Barrons on U.S. Treasury Bond Bubble Bursting

Interest-Rates / US Bonds May 19, 2009 - 07:10 PM GMTBy: Guy_Lerner

This is the second cover story in 5 months for Barron's on the bursting of the bubble in Treasury yields. I have been closely following the yield on the 10 year Treasury since December, 2008, and I would agree that Treasury yields are ripe for a secular trend change. However, this won't be confirmed until there is a monthly close over 3.43% in yield.

This is the second cover story in 5 months for Barron's on the bursting of the bubble in Treasury yields. I have been closely following the yield on the 10 year Treasury since December, 2008, and I would agree that Treasury yields are ripe for a secular trend change. However, this won't be confirmed until there is a monthly close over 3.43% in yield.

In this brief video, Barron's editor, Andrew Bary, states that yields could "rise even more hitting 5% by year end as investors need to absorb the massive amount of debt that government is issuing to fund record budget deficits."

The three main headwinds to the scenario of higher Treasury yields remain: 1) continued economic weakness; 2) continued quantitative easing by the Federal Reserve; 3) continued and persistent bubble bursting "calls" by everyone concerned.

On the other hand, the technical set up for higher yields is compelling, and as Mr. Bary alludes to, investors are demanding higher yields to the increasing supply of debt.

Headwinds

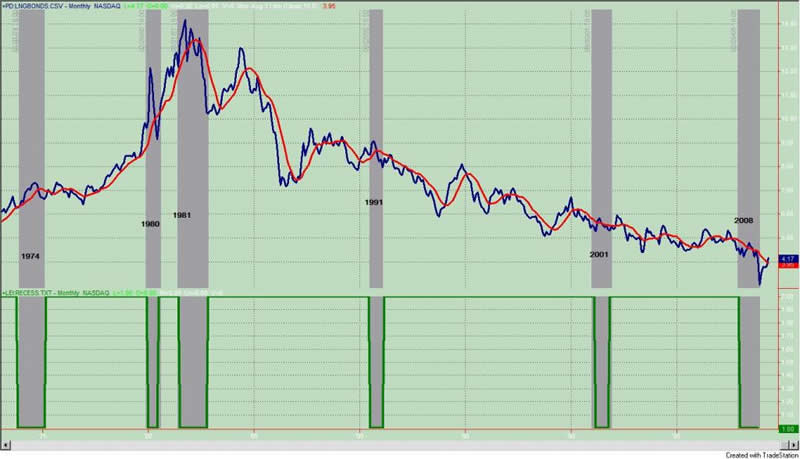

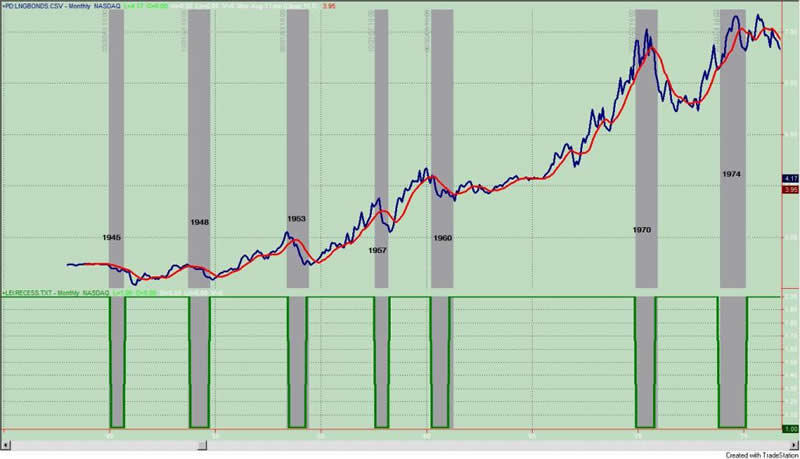

Figures 1 and 2 are monthly charts showing the composite yield on the long term Treasury bond. The indicator in the lower panel is an analogue representation of the National Bureau of Economic Research's (NBER) expansions and contractions. The NBER is the government organization that officiates over the beginning and ending times of a recession. On the graph, the gray vertical bars highlight recessions. The vertical gray bars indicate periods of economic contraction (i.e., recessions). The relationship between Treasury yields and economic contractions is easily seen. It would be highly unusual for yields to rise during a recession.

Figure 1. Long Term Treasury Yields v. NBER Contractions

Figure 2. Long Term Treasury Yields v. NBER Contractions

The pace of economic decline has slowed lately, but there seems to be little consensus on what happens next. Lakshman Achuthan of the Economic Cycle Research Institute sees "Crystal Clear Recovery Signs" by this summer, and that "call" is presented in the following video from Bloomberg. On the other hand, former Merrill analyst, David Rosenberg, had this to say about Treasuries:

"Even if the recession is to end soon, and that is still very debatable, bond yields do not typically bottom until we are well into the next cycle, as inflation continues to decline even after the downturn ends. So just like further upside potential in equity prices seems extremely unlikely over the near and intermediate term, further downside risk Treasury note and bond prices is also less of a risk today, in our view."

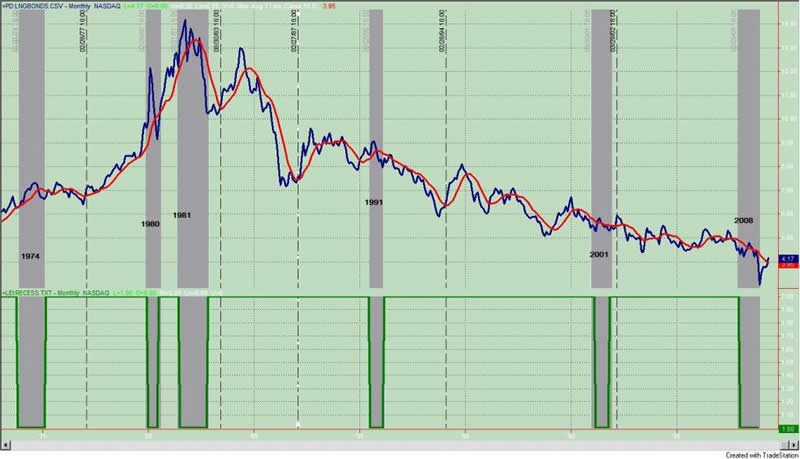

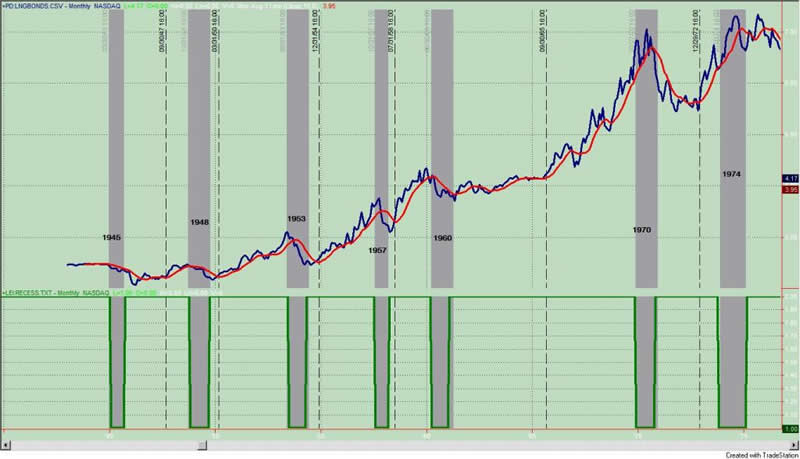

And Rosenberg is correct, higher Treasury yields typically are not seen well into an economic expansion. This can be seen in figures 3 and 4, which are just like the figures above but now I have added a dashed vertical to the graphs indicating when yields traded meaningfully higher and above the simple 10 month moving average. "Typically" higher Treasury yields occur well into a recovery.

Figure 3. Long Term Treasury Yields v. NBER Contractions

Figure 4. Long Term Treasury Yields v. NBER Contractions

I guess the last word between economic growth and Treasury yields goes to the Federal Reserve in this article on Bloomberg: "Fed Views Jump in Yields as Sign of Better Outlook". Higher yields are in juxtaposition as to what the Fed would like to see. Nonetheless, it is their belief that higher yields are the result of improving economic conditions.

Another headwind for higher Treasury yields has to be quantitative easing, which is the Fed's plan, announced March 18, to buy $300 billion of long term Treasury debt. The Fed has bought $100 billion so far, and the option is always on the table to buy more. According to Stuart Spodek , co-head of U.S. bonds in New York at BlackRock:

“The Fed needs to consider increasing its purchases of Treasuries. We are still in a recession. It’s quite bad. They need to stabilize long-term rates.”

It should be noted that despite the medling in the market by the Fed, 10 year Treasury yields are higher than the day the program was announced.

The last major headwind for higher Treasury yields has to do with sentiment. Everyone is looking for a bubble in Treasury yields. It is right there on Barron's cover. Two weeks ago it was part of the Bob Pisani's Investing 101.

Everyone now knows that Treasury bonds are a bad investment and this is rarely a recipe that leads to a secular trend change. Think back to the major trend changes of the past year. Crude oil topped out amid "calls" of $200 oil. The US Dollar Index bottomed amid "calls" for the crashing dollar. Markets rarely reverse when everyone expects them too.

Tailwind

As I have been stating since December, 2008, the technical outlook is such that a secular trend change is in the cards for Treasury yields. We will see higher yields and it isn't a matter of if we will but when we will. The secular trend for higher yields on the 10 year Treasury bond will be confirmed on a monthly close greater than 3.43%, and it is my belief that this will happen by the end of the third quarter of this year.

Will higher yields be the result of increasing economic activity as some are suggesting or as this week's Barron's article suggests there is an excess of government bonds coming to market, and investors are demanding higher yields?

Of course, we will see how this plays out over the next couple of months. The markets (equity and bond) are at another one of those critical junctures. So let's give the last word to CNBC's Rick Santelli who always seem to provide some good perspective of the broader playing field.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.