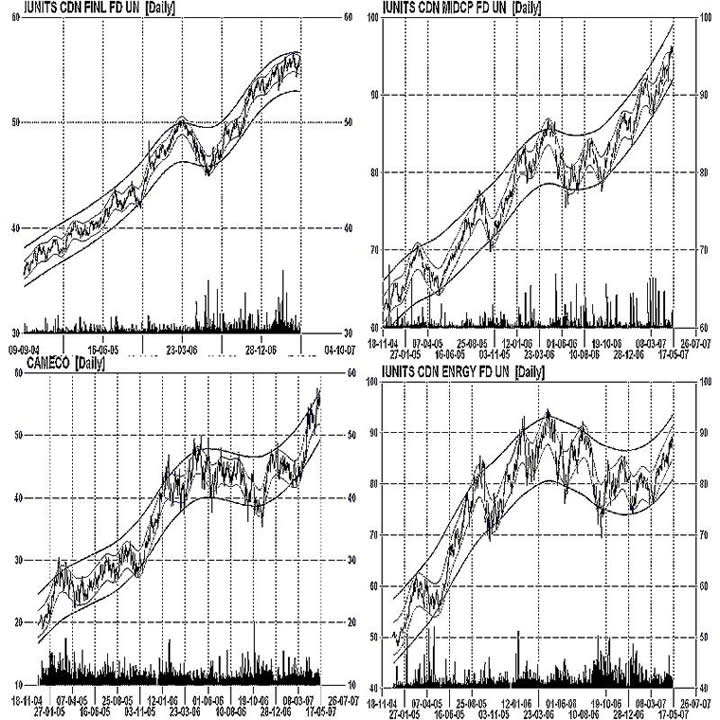

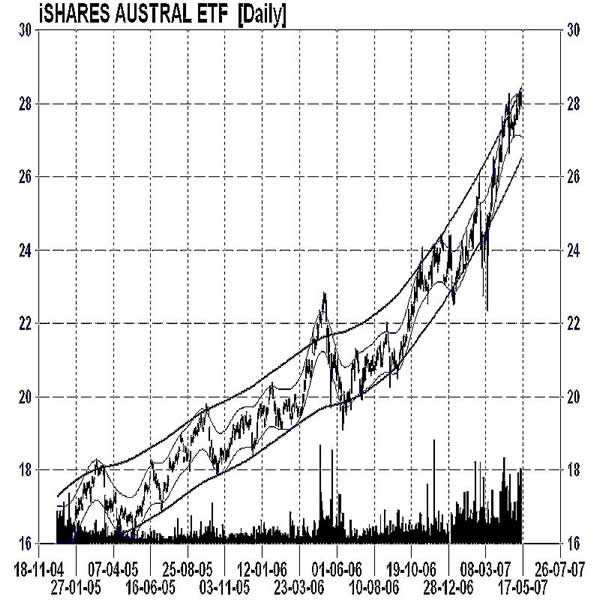

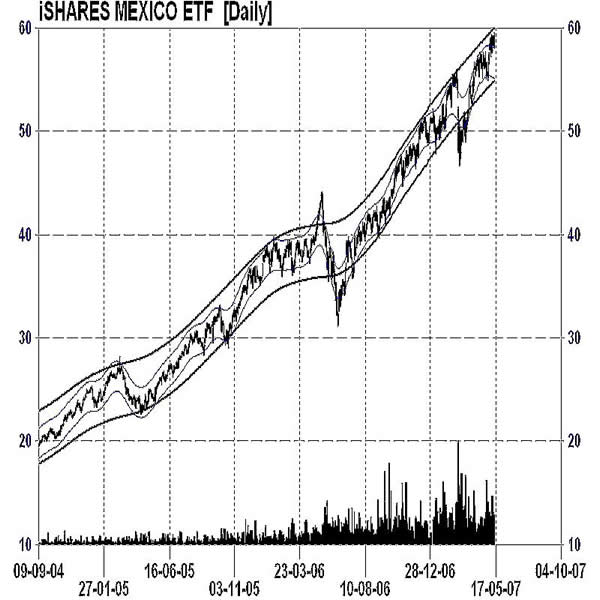

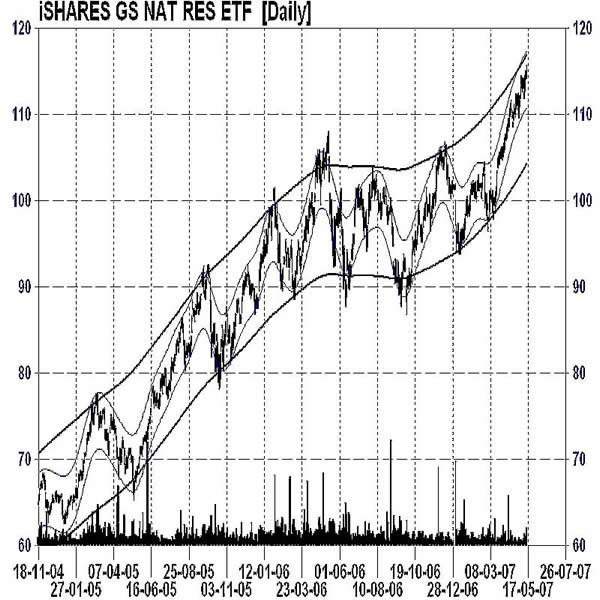

The Canadian-dollar portfolio is weighted toward commodities and currently holds five securities out of eight that are natural resource-based. In the U.S.-dollar portfolio, four positions are directly related to tangibles and the remaining four are diversified in global ETFs with China, Australia and Mexico offering strong continued performance.

Economic expansion continues in most regions of the world which is driving the on going thirst for raw materials. Technical evidence indicates that this growth can possibly persist for another decade. Asian markets are the leaders for this desire for commodities with no signs of weakening. Though the economic expansion for the U.S.A. remains low compared to other nations, they still are expanding by 2.5% over 2006. It is for these reasons that both growth portfolios will remain weighted in tangibles for the foreseeable future.

Chart 1 represents four of the eight holdings in the Canadian dollar portfolio and charts 2-4 are several of the securities in the U.S. dollar growth portfolio.

Chart 1

Charts 2 to 4

The TS Model Growth Portfolios are designed on a unique investing concept in which the investor can follow the on-going recommendations. More information on these is at www.technicalspeculator.com .

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.