Gold Stock Fundamentals

Commodities / Gold & Silver Stocks Apr 30, 2009 - 10:55 AM GMTBy: Jordan_Roy_Byrne

Since I’ve written about gold more than a few times recently, I thought it was time to check in the gold stocks. Most of the mainstream media seems cautiously bullish on gold yet they offer no position on the gold stocks. While the stocks are well off their highs, there are several key positive developments for the sector. The first is that a new cyclical bull market has started in relative terms.

Since I’ve written about gold more than a few times recently, I thought it was time to check in the gold stocks. Most of the mainstream media seems cautiously bullish on gold yet they offer no position on the gold stocks. While the stocks are well off their highs, there are several key positive developments for the sector. The first is that a new cyclical bull market has started in relative terms.

Below we show the HUI along with some ratios: HUI vs. S&P 500, HUI vs. Emerging Markets and HUI vs. Commodity Shares. When it is tough to get a read on a market, one should compare it to other markets. In both relative and nominal terms, 2008 was a major bottom for the gold stocks. Relatively speaking, the stocks had actually been in a four-year bear market! And that was during a period (2004 to late 2008) when Gold advanced nearly 70%! Turning to the present, we see the HUI successfully retested its “relative” breakout against the various stock sectors.

Relatively speaking, it is clear that a new bull market in the gold stocks is underway. As I have learned and previously written about, a rising gold price isn’t what matters for this sector. Gold Stocks outperform or underperform based on the relationship between the price of Gold and their various costs. Gold Stocks underperformed from 2004 to 2008 because their costs were rising in tandem with price inflation and commodity prices.

Recently, Gold has soared against anything other than Treasuries, Dollars and Yen. This includes the cost inputs of mining, such as Oil and Steel. In the chart below, I try to show Gold’s performance against some of its cost inputs and compare it to the gold stock/gold ratio. From 2001 to 2003 when gold stocks outperformed Gold, Gold was advancing against Oil, Base Metals (my proxy for Steel) and Commodities. Gold stocks had leverage to Gold because Gold was rising faster than cost inputs. Thus, gold stocks outperformed. From 2004 to 2008, Gold fell against Oil and Base Metals while trending sideways against Commodities. During that period the gold stocks underperformed as their cost inputs rose to quickly.

Finally, we should take notice of the mega-breakouts of Gold against Oil, Base Metals and especially Commodities. These breakouts portend to further outperformance by Gold and thus, a further expansion of the margins of gold producers.

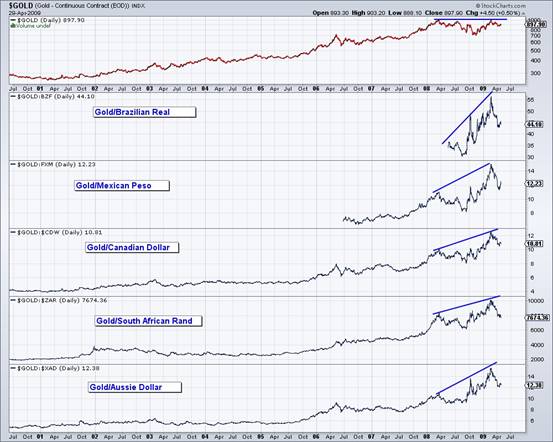

There is another very positive point in regards to the fundamentals of gold stocks. The action in the currency markets, namely a strong dollar, is also boosting the margins of the gold producers. Since most mining and exploration occurs outside of the US, a strong dollar equates to weaker local currencies, which means lower costs. Essentially, if you are a gold company operating outside of the US, strong gold and a strong dollar benefits you the most.

In the chart below I show the price of gold in the local currencies of gold mining hotbeds such as Canada, South Africa, Mexico, Brazil and Australia. In every case, the price of gold in these countries has exceeded its 2008 high. In the bottom three ratios, one can see that the gold price increased only marginally from 2003 to July 2007. It is the local price of gold that matters.

Conclusion

In regards to the gold stocks, the talk of inflation or deflation is missing the point. What matters most is the local price of Gold and the relative price of Gold (Gold against its cost inputs). Let’s look at these things since March of 2008 when the HUI peaked at 519. Since then, the local price of Gold in every case except for the US and Japan has advanced to new all time highs. Meanwhile, even though the official and US price is 14% off its high, mining input costs (Oil, Steel) have fallen much farther. The gold stocks, at 40% off their highs, are clearly undervalued. Should Gold blast through $1,000/oz without the help of a falling dollar or an inflationary tide (in which everything rises), then the gold stocks will be primed for a violent advance.

We are working on developing a newsletter product specific to the gold stocks where we regularly monitor each individual stock based on technicals and sentiment data. If you’d like to know when this service is available or would like to receive any related updates, you can sign up for our email newsletter at our website.

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.