Looming Financial and Economic Crises, Gold the Golden Exit

Stock-Markets / Credit Crisis 2009 Aug 27, 2009 - 03:19 AM GMTBy: Darryl_R_Schoon

To survive a transformative crisis, institutions, nations, and individuals must all change. Those who do, will. Those who don’t, won’t.

To survive a transformative crisis, institutions, nations, and individuals must all change. Those who do, will. Those who don’t, won’t.

In July, Vienna’s Erste Bank, released its 2009 Special Report on Gold, In Gold We Trust. The analysis of the current gold market and its future direction by Ronald-Peter Stöferle and his colleagues at Erste Bank is commendable both for its information and its timeliness; for, today, the future of gold is inextricably interwoven with everyone’s future—whether they know it or not .

The current economic collapse has its roots in a crisis caused by the decline in the value of paper money over time resulting from the removal of gold and silver from global monetary systems. Previously, for much of mankind’s history, money was gold and/or silver and its value was intrinsic and fixed.

Then, following the lead of the Bank of England, the US central bank, the Federal Reserve in 1913 began issuing US dollars in the form of paper money convertible upon demand to gold or silver. But by 1971, even that artifice was no longer true as the amount of paper dollars issued by the US far exceeded the underlying amount of gold.

Today, as a consequence, the US dollar, along with all paper currencies, is not convertible to anything of fixed value; and, while others may wonder why we are having a financial crisis, I don’t. To me, the cause of the current crisis is clear as the uncertain value of money itself.

Paper currencies are now backed only by “the full faith and credit” of their increasingly bankrupt and insolvent issuing governments. Economies based on currencies of variable and declining worth are no more stable than housing developments built on quicksand. The reasons for our economic problems are clear whether we want to know them or not.

The consequences of the degradation of money over time are now with us; and because the loss of value was gradual, it went largely unnoticed, much as an undetected cancer grows surreptitiously until it is too late. What is happening now took decades to develop and its resolution is not over.

This is where we are today, in a late-stage monetary crisis where only massive doses of borrowed money from heavily indebted governments buying their own debt are keeping major economies afloat, e.g. the US, the UK, and Japan. The global economy is surviving only because it’s on full blown artificial life-support

MONETARY TRIAGE

NO EXIT NO CURE

The 2009 Special Erste Bank Report on gold begins:

Since our initial recommendation in 2007 at USD 650, gold outperformed almost every other asset class. The gold bull market has been running with an annual performance of 16% since 2001. Gold closed the year 2008 with the eighth annual increase in a row. And in the year to date, the performance has been outstanding as well; the gold price has recorded an increase of 7 % (in USD) and 8 % (in EUR), respectively. The average price in 2008 was USD 872/ounce, i.e. 25% higher than in 2007 (USD 695).

The Erste Bank report also noted the considerable influence of central bank policy on the future price of gold:

Central banks are laying [the] perfect foundation

The strongly expansive policy followed by the central banks and the resulting money creation at historic levels as well as the massive expansion of government debt around the globe might make inflation literally the problem of the coming years. In conjunction with the almost worldwide zero-interest policy and the rising criticism regarding the US dollar as global reserve currency, in our opinion this situation offers a perfect basis of further increases in the gold price.

Central banks are monetary paper mills singularly synonymous with paper currencies and their monetary effluence, e.g. inflation, recession, deflation, hyperinflation, etc. The increasing instability of central bank paper currencies is now threatening the heretofore unquestioned belief that central banks are prerequisites for economic well-being in modern economies.

Indeed, the very opposite is true; and, very soon, central banks themselves will be engaged in a fight for survival—as it becomes more and more obvious that our economic well-being is being threatened by theirs.

MYTHS, FACTS & FALLACIES

The Erste Bank Report on Gold covers a number of subjects, e.g. technical analysis, cycles, the gold supply, de-hedging, gold leasing, backwardation, and, a well-deserved acknowledgement to the home team (Austria) with the topic Money Supply Development According To The Austrian School of Economics.

One of the report’s most interesting headings is The Most Common Arguments, Myths, And Points of Criticism About Gold. Here, Stöferle and his colleagues deconstruct and refute the main arguments of those who persist in disbelieving gold’s rising value as an asset and investment in these times.

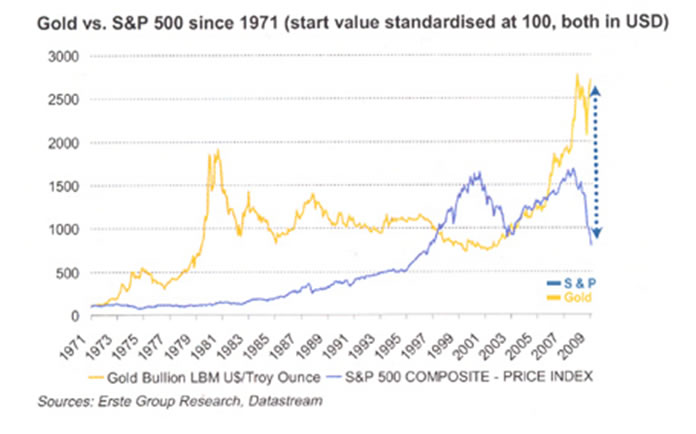

An Erste Bank chart comparing gold and the S&P 500 completely demolishing the myth that gold is a poor investment. In a period that includes the greatest bull run of stocks in history, gold clearly outperforms the S&P 500:

The distance between those who believe in gold and those who still believe in paper is similar to the distance that once separated the few who believed the earth was round and the many who believed it flat.

As one whose world still appears flat (notwithstanding apparently irrefutable scientific fact to the contrary), I find Erste Bank’s dismissal of the gold-deniers’ arguments refreshingly substantive and accurate, especially now when gold-deniers far outnumber gold-believers (note: gold-deniers are about to get a crash-course in denial that will irrevocably point out the error of their ways as nothing can compare to a real-time demonstration).

GOLD FUNDS ALTERNATE CURRENCIES AND ALTERNATE REALITIES

Last month, when Martha and I were in San Francisco, we interviewed Professor Antal Fekete who was lecturing at the San Francisco School of Economics. With the Professor was Sandeep Jaitly of the London investment group, Soditic.

The interview, now posted on YouTube, focused on a gold fund being created by Soditic, to be managed by Mr. Jaitly. However, Martha and I were in San Francisco not only to interview Professor Fekete and Mr. Jaitly, I was there to address a members-only gathering of favors.org.

The founder of favors.org, Sergio Lub, has a deep interest in matters of money. His circle includes Bernard Lietaer, author of The Future of Money and once named the #1 currency trader in the world by Business Week, Thomas Greco, author of The End of Money and the Future of Civilization, and Ellen Brown, author of The Web of Debt and others with similar monetary concerns.

Lietaer’s and Greco’s books, The Future of Money and The End of Money and the Future of Civilization focus on the possibilities presented by “alternative currencies”. Alternative/local currencies spontaneously emerged during the Great Depression in the US as they had in Germany during the Weimer hyperinflation.

In each instance, alternative currencies were effective countermeasures to monetary chaos, a hyperinflation in Germany and a deflationary depression in the US. Few know that alternative currencies were able to restore the flow of goods and services in each instance. Few also know that both the German and US governments soon outlawed their use.

The reason for the US and German government prohibition of alternative currencies is the same—alternative local currencies pose a threat to those whose power depends on controlling the supply of money and credit in society.

It didn’t matter that alternative currencies could restore the flow of goods and services during desperate times. What mattered to those in power was the continuation of their power, not the alleviation of bitter, widespread social suffering.

Issues of money and power are inextricably bound together in today’s world. To understand the connection between the two is to understand the conduct and behavior of both bankers and politicians; and, to ignore the connection is to persist in ignorance of what causes the behavior of each.

Once this connection is understood, citizens will no longer expect governments to solve their problems. Politicians achieve power not to solve society’s problems but to personally benefit from their privileged positions, positions that over time indebts and impoverishes those they rule.

In my talk before favors.org, I said that to survive the coming economic collapse, it is helpful to understand derivatives. Then, I explained what I meant. I meant derivative realities, not financial derivatives.

Philip Barton of the Gold Standard Institute had flown in from Australia and had heard my previous talks on money. What I spoke about that evening, what Philip heard, was different than my usual presentation. That evening, I stated that the crisis was more than about economics and money.

The crisis was about life itself and the crisis was going to be of such magnitude that in order to survive, we were going to have to understand that just as our paper money is not actually money, our reality is not actually reality—that our reality is, in fact, a derivative reality.

THE SUPERCONSCIOUS AND THE COMING CRISIS

In 1981, Buckminster Fuller wrote that mankind would soon be entering a period of unprecedented crisis, a crisis meant to transform humanity. I believe this financial crisis is just the beginning of the crisis that Buckminster Fuller predicted, a crisis that will become increasingly severe in order to achieve its purpose.

Fuller believed the purpose of this crisis is to force humanity out of its present competitive, difference and scarcity-based consciousness into the deeper understanding that humanity is one, and that as a harmonious, cooperative and interdependent whole, we can create a world of abundance and well-being instead constantly experiencing war, scarcity, and strife.

What must change are not only our notions about money, but our notions about ourselves as well. That process is now in motion as evidence of higher and deeper levels of consciousness are occurring in greater measure.

One such occasion occurred in 1985 in which I was further convinced that life was far more than we experience or can even imagine. That year, my 12 year old son was attending a private school where he had been exposed to the ideas of Plato, Socrates, and others; and, for his final paper, he had been assigned to write a 10 page paper on The Role of the Superconscious in Art and Culture.

He never wrote that paper. Instead, frustrated with the assigned subject, he asked his “higher self” for help and instead of the 10 page paper assigned, he wrote an extraordinary one page essay called The Superconscious. (the YouTube link is http://www.youtube.com/watch?v=LDrvMUIU-8o ).

The truths presented in The Superconscious are stunning as they are true; and, they offer us a way to deal with a present increasingly filled with crises, crises that are forcing me to finally put into practice what was suggested in that essay 24 years ago. That’s what crises are for.

This November in Canberra, Australia, Professor Fekete will lecture on The World Financial Crisis and The Vanishing Gold Basis. Sandeep Jaitly (Soditic /London), Nathan Narusis (Bullion Management Group/Canada), Bron Suchecki (Perth Mint/Australia), Rudi Frisch (Gold Standard Institute/Canada) and I will be speaking and/or participating as panelists, http://www.goldstandardinstitute.com/html/events.html

WHAT’S NEXT

Just as economists did not expect the recent collapse of global markets, they do not expect what will happen next. So much money is now in circulation, economists actually believe that rising stock markets reflect expanding economic activity instead of reflating speculative bubbles.

The trillions of dollars of credit being pumped into the global economy is only an interim solution to a long-term systemic problem; and, until those problems are fixed, the consequences will continue, consequences which now include a severe deflationary depression coupled with the possibility of hyperinflation.

These are the real possibilities which now face the global economy, no matter how optimistic the ostriches believe the future to be.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.