Financial Markets React to Growing Signs of Economic Recovery

Stock-Markets / Financial Markets 2009 Jun 07, 2009 - 08:22 AM GMT Ups and downs on financial markets were plentiful during the past week, but investor sentiment, on balance, brightened on the back of constructive financial and economic data - capped by a better-than-expected US non-farm payrolls report on Friday.

Ups and downs on financial markets were plentiful during the past week, but investor sentiment, on balance, brightened on the back of constructive financial and economic data - capped by a better-than-expected US non-farm payrolls report on Friday.

“It appears that the global economy has finally found the ripcord,” said Rebecca Wilder (News N Economics) in her weekly review of global economic reports.

“The global economic reports are becoming saturated with signs of forming a bottom. Auto sales in Japan and the US are improving somewhat; exports are dangling in the double-digit loss rates; and GDP really couldn’t get much worse (the inventory cycle alone will create some growth). Finally, money growth rates are slowing, perhaps an indication that policymakers feel that the worst is behind us,” she commented.

Source: Scott Stantis, June 1, 2009.

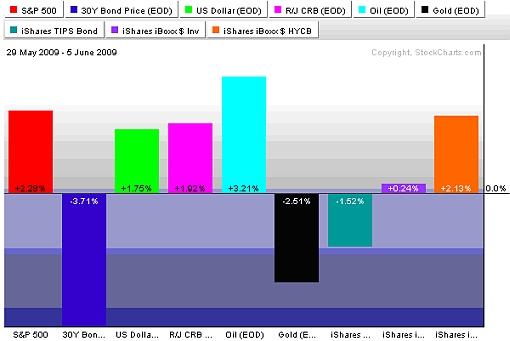

As the risk appetite of investors swelled on the prospect that the global economy was on the mend, many stock markets reached their highest levels this year, and metals and oil continued their surge. After trending down since early March, the US dollar snapped back on the employment data, but government bonds tanked as yields rose to six-month highs. Interbank lending rates edged down, whereas corporate bond spreads touched their lowest levels since October. Gold and silver - strong performers in recent times - took a breather, but platinum gained strongly from better vehicle sales in many parts of the world.

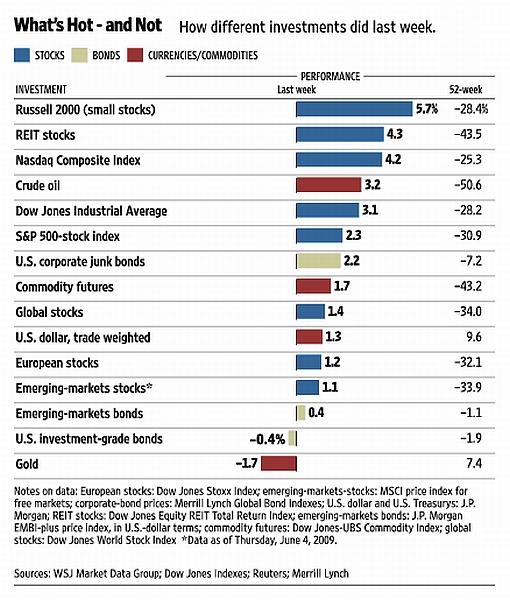

The week’s performance of the major asset classes is summarized by the chart below.

Source: StockCharts.com

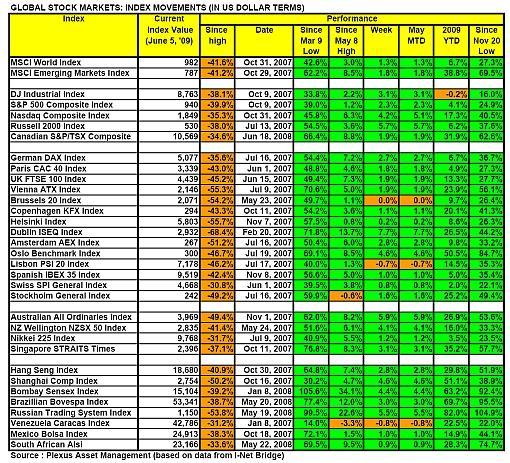

The MSCI World Index (+1.3%) and the MSCI Emerging Markets Index (+1.8%) last week added to the rally’s gains to take the year-to-date returns to +6.7% and a massive +38.8% respectively. Both these indices have only had one down-week since the advance commenced in early March.

The major US indices gained for a third straight week - and for the eleventh week out of the past 13 - as seen from the movements of the indices: S&P 500 Index (+2.3%, YTD +4.1%), Dow Jones Industrial Index (+3.1%, YTD ‑0.2%), Nasdaq Composite Index (+4.2%, YTD +17.3%) and Russell 2000 Index (+5.7%, YTD +6.2%).

The Dow remains the only major index still in the red for the year to date, albeit only by 0.2%, trailing the Nasdaq (+17.3%) by a wide margin.

Click here or on the table below for a larger image.

As far as non-US markets are concerned, returns ranged from top performers Vietnam (+16.3%), Serbia (+12.0%), Qatar (+10.9%), Egypt (+10.2%) and the Czech Republic (+10.0%), to the Ghana (-8.7%), Cyprus (-5.6%), Pakistan (-‑5.3%), Croatia (-5.0%) and Estonia (-3.7%), which experienced headwinds. (Click here to access a complete list of global stock market movements, as supplied by Emerginvest.)

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the “ETF of the Month” was PowerShares India Portfolio (PIN), which gained a whopping +32.5% during May. The leaders for the week included Claymore/MAC Global Solar Energy (TAN) (+10.9%), Market Vectors Coal (KOL) (+9.4%) and United States Oil (USL) (+7.0%). Poor performers were again all things “short”, with notable laggards being ProShares Short Russell 2000 (RWM) (-7.8%), ProShares Short QQQ (PSQ) (-5.1%) and ProShares Short Dow30 (DOG) -5.4%.

The higher Treasury yields had a further negative impact on mortgage rates, with the 30-year fixed rate increasing by 19 basis points to 5.46% on the week and the 15-year fixed rate by 15 basis points to 5.02%, as indicated by Bankrate.com.

“That’s quite a jump,” said Donald Rissmiller, chief economist at New York-based Strategas Research Partners, in a Bloomberg interview. “The more rates go up, the more we need home prices to go down to equalize consumers’ payments. It’s those payments that have brought about a level of stability in housing unit sales.” Policymakers might be forced to increase their Treasury buy-backs.

The quote du jour comes from Dallas Fed President Richard Fisher who seems to share Bespoke’s concern that listening to the rating agencies is like making investment decisions based on last month’s newspaper. In a recent Wall Street Journal interview, he said: “I served on corporate boards. The way rating agencies worked is that they were paid by the people they rated. I saw that from the inside.” He said he also saw this “inherent conflict of interest” as a fund manager. “I never paid attention to the rating agencies. If you relied on them you got … you know. You did your own analysis. What is clear is that rating agencies always change something after it is obvious to everyone else. That’s why we never relied on them.”

In other news, during his first visit to Beijing as Treasury secretary, Timothy Geithner went out of his way to assure the Chinese that their large holdings of US dollar assets were secure and that the US administration remained committed to a strong dollar and keeping inflation under control. Although the Chinese leaders did not again raise their unease that the US will inflate away its mounting debt, there were “plenty of other signs of concern”, including tough questioning at Peking University, reported the Financial Times.

Regarding the outlook for the Chinese renminbi versus the US dollar, James Grant (Grant’s Interest Rate Observer) said: “We are bearish on the renminbi. On the other hand, we are also bearish on the US dollar, euro, pound, Swiss franc and Zimbabwean dollar. We hate them all, with appropriate analytical nuances. Show us a monetary asset whose value is not subject to governmental debasement, and we will show you a Krugerrand.”

According to MarketWatch, President Barack Obama plans to announce on Monday how his administration is speeding up implementation of his $787 billion economic stimulus plan.

Oh yes, General Motors filed for Chapter 11 bankruptcy protection, and was duly replaced as one of the 30 constituents of the Dow, whereas a judge cleared the path for Chrysler to exit bankruptcy by approving the sale of the bulk of the automaker’s assets to a new entity to be managed by Italy’s Fiat.

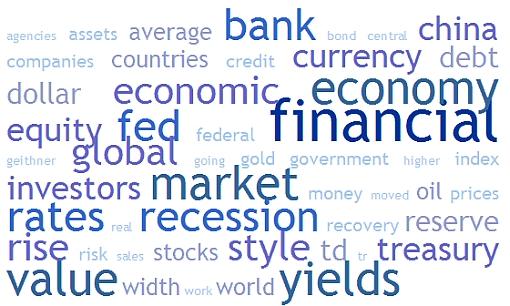

Next, a quick textual analysis of my week’s reading. No surprises here, with the words “financial”, “bank”, “economy” and “market” still dominating the media. But, strikingly, “value” and “yields” have soared in prominence as pundits debate whether equities and government bonds have seen secular turning points.

Focusing on the US stock markets, the most recent Investors Intelligence sentiment report shows that 42.5% of portfolio managers are now bullish on equities versus 25.3% that are bearish. While the high level of bullish sentiment seems to indicate an overbought market, the spread of 17.2% between bulls and bears is still below the ten-year average of 19%, according to Bespoke.

Interestingly, Barclays Capital issued a report on Monday showing that only 17.5% of the 605 global investors interviewed for its quarterly FX investor sentiment survey thought risky assets have further to rise. “Just 4.5% of respondents believe the trajectory of the global economy over the next year will be ‘V-shaped’ - indicating weakness followed by a sharp recovery,” reported the Financial Times.

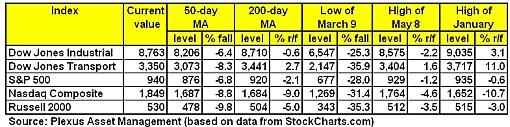

An analysis of the moving averages of the major US indices shows all the indices (with the exception of the Dow Jones Transport Index) above their 50- and 200-day moving averages and May 8 highs. The S&P 500, Nasdaq and Russell 2000 have also now surpassed their early January peaks.

Click here or on the table below for a larger image.

Kevin Lane, technical analyst of Fusion IQ said: “While crossing the 200-day line is more a psychological milestone than anything else, it does suggest that upward price strength momentum is persistent. Can we have pullbacks along the way still? Of course. However, there is now no real resistance on the S&P 500 until the 1,000 level. As long as breadth remains strong it is hard to expect any major corrections, but given the extended nature of the market we would keep trailing stops higher.”

On the downside, the levels from where the rally commenced on March 9 should hold in order for base formations to remain in force.

A useful indicator of market breadth is a chart showing the percentage of New York Stock Exchange stocks trading above their 50-day moving averages. Although this measure has declined from 94% in early May to 87% on Friday, it is still at a level typically seen at prior peaks during the bear market (see green chart below). This looks overdone in the short term. Secondary corrections aside, the primary trend of the market is now bullish as the bulk of the index constituents (66%) are trading above their 200-day averages (see red chart below).

Source: StockCharts.com

Source: StockCharts.com

Bill Gross, co-founder and co-CIO of PIMCO, advised the following in his latest newsletter: “Bond investors should confine maturities to the front end of yield curves where continuing low yields and downside price protection are more probable. Holders of dollars should diversify their own baskets before central banks and sovereign wealth funds ultimately do the same.

“All investors should expect considerably lower rates of return than what they grew accustomed to only a few years ago. Staying rich in the ‘new normal’ may … require investors to resemble … Will Rogers, who opined in the early 30s that he wasn’t as much concerned about the return on his money as the return of his money.”

From across the pond, David Fuller (Fullermoney) said: “We could be seeing one of those occasional all-change signals in terms of short-term trends. Basically, while medium-term trends are bullish for stock markets and commodities, but bearish for the USD and long-dated government bond prices, many of these trends are overstretched in the short term. For leading stock markets, this will probably be limited to reversion to the mean in terms of 200-day moving averages, which are beginning to rise.”

And lastly, John Murphy (StockCharts.com) concurs, remarking: “As good as the spring rally has been, I believe the market is still in need of some corrective action (or consolidation) before moving substantially higher. V bottoms are extremely rare. W bottoms are a lot more common. So are head and shoulder bottoms. It seems unlikely that the market will continue to rally in a straight line. More basing activity is most likely needed. And that’s going to require more time.”

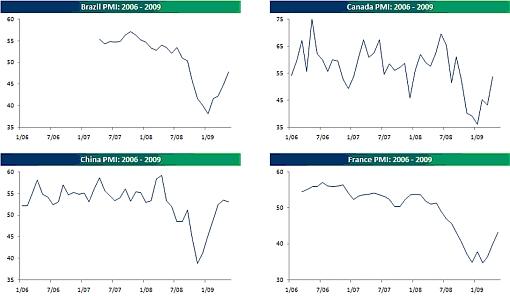

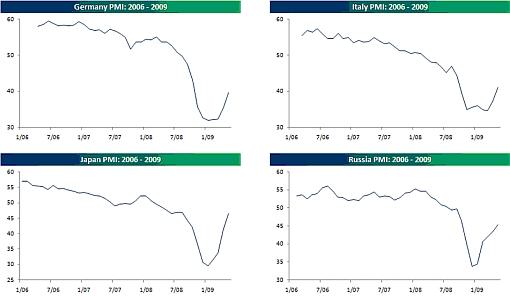

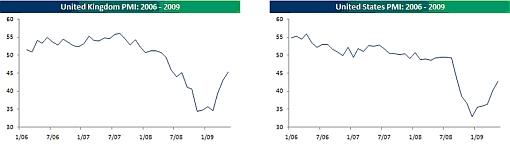

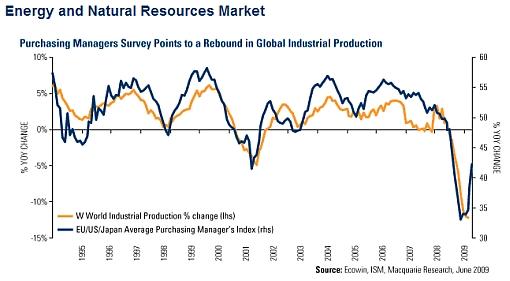

I am busy studying the relationship between stock market movements and the Purchasing Managers Index (PMI) and should have a post on this up on the site within the next few days. Keep an eye out for this article to cast light on the likely outcome of the battle between the bulls and bears.

For more discussion on the direction of stock markets, also see my recent posts “Video-o-rama: Figuring out the lie of the financial land“, “Baltic Dry Index - more than a snap-back rally“, “Asian markets won’t retest lows, says Chris Wood“, “Secular bull in commodities remains intact“, “How far can the dollar fall?“, “Technical talk: Breaching the 200-day line” and “Green shots or smoking weeds?“. (Also, Donald Coxe’s webcast has been updated for June 5 and makes for good listening. This can be accessed from the sidebar of the Investment Postcards site.)

Economy

The global economy continues to make its way back from the abyss and based on the relationship between the US/EU/Japan PMI and global industrial production, better tidings seem to be in the offing. But although stabilization has set in, the PMIs for all the countries besides China are still below 50 and therefore need to do more work before entering the expansion phase.

Source: US Global Investors - Weekly Investor Alert, June 5, 2009.

In line with market expectations, the Bank of England (BoE) Monetary Policy Committee and the European Central Bank (ECB) left their key policy interest rates at 0.5% and 1.0% respectively. The BoE also decided to continue with its current £125 billion asset purchase programme which it began in March, whereas the ECB announced a €60 billion plan to buy euro-denominated covered bonds.

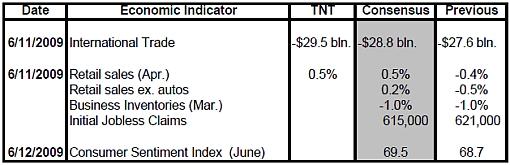

Turning to the US, a snapshot of the week’s economic data is provided below. (Click on the dates to see Northern Trust’s assessment of the various data releases.)

June 5

• Mixed bag of labor market news - a tad more positive than negative

June 4

• Jobless Claims report points to small but noteworthy improvements • Revisions of output raise productivity estimate - trend needs to improve

June 3

• Chairman Bernanke’s testimony touches on expected issues, emphasizes fiscal balance • Challenger report points to sharp decline in layoffs • ISM Non-manufacturing Survey slightly better

June 2

• Auto Sales advanced in May • Pending Home Sales Index surges in April

June 1

• ISM Manufacturing Survey advances in May, noteworthy jump of New Orders Index • Increase in Personal Income reflects impact of fiscal stimulus, consumer spending remains weak • Construction Spending advances in April, reflecting positive contribution from residential sector

Fed Chairman Ben Bernanke in his testimony to the House Budget Committee on Wednesday reiterated his view that he was expecting to see growth “later this year”. He cautioned as follows: “Even after a recovery gets under way, the rate of growth of real economic activity is likely to remain below its longer-run potential for a while, implying that the current slack in resource utilization will increase further. We expect the recovery will only gradually gain momentum and that economic slack will diminish slowly. In particular, businesses are likely to be cautious about hiring, and the unemployment rate is likely to rise for a time, even after economic growth resumes.”

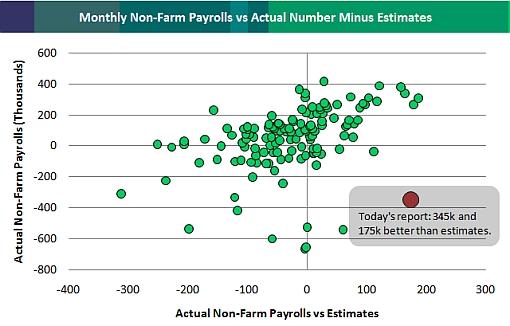

Employment losses were far lower than expected in May, with non-farm payrolls declining by 345,000, well below the expected 520,000. Bespoke prepared a scatter chart that compares the monthly non-farm payrolls data with the difference between the actual number and the estimates. Going back to 1998, this month’s report appears to be an outlier. Although still one of the weakest job reports over the last 11 years, it was also the third-best when comparing actual data to estimates.

Source: Bespoke, June 5, 2009.

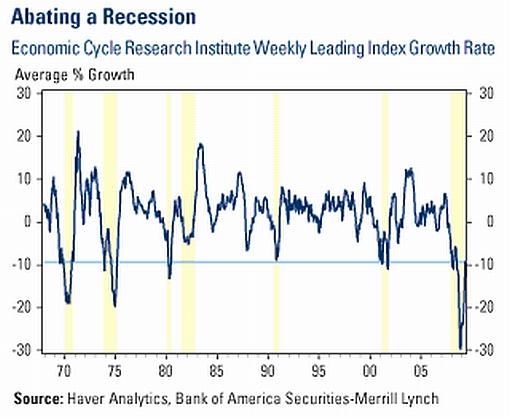

A research note by Merrill Lynch (via US Global Investors) directed the attention to the ECRI Weekly Leading Index that has rebounded sharply from the lows and has improved for ten consecutive weeks. “This index is a timely leading indicator for future GDP growth and while it is not out of recession territory yet it appears to be well on its way, as indicated in the chart,” said the report.

Source: US Global Investors - Weekly Investor Alert, June 5, 2009.

Given the “less bad” economic reports, investors in interest rate futures are now betting the Fed will hike rates by year-end, according to MarketWatch. The December Fed funds futures contract on Friday priced in a Fed funds rate of approximately 0.5% compared with 0.3% a week ago.

Summarizing the economic outlook for the US, Asha Banglore (Northern Trust) said: “The Fed is in a watch-and-wait mode. Credit market spreads have narrowed significantly from their highs in the early part of the year. Positive economic reports by way of the ISM Manufacturing Survey, stability of home sales, glimmers of improvement in the May employment data, a decline in continuing jobless claims, and the downward trend of initial jobless claims are factors that are encouraging. The coast is not clear and more is necessary to declare the recession has ended.”

The last words come from David Rosenberg, chief economist & strategist of Gluskin Sheff & Associates: “Recession pressures may well be subsiding next to the sharp contraction earlier this year; however, deflation risks are not only lingering but in fact are intensifying. We still believe the V-shape recovery hopes that have underpinned the equity market while undermining the bond market in recent months will inevitably prove to be under water.”

Week’s economic reports

Click here for the week’s economy in pictures, courtesy of Jake of EconomPic Data.

Source: Yahoo Finance, June 5, 2009.

In addition to the release of the Fed’s Beige Book (June 10) and the meeting in Rome of the G8 finance ministers (June 11 & 12), the US economic highlights for the week include the following:

Source: Northern Trust

Click here for a summary of Wachovia’s weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global financial markets performed during the past week.

Source: Wall Street Journal Online, June 5, 2009.

James W. Frick said: “Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.” (Hat tip: Charles Kirk.)

Let’s hope that the news items and quotes from market commentators included in the “Words from the Wise” review will help Investment Postcards readers to prioritize properly and spend their investment dollars judiciously.

For short comments - maximum 140 characters - on topical economic and market issues, web links and graphs, you can also follow me on Twitter by clicking here.

That’s the way it looks from a wintery Cape Town.

Source: John Darkow, Columbia Daily Tribune, June 3, 2009.

David Fuller (Fullermoney): Outlook for major asset classes “Cash (fiat currency positions) - These need to be managed if purchasing power is to be preserved. For instance, barely two months ago people were still referring to the USD as a ’safe haven’, but it is predictably and clearly sliding once again. In contrast, the currencies of emerging Asia/Pacific and resources exporters are in fashion once again.

“Monetary metals - We are living through the greatest monetary reflation in global history. Until reined in, this is the key driver of many trends. Connecting the dots, precious metals such as gold, silver and platinum are obvious beneficiaries.

“Commodities - Chart action supports Fullermoney’s contention that the commodity supercycle was sharply interrupted by the global recession, not halted. We still have a chance to repurchase many of these resources cheaply once again, before they reach price levels which choke off demand. Inflation hedge money is moving into most commodities. Fullermoney has previously mentioned a resources war, hopefully of the non military variety. Currently, this is being won by China which continues to boost its strategic reserves, while also using its financial surplus to secure long-term supplies at attractive prices.

“Stock markets - Equities are proving to be inflation hedges and economic recovery candidates of choice, along with monetary metals plus industrial and agricultural commodities. Consequently the next bubbles will emerge from these groups, as I have said before. However performance varies considerably. Price charts are the best guide and Fullermoney themes - emerging Asia, resources, technology - remain in leading positions. We can expect a multi-month correction once this maturing first upward leg runs out of momentum. For leaders, this will probably be limited to reversion to the mean in terms of 200-day moving averages, which are beginning to rise.

“Government bonds - The bear market in long-dated issues is underway, although it may experience some temporary respite when stock markets undergo corrections. Among corporate bonds, conservative investors may prefer to not stray from quality issues, unless you are specialists in this area. Too many corporate hangovers are due to excessive balance sheet leverage.”

Source: David Fuller, Fullermoney, June 3, 2009.

Financial Times: Fed dismisses Tarp objections

“US regulators insisted that JPMorgan Chase and American Express raise equity this week before repaying bail-out funds, in spite of strong objections from executives who claimed the banks did not need the money, people close to the situation said.

“In fraught talks last week, Wall Street chiefs disagreed with the authorities over whether the Federal Reserve should require an equity offering as a condition for inclusion in the first wave of repayers of the troubled asset relief programme.

“People close to the situation said the Fed imposed the requirement on JPMorgan and Amex because they were the only institutions that had passed the recent ’stress tests’ but had not yet raised equity.

“The offerings by JPMorgan, which sold $5 billion of shares on Tuesday, and Amex, which raised $500 million, took many investors by surprise because the two were among the eight banks deemed not to need capital after last month’s tests.

“Jamie Dimon, JPMorgan’s chief executive, said on Monday he did not believe that the ability to tap capital markets should have been a relevant test for his bank.

“‘Any argument you could think of, you could assume we made with our regulators. And, as you could also expect, they won,’ he said. ‘The primary reason was access to equity capital markets, and it’s hard for me to imagine that really applies in JPMorgan’s case.’”

Source: Francesco Guerrera, Henny Sender and Krishna Guha, Financial Times, June 4, 2009.

Financial Times: CCB reveals aversion to western bank stakes

“Chinese banks are shunning investments in western banks because they hold doubts about their financial health, one of China’s most senior bankers has warned.

“Guo Shuqing, chairman of China Construction Bank, said Chinese banks also were being deterred by a lack of growth potential in developed markets

“‘It’s very difficult at the moment because there are still so many uncertainties,’ Mr Guo told the Financial Times in an interview on Monday. ‘We are not very interested on expanding our business in developed countries because the market is limited and growth potential is not there because of over-banking.’

“The warning came as Goldman Sachs on Monday sold up to $1.9 billion worth of shares in Industrial and Commercial Bank of China, in the latest high-profile divestment of stock in a mainland lender.”

Source: Jamil Anderlini and Sundeep Tucker, Financial Times, June 1, 2009.

Bloomberg: Dudley’s TALF comments add signs of a PPIP stall

“The Federal Reserve may not start lending against residential mortgage-backed securities under its Term Asset-Backed Securities Loan Facility, Federal Reserve Bank of New York President William Dudley indicated.

“‘We’re still in the process of assessing whether a legacy RMBS program is feasible, and if it were feasible, whether it would be significant enough to make a major impact,’ Dudley said at a conference today in New York hosted by the Securities and Financial Markets Association and Pension Real Estate Association.

“His comments add to signs that Treasury Secretary Timothy Geithner’s Public-Private Investment Program to boost debt prices and rid banks of devalued assets to expand lending is stalling, after helping to spark a rally in stocks and bonds. The Federal Deposit Insurance Corp. yesterday delayed a test sale of bad loans held by US banks that had been billed as a tryout for its role.

“Responding to questions after a speech at the conference, Dudley said each home-loan security is different and must be separately evaluated for the size of the haircut that should be applied, so ‘there’s a huge administrative hurdle’ to expanding the TALF to the bonds.

“Under the PPIP, which was announced in March, funds run by private managers buying so-called legacy securities may be able to supplement Treasury co-investments and loans with additional TALF financing. Under a ‘Legacy Loans Program’, FDIC-guaranteed debt would provide the leverage.

“TALF loans may also be available to other investors as the government seeks to boost prices for the more than $2.5 trillion of US residential and commercial mortgage bonds without government backing to free banks and funds to create new credit.

“Since the PPIP was announced, US banks have raised capital through stock sales and by converting preferred shares, and as of yesterday the total reached almost $100 billion, according to data compiled by Bloomberg.”

Source: Jody Shenn, Bloomberg, June 4, 2009.

CNBC: GM CEO discusses bankruptcy

“General Motors CEO Fritz Henderson discusses his company’s bankruptcy filing and what’s next for the automaker, with CNBC’s Phil Lebeau.”

Source: CNBC, June 1, 2009.

Jon Stewart (The Daily Show): BiG mess

“As long as the American taxpayers are buying companies like GM, is there any way they could grab a couple of them that make money?”

Source: Jon Stewart, The Daily Show, June 2, 2009.

CNBC: Reviving the global economy

“World leaders are gathering in Russia for answers on how to prevent another financial crisis and build a sustainable economy. CNBC’s Maria Bartiromo is at the event.”

Source: CNBC, June 5, 2009.

Bloomberg: Zoellick warns stimulus “sugar high” won’t stem unemployment

“World Bank President Robert Zoellick warned policy makers that fiscal-stimulus plans are insufficient to turn around the ‘real economy’ and rising joblessness threatens to set off political unrest across the globe.

“‘While the stimulus has given an impulse, it’s like a sugar high unless you eventually get the credit system working,’ Zoellick said in an interview yesterday with Bloomberg Television. ‘When unemployment increases, that’s probably the most political combustible issue.’

“Zoellick’s caution is a contrast with private economists, who are raising their outlooks for growth from India to China as stimulus measures take effect. The biggest developed and emerging nations have committed spending increases and tax cuts totaling 2% of their combined economies, a level the International Monetary Fund recommended to end the recession.

“The World Bank is monitoring private companies’ abilities to roll over ‘a lot’ of debt in the developing world, Zoellick said. At the same time, he played down risks to the global recovery posed by rising US Treasury yields, saying that ‘in terms of absolute levels, rates are still pretty low for most players’.

“Zoellick also said that the dollar will remain the world’s main currency ‘for a long time’, and noted that investors flocked to the dollar as a haven during the worst parts of the financial crisis.”

Source: Timothy Homan, Bloomberg, May 30, 2009.

Bespoke: International Purchasing Manager Indices on the up

“While the stabilization of economic activity in the US has been well documented, similar trends have been evident across the globe. The charts below show the monthly Purchasing Managers Indices for some of the largest global economies.

“For each of these indices, readings over 50 indicate a growing economy, while readings below 50 imply contraction. As shown, the PMIs for each country have shown sharp rebounds from their lows earlier in the year. However, while stabilization is better than nothing, the PMIs for every country with the exception of China are still below 50.”

Source: Bespoke, June 3, 2009.

John Authers (Financial Times): Decoupling retold

“John Authers says this time there is a difference in the emerging markets decoupling story - the market really seem to believe it.”

Source: John Authers, Financial Times, June 4, 2009.

Financial Times: Geithner says China backs US stimulus

“China has expressed confidence in the US economy and the Obama administration’s policies on fighting the recession, the US Treasury secretary said on Tuesday.

“Speaking on the second day of a closely watched visit to Beijing, Tim Geithner said there was ‘a very sophisticated understanding’ in China about why the US needs to run large budget deficits in the short term, although he repeated the pledge to sharply reduce deficits when the crisis is over.

“‘I sense … a fair amount of confidence not just in the basic underlying strength of the US economy but in our capacity not just to solve this crisis, to get growth back on track, but to go back to living within our means,’ Mr Geithner told reporters.

“During the visit, his first to Beijing as Treasury secretary, Mr Geithner went out of his way to assure the Chinese that their large holdings of US dollar assets were secure and that the administration remained committed to a strong dollar and keeping inflation under control.

“In recent months, Chinese leaders have issued a string of warnings about the risks that the US will inflate away its mounting debt burden.

“Although Chinese officials did not bring up the issue again in public during the visit, there were plenty of other signs of concern, including the tough questioning Mr Geithner received from students after giving a speech at Peking University.

“Mr Geithner said that his confidence in the US dollar was shared by Beijing. ‘I believe the Chinese expect the dollar to be the principal reserve currency for a long period of time, as do we,’ he said.

“Mr Geithner said the two countries had already demonstrated they could co-operate in laying a foundation for economic recovery. ‘I think probably because of the actions put in place by your government and by President Obama, we are starting to see some early signs of stabilisation and recovery in the global economy,’ he said in a meeting with Hu Jintao, China’s president.

“Mr Hu said the visit by Mr Geithner, who irritated Beijing when he said during his confirmation hearing that China ‘manipulated’ its currency, had helped improve co-operation between the two countries.”

Source: Kathrin Hille, Financial Times, June 2, 2009.

Financial Times: US dollar backed as reserve currency

“A leading Chinese financial official on Monday rejected suggestions the US dollar could be replaced quickly as the global reserve currency, as US Treasury secretary Tim Geithner arrived in China on his first official visit.

“‘In the short term I don’t think we can find another currency to replace the US dollar,’ said Guo Shuqing, chairman of China Construction Bank and former head of the country’s foreign exchange administrator. ‘The US dollar is the main currency because their economy is number one in terms of competitiveness, in terms of innovation.’

“Speaking in an interview with the Financial Times, Mr Guo also raised doubts about a proposal from China’s central bank governor, Zhou Xiaochuan, to replace the dollar with a ’super-sovereign reserve currency’ based on special drawing rights issued by the International Monetary Fund.

“‘We’ve had SDRs for many years but everybody knows they don’t work so well,’ said Mr Guo. ‘People worry about US dollars very much because of the imbalances in the current account but that has been the case for many years - they have had a deficit in the current account since the very beginning of the 1970s.’

“The bulk of China’s total international investment position is held in US dollar assets and only 6% is in the form of direct investment.

“Fears that US moves to tackle the recession could undermine the value of the dollar have led to calls from senior Chinese officials, including Mr Zhou, for more conservative fiscal policy and suggestions that the dollar be replaced as the world’s reserve currency.”

Source: Lionel Barber, Martin Wolf, Jamil Anderlini and Kathrin Hille, Financial Times, June 1, 2009.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.