Walls to Block U.S. Deflation

Economics / Inflation Jul 01, 2009 - 12:09 PM GMTBy: Jim_Willie_CB

Many are the obstructions to the so-called (mislabeled) deflation threat within the US Economy. To begin with, falling asset prices does not constitute deflation. One of the primary objectives of the banking elite in firm control of the USGovt and US Congress is to confuse the public and investment community on the entire topic of inflation, what it is, how it is measured, and its risks. The same goes for deflation. All debate as to whether the Untied States will suffer from inflation or deflation is a horrible misdirected distraction that manifests the confusion. The US will suffer both higher monetary inflation and worse economic deterioration, not one or the other, but BOTH, and with steadily increasing intensity.

Many are the obstructions to the so-called (mislabeled) deflation threat within the US Economy. To begin with, falling asset prices does not constitute deflation. One of the primary objectives of the banking elite in firm control of the USGovt and US Congress is to confuse the public and investment community on the entire topic of inflation, what it is, how it is measured, and its risks. The same goes for deflation. All debate as to whether the Untied States will suffer from inflation or deflation is a horrible misdirected distraction that manifests the confusion. The US will suffer both higher monetary inflation and worse economic deterioration, not one or the other, but BOTH, and with steadily increasing intensity.

Imagine a massive tornado building force, inflicting damage, and being fed to grow even more powerful by current policy. To argue on whether the high pressure or low pressure will prevail misses the entire storm, built upon the grand and growing differential in pressure. The storm is born of opposing pressures, each growing more intense. Human response to economic distress and banking woes ensure evermore pressures to be exerted on each side. The grand growing monetary expansion continues to collide with grand worsening asset price decline, while the Deflation Knuckleheads spout more nonsense. They miss the storm itself, how it is formed, and the dual nature of its tempest.

A very important point must be made, something few if any analysts or pundits or anchors are mentioning. In fact, the staggering direction of monetary aid for rescues of dead banks, for nationalization of dead corporations, and for stimulus to an insolvent nation guarantee more damage. The huge monetary growth guarantees that the asset prices will continue to fall, and that the great tempest will grow in magnitude and danger. Why? Because bad money drives out good money, because phony money undermines legitimate assets, because easy money encourages more bubbles. It acts like a cancer, one that has essentially destroyed the fundamental foundation of the nation. This extremely important point will lead to the ultimate downfall of the Untied States, as their inflation will destroy too much capital in determined yet mindless application.

The primary question that the errant Deflationists avoid is “Why is the Crude Oil price rising?” since it highlights their erroneous position and twisted viewpoint. The strong uptrend in crude oil price stands as contradiction to their argument, but they ignore it. The hidden question that they cannot even manage to formulate is “Is the Shadow Banking System flow data included in the Money Velocity figure?” as some within their camp appear to trust US Fed data itself. The other bank system has kept the entire credit market afloat for over a decade, without benefit of statistical inclusion. Never permit a syndicate to supply critical data. To dismiss official price inflation data but trust their money velocity data is folly. In my travels, when my confrontational questions are posed, they are almost never answered. The posed questions are as little understood as the emotion is great behind their incorrect views. The Deflationists will be correct only if the Central Banks and their franchise system of destruction shut down and halt the accelerated production of phony money. Aint happenin!

What is particularly disturbing is how intelligent aware members of the gold community of sound money principles find themselves ensnared within the lexicon of the Deflationist camp. They show confusion by simply engaging in discussions, as they use the crippled terms. For instance, a bright colleague from inside the gold community recently said in an exchange “Deflation will make the inflation worse” which is nonsense on its face. He meant to say “Falling asset prices will force even more monetary inflation in response in the form of rescue or stimulus.” Another from outside the gold community said “Deflation suffered by the banks from housing will push down the gold price” which is again a comment within a pretzel. He meant to say “The housing pressure on bank balance sheets will lead to falling asset prices generally, and thus harm the gold price” which is utter nonsense. It is actually difficult to debate the topic, since most people are hampered by the faulty lexicon adopted.

To clarify most clouds of confusion, it is best to refer to ‘Falling Asset Prices’ instead of ‘Deflation’ in almost all cases. The bankers must be laughing hard in their snifter glasses at the bewilderment laced throughout the public, as 90% have no idea what inflation and deflation are, let alone where they come from, and surely not how neither could possibly prevail in today’s environment. Meanwhile, the great storm continues, with only minimal recognition, since the growing amplitude in the differential rules the day. The monetary aggregate is growing, just as the asset value destruction continues. Each has its hidden components, to further add to the confusion.

CRUDE OIL CURVE BALL

The biggest elephant in the wayward Deflationist living room is the strong crude oil price. If deflation (whatever they believe that means) is to dominate, then the crude oil price should be around the 40 level. It should be scraping the bottom. Instead, it has staged a rebound that has endured for four months. Put the copper price chart aside, and turn to crude oil, which is still heavily traded. The two principal pillars of the crude oil recovery in full view are US$ monetization by the USFed and USDept Treasury, along with the broad deployment of US$ hedges by private investment houses and sovereign wealth funds. New money and additional credit come into the system. Banks are the primary recipients of such largesse at the public expense. Some finds its way into crude oil instruments on hedge fund ledgers. Banks surely are not lending much. They are investing in the USTreasury carry trade with the trusty help of the US Federal Reserve, which actually likes the steepening yield curve (long-term rates are higher than short-term rates).

Investment banks are also quietly buying crude oil positions, since they work well to add to their crippled balance sheets. The hedge funds flock to crude oil, while the sovereign wealth funds continue not only to stockpile crude oil, but build new storage facilities. The crude oil hedge against the embattled USDollar is just as prevalent globally as the flow of new funds into the backwaters lined with oil. The hidden disguised and improper release of crude oil from the Strategic Petroleum Reserve last summer and autumn provided the perfect conditions for the launch of a powerful rebound, that now is powered by reaction to the USDollar debauchery. The SPR release took the crude oil price too low. Now the weak USDollar and revolt against it will ensure continued upward momentum.

The powerful message is that the monetary rivers and USDollar brokenness dispute the deflation claim in one of the most important asset prices in existence – crude oil. The Deflationists point to falling asset prices, but ignore the crude oil price as an exception. It is the most important economic cost for businesses and households on the tangible side, with the cost of money the most important on the financial side. Watch for a bullish technical crossover as the faster 20-week moving average challenges the 50-wk MA. The more stable longer term moving average is providing support above the 67 level.

GOLD SHOWS NO SIGNS OF SO-CALLED DEFLATION

If deflation (whatever they believe that means) is gaining an upper hand, then somebody should tell the gold price. It is oblivious to any such vapid threat. Being ultimately a monetary instrument, gold continues to build its energy field for the next rise. Notice the rising moving averages and the rising trend on the build-up toward the breakout level of 1000. To be sure, the gold market is reluctant to advance with power. It is being held back by the illicit gold futures shorting campaign that violates every regulatory statute in the book, beginning with the 90% collateral requirement. Heck, we all could bring down the price of a cup of coffee to a mere dime if we shorted the coffee contract into oblivion without benefit of supply, provided the central bankers kept huge inventories to work past the midnight hours in their nether chambers, where they devise new Politburo poppycock plans. Notice not so much the Head & Shoulders reversal pattern shown in past articles, but the upward energy embodied in the chart.

Numerous factors conspire to push the gold price above the 1000 level. Most investment camps seem to be waiting for an ‘All Clear’ sign, to lessen their perceived risk. One might have thought it would have been the mid-March monetization message by the USFed. However, a mountain of new illicit non-collateralized gold futures contract sales at the same time prevented such a power push. The vile Power Elite was prepared and responded. Many other messages are certain to fuel the ultimate power push. The foreign sovereign wealth funds are diverting some of their new trade surplus funds into gold, even announcing it. In fact, the foreign creditors have halted the great majority of USTreasury Bond purchase, even the USAgency Mortgage Bond purchase in a virtual global strike. That new development has escaped the intrepid lapdog US press. They have reported the sharp rise in ‘Indirect Bids’ for USTreasury auctions in back pages where few read.

Translation: foreign central banks are the only buyers anymore, and probably they act on behalf of the USDept Treasury. Thus, the USGovt is the primary buyer of new USGovt debt, monetization. They key point to take home and run with is that the USGovt has begun to disguise its vast monetization, so as not to annoy the already angry Chinese creditors. Maybe the USGovt can pledge a couple US cities as collateral, and toss in a couple national parks and some golf courses.

MAIN PSYCHOLOGICAL THEME

One eager opinionated acquaintance from several years ago maintains with a degree of defiant gusto that the foreigners must retreat to the USDollar for whatever reason, and their undying support will continue, perhaps even reluctantly, to the surprise of the investment community generally. They continue US$ support in his opinion because they are deeply committed to the embattled buck. They do so because their banking systems have cut a multi-decade deal with the deadly dollar devil, thus making them stuck committed. They will do so because no other legitimate alternative with sufficient structure and trading volume is available. They will do so because deep down, they still trust the longstanding security of the USDollar fortress, backed by both a military and huge economy and tradition of financial dominance. They will do so because their export businesses require a USDollar not to fall significantly, and expire on the intensive care table.

My rebuttal reflects what China clearly manifests as a strategy. The rest of the large creditor nations are certain to either follow the Chinese path or set out on a parallel course. Past work has called the Chinese initiatives the spearhead against the USDollar. They realize they must smother (but not kill) the USDollar slowly, eventually suffocating it only at a time their many initiatives are fully deployed in place, much like a neck noose built into a straightjacket.

The strategy has two important sides.

First, they are protecting their outsized core of US$-based bonds of several stripes. They choose not to embark on any aggressive strategy that would seriously undermine their core holdings in reserves. However, they are not stupid. They see the unprecedented and colossal debauchery of the USDollar via trillion$ in new debt, with seemingly little or no concern over foreign reserve holdings, demands, or priorities. The USGovt believes it can deflate its debts one more time, delivering foreigners weak coffee at the lunch counter, and get away with it. They cannot time, not this time, especially since the USEconomy is stuck in a deteriorating spiral, the US banks are insolvent (despite phony accounting), US households are insolvent, and US industry is either absent or depleted. Foreigners are far too aware of the USGovt attempts to inflate debt away, actually an impossible task as those debts multiply like bacteria, or better described as CANCER. The US leaders want to reduce both the value of the debt burden and assure that its ongoing service costs are kept low. Foreigners are in revolt, threatening to pull the plug.

So foreigners have embarked on a broad response.

Second, they are diversifying away from the US$ at the margin in bold moves. They are devoting NEW trade surplus funds to hard assets, like stockpiles, like grand production contracts, like large acquisitions and partnerships. They are regularly urging wider acceptance of the I.M.F. bonds as an alternative to storing surplus funds outside the US$ sphere. In fact, the Chinese lead the global initiative to end international contract settlement in US$ terms, after several decades. They do so with yuan currency swap facilities scattered across the globe like so many automatic teller machines. They do so with historically unprecedented bilateral barter accords, whose systems are being assembled and put into place. See Russia with China. See Russia with Germany also.

The stockpile movement is not strictly a Chinese phenomenon. The Shanghai Coop Organization (SCO) recently completed a global meeting, with several key invited guest nations like Brazil. Their unstated purpose was to make concrete steps in contract settlements for a variety of commodities (from crude oil to natural gas to industrial metals), and do so without USDollar involvement. The June SCO meeting in Yekaterinburg Russia was hardly covered by the US financial press. Where it was covered, it was downplayed. Also, despite its many problems within the European Union, like economic recession and wounded banks, foreigners are flocking to the Euro currency, now over 141 and pushing toward 142.

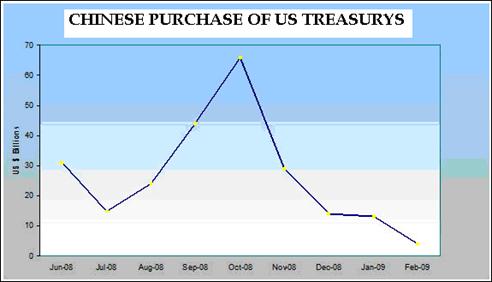

NO, the major theme of 2009 on the Psychology Billboard is REVOLT AGAINST THE USDOLLAR AT THE MARGIN, NOT THE CORE. The foreign creditors and suppliers to the Untied States are in a coordinated global revolt position, being fortified with each passing month. That is the major theme of 2009. Notice the shutdown in Chinese purchase of USTreasury Bonds, down to a mere trickle since October. In fact, the objective of those in revolt is to play down their revolt, to talk nice to the USGovt (which controls an aggressive military), to utter empty words about support for the USDollar, but to work behind the scenes to undermine it AT THE MARGIN. Their exercise is akin to soothing and singing to a large wounded beast, as it is being surrounded, tied up, and muzzled. Their objective includes a pace of undermine intended to be gradual.

Foreign creditors wish to use their USTBond reserves in constructive intelligent manner. The Chinese recently announced a dedication to hedge funds from their vast sovereign wealth fund holdings, a likely avenue for USTBonds used as collateral in accounts. If properly deployed, with sufficient volume, additional USGovt debt can be used to fortify the commodity prices and prevent a perverse unjustified USDollar rebound, built upon failure and liquidation. Slowly but surely, the credit supply for the USGovt and USEconomy will be reduced to the point that later, unclear how much later, it will be cut off.

FOREIGN VULNERABILITY

Reading economic reports from foreign lands serves as a distraction to this entire ill-footed deflation versus inflation debate. Some like my outspoken acquaintance believe that foreign economic distress assures continued decline in US asset prices. They miss the main point. Foreign economic distress assures less trade surplus recycle into USTreasury Bonds, and further isolates the USDept Treasury into monetizing their debt.

A DEEP ISOLATION COMES TO THE UNTIED STATES AS FOREIGN CREDITORS BOTH REFUSE TO FUND AND CANNOT FUND THE PROFOUND CRIPPLING US DEBT.

Hidden within the bowels of the funding process is the gradual destruction in the official bond primary dealers. Last week, Dresdner Kleinwort decided to exit in its role as a primary bond dealer. The US-based dealers are sitting on a mountain of inventory, acting like a huge collection of boulders on a medium sized vessel at sea. Primary dealers now have a record $368 billion in Corporate, Agency (mortgage), mainstream mortgage bonds, and USTreasury inventory. And the vast bulk of their holdings of USAgency debt has less than a 3-year maturity. Just like the private equity groups and Wall Street firms, they are heading toward a day when they choke on their own feces.

The USEconomy is most vulnerable to price inflation, due to US$ weakness and revolt globally against it, as commodity prices are inversely linked. The USEconomy is perversely the most protected from price deflation. The deflationist argument might possibly hold some water with foreign economies, as their currencies rise enough to harm export trade, as their strong currencies keep commodity costs down. The Deflationist Knuckleheads at best have it backwards, and at worst continue to be lost.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.