Volcker Says U.S. Economy is ‘Leveling Off’ even though GDP Shrinks Most in 50 Years

Economics / Recession 2008 - 2010 Apr 30, 2009 - 02:47 AM GMTBy: Mike_Shedlock

GDP shrank at an annual rate of 6.1% according to the First Quarter 2009 Advance GDP Report.

GDP shrank at an annual rate of 6.1% according to the First Quarter 2009 Advance GDP Report.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009, (that is, from the fourth quarter to the first quarter), according to advance estimates released by the Bureau of Economic Analysis. In the fourth quarter, real GDP decreased 6.3 percent.

The decrease in real GDP in the first quarter primarily reflected negative contributions from exports, private inventory investment, equipment and software, nonresidential structures, and residential fixed investment that were partly offset by a positive contribution from personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, decreased.

Real personal consumption expenditures increased 2.2 percent in the first quarter, in contrast to a decrease of 4.3 percent in the fourth. Durable goods increased 9.4 percent, in contrast to a decrease of 22.1 percent. Nondurable goods increased 1.3 percent, in contrast to a decrease of 9.4 percent. Services increased 1.5 percent, the same increase as in the fourth.

Real nonresidential fixed investment decreased 37.9 percent in the first quarter, compared with a decrease of 21.7 percent in the fourth. Nonresidential structures decreased 44.2 percent, compared with a decrease of 9.4 percent. Equipment and software decreased 33.8 percent, compared with a decrease of 28.1 percent. Real residential fixed investment decreased 38.0 percent, compared with a decrease of 22.8 percent.

The real change in private inventories subtracted 2.79 percentage points from the first-quarter change in real GDP after subtracting 0.11 percentage point from the fourth-quarter change. Private businesses decreased inventories $103.7 billion in the first quarter, following decreases of $25.8 billion in the fourth quarter and $29.6 billion in the third.

Real final sales of domestic product -- GDP less change in private inventories -- decreased 3.4 percent in the first quarter, compared with a decrease of 6.2 percent in the fourth.

Real gross domestic purchases -- purchases by U.S. residents of goods and services wherever produced -- decreased 7.8 percent in the first quarter, compared with a decrease of 5.9 percent in the fourth.

Current-dollar personal income decreased $59.9 billion (2.0 percent) in the first quarter, compared with a decrease of $42.9 billion (1.4 percent) in the fourth.

Personal current taxes decreased $193.5 billion in the first quarter, in contrast to an increase of $19.7 billion in the fourth.

Disposable personal income increased $133.6 billion (5.1 percent) in the first quarter, in contrast to a decrease of $62.6 billion (2.3 percent) in the fourth. Real disposable personal income increased 6.2 percent, compared with an increase of 2.7 percent.

Personal outlays increased $18.1 billion (0.7 percent) in the first quarter, in contrast to a decrease of $260.2 billion (9.5 percent) in the fourth. Personal saving -- disposable personal income less personal outlays -- was $453.0 billion in the first quarter, compared with $337.4 billion in the fourth. The personal saving rate -- saving as a percentage of disposable personal income -- was 4.2 percent in the first quarter, compared with 3.2 percent in the fourth.

Key Changes From Last Quarter

The biggest negative factor in GDP was the change in private inventories which subtracted 2.79 percentage points GDP compared with a subtraction of 0.11 percentage points last quarter. Meanwhile personal consumption added 1.5% to GDP after subtracting 4.3% last quarter.

The good news is personal consumption expenditures is a leading indicator while the change in private inventories is a lagging indicator. Calculated Risk has a great set of charts on this theme in GDP Report: The Good News.

Key Question:

Are personal consumption expenditures

1) an outlier

2) a resumption of the prior trend in strong consumer spending

3) on a "leveling off" course

4) a short term phenomenon to be followed by a double dip recession or series of recessions

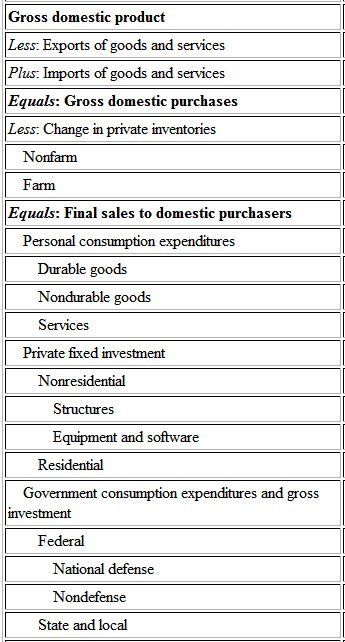

Table of GDP Components

The following GDP Table helps show how some of the numbers mentioned above relate to each other.

Volcker Says the U.S. Economy Is ‘Leveling Off’

Bloomberg is reporting Volcker Says the U.S. Economy Is ‘Leveling Off’.

The U.S. economy is “leveling off at a low level” and doesn’t need a second fiscal stimulus package, said former Federal Reserve Chairman Paul Volcker, one of President Barack Obama’s top economic advisers.

Volcker, head of Obama’s Economic Recovery Advisory Board, said the 6.1 percent decline in first-quarter gross domestic product reported by the government today was “expected.” More recent data show the contraction in housing, business spending and inventories has slowed, and stimulus spending is only just beginning to hit the economy, he said.

Still, with the financial system functioning only by “the grace of government intervention,” the economy is “in for a long slog” before a recovery takes hold, Volcker said. “I’m not here to tell you the economy is going to recover very strongly in the short run,” Volcker said. “There is reason to believe that it should be leveling off, at a low level.”

“I do not think there are grounds for great optimism,” Volcker said. “It is going to take a while, I think, to have a strong recovery.”

“The Federal Reserve is going beyond the traditional role of central banks here or abroad,” Volcker said. “At some point it’s reasonable to ask should this particular institution, with its independence very well protected, be allocating so much of what is essentially government money.”

Volcker said Fed Chairman Ben S. Bernanke is “doing a great job” and he declined to speculate on whether Obama will reappoint Bernanke when his term as chairman ends in 2010. “It’s not a situation where any of this problem reflects shortcomings on Mr. Bernanke’s part.”

Volcker agreed with economists who say the expansion of the Fed’s balance sheet, to more than $2.2 trillion as of last week, might pose an inflation danger at some point.

“The inflation problem, which should be a real threat for the future, is not right on the doorstep,” he said. “But two or three years from now that may be the critical problem, how that’s handled. Because, given what the Federal Reserve has been doing, it’s going to be harder to retrace their steps, so to speak, than it ordinarily would be.”

Volcker said he wouldn’t favor bringing back the Glass-Steagall Act, repealed in 1999 with the support of then-Treasury Secretary Summers. He would, however, separate commercial-bank functions from what he calls “traders,” venture capital funds, private equity funds and hedge funds.Anyone claiming "Fed Chairman Ben S. Bernanke is doing a great job" is going to lose credibility with a lot of people. Still others (but not me) will be moaning about Volcker's position on Glass-Steagall, a position that is quite similar to mine.

For further discussion of Glass-Steagall and regulation in general, please see Anti-Libertarian Nonsense From Henry Kaufman & Company.

Returning To The Key Question:

Are personal consumption expenditures

1) an outlier

2) a resumption of the prior trend in strong consumer spending

3) on a "leveling off" course

4) a short term phenomenon to be followed by a double dip recession or series of recessions

Volcker is suggesting door number 3.

I vote for what's behind door number 1 or door number 4 on the grounds there is too much debt overhang, too few jobs, and no sustainable driver for jobs looking ahead. In addition, there is little support for more stimulus in Congress and whatever lift the economy gets out of inventory replenishment and the Congressional stimulus will eventually fade.

If the recession ends later this year, plan on a revisit in 2010-2011 and anemic growth at best for a long time thereafter. The Case for an "L" Shaped Recession (or series of recessions) is still very much alive.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.