U.S. Housing Market Driven by Super Sizing Baby Boomers Now Going Bust

Housing-Market / US Housing May 13, 2009 - 09:45 AM GMTBy: James_Quinn

Beneath the finely groomed blissful suburban façade of America lurk desperation, denial, hypocrisy, and anger. The kids of suburbia today have an entirely different reality than the suburbs I grew up in during the 1970’s. The Ozzie & Harriet idealized version of suburbia from the 1950’s has degenerated to the Green Day nightmare vision of today. The suburbs have mansion-like homes with spotless interiors, entertainment centers, three car garages, manicured lawns, and no soul. The children of suburbia have been brought up on soda pop and Ritalin.

Beneath the finely groomed blissful suburban façade of America lurk desperation, denial, hypocrisy, and anger. The kids of suburbia today have an entirely different reality than the suburbs I grew up in during the 1970’s. The Ozzie & Harriet idealized version of suburbia from the 1950’s has degenerated to the Green Day nightmare vision of today. The suburbs have mansion-like homes with spotless interiors, entertainment centers, three car garages, manicured lawns, and no soul. The children of suburbia have been brought up on soda pop and Ritalin.

They come home to empty mansions, as both parents must work to pay for the glorious abode. Our homes have gotten bigger and better, while our lives have gotten smaller and less satisfying. One third of all children in the United States are growing up in a single parent household. Many kids feel angry and disconnected from their families, friends and home. Fifty percent of all marriages end in divorce. The kids feel rage and hopelessness at their existence in a suburban nightmare. There are 2 million children who take Ritalin every day. Is this because they truly have ADHD, or it is the painless way out for overstressed suburban parents?

JESUS OF SUBURBIA

Everyone is so full of shit

Born and raised by hypocrite

Hearts recycled but never saved

From the cradle to the grave

We are the kids of war and peace

From Anaheim to the middle east

We are the stories and disciples

Of the Jesus of suburbia

Land of make believe

That don't believe in me

Land of make believe

And I don't believe

And I don't care! Jesus of Suburbia – Green Day

My parents both grew up in South Philly. My Dad had a good secure job with Atlantic Richfield and they took the leap to the 1st ring of suburbs outside of Philadelphia in 1955. They bought a 1,120 sq ft row home in Collingdale for $10,000. It had 3 small bedrooms and one small bathroom. They raised three kids (and three dogs) in this home and my Mother still lives there today. I shared (not happily) a 100 sq ft room with my brother and when I was six, the boogeyman who lived under the bed. We had a double bed, two bureaus, a nightstand, a bookshelf and a desk for studying in this room. When I walk in the room today, I wonder how we possibly shared this small space. Prisoners at Guantanamo have more space.

In the summer, with no air conditioner upstairs, I’m sure it got as hot as a Guantanamo prison cell. The walls were so thin between row homes I knew what the people next door were thinking. People never moved. We were a neighborhood where everyone knew everyone. You could depend on your neighbors. There were cookouts, holiday parties, and you could ask your neighbor for a cup of sugar. If your son (me) fell through the basement stairs and cracked his head open on the concrete floor, a neighbor would drive him to the hospital. The fathers went to work. Mothers worked at home, because they could. Mothers were there when the kids arrived home from school. No one was divorced in our neighborhood. All the kids went to the same school. No one was diagnosed with ADHD. I cut our lawn with a manual push mower. Times have surely changed. Bigger hasn’t translated into better over the decades.

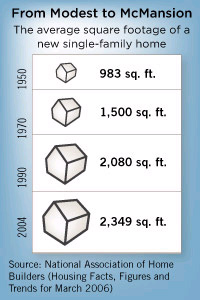

Super Size It

The average household size has declined from 3.4 in 1950 to 2.5 today, a 26% reduction. The average household size was 4.6 in 1900. Our average home size has increased from 1,000 sq ft in 1950 to 2,400 sq ft today, a 140% increase. The average square feet per person in the household has increased by 218%.

In 1950, only one percent of homes built had four bedrooms or more, but 39 percent of new homes had at least four bedrooms in 2003. We have one less person per household, but we have added one extra room. Our society has chosen to super size our houses, our vehicles, our TVs, our kitchens, our burgers, our sodas, and our egos. This desire to "keep up with the Joneses" combined with a rise in two-income families convinced millions to pour money into their home and its amenities. This seemed like a great idea when home prices were rising annually at a double digit clip. Most of the money was borrowed, so with home prices down 25% to 50% in many parts of the country the “Joneses” are in a heap of trouble.

The Baby Boom Generation, as usual, has driven the Supersizing of America. The bigger and gaudier your home, the more successful you appear. Nothing tells the world you’re a winner more than living in a 11,000 square foot McMansion with a Hummer (with a save the environment license plate) and a BMW (with a yellow support the troops ribbon on the back, even though there are no troops from their exclusive neighborhood in the war) in the driveway. The Boomers have chosen a lifestyle built on luxury, gadgets, and home equity. They want vaulted ceilings, spiral staircases, four bathrooms, a three car garage, a study (even though Boomers don’t read), a finished basement, a home theatre, a kitchen the size of a 1950 home, granite, stainless steel, ceramic tile, a computer room, a laundry room, a pet bedroom, a deck, and of course room to expand.

The desire to assert more success by having more home spans all classes. In his book “Luxury Fever,” Cornell University economist Robert Frank noted that Microsoft co-founder Paul Allen built a 74,000-square-foot house. According to Frank, that roughly equaled the size of Cornell’s entire business school, with a staff of 100. Frank sees a “cascading effect” of imitation all along the social spectrum. The super-wealthy influence the wealthy, who influence the upper middle class — and so on. The damage from this game of one ups-man-ship would be minor, if these Boomers hadn’t borrowed all of the money to live the lifestyle of the rich and famous. Glory is fleeting.

Even though 1 in 8 homes exceed 3,500 square feet, there still isn’t room for all our stuff. George Carlin explained this concept in one of his famous comedy bits:

Actually this is just a place for my stuff, ya know? That's all, a little place for my stuff. That's all I want, that's all you need in life, is a little place for your stuff, ya know? That's all your house is: a place to keep your stuff. If you didn't have so much stuff, you wouldn't need a house. You could just walk around all the time. A house is just a pile of stuff with a cover on it. You can see that when you're taking off in an airplane. You look down, you see everybody's got a little pile of stuff. All the little piles of stuff. And when you leave your house, you gotta lock it up. Wouldn't want somebody to come by and take some of your stuff. They always take the good stuff. They never bother with that crap you're saving. All they want is the shiny stuff. That's what your house is, a place to keep your stuff while you go out and get...more stuff! Sometimes you gotta move, gotta get a bigger house. Why? No room for your stuff anymore.

Americans have accumulated so much stuff that their McMansions can’t contain it all. At year-end 1984 there were 6,601 self storage facilities with 290 million square feet of rentable self storage in the U.S. At year end 2008, there were 51,250 “primary” self storage facilities representing 2.35 billion square feet -- an increase of more than 2.0 billion square feet. There is 7.4 square feet of self storage space for every man, woman and child in the nation; thus, it is physically possible that every American could stand – all at the same time – under the total canopy of self storage roofing. It took the self storage industry more than 25 years to build its first billion square feet of space; it added the second billion square feet in just 8 years (1998-2005). Boomer materialism was taken to whole new dimension in the last decade. Boomers would be bursting with pride if they had the room.

Home Equity – The Drug of Choice

Get my television fix sitting on my crucifix

The living room or my private womb

While the moms and brads are away

To fall in love and fall in debt

Jesus of Suburbia – Green Day

I believe owning something is a part of the American Dream, as well. I believe when somebody owns their own home, they're realizing the American Dream. The goal is, everybody who wants to own a home has got a shot at doing so. The problem is we have what we call a homeownership gap in America. Three-quarters of Anglos own their homes, and yet less than 50 percent of African Americans and Hispanics own homes. That ownership gap signals that something might be wrong in the land of plenty. And we need to do something about it.

We are here in Washington, D.C. to address problems. So I've set this goal for the country. We want 5.5 million more homeowners by 2010 -- million more minority homeowners by 2010. Five-and-a-half million families by 2010 will own a home. That is our goal. It is a realistic goal. But it's going to mean we're going to have to work hard to achieve the goal, all of us. And by all of us, I mean not only the federal government, but the private sector, as well. And so I've asked Congress to fully fund an American Dream down payment fund which will help a low-income family to qualify to buy. We believe when this fund is fully funded and properly administered, which it will be under the Bush administration, that over 40,000 families a year -- 40,000 families a year -- will be able to realize the dream we want them to be able to realize, and that's owning their own home.

I want to set up a single family affordable housing tax credit to the tune of $2.4 billion over the next five years to encourage affordable single family housing in inner-city America. One of the things that the Secretary is going to do is he's going to simplify the closing documents and all the documents that have to deal with homeownership. And I'm proud to report that Fannie Mae has heard the call and, as I understand, it's about $440 billion over a period of time. They've used their influence to create that much capital available for the type of home buyer we're talking about here. It's in their charter; it now needs to be implemented. Freddie Mac is interested in helping. I appreciate both of those agencies providing the underpinnings of good capital. President George W. Bush – June 18, 2002

President Bush’s wisdom and farsightedness is breathtaking to observe. Even though 67% of Americans owned a home in 2000, an all-time high, Mr. Bush felt that everyone deserved to own a home. He was going to use the bully pulpit, legislation and a little nudging of the “quasi” governmental agencies to make sure Blacks and Hispanics got a home, just like White people. This was a cause that Barney Frank and Chris Dodd could support with all their corrupted hearts. Of course, those inconvenient facts always seem to get in the way. The median household income of White households in 2003 was $48,000 versus $33,000 for Hispanic households and $30,000 for Black households. Where I come from income is used to save for a down payment and make mortgage payments. In the Bush fantasy world, no one needed a down payment, tax credits paid the mortgage, Fannie & Freddie provided the dough, and the bankers on Wall Street were given the all clear to get creative. This fabulous collaboration led to homeownership soaring to almost 70% and a collapse of the worldwide financial system. I’m sure GWB will write about this episode with pride in his upcoming memoirs.

![[Q4HomeownershipRate.jpg]](/images/2009/May/us-housing-13_image004.jpg)

The housing fantasy land didn’t just apply to the poor and needy. The tax code has always encouraged homeownership, with tax deductions for mortgage interest and property taxes. The bigger and more expensive the house the bigger the tax deductions. President Clinton took time from his extra-curricular activities in 1997 to sign a bill that essentially eliminated capital gain taxes for selling your home. The tax incentive gave people a new inducement to plow ever more money into real estate, and they did so. When you give that big an incentive for people to buy and sell homes, they are going to buy and sell homes. Home ownership stayed flat at 64% from 1985 through 1996 then skyrocketed after this tax incentive was introduced. When prices started to take off in 2000, the rapid appreciation with no tax consequences encouraged people to move on up to the most luxurious house they could “afford”. No money down, option ARMs, and negative amortization loans made perfect sense because you would just trade up in two years with the guaranteed 30% appreciation. This was a can’t lose proposition, just like Pets.com.

Source: John Mauldin

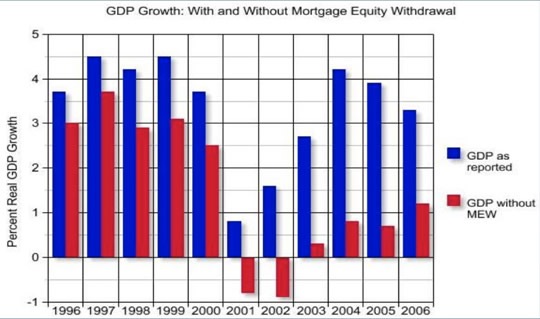

Even the people who weren’t flipping their houses every two years found a way to get into the act. The “irreversible” relentless appreciation in home prices allowed every homeowner to treat their home as an ATM. Americans extracted over $4 trillion of equity from their homes between 2000 and 2008. The equity was spent on flat screen TVs, luxury cars, granite kitchens, exotic vacations, and 2nd & 3rd homes. Everyone knew that home prices never go down. The National Association of Realtors said so. Their mouthpiece was David Lereah. He regularly trumpeted the infallibility of housing as an investment in interviews, on TV and in his 2005 book, Are You Missing the Real Estate Boom?

Below are some of Lereah’s best lines. As an aside, existing home sales have plunged 30% and prices have declined 25% since he spoke these words:

"The level of home sales activity is now at a sustainable level, and is likely to pick up a bit in the months ahead." – January 2006

"This is additional evidence that we're experiencing a soft landing." – April 2006

"We expect sales activity to pick up early next year." – October 2006

Barry Ritholtz accurately describes the NAR and Lereah:

Of all the various parties who contributed to the boom and bust in housing and credit, none have escaped more unscathed than the National Association of Realtors, and their former Baghdad-Bob-in-Chief, David Lereah. The NAR turned a blind eye to fraud amongst realtors in terms of referrals to corrupt appraisers and mortgage brokers. They constantly cheerlead prices, despite evidence to the contrary. For 3 years, they have been forecasting 2nd half price recoveries, dissuading realism amongst home sellers. They continually spun data, presented misleading commentary, and otherwise engaged in behavior that could only be characterized as sleazy.

![[MEWQ42008.jpg]](/images/2009/May/us-housing-13_image007.jpg)

The $4 trillion of equity extraction was essential to artificially making our economy appear strong from 2001 through 2007. Without the consuming of this equity, the GDP would have hovered between -1% and +1% over this entire time period. The glorious Bush tax cuts and rebates did not create a strong economy. Borrowing and spending led the way. The median price of an existing home in 2000 was $143,600. It skyrocketed to a peak of $221,900 in 2006, a 55% increase in six years. Despite this tremendous rise, owner’s equity remained in the 60% range where it had been since 1990. The equity was frittered away on trinkets and baubles. Fast forward to today and median prices have plunged to $169,000, still 18% above the 2000 level, but owner’s equity is down to 43%. That is the amazing thing about debt, it remains in place as the asset behind the debt drops 24%. This is where we find ourselves today.

Alan Abelson from Barron’s passed along the wisdom of a skeptical Stephanie Pomboy regarding the much anticipated recovery in housing and the financial sector:

“The complacent reaction among the investment cognoscenti is that the credit markets are wildly oversold. More likely, she sniffs, it has something to do with the fact that “an overwhelming portion of some $8 trillion in mortgage debt (or 80% of the total) is teetering on the edge of, or in some state of, negative equity.”

As to the Fed’s claim that the equity of homeowners as a group stands at 43%, she points out that what the Fed neglects to tell you is that roughly a third of them have their houses free and clear. Lo and behold, some basic arithmetic reveals that 67% of homeowners with mortgages have equity of less than 15%. That, Stephanie comments drily, suggests the “destruction priced into the credit markets hardly seems out of whack with potential reality.”

And while, thanks to “the transfer of toxic assets to taxpayers” and the magic of accounting legerdemain, the scarred financials to some significant extent may be spared further pain, the same, alas, can’t be said for the nonfinancial sector. Little recognized, she insists, is how much the extraordinary gains in domestic nonfinancial profits from the low in 2001 to the peak in 2006 — a stunning rise of 388% — owed to the housing bubble.”

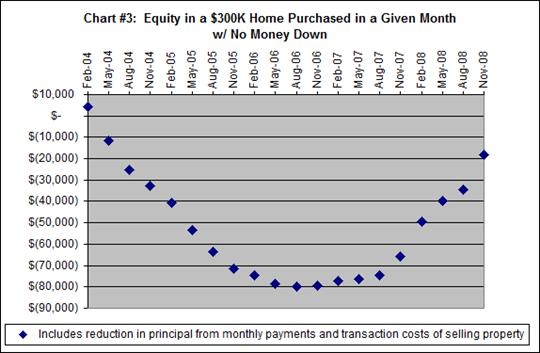

The fascinating chart below paints a clear picture of the housing gamblers from the past decade. If you purchased a home with no money down between 2004 and 2008, you are underwater in your loan. If you purchased in August 2006, you win the prize for dumbest move ever. On a $300,000 house, you’ve managed to lose $80,000 in less than three years. More than 20 million residences or 22% of all homes in the U.S. are in a “negative equity” position, with 67% in Las Vegas and 51% in Stockton and Modesto California. With at least another year of declines and another 10% reduction in home values, this doesn’t appear to be a recipe for a strong housing recovery.

Source: Chartingeconomy.com

Housing Has Bottomed

At the center of the Earth

In the parking lot

Of the 7-11 where I was taught

The motto was just a lie

It says home is where your heart is

But what a shame

Cause everyone's heart

Doesn't beat the same

It's beating out of time

Jesus of Suburbia – Green Day

There is no need to worry. Jim “Mad Money” Cramer assures us that the bottom is in for housing. Here are his words:

“The bottom, well, is now. We are seeing a huge wave of buying of foreclosed homes in Northern and Southern California and in Florida. The numbers are too positive to think that these, the hardest-hit areas, aren't putting in long-term bottoms.” Jim Cramer – April 19, 2009

Of course, Jimbo has called more bottoms than a proctologist. His housing market bottom call of 2006 was off slightly, by about 4 years. His latest call will be off by two years, so he is getting better. Jim Cramer is the best salesman since P.T. Barnum. He is able to hock his 4 books and website twenty times in the space of an hour every night, while helping clueless morons lose what is remaining of their retirement savings. You will learn more and lose less by watching Cash Cab every night from 6:00 pm to 7:00 pm rather than watching the shameless shill Jim Cramer.

Based on past results, I think I’d rather put my faith in Professor Robert Shiller, who called the Tech bubble and the Housing bubble when others were proclaiming a new paradigm. According to the Case-Shiller Index, home prices have dropped between 25% and 30% since the mid-2006 peak.

![[case-shiller-2009-03-TC.png]](/images/2009/May/us-housing-13_image013.jpg)

Based on the Case-Shiller Futures Index which has performed better than a Jim Cramer appearance on the Daily Show with Jon Stewart, the bottom of the housing market will occur in late 2010, with further declines of 5% to 25% in major markets. Cramer’s house in Northern New Jersey will take a 24% hit by November 2010 according to the futures market. I’m sure he sees that coming. It would be refreshing if he ever looked at facts and based his ever changing recommendations on a sound basis in reality.

![[case-shiller-2009-03-tcf.png]](/images/2009/May/us-housing-13_image015.jpg)

How can anyone in their right mind say that housing has bottomed when the months supply of new homes is at an all-time high of 13 months, the months supply of existing homes is 10 months, there will be 2.1 million foreclosures in 2009 versus 1.7 million in 2008, and 7 to 8 million more people will lose their jobs in 2009? Neither foreclosure counseling, foreclosure moratoriums or magic pixie dust will keep housing prices from completing their roundtrip back to 2000 levels. Bubbles never burst halfway. They burst completely and the mess spreads everywhere.

![[NHSJan2009Months.jpg]](/images/2009/May/us-housing-13_image017.jpg)

Boulevard of Broken Dreams

Now the bad news. We are in a momentary lull of mortgage resets. The subprime crisis is mostly behind us. Now the Option ARM and Alt-A crisis is coming down the track like a freight train. Even a Citicorp or Bank of America CEO could understand the following chart, given enough time and sixth grader to explain it to them. The Option ARM wins the prize for most creative financial product of mass destruction. These are ticking time bombs set to explode in 2010 and 2011.

![[recast.gif]](/images/2009/May/us-housing-13_image019.gif)

The beauty of an Option ARM is that it usually has three options. You can make a principal & interest payment, just an interest payment, or a minimum payment that increases the principal balance. Most of these loans also had introductory low teaser rates. The resets for these loans skyrocket in 2010 and 2011. Payments on these loans will go up 50% to 80%. Most of these loans are already underwater. Millions more “homeowners” will walk away and foreclosures will grow. Luckily, the Federal Reserve and Treasury cut the Stress Test off in 2010. The coming enormous bank losses in 2011 would have put a crimp in their little confidence game. The government solution to this problem has been to coerce, threaten, and provoke fear in the populace to seize their tax dollars, pile the hundreds of billions into a giant dump truck and unload the pile of tax dollars onto the front steps of Citicorp, Bank of America, Goldman Sachs, Wells Fargo and JP Morgan. Creative market based solutions that require thought, rationale, wisdom, and fortitude are dismissed. John Mauldin’s proposal to grant a green card to any immigrant who buys a home and John Hussman’s PAR proposal that would solve the foreclosure problem aren’t even considered because they wouldn’t increase the power of government over the people.

![[YouAreHere.jpg]](/images/2009/May/us-housing-13_image021.jpg)

Turning Japanese

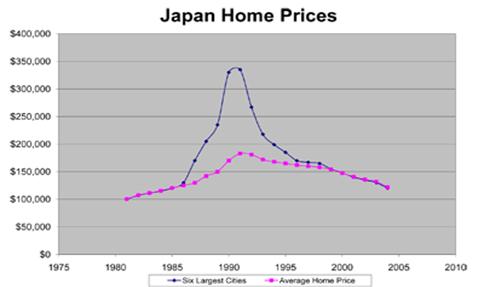

The good news is that housing prices will eventually bottom. This will likely occur in 2010. Then what? The cheerleaders on CNBC expect 5% to 10% gains to resume as if nothing had happened. The example of Japan is more likely to be our future. Every circumstance leading up to the Japanese housing crash has been present in the U.S. during the last decade:

- Historically low interest rates

- Housing touted as a 'can't miss investment'

- Median home prices doubled

- Median home prices in largest markets tripled

- Lenders offered risky loans

- Government acted as a partner to industry

- Home price increases far outpaced wages and rents

After reaching peak values, Japanese home prices declined by an average of 40%. In the country's largest cities, the declines were worse, averaging 65%. Homes in Tokyo lost 80% of their value and are still on the downward slide to this day. National home prices in Japan were $125,000 in 1985. Twenty years later home prices are again at or near the $125,000 level. If the U.S. follows this path, median home prices will be $143,600 in 2020, the same level as 2000. You won’t hear any “experts” making this prediction, because the economic implications would be too dire. A nice dose of runaway inflation could solve this dilemma. Are you up for it?

|

Fraud, Lies & Deceit

“The lies the government and media tell are amplifications of the lies we tell ourselves. To stop being conned, stop conning yourself.” James Wolcott

The entire suburban existence of the last twenty years has been a fraud, built on a foundation of debt, with bankers lying to investors and homeowners deceiving themselves. Fraud is the intentional perversion of truth in order to induce another to part with something of value. The CEO’s of major financial institutions intentionally created and marketed fraudulent mortgage products in order to enrich themselves. Why would someone create NINJA loans (No Income, No Job or Assets) unless you wanted to induce borrowers to commit fraud? What good business reason would a professional financial manager have for not wanting to know whether the person has a job or income when you are loaning them $400,000? The reason is simple. They knew the loans they were making were frauds, but they didn’t care. They were bribing Moody’s and S&P with huge payoffs to buy a AAA rating for their packages of fraudulent loans, so they could sell them to unsuspecting investors throughout the world. Former banking regulator William Black described the process:

“The way that you do it is to make really bad loans, because they pay better. Then you grow extremely rapidly, in other words, you're a Ponzi-like scheme. And the third thing you do is we call it leverage. That just means borrowing a lot of money, and the combination creates a situation where you have guaranteed record profits in the early years. That makes you rich, through the bonuses that modern executive compensation has produced. It also makes it inevitable that there's going to be a disaster down the road.”

The executives of Countrywide, Indy Mac, Washington Mutual, among others committed this fraud on a gigantic scale. CEOs, Vice Presidents, mortgage brokers, appraisers, and loan officers all knew they were committing fraud. Were these people raised by moral parents or Satan? None of them are in jail. How could trillions be lost and no one goes to jail? Angelo Mozilo is working on his tan on a beach in the Caribbean enjoying the $140 million he sucked out of Countrywide, when he should be in prison worrying what will happen during his next shower. Our government is covering up. William Black explains why:

“Geithner is covering up. Just like Paulson did before him. Geithner is publicly saying that it's going to take $2 trillion — a trillion is a thousand billion — $2 trillion taxpayer dollars to deal with this problem. But they're allowing all the banks to report that they're not only solvent, but fully capitalized. Both statements can't be true. It can't be that they need $2 trillion, because they have massive losses, and that they're fine. These are all people who have failed. Paulson failed, Geithner failed. They were all promoted because they failed. AIG was being used secretly to bail out favored banks like UBS and like Goldman Sachs. Secretary Paulson's firm, that he had come from being CEO. It got the largest amount of money, $12.9 billion. And they didn't want us to know that. And it was only Congressional pressure, and not Congressional pressure, by the way, on Geithner, but Congressional pressure on AIG.”

The lies we’ve been told by government, corporate America, and the media are no worse than the lies we’ve told ourselves. We have tripled the size of our houses, and reduced the sense of community in our nation. Many have perfectly manicured lawns, polished appliances, 12 spotless rooms and dysfunctional, aloof, joyless lives. A McMansion, stainless steel appliances, 6 flat screens, and granite countertops do not guarantee happiness. When all of these items are bought on credit, you have a tragedy. America has degenerated into a materialistic, corrupt, me first, soul-less society. Nobody is right. Nobody is wrong. Everyone deserves to win, even if they made horrible decisions. Unless this changes soon, this country is doomed. By 2020 the United States will essentially be an old aged pension fund with an army.

The time for fraud, lies and deceit are over. Anyone within the banking industrial complex, from CEOs to loan officers that committed fraud must go to jail. If individuals lied on their mortgage documents, they should be prosecuted for fraud. If Hank Paulson and Ben Bernanke told Ken Lewis to lie, they should be prosecuted. If you borrowed too much and can’t make the payment on the house you are occupying, move out. You lose. Let prices fall to bargain levels and the winners in society who didn’t take on 150% leverage will buy the houses. A twenty year period of economic stagnation may be the best thing that could happen to this country. Saving would again become a virtue. Materialism would be ridiculed. Homes would be a place to live, rather than an investment. Truly important things like family, friends, community, trust and faith might take precedence once again. Or we could go on flipping houses and keeping up with the Joneses. What would Jesus of Suburbia Do?

If you are seeking the truth, join me at www.TheBurningPlatform.com .

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.