Why Did the U.S. Government Confiscate Gold in 1933 and Can it Happen Again? Part3

Commodities / Gold & Silver 2009 Aug 29, 2009 - 02:03 PM GMT In this the third part of this series we look at the fall of gold as a medium of exchange and the freeing up of gold ownership from August 15th 1974 onwards.

In this the third part of this series we look at the fall of gold as a medium of exchange and the freeing up of gold ownership from August 15th 1974 onwards.

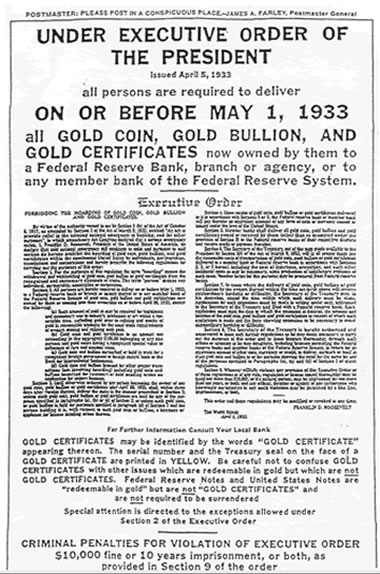

We previously stated that gold ownership was made illegal on 1st May 1933. What we did not tell you and we correct now, was that U.S. citizens, under Order 6102, were to own up to $100 in gold coin [±5 ounces]. Today that would be worth under $5,000 a mere token gesture to real gold owners. It acted as a tiny 'escape valve' to the general body of citizens and did not detract from the fact that effective gold ownership was abolished. So that we fully understand the attitude of governments to gold [which remains real money in times of crisis] we add this paragraph: -

We previously stated that gold ownership was made illegal on 1st May 1933. What we did not tell you and we correct now, was that U.S. citizens, under Order 6102, were to own up to $100 in gold coin [±5 ounces]. Today that would be worth under $5,000 a mere token gesture to real gold owners. It acted as a tiny 'escape valve' to the general body of citizens and did not detract from the fact that effective gold ownership was abolished. So that we fully understand the attitude of governments to gold [which remains real money in times of crisis] we add this paragraph: -

Congress could easily revoke the privilege again. In fact, at no time during this century has the U.S. government recognized the right of private gold ownership. The Trading with the Enemy Act, which President Roosevelt invoked in 1933 to restrict private gold transactions, remains law. Although private ownership of gold in the United States was legalized on August 15, 1974, the power to confiscate gold remains in the hands of the President. The President still retains the right, under the Emergency Banking Relief Act, to "investigate, regulate or prohibit... the importing, exporting, hoarding, melting or earmarking of gold" in times of a declared national emergency. It is highly unlikely that either the Courts or Congress would successfully argue that confiscatory powers are not implicit in the Emergency Banking Relief Act if a currency crisis or other fiscal emergency prompted the President to, once again, nationalize gold.

The 'privilege' not right, to own gold was restored to U.S. citizens on the 15th August 1974 [not 1971, when Nixon 'floated the $ against gold and stopped foreign central banks from converting U.S. dollars to gold]. It is pertinent to the thinking behind this series, to understand why these moves were made.

The entire exercise was to move gold away from the core of the monetary system for it could not be controlled by governments and particularly the most powerful of them on this earth, the United States. For government to have control of money they had to control its issue away from the measuring line of gold. In the opinion of the U.S., then the I.M.F. and then accepted by all governments money had to be simply an un-backed I.O.U. drawn on governments. Gold had to be discredited and sidelined to make this happen convincingly. It worked!

The $ replaces Gold

-

As the world moved out of the post-war recovery period into a global growth period, and the U.S. $ was devalued, then floated against gold, the need for a change in the system of foreign exchange arose. This was to cope with the changing global economy and to counter, what was to be, a depreciating $ as its role burgeoned into the global reserve currency. In the process gold was, effectively, eliminated from the system.

-

President de Gaulle and his fellow European leaders, amazingly, complied with this, after years of exchanging the $s spent in the country for gold drawn from Fort Knox in the U.S. They were prevented from changing their U.S. dollars into gold when U.S. gold was made unconvertible. No doubt the huge advantages of controlling one's own money systems, nationally, appealed to all governments. Bankers, to this day, salivate over the thought - money unchained from gold. So for the first time in modern history gold left the system as a medium of exchange and currencies were issued with no backing whatsoever.

Gold is money no more.

How could this have happened? Well, the $ had to be put into a position where it was indispensible! The U.S. had dominance over oil supplies through the Arab oil suppliers. The world was stunned to see the oil price rise from $8 a barrel to $35 a barrel alongside the running price of gold. Oil was priced only in the U.S. $. The 'cold war' was still on, so Russian oil supplies were not as important then as now. It was O.P.E.C. that dominated the oil price and these governments had to rely on the U.S. for their security. Their oil interests became the vital interests of the U.S. The concept of oil priced in any other currency was removed by the U.S. as the Persian Gulf came under the protection of the U.S. Had Russia tried to take any from the U.S. it would have brought the world to the brink of nuclear war. Anybody who used oil needed to buy U.S. $s first. Thus the $ met the requirements of a medium of exchange and spread the world over. Who needed gold after that?

It is only now, nearly 40 years later, that a tiny number of buyers pay the € for their oil, not enough to topple the $. Certainly O.P.E.C. will only do so when they can feel secure away from the protection of the U.S. And they will only change that pricing if they can dominate demand more fully. This can only happen once China is next to the States as a global economic force and insists on using the Yuan to pay for their oil. Until then they will continue to have sufficient of the U.S. $ to pay for their oil in dollars.

The need for gold was eliminated by its exclusion from international finance and as a direct alternative to the $. So what, if the gold price went from $42.35 to $850 over the next decade. Gold was relegated to a private investment medium from its money role. The effect of the rising gold price was emasculated in the system as the $ became an absolutely necessary medium of exchange. Gold was money no more, but it was still considered to constitute a danger to the $. Hence gold sales from the U.S. first, followed by gold sales from the I.M.F., as they used these gold sales to elevate the $ [and the SDR - unsuccessfully] over gold, as money. They were successful, but the running gold price still reflected the falling value of currencies.

As no government really wanted gold out of the system completely [so continued to hold onto their reserves of gold] but still wanted the gold price to drop back into insignificance they followed a path of accelerating gold supplies through loaning bullion to gold miners in a process that allowed miners to make money as the gold price was falling [accelerated sales]. So the gold price fell from $850 to $295 through these accelerated sales and the threat of central bank sales, until 1999 and the "Washington Agreement".

But, at the turn of the century, through these central bank gold sales agreements, it became clear that gold was not down and out. The cap on the central bank sales of gold reassured the market that there would be no more than a containable amount of gold sales each year. Bear in mind that to the central banks, the price of gold will only be really relevant in the extreme days that may lie ahead, not before then.

But, at the turn of the century, through these central bank gold sales agreements, it became clear that gold was not down and out. The cap on the central bank sales of gold reassured the market that there would be no more than a containable amount of gold sales each year. Bear in mind that to the central banks, the price of gold will only be really relevant in the extreme days that may lie ahead, not before then.

When those extreme days come the price of gold will be secondary to the amount each central bank holds! Then the prospect of confiscating its citizen's gold will become very attractive again.

The fact that it has happened before makes it possible that it can happen again! It is wise to make sure that you are not vulnerable to such an act. We will look at this in more detail in a later part of the series. Make sure you follow this and other fundamental gold matters in the : -

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.