Ford: Playing Its Last Hand?

Companies / US Auto's Jun 26, 2009 - 02:39 AM GMTBy: Mike_Stathis

An article from the Huffington Post on June 24, 2009 claims that Ford is "secretly" in talks to sell Volvo.

An article from the Huffington Post on June 24, 2009 claims that Ford is "secretly" in talks to sell Volvo.

First, let me say that this is another example of the media trying to create the perception of valuable content.

First, let me say that this is another example of the media trying to create the perception of valuable content.

It's been known for quite some time now - for at least two years - that Ford has been looking for buyers. In fact, I discussed this in an article a year ago when critiquing its sale of Jaguar and Land Rover to Tata Motors (“Ford As a Crystal Ball For America).

Those of you who have not read the article, I advise you to because it’s quite revealing in many ways. http://www.avaresearch.com/article_details-80.html

Here are some excerpts:

“Although Ford bought Volvo in 1999 for $6.4 billion, it has been the company’s best seller of the premier brands. But as a part of its only remaining way to raise cash, Ford has been looking for potential buyers for Volvo for over a year.

While talks were in place with BMW in 2007, nothing came out of this. Perhaps this prompted the decision to sell Jaguar and Land Rover. If the company sells Volvo, it could bring in potentially $9 billion, assuming there are any buyers who are willing to pay fair value during current economic conditions. However, based upon the continued problems, Ford may soon have no choice but to sell Volvo to the highest bidder.

Selling Volvo would certainly help Ford in the short-term, but would severely hinder its longer-term business prospects because it will no longer have any premium brands other than the struggling Lincoln. Given the desperate need for cash as well as the global economic outlook, it is quite possible that Ford will be forced to sell Volvo for much less than it’s worth.”

So when I ran across the Huffington Post headline, I thought there were some “breaking new developments.” After clicking the “read the whole story here” link, I was quite annoyed to see a Bloomberg article appear, dated February 5, 2009.

http://www.huffingtonpost.com/2009/02/05/ford-in-talks-to-sell-vol_n_164130.html

What kind of legitimate newspaper publishes this misleading content? The best they can do is feed off of stories that are five months old from another source, while giving readers the impression they have breaking news? What a complete waste of time!

As for Bloomberg, given the events that occurred in the auto industry in 2008, why did it take them so many months to come out with that story?

All I have to say is these journalists are so behind the curve it’s inexcusable. This is why the media is approaching bankruptcy.

Back to the original point that caught my interest. Much has happened since the twelve months I wrote that piece. At this stage, I have little doubt Ford will sell Volvo soon. If it does, that would be a very big mistake unless they happened to get at least $8 billion for the unit, which is highly unlikely.

Continuing from my July 10, 2008 article,

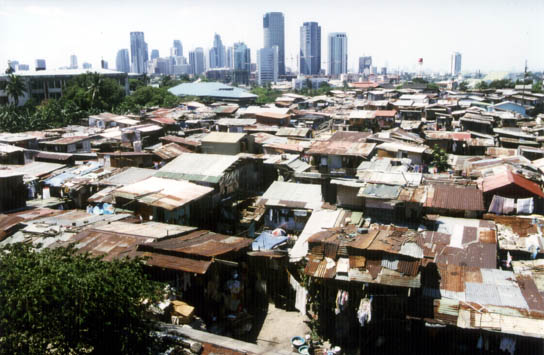

“We have already seen how Asian and European auto makers have taken leadership of what was once the pride of American manufacturing. One need only look at Detroit’s socioeconomic demise over the past two decades to see the effects of free trade. Detroit represents but one of many casualties of free trade. On a larger scale we see similar effects in Ohio, Illinois, Pennsylvania and many other states.

In exchange for more affordable automobiles, America has traded good jobs. In exchange for cheap trinkets from China, America has mortgaged off its future with ballooning debt. In exchange for the hope of oil deals in Iraq, America has traded thousands of lives and up to $3 trillion before it’s over. While money is spent in Iraq to rebuild hospitals, schools, roads and bridges – all destroyed due to the US presence - taxpayers are stuck with the bill to rebuild this demolition.

Meanwhile, America’s own infrastructure continues to erode, while US workers struggle with several years of muted wage growth and soaring costs for basic necessities - all while the Federal Reserve opens its printing press to bail out the banking system, causing the further devaluation of the dollar and higher oil prices.

Going forward, it is very likely we will see a bailout for US auto makers and airlines, shifting even more strain on taxpayers. In the end, there will be very little funds for Medicare or Medicaid, while the buying power of Social Security continues its slide. If fiscal and monetary responsibility does not soon become the top priority in Washington, these benefits will face devastating cuts while taxes soar. And this will only guarantee the continued decline of American living standards for decades to come.

Ultimately, the sale of these two auto divisions is but one of thousands of transactions that have served to transfer wealth from America to developing nations. This trend has been in place for well over a decade. In conclusion, Ford’s recent Jaguar-Land Rover “fire sale” represents just another signal to the end of America’s consumption orgy fueled by delusional gains and dependent on foreign credit.”

As you’ll note from my previously published article, the possibility of such a sale has many implications beyond the surface. I’ve already mentioned how the sale of these units tells the story of America’s decline, while painting a bleak picture for its future.

Now let’s look at the direct implications for the eventual buyer of Volvo, using my previous discussion of Jaguar and land Rover.

“First you should understand that brand recognition has multiple sources of potential revenue streams. The Jaguar brand name can be licensed out to sell retail goods and even be partnered with services. And of course, each brand can be licensed for distribution rights in specific geographic markets such as those in Europe and Asia. The same is true with Land Rover. Dealers pay a flat fee plus a percentage of revenues in exchange for the rights to sell and service these autos, similar to other franchising arrangements.

But if the autos aren’t selling there won’t be a demand for dealerships and revenues will fall. Next, consider how brands are built. It takes many years of customer satisfaction and hundreds of millions of dollars for R&D, marketing and promotional activities to build a reliable brand. So when looking at the revenue potential as well as the capital invested, these two brands have significant value.

Now let’s look at other intellectual property such as design and technology patents and manufacturing and operational trade secrets. Without going into the details, I would roughly estimate this intellectual property to be worth $2 billion, at minimum.

But the ability to generate revenues from these assets on a short-term basis is limited. The real potential rests upon the ability to sale the vehicles. Thus, the synergy of these intellectual assets is what really matters. And that depends on how well management executes all of the operations to produce sales. In other words, sales ultimately determine the income potential and therefore the valuation. However, the value of these assets may also be determined by considering the cost to develop similar assets (that is creating a strong luxury brand name, R&D manufacturing and design patents and manufacturing trade secrets) by starting with nothing or by leveraging current assets. Most likely, when Tata analyzed the deal, management calculated both the value of these assets, as well as the estimated costs to create similar assets.

Finally, while I have no numbers on the tangible assets such as facilities and equipment or how much if any debt or lease payments were attributable to these assets, I would say a reasonable estimate would place this figure around $700 million.

Combining the intangible and tangible assets and assuming reasonable execution, I would value the deal roughly at around $8 billion for synergy effects. Without reasonable execution, the deal would be worth about $4.7 billion (i.e. for the “bare bones” valuation of the intellectual property, equipment, plants and facilities).

Thus, either way, Ford handed Tata Motors a great deal. At the very worst of all scenarios, Tata paid $2.3 billion for facilities and equipment, access to (and ownership of) state-of-the-art automotive R&D, manufacturing and design secrets and other valuable know-how, which would otherwise take many years and billions of dollars to match.

But the closing of this deal wasn’t valued based on what Tata stands to gain but rather how desperate Ford was for cash. Ford’s desperation, along with what appears to be a fairly uncompetitive bidding process enabled Tata to walk away with a sweet deal. In exchange, it bought Ford another year or two before having to take even more drastic measures.”

Similar to Ford’s sell of Jaguar and Land Rover to Tata last year, a sale of Volvo to China or any other Asian company will pay huge dividends because it will have instant brand recognition in the world’s largest auto market.

Moreover, the acquiring company will benefit from receiving a highly developed portfolio of intellectual property, which can be transferred to help build the nation’s own auto industry, from design patents, trade secrets, trade marks and logos, to manufacturing processes and know-how.

Beyond the intellectual property directly involved with manufacturing Volvo, the acquiring company will receive a potentially huge source of revenues from merchandising licenses and many other strategies that leverage the brand name.

Ford already lost big by virtually giving away Jaguar and Land Rover. I find it ironic that just a year later, Jaguar dethroned Lexus as the world’s most reliable car.

Anyone who claims timing doesn’t matter is simply a fool or a liar. This also applies to the financial markets. Timing is just as important as price. You cannot consider one without the other. To do so is playing the game of fools.

I want to encourage all who seek the truth and valuable guidance to follow me to my new site www.avaresearch.com . You won't see me pitching gold or investments to you like others. You will continue to receive nothing but unbiased top-tier insight, education and commentaries.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

Mike Stathis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.