Why Did the Housing Phenomenon Spread? Three Key Reasons for a Social Epidemic: Housing Connectors; Mavens; and Salespeople

Housing-Market / US Housing Jul 28, 2007 - 12:33 AM GMT

We can learn a lot from the social sciences especially in analyzing the current housing bubble. Many may see very little connection between housing and social science but behavioral economics and marketing have much to do and say regarding our current environment. This is particularly relevant in analyzing the current housing market because we are in a bubble; and by definition something in a bubble does not follow conventional rules.

We can learn a lot from the social sciences especially in analyzing the current housing bubble. Many may see very little connection between housing and social science but behavioral economics and marketing have much to do and say regarding our current environment. This is particularly relevant in analyzing the current housing market because we are in a bubble; and by definition something in a bubble does not follow conventional rules.

First, we must ask ourselves how can a relatively stable investment such as housing, become the topic de jour in all investing circles for the past 7 years. Next, we need to ask why housing became such an overnight phenomenon and spread like a blistering hot wildfire. Not only did housing spread into every imaginable aspect of the American psyche, it also contributed to 30% of all employment since the start of the millennium.

In examining the housing bubble we need to acknowledge that certain people have a better understanding of the economics behind the housing market. Even though practically 100% of the population lives or rents a home, a very slim proportion actually understand the dynamics of the housing market enough to spread the gospel of housing wealth. From Malcom Gladwell's principles and other sources of behavioral economics we realize that three principles players exist in spreading any social epidemic; and do not kid yourself because we are in an epidemic of biblical proportions. The key players are the housing connectors, the housing mavens, and the housing salespeople.

Housing Connectors

In every society we have key people who are massively connected in the community. They know everyone. From congressmen to doctors to your local supermarket manager. These people can spread information quickly because they have access to the ears of those who will listen. You can look at the massive growth in MySpace for example. Otherwise a very small and obscure website, a few techies spread the word to key people on college campuses and all of a sudden millions in the population have their face plastered on the internet for the public to see.

Those in the housing community known as the housing connectors are the hedge funds, the mortgage back security markets, and the Federal Reserve. The hedge funds played a massive role because they created a market in which trading mortgage backed securities (MBS) was possible. Not only was it possible it was profitable and in a world with low returns, hot money was seeking better yields. Then we have the Federal Reserve dropping rates after the September attacks:

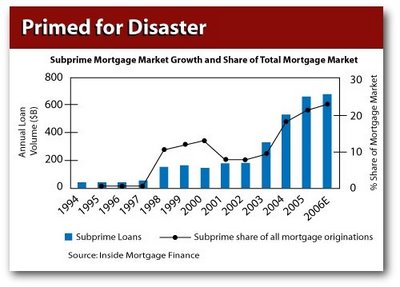

If you recall, we did have a very brief recession that was stifled by an absolutely irresponsible monetary policy that created multiple bubbles that we are now dealing with. The Federal Reserve not only dropped key interest rates, they encouraged folks to take riskier mortgages. Remember Alan Greenspan talking about ARMs? Good job AG, make a bubble before you hit the public speaking circuit. He would leave you to believe that this did not increase the amount of money flowing to risky mortgages. Take a look at the chart below:

The key thing to remember here is the access these connectors have to the public. They are the tip of the pyramid and have a podium to the public. When Alan Greenspan encouraged riskier mortgages he was essentially giving the MBS market a blessing that exotic mortgages were okay. Once this message was processed, Fannie Mae and Freddie Mac felt as if they had a government safety net protecting them in case anything would collapse; otherwise known as a lender of last resort label.

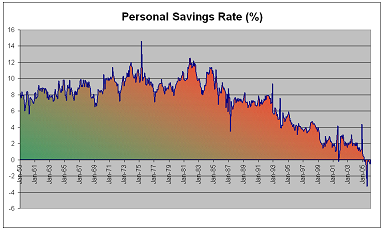

The problem with this logic is of course that encouraging unmitigated debt spending would cause inflation and even worse, the bubble we are currently in. Then we have Bush ushering in the patriotic movement that spending was as American as apple pie. What happens to the savings rate?

I like visuals because they colorfully highlight the credit mess we are in and vividly portray the direct correlation between all these actions. Since the economy was supported on credit spending and now that credit is tightening we will see a withdrawal effect and I have discussed this regarding the Duesenberry Effect . It is very hard to give someone massive access to credit and suddenly turn off the spigot; have you ever given a child a lollipop and suddenly taken it away? If you have, that's pretty messed up but you will get an understanding of what will happen when the credit lollipop is taken away from the public.

Housing Mavens

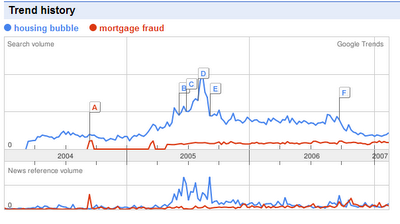

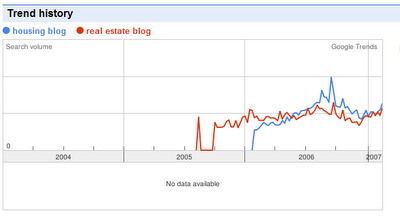

Those that have access to information and massive amounts of information are known as the housing mavens. They are information brokers. They spread information because they enjoy educating the public; people that fall into this group are housing/economy bloggers, housing bears, housing bulls, and economist. These people have many listeners but do not have the massive network of the connectors. However when Mavens talk, people listen. Initially, there may be some doubt from people catching on to the information but slowly the information traffic picks up. Let us take a look at searches in Google for the past couple of years:

You notice a couple of interesting things from the query. First, housing bubble searches peaked in the summer of 2005, which for the nation is about accurate. Then we see a trailing off effect. Many coastal readers are thinking this bubble is over but keep in mind not everyone lives in California , New York , or Florida (our bubble popping is just beginning). As this point trails off you can see the search for "mortgage fraud" nearly converges with "housing bubble." As a bubble peaks, fraud and shyster enter the game because they go to where the money is at. Interesting to see that mortgage fraud rears its public search head about the same time that the housing bubble trend emerges. Let us take a look at another interesting trend that highlights the maven concept:

You notice a couple of interesting things from the query. First, housing bubble searches peaked in the summer of 2005, which for the nation is about accurate. Then we see a trailing off effect. Many coastal readers are thinking this bubble is over but keep in mind not everyone lives in California , New York , or Florida (our bubble popping is just beginning). As this point trails off you can see the search for "mortgage fraud" nearly converges with "housing bubble." As a bubble peaks, fraud and shyster enter the game because they go to where the money is at. Interesting to see that mortgage fraud rears its public search head about the same time that the housing bubble trend emerges. Let us take a look at another interesting trend that highlights the maven concept:

From the above, you can see that many folks started searching for housing blogs starting at the peak of the housing bubble. This interesting growth for alternative media is what is driving a quicker and much more pronounced decline in the housing market. Information travels at the speed of light and people are looking for alternative pieces of media. The benefit of this is that people have options of what they hear. Many mainstream media pieces have been driven by bloggers and housing mavens such as Redfin, who was featured on a 60 Minutes piece arguing against the sacred 6% commission.

From the above, you can see that many folks started searching for housing blogs starting at the peak of the housing bubble. This interesting growth for alternative media is what is driving a quicker and much more pronounced decline in the housing market. Information travels at the speed of light and people are looking for alternative pieces of media. The benefit of this is that people have options of what they hear. Many mainstream media pieces have been driven by bloggers and housing mavens such as Redfin, who was featured on a 60 Minutes piece arguing against the sacred 6% commission.

Housing Salespeople

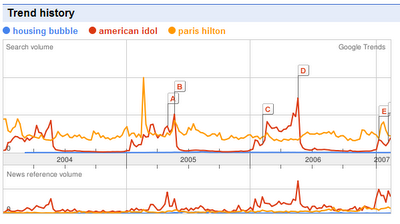

As you may have noticed not everyone cares about the housing bubble. People care more about Paris Hilton or even American Idol. Take a look below:

It is not fair to assume that everyone is interested in this market even though we have folks earning minimum wage buying $720,000 homes. Given that housing isn't at the forefront of everyone's mind, how did the American public become captivated into this frenzy? The final actor in this play are the salespeople. These are the agents, brokers, gurus, and housing pundits that pushed this market beyond any economic fundamentals. I am reminded of a quote from Walter Bagehot:

It is not fair to assume that everyone is interested in this market even though we have folks earning minimum wage buying $720,000 homes. Given that housing isn't at the forefront of everyone's mind, how did the American public become captivated into this frenzy? The final actor in this play are the salespeople. These are the agents, brokers, gurus, and housing pundits that pushed this market beyond any economic fundamentals. I am reminded of a quote from Walter Bagehot:

“The reason why so few good books are written is that so few people who can write know anything.”

When you read Rich Dad Poor Dad or any bathroom literature you are given vague ideas of how to pursue wealth. It makes you feel good. Certainly it is more uplifting than reading Manias, Panics, and Crashes but at what cost? We are certainly bound to repeat history if we do not learn from the past. And this hyper-bubble is another lesson in psychology that human nature, for whatever reasons will always remain with us. Greed is a profound desire and many of the salespeople, via charm, persuasion, or any of their other tools was able to convince people that a $500,000 box is worth every shiny penny.

The fact that we have so many people in the sales ranks is another testament of the growth of the housing bubble. In fact, we have a bubble in those peddling the bubble; those that are agents and brokers. When the market declines and housing takes a hit these jobs will go away. They are the prototypical cyclical job. Unfortunately we have a tremendous amount of people in this industry. In addition, the mere assumption that these jobs are extremely high paying, we will lose a lot of consumption when people are laid off or cannot find work. Many will need to go back to school to learn a new trade or take a massive pay cut. They will no longer be in the work force or fully productive.

So there you have it. The three market brokers of the housing bubble and why it spread as it did. Not everyone was equally responsible but from the top like the Federal Reserve to the absolute bottom of graduate students buying outrageously priced homes , this bubble is one for the ages.

By Dr. Housing Bubble

Author of Real Homes of Genius and How I Learned to Love Southern California and Forget the Housing Bubble

http://drhousingbubble.blogspot.com

Dr. Housing Bubble Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

BloodyMaryBreakfast

29 Jul 07, 16:11 |

Bubble Makers

All the bubble makers are listed, though not specifically, in your connectors. The two you didn't list are the lenders who made all the subprime loans and the individuals who took them with full knowledge they couldn't afford the home they were buying. The mavens talked and the sales agents sold, but they didn't create a housing bubble any more than "Car & Driver" magazine and car salespersons. All the talk and salesmanship in the world can't create a bubble without the easy credit that comes from monetary expansion and folks willing to mortgage their future for a few more square feet today. Please see "Addicted to Easy Credit - Business Cycles and Fiat Money" |