Wages Contract in US, UK, Japan

Economics / Recession 2008 - 2010 May 05, 2009 - 01:54 AM GMTBy: Mike_Shedlock

Inquiring minds are investigating trends in wages, disposable income, and ability to service debt.

Inquiring minds are investigating trends in wages, disposable income, and ability to service debt.

Japan’s Wages Fall at Fastest Pace Since 2002 on Output Slump

Japan’s wages dropped at the steepest pace in more than six years in March as manufacturers slashed overtime pay to cope with a collapse in exports. Monthly wages, including overtime and bonuses, dropped 3.7 percent from a year earlier, the most since July 2002, the Labor Ministry said today in Tokyo.

Overtime payments slid an unprecedented 20.8 percent as manufacturers cut extra working hours by a record 49.5 percent, the report showed. The government has been tracking the figures since 1990.

Weekly wages fell at the fastest rate in 60 years in February as City bonuses were slashed and workers agreed to reduced hours in the wake of recession, the latest official figures show.

The Office for National Statistics said average weekly earnings fell 5.8pc compared with the same month last year, to £459.10. The private sector took the full force of the fall in weekly earnings, down sharply by 7.7pc at £463.50, while average weekly earnings in the public sector actually rose by 3.2pc to £442.90. Bonuses in the financial services fell to £549.90 a week in February - which is part of the peak period for bonus payments - from £1,312.80.

"We certainly haven't seen anything like this in the last 60 years - and probably not in peacetime since the 1930s. In that sense it's much like everything else in the economy," said Michael Saunders, chief UK economist at Citigroup.

Across the country, workers' earnings are stagnating or, in some cases, declining. For many Americans, the setbacks are all the more troubling because they have lost so much wealth in recent months, with the value of their homes and retirement packages plummeting.

Employers big and small have resorted to slashing hours and once-unthinkable wage cuts. In March, staffing agencies that work for Microsoft agreed to a 10 percent reduction in their bill rate. In April, hotel operators in New York City asked unionized waiters, housekeepers and bellhops to reopen their contract and accept wage cuts. State governments such as Indiana's have frozen pay, while others, including Maryland and California, have furloughed employees.

According to a recent Washington Post-ABC News poll, more than a third of Americans say they or someone in their household has had their hours or pay cut in the past few months. That's a nine-point increase since a similar poll was conducted in February.

The previous U.S. recession, in 2001, was relatively weak and didn't last the full year. But once inflation is factored in, wages actually fell, sapping workers' buying power, and didn't return to pre-recession levels until 2006, just before the economy fell into its latest funk. As a result, from 2000 to 2007, the median income of American households, when adjusted for inflation, fell by $324, according to the Commerce Department.

Wages for new hires have already fallen, according to an index compiled by the Society for Human Resource Management, a trade association based in Alexandria. Temporary workers' hourly rates are shrinking, too. Joanie Ruge, senior vice president of the staffing firm Adecco Group North America, said her company's clients have shaved as much as 10 percent off their rates.Trends In Disposable Personal Income

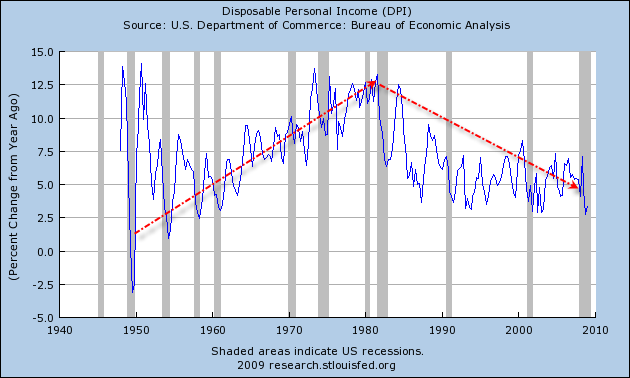

Disposable income is the amount of income left to an individual after taxes have been paid, available for spending and saving. Please consider the following chart.

The chart shows DPI is still growing, in aggregate. What it does not show is how skewed the growth is. I would be interested in seeing what the chart would look like with the top 10% of wage earners taken out. I do not have that data but I suspect that if we took out the top 10% of wage earners, the chart would be negative.

Notice that DPI growth became very weak in the era of biggest debt growth, yet it was strong when debt growth was subdued. So much for the notion that inflating money supply and credit 'creates wealth'. It is not only a theoretically indefensible position, the empirical data confirm it as well.

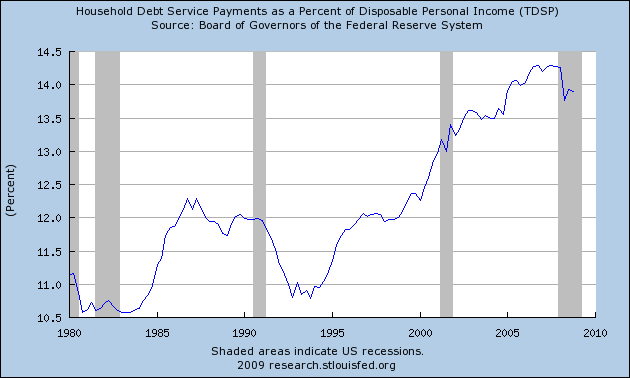

Household Debt Service Payments Rise

It now takes close to 14% of disposable income to service household debt. In the early 1990's it took under 11%. Factor in property taxes and automobile lease payments and the numbers get worse.

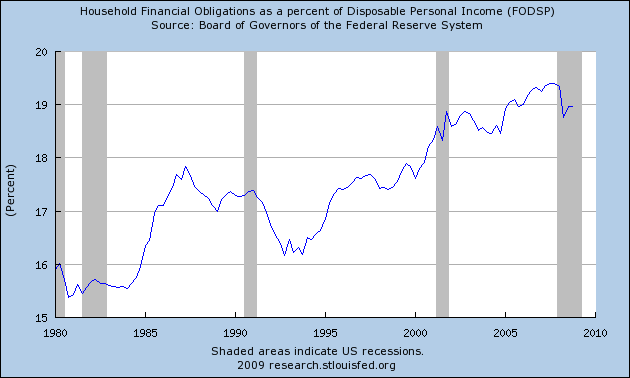

Household Obligations Rise

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

It now takes 19% of DPI to meet household financial obligations.

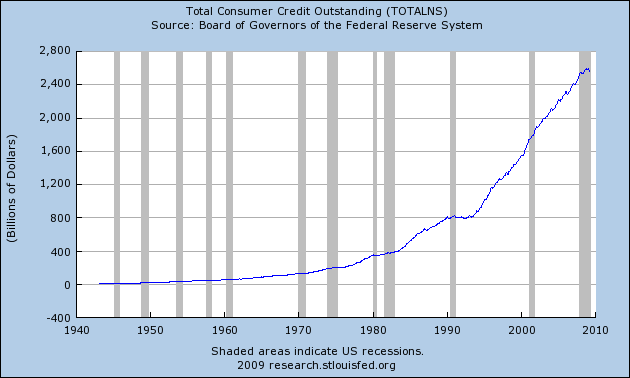

Total Consumer Credit

Think that consumer credit is going to be paid back? I don't, not as long as we are losing 600,000 jobs a month and wages are contracting on top of that.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.