Soggy End to Yet Another Down Week for Stocks

Stock-Markets / Financial Markets 2009 Jul 13, 2009 - 05:08 AM GMTBy: PaddyPowerTrader

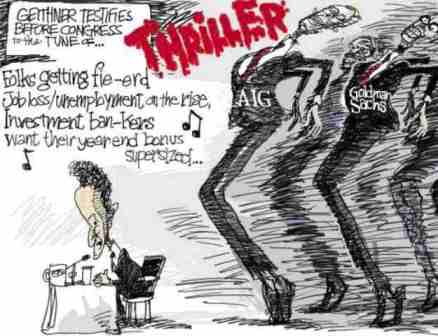

Stocks were down again on Friday (making it down four weeks in a row) as a fall in fall prices (they had their worst week since January) and a drop in consumer sentiment proved a drag. Chevron joined in the chorus of doom on Friday by warning that Q4 earnings would be “significantly lower” than the preceding quarter, hightening earnings worries. Against such a background, the ordinary punter finds it hard to comprehend that yet again failure is being rewarded; AIG in talks with U.S. over another $250 million in bonuses.

Stocks were down again on Friday (making it down four weeks in a row) as a fall in fall prices (they had their worst week since January) and a drop in consumer sentiment proved a drag. Chevron joined in the chorus of doom on Friday by warning that Q4 earnings would be “significantly lower” than the preceding quarter, hightening earnings worries. Against such a background, the ordinary punter finds it hard to comprehend that yet again failure is being rewarded; AIG in talks with U.S. over another $250 million in bonuses.

The Dow has now fallen back 7.4% since that June 12 finish. The S&P 500 and Nasdaq have fallen back by similar amounts. The Dow finished the week down 1.6%. The S&P 500 dropped 1.9%, with a 2.6% decline for the Nasdaq. Investors fretted about the potential for a string of tepid earnings reports this week and worried about the pace of the alleged recovery. Among the big companies reporting next week are railroad CSX, Goldman Sachs, Intel, IBM, JPMorgan Chase, Bank of America, Citigroup and General Electric. Personally I think that the earnings of the financials will be almost impossible to decipher but watch for increased provisioning against non performing loans.

Two of my favourite market indicators – USD/JPY and US equity prices— are showing nearly identical chart patterns (adjusted for scaling): USD/JPY stronger; US equities weaker. The yen gained 3.5 in the past week vs. the dollar and now appears set to test 90 and maybe even the double bottom at around 87 seen in January. Meanwhile, the S&P is down 3% and closed below its 200 day moving average. Worse yet, the 20 day m.a. has cut the 50 day from above, an indicator of more short-term downside for US stocks. Why dwell on these technical developments? Because they are confirming what my nose for the fundamentals is telling me: the rally in risk assets is coming to an end. Decelerating deterioration in the global economy (I’m determined not to say “green shoots” one more time) and the genuine success of central bankers in restoring liquidity to the financial markets, thereby sharply reducing the risk of a systemic meltdown, caused the rally along with the inventory cycle.

“Great, but what have you done lately?” says market participants. After all, even if unusually high rates of growth are sustained in the countries hardest hit by the downturn such as Japan and the US, it will be years before negative output gaps are fully eliminated. This is the crux of the matter because the excess capacity, low rates of return on assets, and the high levels of unemployment associated with a large negative output gap feedback to the real economy, weighing on both capital spending and consumption. The financial system won’t be spared. Bankruptcies and non-performing loans will soar, causing banks to further curtail lending, which in turn will short out the credit multipliers. The inflationary pop from high powered money that we all fear will be reduced to a damp squib. An close encounter with a grizzly bear looms large.

Today’s Markey Moving Stories

- Asian stock markets were heavy as investors face the uncertainty of several key 2nd quarter operating results in the US this week. Taiwanese stocks fell the most on concerns that cross-strait talks would take time to produce tangible results. Looking ahead, Chinese Q2 GDP data looms large on Thursday; a growth figure of over 8% could unleash the bulls yet again. The consensus is currently forecasting growth of 7.8%.

- The UK’s fiscal situation was very much in the spotlight again at the weekend. The Sunday Telegraph cited the IMF as saying the UK is alone with Argentina amongst G20 countries as being unable to budget for temporary spending increases next year. Alistair Darling chose the Telegraph to give an interview in which he indicated that there will be a “pared down” spending review before the next election. This differs somewhat from Mandelson’s recent comments. Darling’s tone on spending also differed from Brown’s, saying the government must “at all times” be honest with people about what lies ahead and that spending will be “tighter”.

- Reports over the weekend suggest that Halifax will be forced to exit the Irish banking market at the behest of the UK Treasury. In a direct instruction from the UK Treasury, Bank of Scotland Ireland will prepare to repatriate £20 billion in Irish assets of a £30 billion loan book from September onwards, according to reports. The move comes after the sharp deterioration of the Irish loan book, against a backdrop of significant UK Government support of the parent Lloyds Banking group. Such moves aren’t exactly going to benefit borrowers as competition drops & it ultimately will permit the more established players to “repair margins” Note the Sunday Times reported that Lloyd’s are poised to write off as much as £13 bn on its loan book. Banking stocks in general are showing some weakness this morning with Barclays & Spain’s BBVA leading the move south. Barclay’s is rumoured to be looking around for bids for its private equity division. Selling at the bottom of the market is hardly good sign & things may be less rosy than the picture painted by management. Recall they sold the family silver BGI

- European stocks have opening soft again today for a myriad of reasons. Nomura has downgraded its outlook on continental European stocks to “underweight”. Rio Tinto, Xstrata, French oil producer Total and Royal Dutch Shell are vulnerable with copper & crude prices slipping again. Insurers may also under pressure after Keefe, Bruyette & Woods cuts their house view on European property and casualty insurers to negative (watch Amlin, Hiscox & Brit). In contrast UK insurer Friends Provident is up sharply after rebuffing a takeover approach from Clive Cowdery’s opportunistic Resolution Ltd.

- Dutch electronics giant is one of only a few stocks heading north this morning after posting better than expected Q2 results defying the analysts who follow the stocks (they’d predicted a small loss). Also to the upside though is Porsche on a report that Qatar is set to invest 7 bn euros for a stake and stock options in VW.

- A report in the Observer claims that Xstrata (Baa2n/BBBn) may be considering a EUR 5bn rights issue to fund some kind of cash sweetener to Anglo American’s shareholders in order to persuade them to accept Xstrata’s merger proposals. The report also goes on to claim that Xstrata could also be prepared to accept a smaller stake in Anglo of around 45% rather than the original 50%. While Xstrata need to work to get Anglo to the negotiating table, we are not convinced these proposals make sense (why would Xstrata shareholders pay GBP5bn for this to be paid to out to Anglo shareholders…) and Xstrata subsequently put out a comment stating that their proposal “remains a nil premium merger of equals, in which both companies’ shareholders will share equally the substantial benefits that are uniquely available from a merger.” Stories like this are going to rumble on however for the foreseeable future, which makes me cautious/neutral on both Anglo and Xstrata.

An article from Bloomberg echoing what I have been saying here for a while ie that Emerging Markets are at their Priciest Since 2007 When Shares Fell.

More than just a conspiracy theory, it does seem that real investors are getting fleeced.

A personal finance tip, if you’re afraid your credit company will profile you as a never-do-well, here’s a few things you should never put on your charge card, i.e.in other words, if you decide to take your personal masseuses on a booze binge/tire-rethreading spree, pay cash.

In another time & place they would have become infamous, but in the era of Madoff they went almost unnoticed

-

I wonder how repossession works in this case?

Notable earning today included Blackrock ($1.54), CSX (0.62), Charles Schwab ($0.18), and Novellus($-0.38)

Looking For a Hasty Exit Could Prove a Disaster

The duration and the depth of the recent global financial crisis and recession has forced governments and central banks to extend policy support in ways that have gone far beyond normal fiscal and monetary fine-tuning. Indeed, there is no historical precedent in the modern era for policy reflation on the current breadth or scale. Huge efforts have been made to loosen credit conditions by providing direct support to dysfunctional banks and the broader financial sector. Large discretionary fiscal stimulus packages have been employed to stabilise economies and in numerous economies, official interest rates have been cut to close to zero. Creating monetary stimulus has been combined by nonconventional means, including programmes of outright quantitative easing. We have been living in a brave new world of macroeconomic policy-making.

However, as the threat of financial Armageddon has abated, the pace of contraction in real activity has slackened off, and hopes of stabilisation and the onset of recovery have strengthened. The issue of “exit strategies” from the range of extraordinary policies put in place over the last 18 months has attracted considerable market and media attention. It is also clear that policy-makers

have themselves been working on contingency plans in this regard, even if, as we suspect, anything but their most gradual implementation is still likely to be some way off. The precise definition of what is meant by “exit strategies” varies. Here we apply a broad characterisation of the process, extending to the withdrawal of financial sector and more orthodox fiscal policy support and a return to (higher) interest rate targeting as the dominant focus of monetary policy. But the lesson form a little economic history is clear. Don’t jump the gun.For example, the record shows that US policy makers got things very wrong in aftermath of the Great Depression. In 1936 and 1937, the combination of a rapid doubling of bank reserve requirements designed to remove excess liquidity, tax hikes, the curtailment of government hand outs to World War One veterans and the introduction of levies to fund unemployment insurance and old age pensions plunged the US economy back into recession after four years of recovery. The downturn was not as extended as that from 1929-33, but the initial pace of contraction was actually steeper than that which followed the Wall Street Crash. In 1938, the tightening of policy was rapidly thrown into reverse, and, as the US economy began to gear up for war, the recovery resumed. Sixty odd years later, Japanese policy-makers got ahead of themselves twice. In 1997 they tightened fiscal policy by about one percentage point of GDP through an indirect tax hike and a number of other measures just when the Asian financial crisis was about to deliver another large shock to a still fragile economy, and in 2000, not only did the government tighten fiscal policy by one and a half percentage points of GDP, but the Bank of Japan also saw fit to abandon the zero interest rate policy (ZIRP) that had been place since March 1999. On both occasions, the net result was a renewed downturn and increased deflationary pressures. And on both occasions, a sharp policy “u” turn proved necessary. The message appears to be that severe financial crises lead to extended balance sheet adjustments and leave private sector confidence in a particularly fragile and vulnerable condition and that subsequent policy adjustments that might normally be absorbed with relatively little disturbance can prove altogether more damaging.

And finally…..

Imagine how much worse CNBC or Fox Bizz News would be if

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.