Gold’s Ugly Price Chart Across Multiple Currencies

Commodities / Gold and Silver 2010 Jan 31, 2010 - 02:45 AM GMTBy: Graham_Summers

Most commentators living in the states have made a big ado about Gold breaking to a new all-time nominal high back in the fall of 2009. I didn’t buy into the mania and wrote an article titled Three Reasons Gold Might be Making a Head Fake that was published on November 10, 1009.

Most commentators living in the states have made a big ado about Gold breaking to a new all-time nominal high back in the fall of 2009. I didn’t buy into the mania and wrote an article titled Three Reasons Gold Might be Making a Head Fake that was published on November 10, 1009.

The primary point of the article was that Gold was struggling to hit new highs against most major world currencies. Sure, the precious metal had rallied impressively when denominated in Dollars. But you have to remember that the Dollar lost roughly 16% of its value in 2009. For that reason, I chose to look at how Gold was doing when priced in Yen, Euros, and Swiss Francs.

At that time I noted that Gold had failed to break to new highs in these currencies. The new highs DID eventually come in late November, but ALL of them were immediately followed by strong retrenchments/ corrections, confirming my views that Gold was in fact making a headfake and not ready to blast into the stratosphere as many Gold bulls predicted.

Gold then promptly plummeted from $1,225 to $1,100 in about two weeks’ time in early December. With the precious metal (denominated in Dollars) continuing to correct today as the Greenback strengthens, I thought it was worth reviewing how the precious metal is faring for those outside the US.

Let’s take a look.

Gold, as priced in Euros is on the literal edge of a cliff. If the precious metal DOESN’T bounce strongly off of its current support (7.60 or so) or enter a lengthy consolidation period, we could be seeing Gold (priced in Euros) down around 7.00 or even 6.50 relatively quickly (much like the gut-wrenching drop that occurred in early 2009). This chart is not a pretty site.

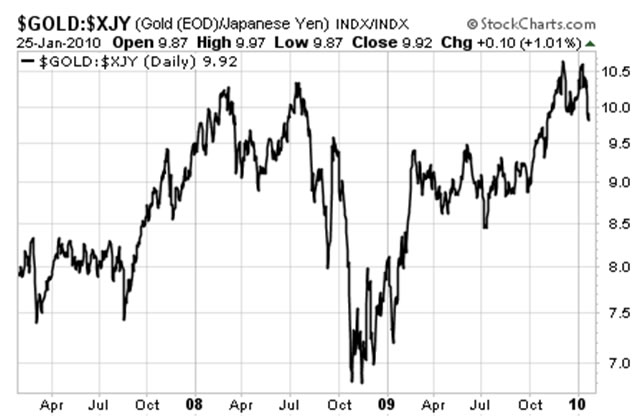

What about Yen?

Here we see Gold (priced in Yen) making what looks like a clear double top. This too is bearish. And with Gold slicing through support at 10.00 the next real support is down around 9.50 or even 9.00. Again, not a pretty site and we need to see a strong reversal if Gold (priced in Yen) has any hope of maintaining its gains since July 2009.

And finally, Swiss Francs:

This chart actually doesn’t look too bad. Gold (priced in Swiss francs) looks to have held support and is not entering a consolidation stage. However, I do want to point out that if Gold breaks below support, there’s a long drop down to 10.50 or even 10.00 (much as is the case in the Euro). So this chart, while not as bad as Gold priced in Euros’ could get very ugly very fast if Gold weakens against the Swiss Franc.

Thus, we see that Gold priced in multiple world currencies has formed several very ugly charts. This does not bode well for the Gold bugs as it indicates that the recent correction in the precious metal is not solely related to the US Dollar’s strengthening. Instead we see paper money in general outperforming the precious metal.

This could be signaling an end to the stimulus/ easy credit that has fueled much of the rally in commodities and stocks over the last year. But all of these charts bear watching in the coming weeks.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.