A High Unemployment Rate Correlates to a High Rate of Inflation

Economics / Inflation Jun 22, 2009 - 04:56 AM GMTBy: Michael_Pento

It absolutely amazes me how sanguine the Fed, Treasury and Administration are about the prospects for subdued inflation. What they and many economists like to point to as the source of their optimism is the high rate of unemployment, which is currently 9.4%.

It absolutely amazes me how sanguine the Fed, Treasury and Administration are about the prospects for subdued inflation. What they and many economists like to point to as the source of their optimism is the high rate of unemployment, which is currently 9.4%.

But the truth is that inflation actually causes higher rates of unemployment, while it is false to believe that inflation can be prevented by a labor slack in the economy.

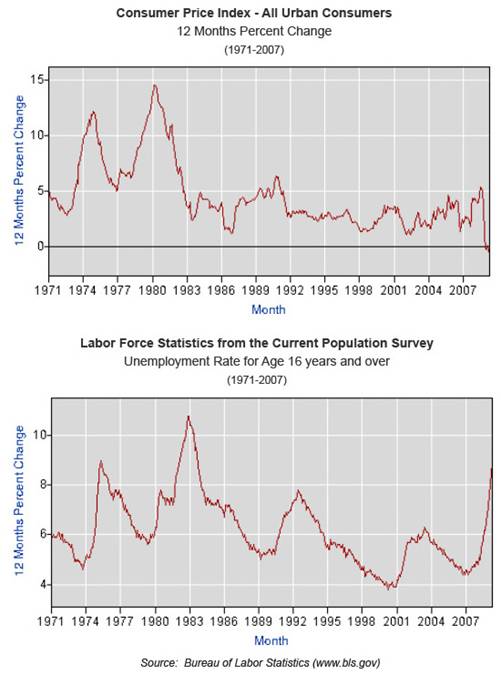

To prove this point, I would like you to observe the following two charts.

I chose 1971 (the year Nixon broke the gold window) as the starting point, as that was the year we began a 100% fiat currency system. The correlation between Consumer Price Inflation and the Unemployment Rate is impossible to ignore. You can clearly see that unemployment rises when CPI increases, with a small lag. The point is this; if inflation causes rising rates of unemployment, is it reasonable to assume that high rates of unemployment must necessarily prevent inflation from occurring? Clearly that would be false.

A closer look at the data

The cyclical high 12.2% Y.O.Y. rise in CPI that occurred in November of 1974 led to the cyclical high of 9% unemployment during May of 1975. Likewise, in 1979 the Y.O.Y increase in CPI reached a high of 14.6% in March and April of 1980, which was followed by another cyclical high 10.8% unemployment print in November and December of 1982. Finally, CPI increased from 1.2% in December 1986 to 6.4% in October of 1990. That again corresponded with the rise in unemployment that occurred from the 5% level in March of ’89 to 7.8% in June of ’92.

There is substantial evidence from the above data to conclude that a rise in unemployment does not serve as a depressant to inflation but rather that inflation leads to an increase in job loss.

However, there is one noted exception. What’s going on today you may ask? We see a huge increase to 9.4% in the unemployment rate and yet CPI decreased 1% Y.O.Y in May—which belies the 38 years of historical data. I believe much of what the CPI is picking up today is the plummet in oil and commodity prices that occurred last year. The price of oil dropped 75% and that caused a onetime temporary distortion in the inflation data. Meanwhile, since then much of the decline in commodity prices has been reversed. Oil is up 70% and copper is up 60% this year while the US dollar is down 10% since March. The CRB Index gained 14% and gas prices are up 26% just in the month of May.

Those who are relying on a high rate of unemployment to keep inflation in check will be severely disappointed. There just isn’t any historical basis for that belief in this country or any other. In fact, there are some extreme examples today of countries that experience high rates of unemployment along with runaway inflation.

The reason for this is simple. More people working and producing more goods to consume has nothing to do with inflation. Inflation is a monetary phenomenon and is caused by too much money chasing too few goods. In fact, fewer people in the work force mean fewer goods and services available to soak up money supply. Higher rates of inflation cause the dissolution of the middle class, as new money created always goes to the rich first. What money the non-rich do possess is subject to the same destruction in purchasing power of the rich, only they have much less of it. One of the consequences of this is a loss of discretionary purchases, which directly leads to a rising rate of unemployment.

The facts are that today that the Fed Funds target rate is near zero, the monetary base has more than doubled and the country needs to sell trillions of dollars in record shattering debt. Those factors alone are a perfect recipe to send CPI inflation rocketing up to meet the level of unemployment. Given the very strong historical relationship between inflation and unemployment, coupled with the recent surge in commodities, along with renewed weakness in the dollar, and it is reasonable to expect the rate of inflation to increase significantly in the very near future. Meanwhile we can only hope that Messrs. Geithner and Bernanke stop believing low inflation must persist just because there are less people out there producing.

*Tired of paying fees while your account value plummets? Learn about our new performance-based pricing.

Be sure to listen in on my Mid-Week Reality Check

Follow me on Twitter: http://twitter.com/michaelpento

Michael Pento

Senior Market Strategist

Delta Global Advisors

800-485-1220

mpento@deltaga.com

www.deltaga.com

With more than 16 years of industry experience, Michael Pento acts as senior market strategist for Delta Global Advisors and is a contributing writer for GreenFaucet.com . He is a well-established specialist in the Austrian School of economic theory and a regular guest on CNBC and other national media outlets. Mr. Pento has worked on the floor of the N.Y.S.E. as well as serving as vice president of investments for GunnAllen Financial immediately prior to joining Delta Global.

© 2009 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.