Gold is a Bargain At $1,000

Commodities / Gold & Silver 2009 Oct 01, 2009 - 03:25 PM GMT Despite a four-digit price tag, gold remains a relative bargain when a little perspective is applied.

Despite a four-digit price tag, gold remains a relative bargain when a little perspective is applied.

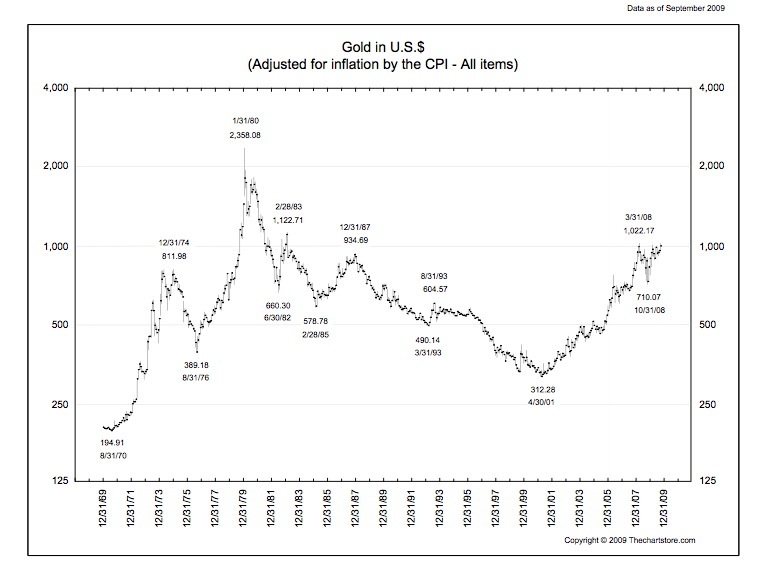

Chart courtesy of The Chart Store

The inflation-adjusted price of gold at its 1980 peak is just over $2350 — that leaves a considerable amount of headroom just on the basis of making up for past inflation, let alone the prospect of continued inflation.

The gold rally of 1970-1980 began in much the same way as the current rally, eventually catching up with inflation, ultimately pushing significantly higher to price-in future inflationary expectations. Having said that, we could indeed still be a long way from any potential top.

The new gold market began in 2002 and is now in its 7th year (in 2009). In terms of cycles, the gold market may have years left to run, consistent with the bullish implications of inflation-adjusted gold.

Jim Rickards, director of market intelligence for Omnis, said in a recent CNBC interview that the Fed is going to have to manage a 14-year devaluation of the dollar – by as much as 50% — with the goal of inflating away a portion of our massive and still growing debt.

I believe Rickards chose a 14-year timeline because it equates with 3.5% to 4.0% inflation over the period. An oppressive inflation rate to be sure, but shy of true hyperinflation. If Rickards’ assessment is accurate, it likely equates with at least 14 more years in gold’s bull run.

Unfortunately in this age of instant gratification, most investors tend to focus on the short-term, when it is the long-term that really matters. Examining the more familiar secular bull market in U.S. equities provides an opportunity to perhaps ascertain where we might be within the current bull market in gold.

The first gold bull market lasted about 13-years, beginning in the late-1960s and lasting to the early-1980s. After a few years of adjustments, the bull market in stocks began around 1982 and lasted until 2007, with a brief respite when the tech-bubble burst in 2000, which was quickly offset by extremely loose monetary policy.

During the 25-year bull market in stocks, the DJIA went from a low of 770 to a 14,480 high — up nearly 19 times. In its first seven years, 1982 to 1989 stocks rose roughly 3.6 times — or roughly 15% of the complete move. Similarly, gold during its first seven years has appreciated roughly 4.0 times having started its bull move at $250 and trading in 2009 at just over $1000 (1032 high as of this writing), and we are not yet at the end of the year.

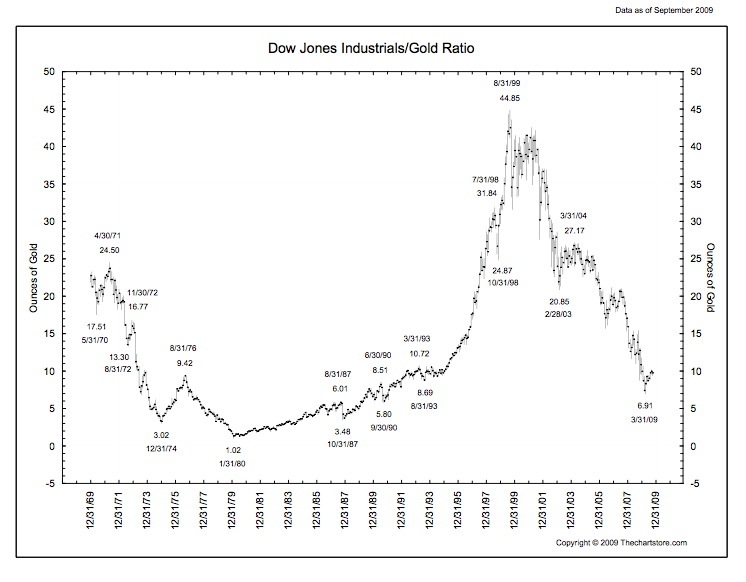

Chart courtesy of The Chart Store

Some analysts believe the DJIA/Gold ratio is heading back to a not unprecedented 1 to 1 ratio. The chart above shows that such a move is very feasible and could be attained by a dramatic rise in gold, a dramatic drop in the DJIA, or more likely some combination of significant gold gains and significant stock market losses.

If gold were to continue to track the stock market’s bull market performance, gold would top over the next years in the vicinity of $4750 per ounce. Will $1000 gold represent less than 25% of the gold market move?

Of course, any number of events could intervene to prevent gold from reaching that level, or vault it even higher.

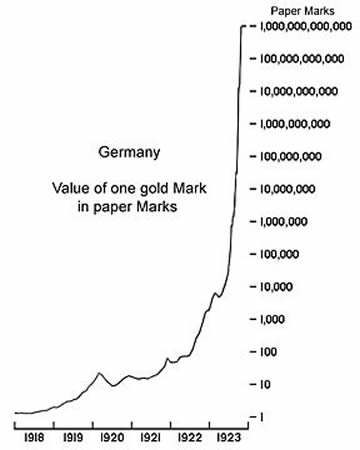

As an example of the latter, take into consideration the nightmare German inflation that took hold in the period between the First and Second World Wars. Famed economist John Maynard Keynes summed it up nicely: “The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance.”

At the beginning of World War I in 1914, an ounce of gold cost 86.8 marks. By November of 1923, the hyperinflationary blowoff drove the price of an ounce of gold to a staggering 63,016,800,000,000 (paper) marks. (Yes, that’s 63 TRILLION marks!)

The following chart shows the ascent of one gold mark in relation to one paper mark. Invert the chart, and you have an illustration of the demise of a fiat currency in just a few short years. Similar events are unfolding even today, where an ounce of gold was not available at any price in terms of Zimbabwe dollars as a result of massive money printing.

(Chart courtesy of Wikipedia)

I’m not suggesting things are likely to get as bad as Weimar Germany in the 1920s, but none of the conditions that have shepherded gold above $1,000 on several occasions now have suddenly gone away. In fact, one could argue that they have accelerated of late, resulting in the first ever monthly close above $1,000 (September 2009).

At the end of the aforementioned CNBC interview, host Joe Kernan says to Jim Rickards, “You just made a heck of case for buying gold right at $1,000…”

It would seem there are any number of cases for such action.

To keep up with breaking news on the gold market, we invite you to visit our News & Views page at: www.usagold.com/cpmforum/

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Forexyard

09 Dec 09, 02:32 |

Gold is a Bargain At $1,000

Cheers for the great post - I loved reading it! I always love this blog. |