Global Stock Market Rally Finally Succumbs to Selling on Premature Recovery Optimism

Stock-Markets / Financial Markets 2009 May 17, 2009 - 12:27 PM GMT A long-awaited reversal in the monumental global stock market rally since early March finally arrived last week. As the first-quarter earnings season started winding down and post stress-test capital-raising weighed on some banks, investors were faced with a slew of gloomy economic reports suggesting the recent optimism about a global recovery might have been premature.

A long-awaited reversal in the monumental global stock market rally since early March finally arrived last week. As the first-quarter earnings season started winding down and post stress-test capital-raising weighed on some banks, investors were faced with a slew of gloomy economic reports suggesting the recent optimism about a global recovery might have been premature.

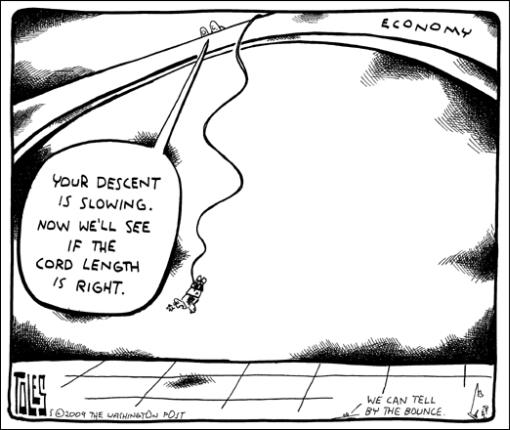

“This week, the hard economic data remind us that the global recession is ongoing: exports remain deep in the red; retail sales disappoint; inflation still volatile on food and energy but down on year; and industrial production declines. However, the data are consistent with the story of a slowing economic decline, foretold by several ‘green shoot’ survey reports,” said Rebecca Wilder (News N Economics).

Source: Tom Toles, Washington Post.

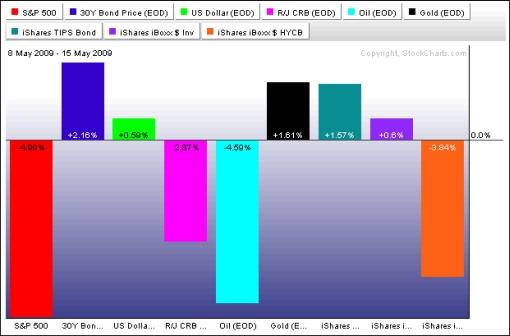

“Less bad” economic reports provided investors with little comfort, sparking a reassessment of their risk appetite and leading to profit-taking on most bourses. Also, commodities retreated after recording four-month highs earlier in the week, and high-yield corporate bonds and emerging-market currencies came off the boil. On the other hand, safe-haven assets such as government bonds, gold bullion, the US dollar and Japanese yen attracted buying. Investment-grade corporate bonds and Treasury inflation-protected securities also closed the week in positive territory.

The performance of the major asset classes is summarized by the chart below.

Source: StockCharts.com

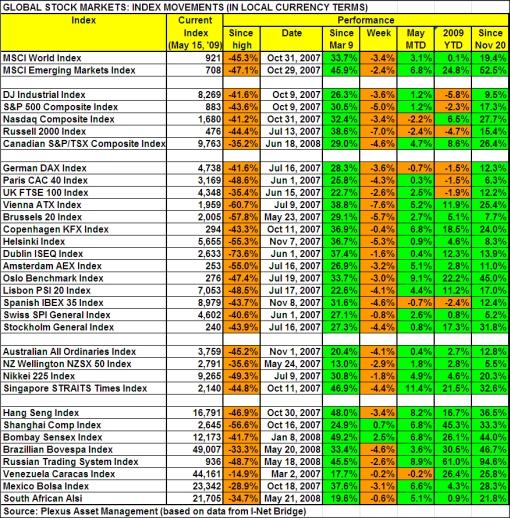

After nine straight weeks of gains, global stock markets succumbed to profit-taking last week with the MSCI World Index falling by 3.4% (YTD +0.1%) and the MSCI Emerging Markets Index down by 2.4% (YTD +24.8%).

Similarly, the major US indices reversed course. The Nasdaq Composite Index (-3.4%, YTD +6.5%) and the Russell 2000 Index (-7.0%, YTD -4.7%) declined after rising for nine consecutive weeks and the Dow Jones Industrial Index (-3.6%, YTD -5.8%) and the S&P 500 Index (‑5.0%, YTD -2.3%) fell after being up eight out of nine weeks.

After last week’s sell-off the Nasdaq is the only major US index still in the black for the year to date, finding itself in the company of the majority of emerging and mature markets.

Returns around the world ranged from top performers Serbia (+10.0%), Cyprus (+9.7%), Bermuda (+9.5%), Namibia (+8.5%) and Vietnam (+6.5%) to Romania (-12.2%), the Czech Republic (-8.3%), Finland (-6.9%), Luxembourg (-6.9%) and Indonesia (-6.0%) which experienced headwinds. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

China (+33.3%), one of the leading stock markets for the year to date together with Brazil (+46.7%) and Russia (+94.6%), notched up another gain (+0.5%) last week despite disappointing economic data. A revival in Chinese property transactions has been a major contributor to China’s recent recovery in industrial activity. Good news for Chinese equity bulls is the close historical relationship between property sales and the performance of Chinese stocks.

Source: US Global Funds - Weekly Investor Alert, May 15, 2009.

With nearly all the US companies having reported first-quarter earnings, the S&P 500 saw earnings decline by 34.6% compared to the same quarter in 2008, reported Bespoke. At the start of the earnings season, a decline of 38.2% was expected. The percentage of companies lowering guidance was cut by more than half, while the percentage of companies raising guidance increased by over 70%. A tough second quarter undoubtedly still lies ahead, especially as companies will not have the advantage of non-recurring cost cutting.

John Nyaradi (Wall Street Sector Selector) reports that the strongest exchange-traded funds (ETFs) on the week were SPDR Russell/Nomura Small Cap Japan (JSC) (+6.1%), Market Vectors Agribusiness (MOO) (+5.4%) and iShares MSCI Chile Index (ECH) (+4.4%). On the other end of the performance scale KBW Bank (KBE) (-15.4%), iShares Dow Jones US Regional Banks Index (IAT) (-14.5%) and KBW Regional Bank (KRE) (‑13.7%) were underwater as positive catalysts for the banking sector dried up.

As far as the economic sector ETFs are concerned, defensive sectors outperformed during the week, with Health Care SPDR (XLV) and Consumer Staples SPDR (XLP) leading the way. Financial SPDR (XLF) and cyclicals such as Consumer Discretionary SPDR (XLY) and Industrial SPDR (XLI) were on the receiving end of the selling pressure.

Source: StockCharts.com

Lower interbank lending rates indicated reduced strains in the financial system, as seen from the three-month dollar, euro and sterling LIBOR rates declining to record lows. After having peaked at 4.82% on October 10, the three-month dollar LIBOR rate declined to 0.83% on Friday. LIBOR is therefore trading at 58 basis points above the upper band of the Fed’s target range - a great improvement, but still high compared to an average of 12 basis points in the year before the start of the credit crisis in August 2007.

Gold bullion seems to be regaining its luster and again edged higher last week. “As sure as night follows day, the Federal Reserve’s purchase of bonds and home mortgages and the resulting rapid increase in bank reserves (quantitative easing in Fed-speak) - unless soon reversed - are underwriting a coming acceleration of inflation,” said gold specialist Jeffrey Nichols. “… by the time the broad financial markets register a worsening of inflation expectations gold will already have made a major move to the upside. It provides an early warning or leading indicator of inflation, signaling the coming acceleration long before financial markets begin to quiver.”

As to be expected, there is a strong relationship between the yellow metal (green line) and Treasury inflation-protected securities (red line).

Source: StockCharts.com

The quote du jour relates to whether the fact that bank stocks have rallied and in some instances been able to raise private capital, augurs an end to the financial crisis. Barry Ritholtz, editor of The Big Picture blog and author of Bailout Nation, a newly published and must-read book, succinctly remarked: “You can’t drink yourself sober and you can’t leverage your way out of excess leverage.” Many big banks remain technically insolvent and “are only being held together by spit, bailing wire and tape,” said Ritholtz in an interview with Yahoo Finance, Tech Ticker.

The banking system needs more time, at least three to five years, to deleverage before it can be left to its own devices, Ritholtz remarked, suggesting only time can heal the sector’s wounds.

In other news, the US Treasury announced that it would make $22 billion available to insurers from the Troubled Asset Relief Program (TARP), and the Obama administration sought new authority to bring transparency to the credit derivatives markets and also to crack down on the credit card industry.

Next, a tag cloud of all the articles I read during the past week. This is a way of visualizing word frequencies at a glance. Key words such as “market”, “financial”, “prices”, “banks”, “government” and “economy” again featured prominently. For the rest, it is really a bit of everything.

Back to the stock market. An analysis of the moving averages of the major US indices shows the spring rally having encountered resistance at the important 200-day line and/or the early January highs. The highs of May 8 are the most immediate target to the upside, whereas the levels from where the rally commenced on March 9 should hold in order for base formations to remain in force.

Click here or on the table below for a larger image.

A useful indicator of market breadth is a chart showing the percentage of S&P 500 stocks trading above their 50-day moving averages. Although this measure has declined to 78% from 92% in early May, it is still at a level typically seen at prior peaks during the bear market. This still looks overdone in the short term, but for a primary uptrend to manifest itself, the bulk of the index constituents should remain above the 50-day line and also trade above their 200-day averages (31% at the moment).

Source: StockCharts.com

Interestingly, Bespoke highlights that on a sector basis the percentage of stocks trading above their 50-day moving lines has fallen the most in Technology, Consumer Discretionary, Utilities and Financials. However, Health Care has actually seen its reading increase over the last few days as investors rotate from cyclical to defensive stocks.

For more about key levels and the most likely short-term direction of the S&P 500, Adam Hewison of INO.com prepared another of his popular technical analyses. Click here to access the short presentation.

Marc Faber, the author of “The Gloom, Boom & Doom Report”, wrote in his latest research report (via CNBC): “… I think that, at least in nominal terms (inflation-adjusted), the global printing presses being run by the world’s central banks and fiscal deficits have begun to impact asset prices positively. The lows reached by resource and mining stocks, as well as Asian equities and most emerging markets, are likely to hold for now.” But very high volatility and “price fluctuations that don’t appear to make any sense” will be the new dominant characteristic of the market, he warned.

Asking Richard Russell (Dow Theory Letters) what fundamentals he thought could cause the market to break the March lows, he replied: “You want guesses? Here are mine. (1) A collapse of the dollar along with a collapse in the bond market. (2) The US losing the reserve status of the dollar. (3) US consumers going on a long and unexpected buying strike plus a consumer saving campaign that shocks the economists and the Fed. (4) The Fed unable to halt asset deflation. (5) Federal budget deficits growing completely out of control, the compounding interest on the federal debt paralyzing the country with the catastrophic result that nobody will lend money to the US.”

According to the Telegraph, James Montier of Société Générale said prolonged suckers’ rallies tend to be especially vicious as they force everyone back into the market before cruelly dashing them on the rocks of despair yet again,” he said. Genuine bottoms tend to be “quiet affairs”.

“Teun Draaisma, Morgan Stanley’s stock guru, expects another shake-out, as reported by the Telegraph. “We think the bear market rally will end sooner rather than later. None of our signposts of the next bull market has flashed green yet. We’re not convinced the banking system has been fully fixed,” he said. He anticipates the new bull market to kick off later this year - perhaps in October - anticipating real recovery in 2010.

I am of the opinion that the US and other mature stock markets are in the process of mapping out a base development formation, which probably means toing and froing between policy tailwinds and economic headwinds.

But the “too-much-too-fast” rally made it inevitable for markets to either consolidate or retrace some of the past nine weeks’ gains prior to moving higher. Such a pullback as is now taking place is natural and necessary and should not be too much cause for concern, provided the levels from where the rally commenced in March hold.

For more discussion about the direction of stock markets, also see my recent posts “Stock markets: Reversal time?“, “Technical talk: Nasdaq in correction mode” and “Video-o-rama: Gloomy economic reports rein in investors’ optimism“. (Also, Donald Coxe’s webcast has been updated for May 15 and makes for good listening material. This can be accessed from the sidebar of the Investment Postcards site.)

John Mauldin’s “Conversations”

For those of you not familiar with John’s latest project (he is the author of Thoughts from the Frontline), it is called “Conversations with John Mauldin”. The most recent Conversation was with Gary Shilling and Donald Coxe, sharing in a rather lively debate their very different views on whether commodity prices will rise or fall. Previous Conversations included the views of Chris Whalen on the banking crisis, Lacy Hunt and Ed Easterling on the fundamentals of the economic crisis, and Nouriel Roubini.

Audios and transcripts of the Conversations are being produced. Although an annual subscription for a dozen Conversations retail at $199, I have negotiated a special price of $109 (-45%) for Investment Postcards readers. To find out more, just click here and enter code JM55 (at the end of the form), which will give you the discounted price.

Economy

“Global business sentiment has meaningfully improved since mid-March. The global confidence index remains consistent with ongoing recession, but the intensity of the downturn is abating. Most notable is a sharp gain in expectations regarding the outlook six months hence; it turned positive last week for the first time since the summer of 2007 just prior to the start of the current financial crisis,” said the latest Survey of Business Confidence of the World conducted by Moody’s Economy.com.

Jean-Claude Trichet, European Central Bank president, said on Monday the global downturn had bottomed out with some large economies already able to put the recession behind them and looking forward to renewed growth, according to the Financial Times. His remarks came as the Organization for Economic Co-operation and Development said there were signs of a “pause” in the economic slowdown in France, Italy, the UK and China.

Source: Financial Times, May 11, 2009.

“The economic free fall has been stopped, the collapse of the financial system averted. National economic stimulus programs are starting to take effect. The downward dynamic is easing,” billionaire investor George Soros was quoted as saying to a German newspaper (via Yahoo Finance).

“I expect the recovery to make up for around half of the downturn we have had and then to move into stagnation. Asia will be first out of the crisis, but America is also currently doing that,” he said.

The International Monetary Fund said the recovery would take longer than normal because the slump was precipitated by a worldwide financial crisis, expecting the global economy to contract by 1.3% this year.

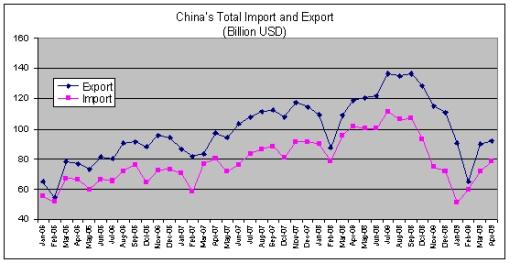

Focusing specifically on China, the Financial Times reported “the total value of Chinese exports fell 22.6% to $91.9 billion last month compared with the same month a year earlier - a faster rate of decline than the 17.1% year-on-year drop in March”. However, Kevin (Sinolese.com) highlights that whereas total trade is down compared with March on an annual basis, this is because of a big increase from March 2008 to April 2008. ”When compared with the March number of this year, the result is positive. Not only so, total trade has been up for two consecutive months, with imports increasing faster than exports.”

Source: Kevin (Sinolese.com), May 15, 2009.

Turning to the US, a snapshot of the week’s economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

May 15, 2009

• The hike in core Consumer Price Index is temporary

• Factory production - moderation in pace of decline

• Consumer sentiment improves in May

May 14, 2009

• Auto industry shutdowns lead to jump in Initial Jobless Claims

• Food prices raise Wholesale Price Index

May 13, 2009

• Retail sales are stabilizing, but Q2 consumer spending should be weak

• Higher prices for petroleum imports lift overall import prices

May 12, 2009

• Small Business Optimism Index improves

• Trade balance widens slightly in March

May 11, 2009

• Fed’s program to purchase Treasuries, mortgage and agency securities - update

Also, RealtyTrac on Wednesday released its April 2009 US Foreclosure Market Report, which shows foreclosure filings - default notices, auction sale notices and bank repossessions - were reported on 342,038 US properties during the month, an increase of less than 1% from the previous month and an increase of 32% from April 2008.

Nobel Prize winning economist Paul Krugman argues that a rapid recovery is “extremely unlikely”. According to Bloomberg, he said: “Some of the measures that have been taken to deal with the crisis seem to be predicated on the belief that this is going to be a short, short recession. Everything says that’s wrong, that this is going to be a sustained period of weakness.”

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

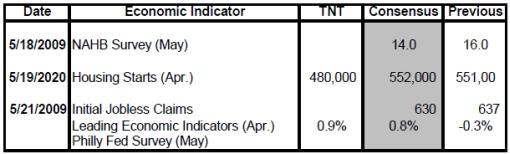

In addition to the Federal Open Market Committee (FOMC) releasing minutes of its April 29 meeting (Wednesday, May 20) and the Bank of Japan announcing its interest rate decision (Friday, May 22), the US economic highlights for the week include the following:

Source: Northern Trust.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, May 15, 2009.

Elroy Dimson, professor at the London Business School, said: “Risk means more things can happen than will happen.” Hopefully the “Words from the Wise” reviews will assist Investment Postcards readers in taking informed decisions to make sure “fewer things” happen to their investment portfolios.

That’s the way it looks from Cape Town (where the days are getting shorter and colder as winter approaches).

Source: Dilbert.com (via Barry Ritholtz’s The Big Picture).

Reuters: US banking crisis may last until 2013 “A day after saying big US banks probably needed to raise only one-fourth the capital demanded by the government, Standard & Poor’s said the nation’s banking crisis has ‘merely entered a new phase’ and might not end before 2013.

“The credit rating agency said the industry is being propped up by hundreds of billions of dollars of government support, especially for lenders considered too important to the financial system to fail.

“While efforts to spur lending, take bad assets off banks’ balance sheets, and restart the market for packaging and selling securities may help the sector, S&P said banks will have a tough time surviving absent a bigger capital cushion than regulators require.

“‘There’s nothing to say that this banking crisis can’t go on for another three or four years,’ S&P Managing Director Tanya Azarchs said.

“On Tuesday, S&P said major US banks need to raise about $18 billion of capital to protect themselves from the economic downturn, though this amount could grow if conditions worsen.

“The amount is well below the $74.6 billion that the government last week ordered 10 of the largest US banks, led by Bank of America Corp and Wells Fargo & Co, to plug potential capital shortfalls.

“S&P on May 4 said it may lower its ratings for 23 US banks and thrifts, including 10 that underwent stress tests, citing concern about the industry’s capitalization.”

Source: Reuters, May 13, 2009.

Financial Times: US to roll out latest phase of rescue plan “With bank stress tests out of the way and favourably received by the markets, the Obama administration will now roll out the next phase of its financial rescue plan: schemes to deal with toxic ‘legacy assets’.

“Senior administration officials are keen to get new private-public marketplaces for these bubble-era loans and securities up and running quickly so banks can clean up their balance sheets and attract the $74.6 billion in equity they need to meet their stress test targets.

“Treasury has drawn up a shortlist of fund managers eligible to partner in the scheme and is expected to announce its selection in early June. The Federal Reserve has been interviewing private firms with a view to hiring one to help it analyse collateral pledged in return for loans.

“Many economists challenge the idea of public-private partnerships - where the government not only co-invests but provides loans to buy assets - as a scheme to funnel subsidies to the banks.

“There will be close attention when the Fed and the Federal Deposit Insurance Corporation release the terms on their loans to see whether these charges look valid.”

Source: Krishna Guha, Financial Times, May 14, 2009.

The New York Times: US considers limits on financial pay “Obama Administration officials are contemplating a major overhaul of the compensation practices in the financial services industry, moving beyond banks to include more loosely regulated hedge funds and private equity firms.

“Federal policymakers have been discussing ways to ensure that pay is more closely linked to performance.

“Among the ideas under consideration are incorporating compensation as a ‘safety and soundness’ concern on official bank examinations as well as expanding the existing regulatory powers of the Securities and Exchange Commission and Federal Reserve to obtain more information.

“Any overhaul is likely to be tied the Obama Administration’s broader efforts to curb systemic risk to the economy. That means the new rules could apply to financial firms like hedge funds or private equity firms that never accepted money from the Troubled Asset Relief Program, or TARP. It would also mean greater oversight on compensation for banks that are seeking to return the TARP money in an effort to avoid the new strings attached to pay.

“Administration officials have been contemplating sweeping pay reforms since early this year. In February, the Treasury Department was instructed to write detailed guidelines to the executive pay clause that was inserted at the 11th hour into the economic stimulus bill.

“Treasury officials have said new executive compsenation rules could be released shortly, with some bankers and lawmakers expecting them to be formally released before the Memorial Day recess.”

Source: Louise Story and Eric Dash, The New York Times, May 13, 2009.

The New York Times: Obama urges rules on credit derivatives “In its first detailed effort to overhaul financial regulations, the Obama administration on Wednesday sought new authority over the complex financial instruments, known as derivatives, that were a major cause of the financial crisis and have gone largely unregulated for decades.

“The administration asked Congress to move quickly on legislation that would allow federal oversight of many kinds of exotic instruments, including credit-default swaps, the insurance contracts that caused the near-collapse of the American International Group.

“The Treasury secretary, Timothy Geithner, said the measure should require swaps and other types of derivatives to be traded on exchanges or clearinghouses and backed by capital reserves, much like the capital cushions that banks must set aside in case a borrower defaults on a loan. Taken together, the rules would probably make it more expensive for issuers, dealers and buyers alike to participate in the derivatives markets.

“The proposal will probably force many types of derivatives into the open, reducing the role of the so-called shadow banking system that has arisen around them.

“‘This financial crisis was caused in large part by significant gaps in the oversight of the markets,’ Mr. Geithner said in a briefing. He said the proposal was intended to make the trading of derivatives more transparent and give regulators the ability to limit the amount of derivatives that any company can sell, or that any institution can hold.

“Derivatives are hard to value. They are virtually hidden from investors, analysts and regulators, even though they are one of Wall Street’s biggest profit engines. They do not trade openly on public exchanges, and financial services firms disclose few details about them. The new rules are meant to change most, but not all, of that opacity.”

Source: Stephen Labaton and Jackie Calmes, The New York Times, May 13 , 2009.

CNBC: Was Paulson’s pressure justified? “Was former Treasury Secretary Henry Paulson justified in applying significant pressure on the banks receiving TARP money last October? Debating the issue: The New York Times’s Andrew Ross Sorkin along with CNBC’s Rick Santelli, Charlie Gasparino and Larry Kudlow.”

Source: CNBC, May 14, 2009.

Yahoo Finance, Tech Ticker: Barry Ritholtz - “You can’t drink yourself sober”; financial crisis far from over

Click here for the article.

Source: Yahoo Finance, Tech Ticker, May 14, 2009.

The Wall Street Journal: US slates $22 billion for insurers from TARP “The Treasury Department will make federal bailout funds available to a number of US life insurers, acting on the embattled sector’s long-running effort to get government help.

“The Treasury is prepared to inject up to $22 billion into the insurers under the rescue plan launched last fall as the Troubled Asset Relief Program, said a person familiar with the matter.

“The capital infusions mark the first new round of federal rescue funding since the biggest banks got more help around the turn of the year. Aid for the struggling life-insurance industry was expected, but the companies had been waiting for weeks since The Wall Street Journal reported in early April that the Treasury had decided to give federal money to qualified companies in the industry. As far back as November, some companies were taking steps such as agreeing to buy savings and loans in order to become eligible.

“The spokesman declined to provide figures on how much capital each company could receive. In return for aid, the government will get warrants as well as preferred shares that initially pay a 5% dividend.

“Many life-insurance companies, like others in the financial sector, got caught carrying too much risk when the financial crisis hit. Some were hurt by their variable-annuity businesses, under which they sold products often linked to equity markets that promised minimum payouts even if markets fell. Insurers also lost money on investments in bonds, real estate and other assets that back their policies.”

Source: Andrew Dowell and Jamie Heller, The Wall Street Journal, May 15, 2009.

Yahoo Finance: Soros says economic downward trend easing “The downward trend in the financial crisis is easing and national economic stimulus packages are starting to work, billionaire investor George Soros was quoted as saying by a German newspaper on Monday.

“Soros also told the Frankfurter Allgemeine Zeitung daily that Asia would be the first region to pull out of the crisis and China was set to overtake the United States as the engine of world growth.

“‘The economic freefall has been stopped, the collapse of the financial system averted. National economic stimulus programs are starting to take effect. The downward dynamic is easing,’ Soros told the newspaper.

“‘I expect the recovery to make up for around half of the downturn we have had and then to move into stagnation,’ Soros said. ‘Asia will be first to find out of the crisis, but America is also currently doing that.’

“Soros said the US dollar was already weak, adding: ‘I don’t expect the dollar to lose much value against the euro, on the contrary.’”

Source: Yahoo Finance, May 11, 2009.

Financial Times: Services sector starts to feel more confident “Service sector companies in European and emerging markets have recovered much of the confidence lost as the global recession took its toll, providing another sign of green shoots after a bruising six months.

“The majority of companies report that they expect the volume of business to improve over the coming year, revenues to grow and a rise in new orders

“Optimistic sentiment has returned more strongly in the Bric countries of Brazil, Russia, India and China than in large European economies and Germany stands as a gloomy outlier, still suffering from growing doubts that business will improve.

“The general mood of returning confidence is signalled in a twice-yearly survey of service sector sentiment from the same companies as are sampled in the closely-watched monthly purchasing managers’ indices. It will underpin the rally in equity markets worldwide that have been reassured that the outlook for the global economy is materially better than it appeared only weeks ago.

“The improving mood contrasts with the persistent gloom among international organisations, such as the International Monetary Fund, which continues to expect little or no growth among advanced economies this year, followed by a weak recovery in 2010.”

Source: Chris Giles, Financial Times, May 10, 2009.

Bloomberg: Paul Krugman says rapid recovery “extremely unlikely” “Paul Krugman, Princeton University’s Nobel Prize-winning economist, said global economic prospects don’t justify the two-month rally that has restored $8.9 trillion to stock markets around the world.

“Speculation that government spending packages and interest-rate cuts worldwide will reinvigorate the global economy has helped the MSCI World Index rally 37% since falling to its lowest since 1995 on March 9. The US Standard & Poor’s 500 Index surged 34% in that time.

“‘It looks to me now as if the markets are now pricing in a rapid recovery, that they’re pricing in a V-shaped recession, which I consider extremely unlikely,’ Krugman, 56, said at a forum in Shanghai today. ‘The market seems to be looking as if this is going to be an average recession, but it’s not.’

“Krugman, who won the 2008 Nobel Prize for economics, joins New York University’s Nouriel Roubini in calling for a more cautious outlook on growth. Roubini said last week analysts expecting the US economy to rebound in the third and fourth quarter were ‘too optimistic’. Nassim Nicholas Taleb, the author of ‘Black Swan’, said the current global crisis is ‘vastly worse’ than the 1930s.

“The International Monetary Fund said on April 22 the global economy will contract 1.3% this year, downgrading its January projection of 0.5% growth. A recovery will take longer than normal because the slump was precipitated by a worldwide financial crisis, the IMF said.

“‘Some of the measures that have been taken to deal with the crisis seem to be predicated on the belief that this is going to be a short, short recession,’ Krugman said today. ‘Everything says that’s wrong, that this is going to be a sustained period of weakness.’

“The economist wrote in a New York Times editorial on April 16 that the ‘green shoots’ for a recovery being cited by government officials and investors could ‘breed a dangerous complacency’.”

Source: Patrick Rial and Stephanie Wong, Bloomberg, May 12, 2009.

Financial Times: America’s triple A rating is at risk “Long before the current financial crisis, nearly two years ago, a little-noticed cloud darkened the horizon for the US government. It was ignored. But now that shadow, in the form of a warning from a top credit rating agency that the nation risked losing its triple A rating if it did not start putting its finances in order, is coming back to haunt us.

“That warning from Moody’s focused on the exploding healthcare and Social Security costs that threaten to engulf the federal government in debt over coming decades. The facts show we’re in even worse shape now, and there are signs that confidence in America’s ability to control its finances is eroding.

“Prices have risen on credit default insurance on US government bonds, meaning it costs investors more to protect their investment in Treasury bonds against default than before the crisis hit. It even, briefly, cost more to buy protection on US government debt than on debt issued by McDonald’s. Another warning sign has come from across the Pacific, where the Chinese premier and the head of the People’s Bank of China have expressed concern about America’s longer-term credit worthiness and the value of the dollar.

“The US, despite the downturn, has the resources, expertise and resilience to restore its economy and meet its obligations. Moreover, many of the trillions of dollars recently funnelled into the financial system will hopefully rescue it and stimulate our economy.

“The US government has had a triple A credit rating since 1917, but it is unclear how long this will continue to be the case. In my view, either one of two developments could be enough to cause us to lose our top rating.

“First, while comprehensive healthcare reform is needed, it must not further harm our nation’s financial condition. Doing so would send a signal that fiscal prudence is being ignored in the drive to meet societal wants, further mortgaging the country’s future.

“Second, failure by the federal government to create a process that would enable tough spending, tax and budget control choices to be made after we turn the corner on the economy would send a signal that our political system is not up to the task of addressing the large, known and growing structural imbalances confronting us.”

Source: David Walker, Financial Times, May 12, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.