Japan in a Permanent Deflation Trap A Myth!

Economics / Japan Economy Jan 16, 2010 - 09:30 AM GMTBy: G_Abraham

Japan is a perfect case study of how monetary policy can go awfully wrong and how the damage can be permanent. Japan, claims PIMCO’s Paul Mcculley, has entered into a disastrous self feeding deflationary spiral which is impossible to exit.

Japan is a perfect case study of how monetary policy can go awfully wrong and how the damage can be permanent. Japan, claims PIMCO’s Paul Mcculley, has entered into a disastrous self feeding deflationary spiral which is impossible to exit.

An economy enters a liquidity trap when the monetary policy rate is pinned against zero, yet aggregate demand consistently falls short of aggregate supply potential. Such a state of affairs generates enduring economic slack, which in turn generates enduring deflation. That was a very real global risk a year ago, but was met head-on by BoJ’s sister central banks, in particular the Federal Reserve, whose mantra was “whatever it takes.” And while a relapse toward the fat tail risk of global deflationary pressures certainly still exists, that tail has been dramatically flattened by innovative, courageous, and explicitly reflationary policies. Not so for Japan, unfortunately: The country has been in a liquidity trap for almost two decades, with nominal GDP hovering near the levels of the early 1990s. And with a current output gap of 7–8% of its GDP, Japan faces perpetual deflation, unless and until the BoJ walks the reflationary walk.

Source: PIMCO newsletter

The BOJ noted in Nov 2009:

“A few members were of the opinion that the Bank should explain clearly to the public that the underlying cause of the continued decline in prices was the slack in the economy – in other words, the weakness in demand. These members added that to improve the situation it was essential to create an environment whereby final demand – specifically, business fixed investment and private consumption – could achieve self-sustaining growth, and for this purpose it was most important to alleviate households’ concerns about the future and underpin firms’ expectations of future economic growth.”

Now here is the shocker from PIMCO staple. They suggest the following three methods for Japan to evolve out of its two decade old deflation.

Three concepts the BoJ could consider:

- Explicitly promise there will be no exit from QE and no rate hikes until inflation is not just positive, but meaningfully positive. One way to do this would be to adopt a price level target rather than an inflation target, embracing the idea that past deflationary sins will not only not be forgiven but require even more aggressive reflationary atonement.

- Buy unlimited amounts of the long-dated Japanese Government Bonds (JGBs) to pull down nominal yields, with an accord with the fiscal authority to absorb any future losses on JGBs, once reflationary policy has borne its fruits, generating a bear market in JGBs.

- Working with the Ministry of Finance, sell unlimited amounts of Yen against other developed countries’ currencies, printing the necessary Yen.

All three methods are foolish and they are the very reasons why Japan finds itself where it is today. These were the exact methods used in 1990 to 2006 and yet not a trace of Japan emerging out of its zero growth and zero rate regime. And yet here is PIMCO suggesting to continue exactly that. If you carefully go through Paul solution to BoJ problems, we will understand that these are the same steps that FED has used to force US out of the crunching slowdown which is now heading to deflation. Does PIMCO have some other motive in suggesting exactly what FED is doing to US treasury? Or are they genuinely suggesting to continue printing an unbelievable amount of YEN even when it has been proven beyond doubt that QE is not the way to get out of deflation but strong regulation and higher productivity that ultimately leads the nation out into stable growth regime. (Example Germany 0f 2009 and US of 1990s). You may well add China and India to that list.

Studying the latest numbers from Japanese trade ministry, we conclude that Japan is indeed coming out of deflation courtesy China and India. I am a great believer that the crisis of 2008 has wrought permanent and irrevocable damages on US and UK balance sheets. Just as US and Uk are in their initial stages of sinking into mire of deflation, we see the genesis of the rise of “kings of the east” namely China, India and Japan.

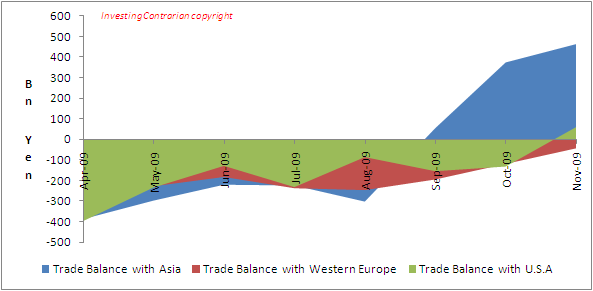

Japan trade shows a tremendous rise in its trade with Asian countries, the effects of which will be seen in the coming few quarters.

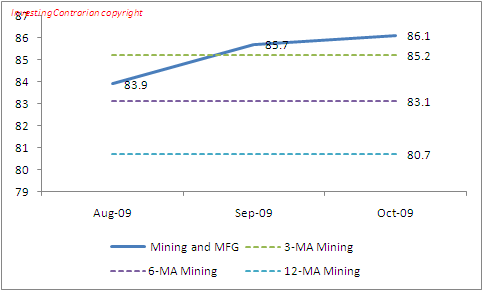

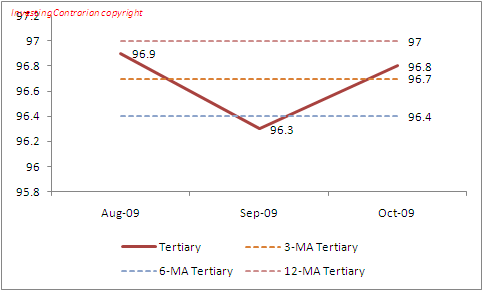

Cleary Japan has been improving sharply from its recession lows. But while the mining and MFG sector has eight straight months of improvement in its mo/mo readings, services has only improved for one month in a row. Services also has improved in five of the past six months. Still, the tertiary sector is only up by 2.5% from its cycle low point whereas MFG and mining is up by 23.8% from its cycle low reading. MFG and mining currently stands by 21.8% below its cycle peak whereas the services sector is off by just 6.4% from its cycle peak. Two sectors are experiencing very different recession and recovery forces.

The service sector stands in the 53rd percentile of its range while Mining and MFG stands in the 40th percentile of its range, well below its mid-way mark. Both Mining and Tertiary numbers stand above the 3 Month, 6 Month and 12 Month averages, a clear sign that the economy is coming out of a long hiatus.

The improvement in Japanese numbers are not cause of it traditional trade partner, US, but cause of the huge developing market of China and India. Japanese automakers continue to lead the auto markets in India though they have been lately challenged by the German auto makers.

Japan is definitely emerging out of its grave. My understanding concerning the likes of PIMCO analysts is that, they are really not looking at the macro developing in Asia. Asian economies have moved on from the crisis and are almost back to 2007 levels of growth while US and UK are still battling on whether to increase the QE to avoid a japan like situation.

As Japan starts moving into higher growth, BoJ can finally start raising rates, almost when US bond funds are terming the decline of Japan as permanent. That will be the perfect contrarian slap on some of the US analysts who continue to breed on QE based capitalism as the solution to all problems. Thank Heavens for the saner heads in China, ECB, India and Australia who have stayed away from outright purchase of junk mortgages from likes of JP Morgan.

Make no mistake, there is only one way out of deflation. That is a stronger currency which enables a stronger consumer which will stimulate domestic demand and spur growth. That is the time tested method of China, India, Germany and Australia. QE is a complete failure and history bears testimony (1937, 1970,1980: US and world recession) that priniting of money has very little chance of success. Infact None!

Maybe, Paul (PIMCO), you believe something and you wrote something else! After all, your fund advises and influences the US monetary policy. May be the US FED needs another era of suppressed YEN as it can serve the carry currency for the next decade as well. Am not sure whether the Japan and China of 2009 will accept it anymore

Source: http://investingcontrarian.com/global/japan-in-a-permanent-deflation-trap-a-myth/

Wish you a great trading and investing week ahead

God Bless.

Godly Abraham

http://investingcontrarian.com/

Formerly a hedge fund analyst for India's largest fund house and currently a Private Equity fund analyst with a swiss firm, Godly Abraham is an active writer at INVESTING CONTRARIAN which is a daily online publishing house, covering investing ideas and economic analysis on wide ranging topics but mainly specialized to covering US,UK, EU and BRIC countries and their political ramifications.

© 2010 Copyright Godly Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.