G-20 Governments Inflate the Global Economy to Economic Prosperity

Economics / Economic Recovery Sep 10, 2009 - 10:20 AM GMTBy: Gary_Dorsch

Who says central bankers can’t inflate an economy to prosperity? To head-off the worst economic downturn since the Great Depression, the “Group-of-20” central banks have slashed interest rates to record lows, while politicians have funneled trillions into the coffers of the most powerful Oligarchic banks. So far, the cost of mopping up after the world financial crisis is a staggering $12-trillion, or equivalent to around a fifth of the world’s annual economic output.

Who says central bankers can’t inflate an economy to prosperity? To head-off the worst economic downturn since the Great Depression, the “Group-of-20” central banks have slashed interest rates to record lows, while politicians have funneled trillions into the coffers of the most powerful Oligarchic banks. So far, the cost of mopping up after the world financial crisis is a staggering $12-trillion, or equivalent to around a fifth of the world’s annual economic output.

The hefty price tag includes capital injections pumped into banks in order to prevent them from collapse, the cost of soaking up toxic assets, guarantees over debt, and liquidity support from central banks. Most of the cash, about $10.2-trillion, was spent by the so-called developed countries, while the emerging countries spent only $1.8-trillion, mostly in the form of liquidity injections into banks.

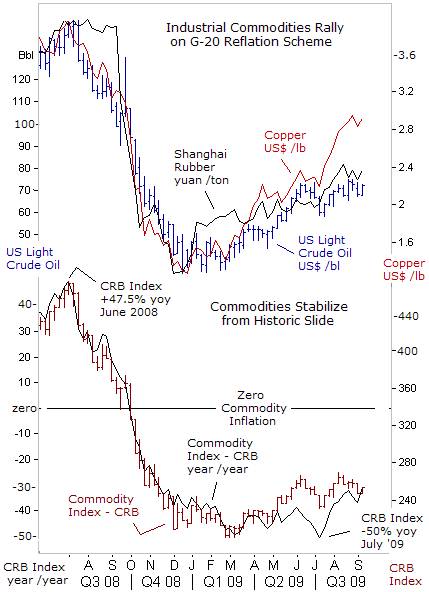

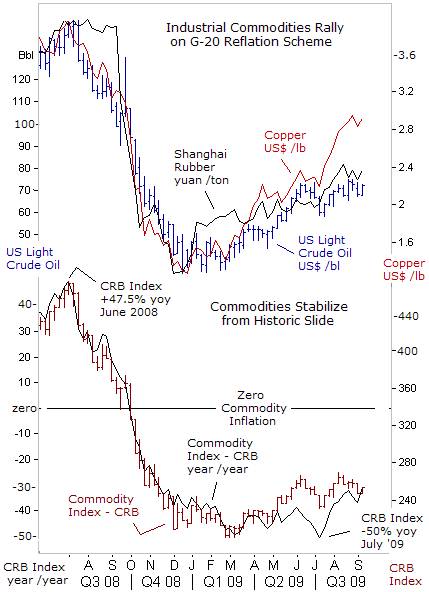

In return for this hefty investment, the pace of job losses has slowed, and there’s been a recovery in industrial output. At the same time, global stock markets have bounced back with startling speed. Since hitting bottom in March, the MSCI World Index has rebounded by 50%, and key industrial commodities, such as crude oil, copper, rubber, and iron-ore have also rebounded in synchronization.

World markets were ecstatic, after the G-20 finance ministers pledged to continue to underwrite the global recovery with massive stimulus, in the form of deficit spending, ultra-low interest rates, and expanding the money supply. On Sept 2nd, US Treasury chief Timothy Geithner said although the global economy has pulled back “from the edge of the abyss,” it’s too early to let up on inflating stock market bubbles. “We’ve come a very long way. We still have a very long way to go,” he said.

The G-20 central banks have pumped an ocean of high-powered liquidity into the world banking system, designed to artificially inflate asset markets. Under the radical “Quantitative Easing” (QE) scheme, the Fed is printing $1.75-trillion in order to buy Treasury and mortgage backed bonds. The Bank of Japan is printing 1.8-trillion yen each month, and monetizing half of Tokyo’s budget deficit this year. The Bank of England has expanded its hallucinogenic QE program to 175-billion pounds.

Even so, US President Barack Obama said on Sept 9th, the G-20’s work is far from complete. “As the leaders of the world’s largest economies, we have a responsibility to work together on behalf of sustained growth, while putting in place the rules of the road that can prevent this kind of crisis from happening again. To avoid being trapped in the cycle of bubble and bust, we must set a path for sustainable growth while steering clear of the imbalances of the past,” Obama declared.

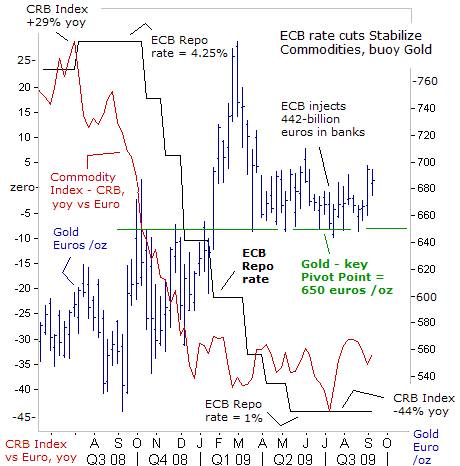

Seeking to spur bank lending and pull the Euro-zone economy out of recession, the European Central Bank also joined the G-20’s money printing orgy, by pouring 442-billion euros ($613-billion) of one-year funds into money markets on June 24th, its biggest fund injection ever. Italian central bank chief Lorenzo Bini Smaghi acknowledged the risks, “This enormous expansion of monetary liquidity created to tackle this crisis, must clearly be eliminated quickly to avoid the same phenomena we have seen before, and avoid fuelling a speculative bubble,” he warned.

Since then however, Smaghi’s rhetoric has simply vanished into thin air, - relegated to the trash-heap of idle chatter and empty threats. Instead, much of the ECB’s money injections were funneled by the elite banking Oligarchs into equities, inflating the German DAX index 15% higher to the 5,500-level, with the tactic approval of the ECB. Ultra-low interest rates are working their magic, and combined with rising equity markets, confidence in the Euro zone’s service sector is rebounding.

Germany’s services PMI jumped to the 53.8 level in August, up sharply from 48.1, to levels that prevailed before the demise of Lehman Brothers. France’s service sector PMI also rebounded sharply, jumping to 49.3 in August, up from 45.5 the previous month. Italy and Spain also showed a noticeable improvement. Still, Euro zone companies have shed jobs for 14 straight months, and the jobless rate rose to 9.5% in July, leaving the number of jobless in the Euro zone at just over 15-million.

On Sept 8th, Bundesbank chief Axel Weber denied that the ECB’s super-easy money policy would whip-up inflationary pressures. “We will start withdrawing our policy of historically low interest rates and non-standard measures at the right time. Fears that our expansionary monetary policy carries the seed for marked increases in inflation are unfounded. Against the backdrop of the favorable price outlook, I consider the current level of interest rates remains appropriate,” he said.

Perhaps, ECB officials are eyeing the gyrations in the global commodity markets, for real-time clues about the future direction of inflation. A basket of commodities included in the Reuters CRB Index, when measured in Euros, is trading -35% lower today from a year ago, providing the ECB with a small window of opportunity to keep its repo rate pegged at a historic low of 1% for a few months longer.

However, window of ultra-easy ECB interest rates is expected to close by year’s end, as the year-over-year comparisons of commodity prices move into positive territory, thus removing the threat of a deflationary spiral. In Europe, the gold market is coiling within a tight range, finding key pivotal support at 650-euros /ounce. Only the Euro’s recent surge to $1.4600 against the US$, has prevented gold from surging above resistance at 700-euros /oz. However, if the ECB fails to live up to pledge to drain liquidity in a pre-emptive strike, gold could surge higher.

Industrial commodities hit rock bottom in the first quarter of this year, in line with rebounds in the global stock markets. China in particular has been the driving force, going on a buying spree after the global collapse in oil, metals, and other industrial staples, bulking up on inventories, while snatching overseas assets from Australia to Africa to Canada to claim natural resources. China’s imports of copper totaled 1.8 million tons in the first half, up 160% over the same period a year earlier, while imports of aluminum rose a stunning 16-fold.

Chinese demand for iron-ore, steel, and rubber were bolstered by brisk car sales, which rose at least 45% for four months in a row, enabling China to overtake the US as the world’s largest auto market. In the first eight months of 2009, China’s vehicle sales rose 29% to 8.33-million, while US vehicle sales dropped 28% to 7.1-million as the recession and huge job losses sapped demand. In Shanghai, the price of rubber, used to make tires and tubes, rallied to the highest in nearly a year. Since the bulk of the rubber produced is synthetic, or derived from petroleum, the price of natural rubber usually tracks the prevailing global price of crude oil.

Crude oil prices surged above $72 per barrel this week, buoyed by the G-20’s super-easy money policies and a weaker US-dollar. On Sept 9th, Saudi oil chief Ali al-Naimi was asked what was driving the oil price. “Just look at the charts. Don’t you see all the stimulus spending? It’s not going to run out, there is going to be growth and there is going to be spending. High inventories for now are irrelevant to the oil price. You guys must realize that there is a fundamental change in the market. Economic growth is the name of the game, that’s what’s going to drive the price. As long as economic growth is there, the price is going to go up,” Naimi said.

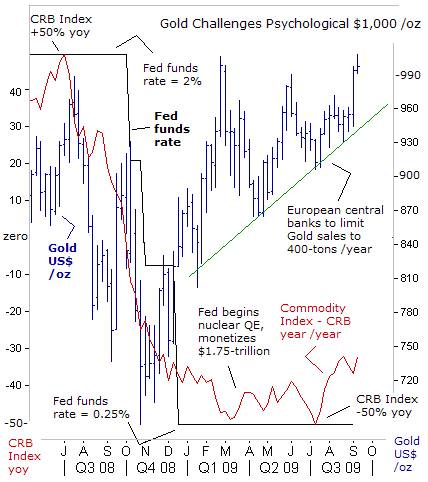

Whenever the price of gold gets uncomfortably high, the Fed’s propaganda artists begin to utter empty threats and idle chatter, in order to keep gold bugs off balance. Interest rate hikes are “some time down the road,” said Chicago Fed chief Charles Evans on Sept 9th. But “as the economy continues to improve, and when we see rising inflation pressures, Fed policy will respond aggressively,” Evans warned.

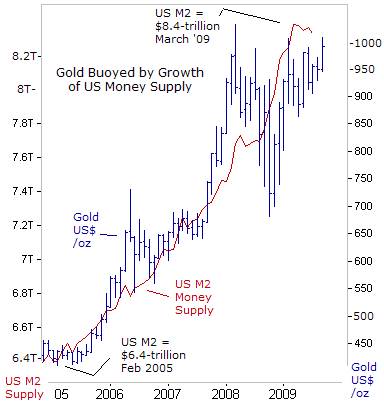

But many commodity traders see through the Fed’s smoke screens, and realize that despite a burgeoning economic recovery, the Fed and other G-20 central bankers will not be lifting interest rates, nor exiting Q-E anytime soon. In New York, gold is challenging the key psychological $1,000 /oz level, recognizing that the Fed has been creating money out of thin air, and printing Wall Street’s way to prosperity, while the US-president was rolling out a mammoth budget deficit of $1.6-trillion, in order to spend the nation into prosperity.

Many economists have argued that the United States cannot “inflate its way out” of its debt, problem, because it would trigger a collapse of the US-dollar, and bring an end to its status as the world’s reserve currency. But the US Treasury and the Fed are ready to take that risk, figuring the only way out of America’s financial crisis is through higher inflation, allowing indebted households and banks to deleverage faster and with less pain. Stimulating inflation is a quick-fix, and the Fed can pursue this strategy, while commodity inflation rate stays in negative territory.

“The Fed believes that a highly accommodative stance of monetary policy will be appropriate for an extended period,” Fed chief Ben “Bubbles” Bernanke said on July 21st. “We will not allow the broad measures of money circulating in the economy to accelerate at a rapid rate that would eventually cause inflation,” he declared. But right now, few traders, believe “Bubbles” Bernanke would live-up to that pledge, and instead, see the Fed aiming to diffuse the damage from the bursting of the sub-prime mortgage debt bubble, by blowing new bubbles elsewhere.

“Deflation has been averted,” declared Chicago Fed chief Evans on Sept 9th. That’s no surprise with the price of gold in New York bumping against $1,000 /oz. On the other hand, historically low capacity utilization rates are balancing the inflationary forces often associated with explosive growth in the money supply, “and if need be, the Fed will step in,” he warned. “Highly regarded analysts suggest that even though we avoided another Great Depression, the US-economy may be facing the Great Inflation. I am confident the Fed will achieve price stability,” Evans said.

“The Fed must be prepared to make unpopular choices and respond to an outbreak of inflation even if it happened while the real economy remained weak. A central bank that dithers too long in raising rates has effectively abandoned its low inflation goal and, as a result, both expected and actual inflation can increase. Running the printing presses on overdrive, usually to finance unsustainable fiscal deficits,” typically end-up with high inflation,” Evans added.

Even though the US monetary base has nearly doubled to $1.7-trillion in the past year, as the Fed expanded its balance sheet, sluggish growth in bank lending has held broader M2 money growth to about 8 percent. Still, Evans said the Fed won’t start to raise interest rates until the jobless rate begins to drop, which isn’t expected until mid-2010. Until then, traders are betting the Fed will blow asset bubbles.

Flooding the market with trillions in paper currency is called a bold and courageous move by G-20 propaganda artists, and economists who are paid salaries by banks that were bailed-out by the Treasury. In actuality however, it’s a guarantee that today’s currency in circulation would buy less in the years ahead. A common reason for printing money is covering the costs of reckless spending by politicians, who are unwilling or unable to pay for budget deficits by raising taxes.

In London, the British government is selling a record 220-billion pounds ($318-billion) of gilts in the fiscal year that ends March 31st, or 50% more than the 146-billion pounds sold last year. Furthermore, the countries that make-up the G-20 will face a combined budget deficit of 10.2% of GDP in 2009, the biggest since the Second World War. Although the biggest will be faced by the US, with 13.5% of GDP, Britain also faces an 11.6% deficit, and Japan 10.3-percent.

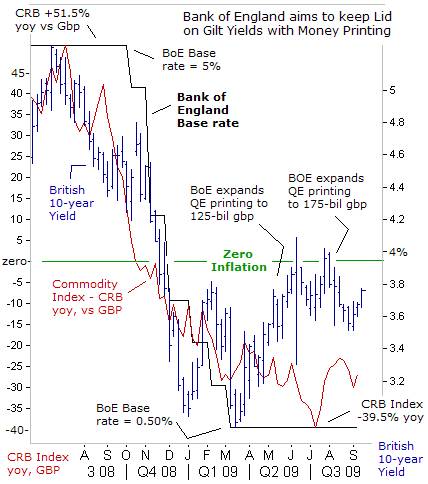

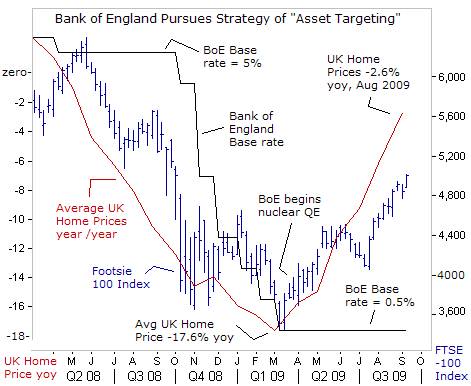

So far, the UK has encountered little difficulty finding buyers for its debt. The Bank of England (BoE) is snapping-up gilts for its QE program and monetizing two-thirds of this year’s budget deficit. The BoE can print with impunity, while commodity inflation stays in negative territory. However, once the CRB Index’s annualized rate of inflation turns positive, it could trigger a sharp slide in the British gilt markets. In turn, once gilt yields turn sharply to counter inflationary pressures, it could deal a stiff blow to the all important UK housing market.

The BoE would eventually have to raise its base lending rate, in order to restore price stability. Until then, the BoE aims to keep the benchmark 10-year British gilt yield locked below the 4-percent level, in order to keep mortgage borrowing costs low. British house prices have risen for four straight months, up +1.6% in August and +1.4% in July, thus lowering the annual rate of decline to negative 2.7-percent. The average price of a British home is 160,224 pounds ($262,000).

Historically, the BoE pursued a policy of “Asset Targeting”, or adjusting its base lending rate in the same direction as trends in the local housing and stock markets. However, the BoE is taking a detour from its usual strategy, by holding rates steady at a record low of 0.50%, while pumping 175-billion pounds into the money markets, in order to artificially inflate the UK housing and stock markets higher. The BoE is expected to linger far behind the inflation curve, watching commodity markets climb sharply higher, before it pulls the trigger on lifting its base rate.

Who says central banks can’t inflate their economy towards prosperity? The endless game of currency devaluations and bubble blowing would only come to an end, when the G-20 bond market vigilantes reawaken from their slumber, and begin to jack-up long-term yields. Until then, G-20 central bankers will continue to zig-zag, and juggle words on a tightrope, while playing a flip-flopping shell game.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.