U.S. Economy, Confidence Games and Ponzi Schemes

Economics / US Debt Aug 07, 2009 - 12:58 AM GMTBy: Tim_Iacono

After hearing a lot of talk in recent days about hopeful signs for the U.S. economy and how it is vital that consumers regain their confidence in order for a recovery to truly take hold, it struck me once again that the U.S. economy, more so than most other economies around the world, is really just a "confidence game".

After hearing a lot of talk in recent days about hopeful signs for the U.S. economy and how it is vital that consumers regain their confidence in order for a recovery to truly take hold, it struck me once again that the U.S. economy, more so than most other economies around the world, is really just a "confidence game".

As in ... a hustle.

As in ... Paul Newman.

As in ... not a good long-term plan (unless, of course, you're the one running the swindle) because, at its foundation, the game is fraudulent.

From Merriam-Webster:

confidence game

noun

a scheme in which the victim is cheated out of his money after first gaining his trust

Now, this is not some short-term hustle where some guy standing on a street corner signals his partner with a tap on his nose - this is a multi-generational scam that has as much to do with flawed concepts about how economies should operate as it does with fading empires and their tendency to transition from manufacturing powerhouses to centers of finance and money shuffling where, over time, the masses are duped into borrowing and spending their way to oblivion and the government does much the same simply because it thinks it has no other choice.

That's kind of where we are now. Let me explain...

The "Engine" of U.S. Economic Growth

Last week's report on second quarter economic growth was notable for its lack of participation by consumers, the group that, heretofore, had been considered the "engine" of U.S. economic growth and, by extension, global growth.

Personal spending made a negative contribution to GDP for the fourth time in the last six quarters and policymakers and economists all across the land continued to pray for consumers to once again open up their wallets and go buy something for the greater good.

In a sign of how times really haven't changed all that much from earlier in the decade when, in 2001, Federal Reserve Governor Laurence Meyer prodded Americans to "go out and buy an SUV" to help pull the economy out of the recession, today we have the wildly popular "Cash for Clunkers" program where, after spending like drunken sailors over the last few years leading the world into the current mess, the solution to our current economic woe is to borrow and spend even more.

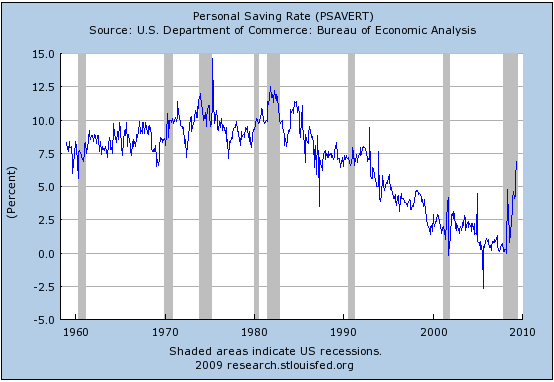

You see, consumption is not necessarily a bad thing. In fact, it is very necessary - people have to buy stuff. But, like most everything else, it is best done in moderation, something that hasn't exactly been a hallmark of the American consumer experience in recent years as the personal saving rate (after-tax income minus spending) went crashing from 10 percent to zero over a period of two-and-a-half decades.

It's now rising like a phoenix and, while that may be a good (and very necessary) thing for one's personal finances, it is definitely not a good thing for the economy in the short-term.

When the local travel agent doesn't spend money at the restaurant down the street, the owners don't pay to have the place remodeled by a contractor who might have bought a new car from the auto dealer around the corner who might then have booked a vacation with the local travel agent who now eats at home.

After years of spending freely - much of it funded not by income, but by taking on record levels of new debt - consumers are now pulling back.

This makes sense.

But, what doesn't make sense is when we are told that an enduring economic rebound will require these now-thriftier Americans to "regain their confidence" in a system that has failed them so miserably over the last few years and, during a period of declining incomes and rising unemployment, go out and spend more money.

In this instance, the "victims" of the confidence game are not so much "cheated" out of their money as they are coerced to spend it when doing so works against their best interests - in a few months time, after the thrill of driving a new car has worn off, many "Cash for Clunkers" buyers will wish they could swap their monthly car payment for their old clunker.

The U.S. Government as a Confidence Game and Ponzi Scheme

Nowhere is confidence more important than at the Treasury Department and other government agencies that manage the nation's money. Come to think of it, "managing the nation's money" is probably not a good way to characterize what exactly is going on there since there is very little money to "manage" - it goes out as fast as it comes in and the process is better described as "directing the flow" of money rather than "managing" it.

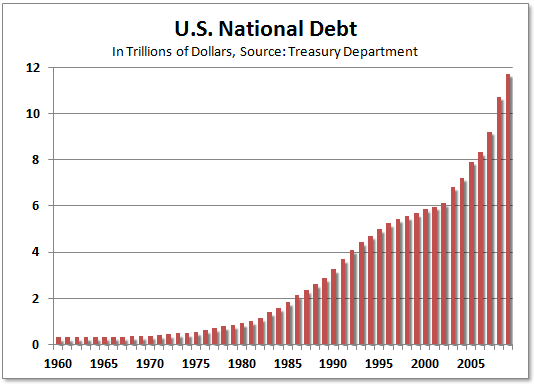

Here, the U.S. government is playing a very high-stakes confidence game with its foreign creditors, many of whom must realize by now that something is seriously wrong as they grow tired of the endless cycle of American borrowing and money printing in order to make ends meet (is that still considered "making ends meet" if you have to borrow and print money to do so?).

The Chinese have been particularly vocal in this regard as they've lent us an enormous amount of money that, someday, they figure they'll want back and they'd prefer it hold onto as much of its purchasing power as possible between now and then. Whether they realize it or not, their confidence is sorely misplaced because the IOUs keep getting piled higher and, despite assurances to the contrary, there is no viable plan to reverse this process.

Stateside, the government's finances - dominated as they are by entitlements such as Medicare and Social Security - appear to be much more of a Ponzi scheme than a confidence game, though, there are surely some characteristics of both.

Once again, from Merriam-Webster:

Ponzi Scheme

noun

an investment swindle in which some early investors are paid off with money put up by later ones in order to encourage more and bigger risksLet's face it, when you and your employer each have 6.2 percent of your wages sent directly to Uncle Sam and deposited into the social security "trust fund", you are "investing" this money in the biggest Ponzi ever perpetrated because your money goes directly back out to recipients and, to make things even worse, what's left over is spent by the government.

Though it didn't start out that way - when the plan was conceived, the average life expectancy was right about the same age that recipients could start collecting payments - the fact that there have been no substantive reforms to make this program into a sustainable system leaves it in a current condition that would make Charles Ponzi green with envy.

If not for our current fiat money / fractional reserve banking system, where there are virtually no limits on the amount of money and credit that can be created "out of thin air", this confidence game/Ponzi scheme run by the U.S. government would have ended long ago.

The Nirvana of Rising Asset Prices

But the biggest deception currently being carried out that directly affects the American public and, for that matter, billions of people around the world in our new globalized economy, has to do with asset prices and, here too, there are characteristics of both a confidence game and a Ponzi scheme.

Centuries ago, equity markets began playing a vital role in building industries and fostering commerce. In return for a "share" of the company's future income stream, mostly in the form of dividends, investors would pay the going rate for a "share" in the company, taking on the added risk of the value of that share fluctuating in price, soaring or sinking as companies prospered or faltered.

In recent years, however, fewer and fewer companies have paid substantial dividends and "investors" have been trained to seek "capital appreciation" instead. That is, when some new investor pays more than they did for the same share, making their share worth more.

Property markets have made a similar transition.

It used to be that real estate was just another depreciating asset, oftentimes requiring very expensive maintenance, and, under a best case scenario, home values wouldn't rise much faster than prices in general.

But here too, over the last few decades, a staid asset class was transformed into a superstar investment sector as money and credit flowed freely from the U.S. government and its banking system, luring millions of "investors" looking to make big "capital gains".

The housing bubble that burst back in 2006 was a near perfect Ponzi scheme that came to an abrupt halt after the last of the new buyers could be found - subprime buyers provided that last push for the late-great U.S. housing bubble.

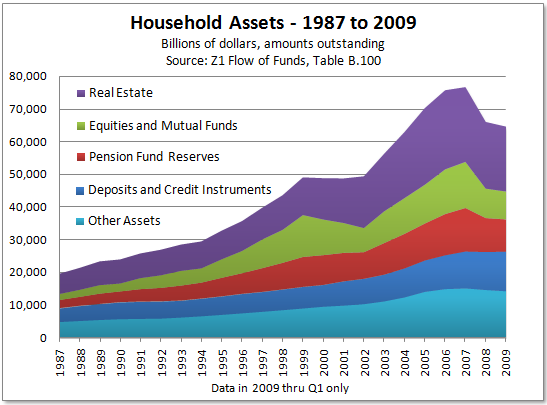

In both stocks and housing, it was rising asset prices that maintained confidence and attracted new money as prices rose. Of course, as we've come to learn, asset prices don't always go up.

In fact, that peak you see above in 2007 may represent a generational high in asset prices since so much of this increase was fueled by a massive expansion of credit enabled by lax lending practices that have now unraveled over just the last couple years.

It was a credit expansion of monumental proportions that pushed asset prices as far as they could be pushed and then things just kind of fell apart.

But, sadly, this won't stop policymakers from trying to push asset prices back up again. To see a shining example of just how effective this can be, one has only to look at China today to see what wonders a few hundred billion dollars in new credit can work on a slumping stock market and real estate market.

The entire world has been duped into believing that asset prices can continue to rise indefinitely and that we'll all eventually grow wealthy as a result. Even in the aftermath of last year's financial market melt-down most still believe that if only governments around the world create enough new money and credit, drawing in many more confident new buyers, the lofty asset prices seen in recent years will be restored.

Ultimately, they will be disappointed.

Confidence games and Ponzi schemes never end well and they are certainly no way to run the world's largest economy.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2009 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.