The Great China Economic Recovery Conundrum

Economics / China Economy Sep 27, 2009 - 02:15 AM GMTBy: Clif_Droke

Probably the biggest “X-factor” in the ongoing effort at reviving the global economy is China. China is seen by many as the world’s emerging industrial powerhouse and its relationship with the United States is considered to be crucial for its own development, as well as for the strength of the world economy. With the U.S. in the role as the world’s premier consumer and China considered to be the major industrial player, all eyes are on the respective economies of these two great nations.

Probably the biggest “X-factor” in the ongoing effort at reviving the global economy is China. China is seen by many as the world’s emerging industrial powerhouse and its relationship with the United States is considered to be crucial for its own development, as well as for the strength of the world economy. With the U.S. in the role as the world’s premier consumer and China considered to be the major industrial player, all eyes are on the respective economies of these two great nations.

There are two dominant views regarding China’s economic outlook and its prospects for total recovery from last year’s credit crash. The first one states that China is essentially a repeat of the Soviet Russian experience in that China’s dictatorial control by its communist rulers will keep it from achieving true “superpower” status.

The other view maintains that China is, in fact, on its way toward economic superpower status that will eventually allow it to eclipse the U.S. The pro-China view posits that China is well on its way toward developing its own internal economy and that its former reliance on the U.S. for exports is gradually fading. In other words, under this view China is “decoupling” from the western nations as it becomes less export-driven and more reliant on a strengthening domestic economy.

The negative view on China’s economic outlook can best be summarized in the following paragraph as stated by one respected observer of China affairs:

“Strong evidence suggests that China today has overstated its growth every year, and yet the U.S. Government, gigantic American corporations and the big TV-newspaper media swallow every falsified Red statistic whole. As we said, if communism – and despite years of lies China is almost completely communist in its command and control structure – is such an all-fired superior way of organizing an economy, there should be examples of that right there in Asia. But what do we see? China itself has been communist since 1949. That is 60 years. Yet nearly 1.2 billion of its 1.3 billion people still live in abject poverty. That is more than 90%.” [Source: Andrew Rothovius’ U.S.A./China Letter, June 2009]

In his China Hotline of June 9, Adrian Van Eck espoused the negative view on China when he wrote, “[Some] say that China’s banks are in better shape than those of the rest of the world. That is also not true. China’s banks are government owned and they lend billions of dollars to money-losing, state-owned firms in violation of World Trade Organization rules. Then the Government replenishes this money and they start over again…making loans intended to allow Chinese firms to sell at money-losing prices and steal millions of jobs in America.”

Underscoring the negative view of the Chinese “economic miracle,” Mr. Van Eck also stated in the August 2009 edition of his Money Forecast Letter, “All the fantasies about [the U.S.] being passed by in the next few years by the likes of China, India, Russia, Brazil, etc., will be exposed as the idle day-dreams they really are.”

Elsewhere he writes, “But there is one nation that is riding a bubble right now and that nation is the People’s Republic of China. Henry Kissinger once told President Nixon that the Chinese People are the smartest on earth. Yet there is a defect in their official national character that has brought them from very high levels of achievement to very low levels of failure a dozen times over the past 4,000 years. They would build dynasties and conquer nations on all sides, forcing these captive people to pay tribute to the Chinese Imperial Court. But then pride turned to arrogance and arrogance caused them to make mistakes – big mistakes and a lot of them. Most of these mistakes had to do with corruption at home, and that is exactly what is showing up these past few years….

Van Eck continues, “Each time that one of their dozen rich dynasties fell China endured long periods of awful poverty. I suspect that will happen again. Now that the Chinese State Bank is spreading billions of dollars in loans around to encourage wild consumer spending by communist party members…all to replace lost sales resulting from the sharp drop off in American consumer product imports from China. China’s money has been pushed up in value 20% since Bernanke took over the Fed. Greenspan allowed them to cut the value of their Yuan by a lot (the higher the number per dollar the cheaper the yuan) and then freeze it. Because of strong domestic inflation, China can no longer afford the kind of cheap prices they have offered. The game is about over for them. And at the same time I expect manufacturing plants to begin coming back to America.” [Source: The Financial Research Center, Inc. Money Forecast Letter, August 2009]

On the other side of the debate, one of the biggest exponents of China as a dominant economic force is George Soros. Soros has been quoted as saying, “China is going to be a positive force in the world and the market, and as a consequence its power and influence are likely to grow. Personally I believe it is going to grow faster than most people current expect,” adding that “China’s aggressive 4 trillion Yuan economic stimulus package last year has bolstered the economy.” He cautioned, however, that because China’s economy is only a quarter the size of America’s economy, “It cannot replace American consumers as the motor of the world economy.”

A U.S. expat living in Shanghai recently gave me his assessment of China’s economic situation. Quoting him at length:

“First, after the October 2008 meltdown, the mood was grim and the term "Financial Crisis" was on everybody's lips. Business announced hiring freezes all over town - although I did not hear of any layoffs in the Multi-national companies I frequent. Down in Guangzhou, of course, it was a different story - as millions of migrant rural workers in Guangdong Province factories were laid off, and there were many riots.

“What a difference a $600 Billion stimulus makes. Beijing flooded the country with stimulus money, and it seems to be working (sentiment-wise). Everybody is now optimistic again. Whereas before, there was a lack of interest in the high-priced real estate here - the interest and investment is back. Companies are optimistic and looking forward to the future - if they are NOT export-driven. But those companies that specialize in exports are still sucking wind. The auto and auto parts industry (for export) have been decimated. Come to think of it - I haven't seen an expat buddy of mine lately since he got laid off from his auto parts company several months ago. But American and European expats from all sorts of industries are getting called home in droves - and that is continuing.

“Hard to figure out this multi-faceted economic elephant - but if I had to put it in a nutshell - it's this: Export-dependent companies are hurting, but what with the stimulus freeing up bank lending and infrastructural development, companies that focus on domestic production and consumption are doing well and are optimistic about the future again, even though there is an employment problem with young college graduates that can't find a job (the job market is not expanding, to my knowledge, but there are no mass layoffs).

“It has me guessing. I've been quite surprised by the turnaround. It looks like China is much less export-dependent for its growth than I'd thought. Perhaps the great "decoupling" theory is correct after all. Then again, there is that $600 billion in stimulus. So, time will tell whether this turnaround is sustainable on its own.”

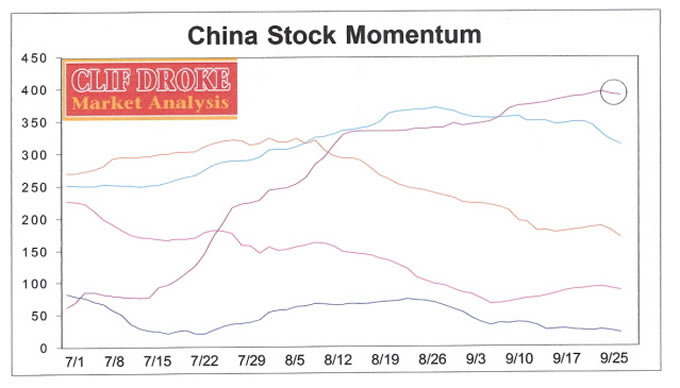

A definite prediction of where China’s economy is headed in the longer-term outlook is beyond the scope of this commentary. Our main concern is the intermediate-term outlook for China’s stock market, which in turn tends to lead economic performance. For that reason we developed the CHINAMO internal momentum indicator series earlier this year and are using them to point to strength or weakness within the market for U.S.-listed Chinese shares. CHINAMO has a secondary application of predicting where the general economy for China is headed in the interim outlook since major stock price trends tend to precede, or at least coincide with, economic trends.

This summer, China’s benchmark Shanghai Composite Index fell more than 20 percent below this year’s high, supposedly on concerns that China’s economic recovery would falter as its government curtails lending. Moreover, there are signs that since hosting last year’s Olympic Games in Beijing, China’s economy is suffering from the infamous “Olympic Curse.”

The lynch pin behind the rally of U.S. listed Chinese stocks (as reflected in the various China ETFs) has been the fact that the dominant longer-term internal momentum indicator for the China stock group has been in a strong uptrend. This has held true since earlier this year when the market recovery first began and continued through the summer, even when the Shanghai Composite Index had its 20% + decline. The short-term momentum indicator (dark blue line) and the internal trend (pink line) have been in decline since June, as has the sub-dominant interim momentum (orange line). More recently the dominant interim momentum indicator (light blue line) has started to roll over into a downtrend. Yet all the while the long-term momentum indicator (circled) continued its rise. Until now…

As the circled indicator shows, long-term momentum has apparently peaked and is just starting to reverse its uptrend. Assuming this continues to accelerate into a downward trend it will eventually lead to a bumpy ride for the China stocks and another fall in the Shanghai index likely to follow.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.