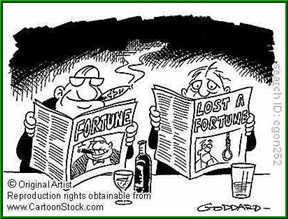

Stock Markets Snap Three Day Losing Streak

Stock-Markets / Financial Markets 2009 May 15, 2009 - 04:50 AM GMTBy: PaddyPowerTrader

On a drab, lethargic day, financials Citigroup and JP Morgan led the Dow Jones to a modest 46 point gain. Chip stocks on the Nasdaq (notably Rambus, who had an anti trust suit against them dismissed by the FTC) and the broader S&P 500 faired better, posting 1% and 1.5% rises respectively. In other equity news Wal-Mart came in with numbers that were in line with expectations, while upper end chain store Nordstrom beat profit estimations after the closing bell. They also bullishly raised guidance for the year.

On a drab, lethargic day, financials Citigroup and JP Morgan led the Dow Jones to a modest 46 point gain. Chip stocks on the Nasdaq (notably Rambus, who had an anti trust suit against them dismissed by the FTC) and the broader S&P 500 faired better, posting 1% and 1.5% rises respectively. In other equity news Wal-Mart came in with numbers that were in line with expectations, while upper end chain store Nordstrom beat profit estimations after the closing bell. They also bullishly raised guidance for the year.

The bad news, of course, is the jobless claims numbers. Thursday’s rise suggests that rather than having turned the corner, jobless claims have just settled into an uncomfortably high range between 600k and 650k. Even worse, continuing claims are shooting up above and beyond the levels implied by initial jobless claims; in other words, the level of hiring is low even relatively to the level of firing.

This jobless claims data gives a strong hint that we are not on a ‘V’-shaped improvement path. Instead, it suggests that having come back from the utter depths of Q4/Q1, we are settling into a new, still fairly awful, paradigm. It’s yet another reason I’m comfortable with a short-term view of S&P heading down towards 800 and a longer-term view that sometime in H2 it will make fresh lows.

There’s a heavy data-set across the regions on Friday which has some chance of breaking the good news/bad news deadlock. For risk the 879 20-day in the S&P is the key level. We have not managed to get below it yet and it will take a full close below it to really get the down move accelerating from here. I can’t say for sure that it will happen today but I do think it will happen soon, and you should be positioning yourself for a swift 5-10% fall in equities once this has happens.

Today’s Market Moving Stories

- Reports in the Telegraph suggest China is laying the groundwork for CNY to overtake USD as the global reserve currency, citing Dr Doom Prof Nouriel Roubini as saying the fact that China has a current account surplus, a focused government and few economic worries, make it an ideal candidate.

- The WSJ reports that the US Treasury will provide up to $22bn in TARP funds to troubled life insurers. Elsewhere, Barclays is reportedly looking to sell BGI for about $10bn.

- ECB council member and chief economist Jurgen Stark has suggested inflation could turn negative this month and will likely remain so for the next six months while Orphanides has said there is a risk that inflation expectations dis-anchor in response to low inflation readings. After the plethora of comments from ECB officials yesterday it is clear they believe rates are low enough for the time being, but clear divisions exist on whether further exceptional policy measures will be necessary.

The German economy contracted at record speed in the first quarter of the year. A GDP decline of 3.8% QoQ is the worst contraction ever. It did not come as a real surprise but it is still shocking to see. According to the first estimate by the German agency for statistics, GDP declined by 3.8% QoQ (-6.9% YoY) in the first quarter of 2009. This is the biggest quarterly decline ever and the fourth consecutive quarter of negative growth. Previously the first quarter of 1987 held the infamous record of worst quarter-ever with -2.5%.

The German economy contracted at record speed in the first quarter of the year. A GDP decline of 3.8% QoQ is the worst contraction ever. It did not come as a real surprise but it is still shocking to see. According to the first estimate by the German agency for statistics, GDP declined by 3.8% QoQ (-6.9% YoY) in the first quarter of 2009. This is the biggest quarterly decline ever and the fourth consecutive quarter of negative growth. Previously the first quarter of 1987 held the infamous record of worst quarter-ever with -2.5%.

The decomposition of the GDP numbers will only be published in two weeks but recent monthly data indicate that the collapse of exports, inventory corrections and declining investments were the main drag on growth. The last three years of economic growth have gone up in smoke.

Equities

Irish Life and Permanent plc issued an IMS statement ahead of its AGM today, highlighting the tough economic conditions and its impact on consumer confidence but also some “positive signs”. The group also talks of setting up a holding company, presumably to facilitate to split up of the bank and life divisions. On the banking side, new residential mortgages are down 80% on the previous year. The group mentioned the growth of its retail deposit book but also highlights the impact of the corporate outflows from Ireland and the expansion of the ECB drawdown.

Irish Life and Permanent plc issued an IMS statement ahead of its AGM today, highlighting the tough economic conditions and its impact on consumer confidence but also some “positive signs”. The group also talks of setting up a holding company, presumably to facilitate to split up of the bank and life divisions. On the banking side, new residential mortgages are down 80% on the previous year. The group mentioned the growth of its retail deposit book but also highlights the impact of the corporate outflows from Ireland and the expansion of the ECB drawdown.

- It’s unclear whether the bank has managed to close the Loan/Deposit gap. As we saw earlier the group has raised €2bn of senior debt, with a maturity of September 2010, under the government guarantee scheme. On the bad debt side, arrears have increased in all the lending books. The group is seeing higher IBNR provisions as a result of higher arrears, with non-performing loans now at 2.6% from 2% in December. This is in line with the increase seen at AIB. On the UK book, arrears have stabalized at 4.2% non-performing to end March up from 3% in December.

- Other shares in the news this morning include Rio Tinto whose shares are up on news that it is going ahead with as planned in raising $19.5bn from Aluminium Corp of China aka Chinalco

- It’s hardly reassuring when 2 employees of the SEC are being probed for insider trading!

- The global financial crisis in diagram form; the beginning to the end and back again.

Today’s Data

US Apr CPI (12:30pm GMT): Modest advances in food and core prices may be just enough to leave the overall index unchanged in April. Meanwhile, the core CPI could have moderated to a 0.1% advance in April. (consensus: 0.0% m/m headline,+0.1% m/m core)

US Industrial Production and Capacity Utilization (2:15pm BST): I expect the decline in manufacturing output in April to have been limited to 0.3%, which would be the best performance since mid-2008. I look for capacity utilization to have slipped again, to 69.0%. (consensus: -0.6% m/m IP, 68.8% CU)

US Consumer Sentiment University of Michigan (3:00pm BST): Consumers have understandably grown more optimistic as stock prices have rebounded and recent economic reports have turned noticeably less dire. We look for the University of Michigan measure to have improved further in May, perhaps to 69.

Earnings today from JC Penny ($0.10), Abercrombie and Fitch ($-0.14)

Global Gardening

The recent bounce in financial markets, notably equities, seems justified by the improvements in the business surveys and the stabilization in consumer confidence. However, further large gains from here would require a V-shaped economic recovery. While that scenario is not completely unrealistic in some countries, including the US and Japan, it is much more likely that the recovery falters as the temporary factors that have contributed to the rebound start to fade or actually go into reverse. Many economies are also at growing risk of a new shock in the form of falling wages.

Even unrepentant bears, such as myself, did not expect the major advanced economies to continue shrinking at the same rate as they have done over the last two quarters. The collapse in confidence following the bankruptcy of Lehman Brothers last September undoubtedly accelerated the rundown of inventories and exacerbated the slump in world trade via its impact on the flow of trade finance. The unprecedented policy measures taken to avert the threat of a financial meltdown and cushion the real economy have at least halted this downward spiral. Nonetheless, there are many reasons to hesitate before predicting a smooth recovery.

For a start, history shows that recessions triggered by financial crises are deeper and last longer than those caused by other shocks, and recoveries are slower. What’s more, this is a synchronized global downturn where the scope for exports to contribute to any country’s recovery is clearly limited.

Second, aside from the business surveys, the evidence of recovery is still patchy. Manufacturing had been hit out of all proportion to the rest of the economy by the inventory correction and collapse in world trade and therefore has plenty of room to recover. But consumer spending could still weaken further. Even within industry the inventory correction probably still has further to run.

Third, the extraordinary policy stimulus will not be repeated and in some cases, notably the UK, the fiscal stimulus may soon have to be reversed. Even if official interest rates remain near zero for longer than generally anticipated (as we expect) they clearly cannot be cut further. The widespread adoption of quantitative easing is helping to restore risk appetite in financial markets, but so far there is little evidence that it is yielding major benefits in terms of the cost or availability of credit.

Another risk is a further wave of problems in the financial sector. The most toxic assets may have been addressed, but the depth of the recession and the prospect of further large rises in unemployment mean that there are still plenty of losses to come from conventional lending. Finally, the recovery has been flattered by the one-off boost to the growth of real incomes from the sharp falls in headline inflation. The onset of widespread price deflation - including falling wages - would bring a whole new set of problems.

Another risk is a further wave of problems in the financial sector. The most toxic assets may have been addressed, but the depth of the recession and the prospect of further large rises in unemployment mean that there are still plenty of losses to come from conventional lending. Finally, the recovery has been flattered by the one-off boost to the growth of real incomes from the sharp falls in headline inflation. The onset of widespread price deflation - including falling wages - would bring a whole new set of problems.

And Finally…

Mmmmm; from stiff upper lip to…?

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.