Gold Stock Peak and the Dow to Gold Ratio Update

Commodities / Gold & Silver Stocks Nov 05, 2009 - 01:58 AM GMTBy: Adam_Brochert

I firmly believe in the concept of the Dow to Gold ratio to guide my longer term investment decisions. I also believe that for this economic cycle, the Dow to Gold ratio will get back down to 2 or less before the current secular general stock bear market is over. Why do I like the Dow to Gold ratio? Because it negates the need to worry about the inflation-deflation debate! If some of the smartest and most savvy investment professionals in the business can't agree on the inflation-deflation debate, how can a typical retail investor hope to figure it out? By reducing the issue of where to put your investment money into two simple choices (i.e. put it in the Dow Jones or buy physical Gold), the mystery of investing is reduced to the absurdly simple.

I firmly believe in the concept of the Dow to Gold ratio to guide my longer term investment decisions. I also believe that for this economic cycle, the Dow to Gold ratio will get back down to 2 or less before the current secular general stock bear market is over. Why do I like the Dow to Gold ratio? Because it negates the need to worry about the inflation-deflation debate! If some of the smartest and most savvy investment professionals in the business can't agree on the inflation-deflation debate, how can a typical retail investor hope to figure it out? By reducing the issue of where to put your investment money into two simple choices (i.e. put it in the Dow Jones or buy physical Gold), the mystery of investing is reduced to the absurdly simple.

I know some people do or will think this concept is too simple and may not work this cycle, yet it is performing on schedule and as expected so far. In deflationary secular stock bull markets (a la the 1930s), Gold reverts to its role as the international currency "of last resort" (i.e. cash equivalent holding). In inflationary secular stock bull markets (a la the 1970s), Gold is simply one of many hedges against inflation and is by no means the best or only inflationary hedge in such circumstances. I favor a deflationary outcome, but so many things could go wrong in the United States specifically due to the strong potential for the U.S. to lose its global reserve currency status (i.e. major currency devaluation if this occurs).

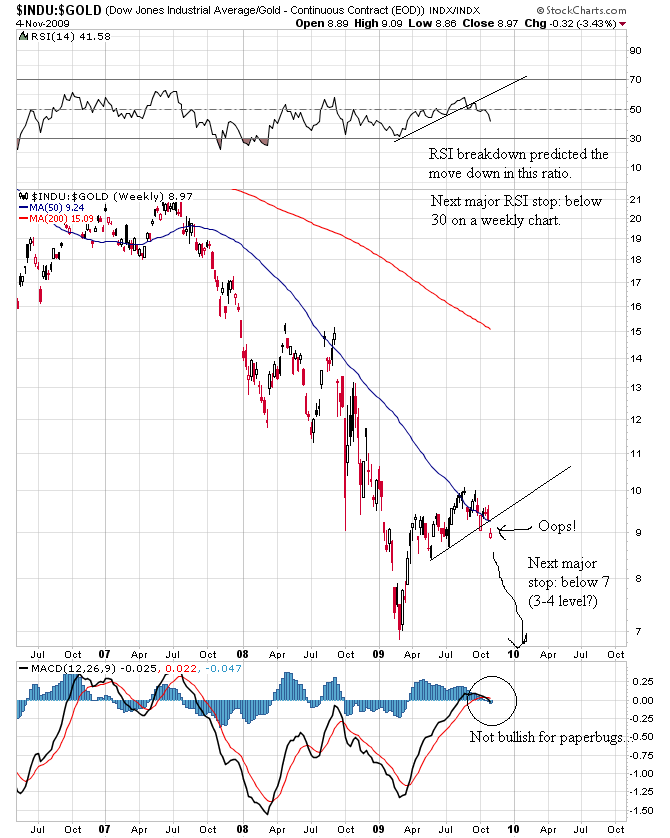

The Dow to Gold ratio chart just broke down again and we are headed for lower lows in this ratio (with some short-term twists and turns along the way to keep people climbing the "wall or worry" in the Gold patch). Here's a 3.5 year weekly chart thru today's close showing the breakdown:

In 1932, the Dow to Gold ratio bottomed at around 2. In early 1980, this ratio bottomed around 1. I think 2 is the minimum level before the Dow to Gold ratio bottoms this time around. It could even go below 1 this cycle given the major excesses in the financial and debt markets (i.e. "paper") that have occurred over the past 20-30 years.

However, an interesting point to note for Gold bulls is that Gold stocks have peaked long after the Dow to Gold ratio bottomed in the past two cycles. In the 1930s, the Dow to Gold ratio bottomed in 1932 while Gold stocks peaked in the 1936-1938 time frame. In the 1970s Gold bull, the Dow to Gold ratio bottomed in January of 1980 but most Gold stocks didn't peak until about a year later.

While I realize we are currently far from a Dow to Gold ratio of 2 or less, I always like to think ahead. This information will help to give me the confidence to sell some of my physical Gold when the Dow to Gold ratio gets down to the 2 level or so and not worry about missing the final potential part of the Gold price move. Why not worry about missing this last part of the move? Because I will likely just put the cash proceeds from my Gold sale into Gold stocks for a year or more of further Gold sector gains after the Dow to Gold ratio hits 2!

Just another bullish thought on the Gold sector. Though the very short term is starting to get a little frothy, this secular Gold bull market has years to go, not weeks or months. November thru January are bullish seasonal months for the Gold sector and I don't think this year is going to be an exception.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.