The Great Missed Stock Market Investment Opportunity of 2009

Stock-Markets / Stocks Bull Market Aug 02, 2009 - 07:38 PM GMTBy: Clif_Droke

When the books have been written on 2009, the prevailing story will undoubtedly be one of lost opportunity. Countless numbers of investors caught up in the tangled web of pessimistic headlines failed to pull the trigger on what is turning out to be one of the best market recovery years of our lifetime.

When the books have been written on 2009, the prevailing story will undoubtedly be one of lost opportunity. Countless numbers of investors caught up in the tangled web of pessimistic headlines failed to pull the trigger on what is turning out to be one of the best market recovery years of our lifetime.

Where else but in the perverse world of the financial marketplace can we witness such a sad spectacle? Most people in conducting their everyday business exercise common sense and prescience, acting according to their financial self interest and looking ahead at the potential pitfalls and benefits of the transaction before making it. But when it comes to the financial market, rationality goes out the door, which in turn paves the way for countless mistakes and missed opportunities.

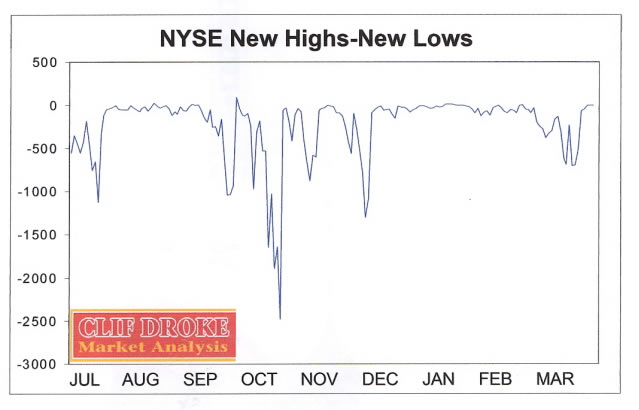

With the S&P 500 Index (SPX) having already rallied almost 50 percent from the March low, it’s sad indeed to consider that most investors have missed most, if not all, this great recovery rally. The foundation for this missed opportunity was laid last year during the credit storm. Investors were understandably jittery entering 2009 when the market had just experienced one of the worst declines since the Great Depression. The final decline into March of this year increased their fears even more. But something happened at the March bottom that should have shown them that the worst was over. To begin, there were all kinds of divergences showing up in the various market internal indicators. The number of stocks making new 52-week lows wasn’t nearly as great as it was at the previous major bottom in November 2008. This indicator alone was a screaming signal to the alert investor that a bearish investment posture wasn’t warranted.

Secondly, the important and oft-overlooked role of the NASDAQ 100 Index in not confirming the lower low in the S&P 500 broad market index. While the SPX did make a lower low in March, the NDX did not. This again was another screaming positive divergence that was simply too big to ignore. Yet all the while this was happening, headlines were swirling with doom and gloom. The financial press was engaged in making dire predictions of calamity in the most alarmist tone it could conjure. Not surprisingly, most investors ignored the clearly positive signs in the market itself and instead chose to listen to the fear mongers in the media. In doing so they missed out on the first leg up of the recovery rally.

Since the mainstream news media can only echo the dominant themes of the past 6-12 months, there was zero chance it could have prepared investors to look ahead at the tremendous opportunities for profit in 2009. The media doesn’t understand cycles, so there is no way it could have discussed the positive implications of the 6-year and 10-year cycles in 2009. Even the most basic analysis of the yearly cycles could have saved investors from missing out on the first half of the 2009 recovery rally. For instance, by going back and looking at all the previous instances where the 10-year cycle peaked while the 6-year cycle was rising, you can see that those years always resulted in a winning performance for the stock market. By taking the 6-year cycle alone and incrementally back tracking the previous six years from 2009 we can see that the years 2003, 1997, 1991, 1985 and 1979 were all positive years for the market.

Another place where the media misguided investors was in the commodities market. With the positive divergence in the XAU Gold Silver Index visible last fall, the signs were clear and obvious that insiders were accumulating base and precious metals mining stocks for the anticipated global economic recovery in 2009. Once again, investors chose to ignore the message of the tape (which doesn’t lie) and instead turned to the fear-drenched fulminations of the media.

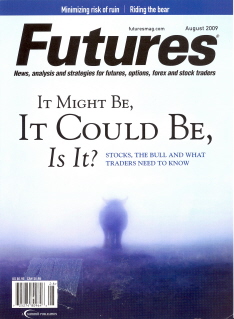

There are signs beginning to appear, however, that the media are slowly, grudgingly considering the possibility that maybe, just maybe, last year’s financial storm is over and better days lie ahead. One example of this can be found on the latest cover of Future magazine. It shows the faint outline of a bull emerging from a thick fog with the headline, “It Might Be, It Could Be, Is It?”

This is the epitome of the prevailing attitude to the recovery. After nearly a 50 percent recovery already (massive by historical standards), only now is the question asked if this is the start of a cyclical bull market. (The media have always used as its definition of a bear market a greater than 20 percent drop in the SPX, so wouldn’t a greater than 20 percent rally constitute a bull market by that same definition?) But the begrudging turning away from its super pessimistic outlook is obviously going to take some time. In the upper portion of that same magazine you’ll see another headline which reads, “Riding the bear.” Clearly the media aren’t ready to throw in the towel on their stubborn pessimism despite signs of recovery appearing everywhere.

This is the epitome of the prevailing attitude to the recovery. After nearly a 50 percent recovery already (massive by historical standards), only now is the question asked if this is the start of a cyclical bull market. (The media have always used as its definition of a bear market a greater than 20 percent drop in the SPX, so wouldn’t a greater than 20 percent rally constitute a bull market by that same definition?) But the begrudging turning away from its super pessimistic outlook is obviously going to take some time. In the upper portion of that same magazine you’ll see another headline which reads, “Riding the bear.” Clearly the media aren’t ready to throw in the towel on their stubborn pessimism despite signs of recovery appearing everywhere. As for those investors who don’t want to miss out on the rest of this year’s recovery, it would do well to remember an old adage: newspaper is best used for wrapping fish. It’s not for making important financial decisions.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.