U.S. Housing Market Crash Real Story as Home Vacancies Hit 19 Million

Housing-Market / US Housing Jul 24, 2009 - 06:37 PM GMTBy: Mike_Shedlock

Bloomberg is reporting U.S. Home Vacancies Hit 18.7 Million on Bank Seizures.

Bloomberg is reporting U.S. Home Vacancies Hit 18.7 Million on Bank Seizures.

More than 18.7 million homes stood empty in the U.S. during the second quarter as the steepest recession in 50 years sapped demand for real estate and banks seized properties from delinquent borrowers.

The number of vacant properties, including foreclosures, residences for sale and vacation homes, was little changed from 18.6 million a year earlier, the U.S. Census Bureau said in a report today. The quarterly homeownership rate was 67.3 percent, seasonally adjusted.

More than 14 percent of homes were vacant in the period, the Census said. Home values dropped 33 percent since 2006, according to the S&P/Case-Shiller index, and the unemployment rate in June rose to the highest in almost 26 years. Tumbling home prices and rising job losses have thwarted government efforts to reverse the housing decline at the heart of the longest U.S. recession since the 1930s.

There were 130.8 million homes in the U.S. in the second quarter, the Census Bureau said. In addition to the 1.9 million empty properties for sale, the report counted 4.4 million vacant homes for rent and 4.6 million seasonal properties that are only used for part of the year.

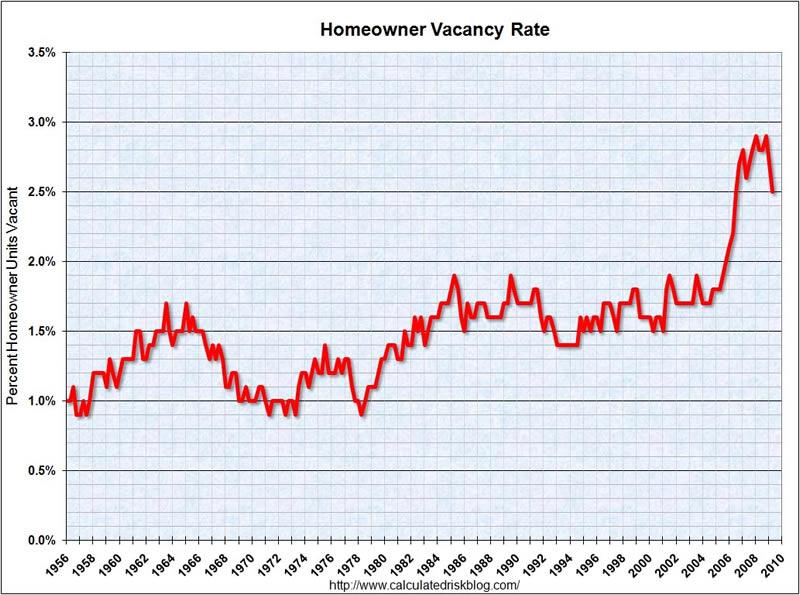

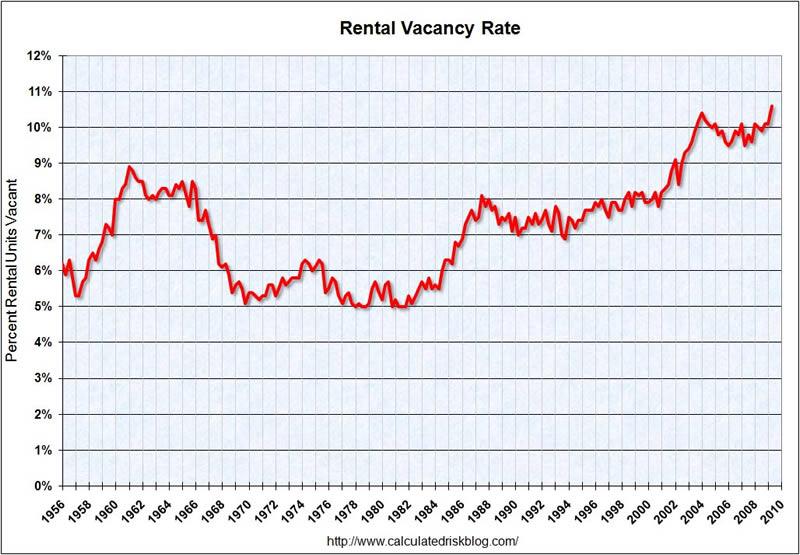

Graphs From Calculated Risk

As is typical, Calculated Risk has posted some great charts showing the trends.

The homeowner vacancy rate was 2.5% in Q2 2009.

This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal, and with approximately 75 million homeowner occupied homes; this gives about 600 thousand excess vacant homes.

The rental vacancy rate increased to a record 10.6% in Q2 2009.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.Dip In Vacancy Rate Reflects Rise In Rental Rate

It appears as if there is improvement in the homeowner vacancy rate, but the main reason for the dip in homeowner vacancies is consumers have given up on trying to sell their homes and instead are attempting to to rent them. Furthermore, the record 10.6% rental vacancy rate is pressuring rental prices as Calculated Risk noted above.

Of course there are many finished condo building that were for sale that are instead for rent as apartment buildings. Many of those anticipated condo sales will never be sold. Oversupply of condos is especially rampant in places like Florida, Las Vegas, and San Diego. That adds to various localized pressures.

I spoke with Calculated Risk this morning and asked "How many of those vacancies" are even livable. Neither of us could find an answer.

Yet the question is an important one as 50 Cities Must "Shrink to Survive".

The government looking at expanding a pioneering scheme in Flint, one of the poorest US cities, which involves razing entire districts and returning the land to nature.

Local politicians believe the city must contract by as much as 40 per cent, concentrating the dwindling population and local services into a more viable area.

The radical experiment is the brainchild of Dan Kildee, treasurer of Genesee County, which includes Flint.

Having outlined his strategy to Barack Obama during the election campaign, Mr Kildee has now been approached by the US government and a group of charities who want him to apply what he has learnt to the rest of the country.

Mr Kildee said he will concentrate on 50 cities, identified in a recent study by the Brookings Institution, an influential Washington think-tank, as potentially needing to shrink substantially to cope with their declining fortunes.Banks Walk Away On Foreclosures

For further proof many homes are worth nothing (or a liability) please consider Banks Walk Away On Foreclosures.

City officials and housing advocates in cities as varied as Buffalo, Kansas City, Mo., and Jacksonville, Fla., say they are seeing an unsettling development: Banks are quietly declining to take possession of properties at the end of the foreclosure process, most often because the cost of the ordeal — from legal fees to maintenance — exceeds the diminishing value of the real estate.

Astonishing Home Prices In Detroit

Also note that Median Home Prices In Detroit Fall To $6,000 as Detroit heads towards bankruptcy.

Totaling Unlivable, Worthless Home

How many homes for sale in Detroit are unlivable with liabilities that exceed the asking price or are simply unlivable at all? What about Flint, LA, Memphis, Toledo, and even places like Danville, Illinois?

There is simply no way to know what that total is.

Looking ahead, how many more foreclosures will we see as the unemployment rate heads towards 11% in 2010?

These are the kind of factors that are not readily apparent when one looks at the headlines such as "Home Vacancies Hit 18.7 Million on Bank Seizures" and then sees a dip in vacancies.

The real story is things are much worse than they look in many ways, even if one could figure out how to subtract vacant "unlivable worthless" homes from the totals.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.