How Stock and Currency Markets Behave After a Financial Crisis

Stock-Markets / Financial Crash Jun 03, 2009 - 02:57 AM GMTBy: John_Lee

Debt-based monetary systems are inherently unstable. Money is created out of thin air by the banks and lent to government, consumers and businesses. In order to service and replay those debts, the borrowers take on more debts. Asset prices are inflated, and the vicious cycle continues until the debtors are unable to borrow or the banks are unwilling to lend. At that point the system snaps, everything is sold off, and we have a financial crisis at hand. In this paper we examine what happens to equity and currency markets in the aftermath of financial crisis.

Debt-based monetary systems are inherently unstable. Money is created out of thin air by the banks and lent to government, consumers and businesses. In order to service and replay those debts, the borrowers take on more debts. Asset prices are inflated, and the vicious cycle continues until the debtors are unable to borrow or the banks are unwilling to lend. At that point the system snaps, everything is sold off, and we have a financial crisis at hand. In this paper we examine what happens to equity and currency markets in the aftermath of financial crisis.

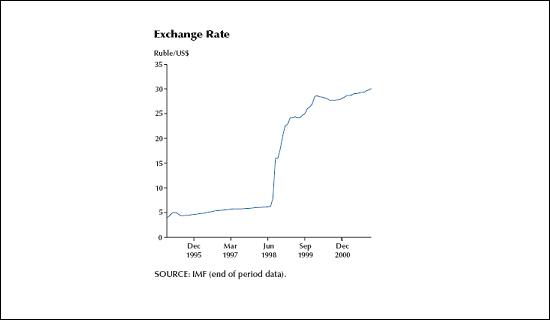

1998 Russia

Declining productivity, an artificially high fixed exchange rate between the ruble and foreign currencies to avoid public turmoil, and a chronic fiscal deficit were the background to Russia 's financial meltdown in 1998. The economic cost of the first war in Chechnya that is estimated at $5.5 billion was also a cause.

Prior to the culmination of the economic crisis, the government-issued GKO bonds policy had been described as similar to a Ponzi scheme , with the interest on matured obligations being paid off using the proceeds of newly issued obligations.

Two external shocks, the Asian financial crisis that had begun in 1997 and the following declines in demand for (and thus price of) crude oil and nonferrous metals , impacted Russian foreign exchange reserves. A political crisis came to a head in March when Russian president Boris Yeltsin suddenly dismissed Prime Minister Viktor Chernomyrdin and his entire cabinet in March.

The Asian crisis and political event rattled investor confidence caused foreign investors to sell off Russian stocks, bonds, and took a flight out of rubles.

The amount of GKO at some $150 billion was not a cause of concern for a $1 trillion economy. But with over 30% of GKO owned by foreigners, the foreign selloff caused havoc in equity, bond and the ruble.

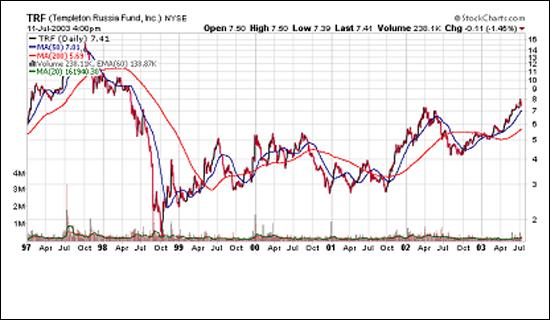

Russian broad equity index down 90%+ from late 1997 to October 1998

Ruble went from 5 to 1 USD to 30 to 1 USD in June 1999

After the equity panic bottom in October 1998, Russian equity index, measured in rubles rebounded strongly in part thanks to the depreciating ruble.

However, measured in US dollars, Russian stocks didn't make full recovery till some 5 years later.

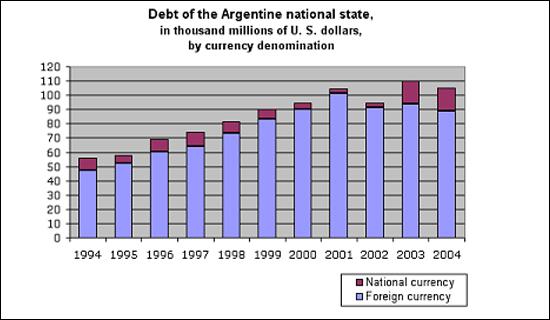

2001 Argentina

In 1998, Argentina officially entered a recession, which lasted for three years and ended in a collapse as fears of the devaluation of the peso led to bank runs. This brought about grave amounts of protest and violence affecting many people and companies, causing several deaths.

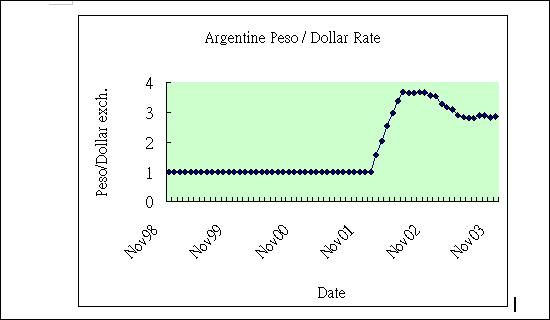

In 2001 Argentina had US $100 billion of national debt, which is approximately 40% of its GDP. While the amount is containable relative to its GDP, the Argentines made a mistake of denominating its debt in US dollars. With shrinking current account surplus, the country wasn't able to raise dollars to pay debt principal and interests in 2001 and eventually repudiated on the foreign debts. The fixed exchange rate was removed and the peso was quickly devalued. The exchange rate was then left to float, causing further devaluation (about 4 pesos per dollar).

Argentine equity index dived 60% in 2001

Peso went from 1 to 1 USD to 4 to 1 USD in early 2002 after the government allowed the Peso to float.

America is privileged to have its dollars serving as the world's reserve currency. America 's debt is denominated in dollars, which can be printed at will by the Fed. And printing is what the Fed did.

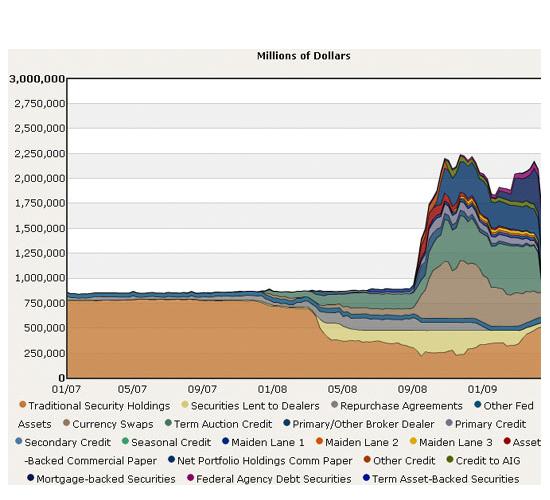

The Fed has printed over 1.5 trillion dollars to bail out various groups.

S&P500 responded positively to monetary easing as it rose 40% since March in nominal terms. It shouldn't be surprising to see the index recover to pre-crisis level. Equities have to rise as in Russian and Argentine cases, when currencies had been massively devalued.

In real terms however, when S&P500 is measured in gold in the chart below, it likely takes many years before the index recovers.

Where does the dollar go from here?

When foreign investors took flight from Russian rubles and Argentine pesos, the dollar was the beneficiary. When global investors took flight from the dollar, which currency benefits?

Gold is the ultimate antithesis to the dollar. Gold is liquid, universally recognized, limited in quantity. Just like Russians and Argentines trying to anchor their currencies to the dollar, the US government devised various ways to slow down the rise of gold prices to maintain dollar's soundness. However the massive money printing by the Fed and fast-eroding confidence in the dollar by international investors might just be the key to drive gold past the all illusive $1,000/oz level and not look back.

As we saw in the past crisis in Russia , Argentina , Thailand , and Brazil ; equity markets eventually do return while the devalued currency never regained strength. The US case is no different. Further rebound by the equity market in nominal terms can be seen albeit with extreme volatility, and we will likely witness a 4-digit gold price in 2009 that will never look back. As the Chinese saying, crisis is spelled danger + opportunity. There is still time to diversify out of dollars before the world recognizes the dollar's permanent debasement and demotion of status. Visit goldmau.com and sign up for our free market and stock updates.

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.