China Production Capacity Bumps!

Economics / China Economy Jan 24, 2010 - 05:32 AM GMTBy: G_Abraham

Chinese economy soared 10.7% in the fourth quarter, leaving shell shocked analysts in a state of complete disbelief. Chanos even called for a contrarian bet on China. The growth has been very strongly supported by China’s aggressive stimulus spend which have been well observed through Bank lending.

Chinese economy soared 10.7% in the fourth quarter, leaving shell shocked analysts in a state of complete disbelief. Chanos even called for a contrarian bet on China. The growth has been very strongly supported by China’s aggressive stimulus spend which have been well observed through Bank lending.

Some key points:

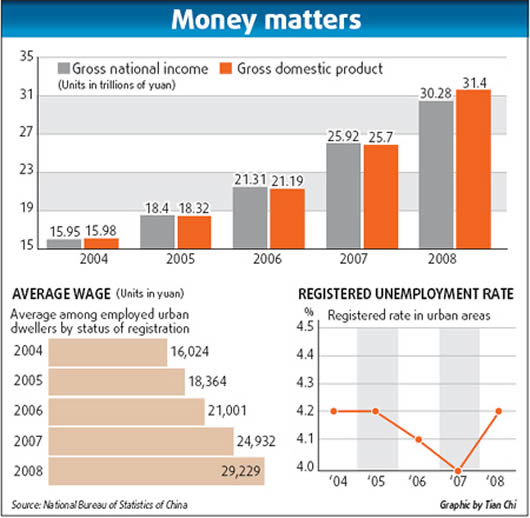

- China GDP reached 32 trillion yuan while Gross National Income at 31 Trillion Yuan which shows that China is among the least leveraged economies in the world and hence best placed to surge into the next decade.

- Chinese employment wage has risen 20% YoY inspite of the recession, which will spur strong demand side inflation over the next few years. Inflation is important for growth but the fear is if it gets out of hand. Chinese central bank has been upto the task as it has moved to limit the lending to $1.1 Trillion which in my view is still very accommodative.

- Chinese employment is well below 5% compared to US rate of 10% and EU rate of 9.8%.

Bank loans in rural areas increased 33 percent last year, 15 percentage points higher than in 2008. Loans for SMEs rose 30 percent, 16.6 percentage points higher than the previous year, while bank lending in western regions expanded by almost 38 percent, compared with 30 percent in the east.

The lending has gone to production capacity creation which needs to be supported by pick up in global demand. If the demand does not utilize 70% of the new capacity, china will face a second economic transition, one that will be more challenging than the economic slump itself. Chinese consumers need to start consume and save less. Currently, the proportion of consumption to GDP is less than 40 percent in China while it is often more than 70 percent in the developed countries. Chinese central bank is well aware of this fact. The second transition refers to the country’s upcoming economic restructuring, which is expected to make the economy more consumption driven, services oriented and environmentally friendly. The first transition, which began in the late 1970s, was focused more on growth.

Having said that, I continue to be very bullish on China and will back the China central bank to take the right decision than the US Fed. Treat the last week correction in China as mere noise in a much longer term upward move in Chinese economy.

Source: http://investingcontrarian.com/china-investing/china-production-capacity-bumps/

Wish you a great trading and investing week ahead

God Bless.

Godly Abraham

http://investingcontrarian.com/

Formerly a hedge fund analyst for India's largest fund house and currently a Private Equity fund analyst with a swiss firm, Godly Abraham is an active writer at INVESTING CONTRARIAN which is a daily online publishing house, covering investing ideas and economic analysis on wide ranging topics but mainly specialized to covering US,UK, EU and BRIC countries and their political ramifications.

© 2010 Copyright Godly Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.