Colombia, A New Gold Rush?

Commodities / Gold and Silver 2010 Mar 03, 2010 - 03:25 PM GMTBy: Casey_Research

by Andrey Dashkov, Casey’s International Speculator - For many investors, Colombia remains a grey spot on their mental maps of South America. La Violencia, the 50-year dark age in its recent past, came to an end with the close of the 20th century. But the memories are fresh, and the impact on the local economy and international perceptions of the country lingers. This reputation still prevents most foreigners from investigating Colombia’s potential – and that spells opportunity.

by Andrey Dashkov, Casey’s International Speculator - For many investors, Colombia remains a grey spot on their mental maps of South America. La Violencia, the 50-year dark age in its recent past, came to an end with the close of the 20th century. But the memories are fresh, and the impact on the local economy and international perceptions of the country lingers. This reputation still prevents most foreigners from investigating Colombia’s potential – and that spells opportunity.

For those curious and courageous enough to see Colombia as a new frontier, early speculations are starting to yield big rewards. The country has abundant natural resources, including gold, silver, copper, coal, oil, gas, and more, a good deal of which remains underexplored.

But is it safe to explore for gold in a place distant from other relatively stable regions and drill in areas formerly held by AK47-toting guerillas?

That’s a good question. Truth be told, the country is still far from being as secure a place for mining companies as some of its Latin American peers, like Mexico or Chile. That said, our own Louis James visited Colombia in ’08 and ‘09 and saw marked improvement in the country. Kicking rocks in remote areas formerly controlled by the infamous paramilitary groups advancing their Marxist ideals, he saw scars left by the violence, but no sign of any current danger.

The critical factor is that there is huge support for President Alvaro Uribe, whom Colombians of all political stripes credit with ending the violence and jump-starting the country’s economy. Uribe’s second term will end this year, and it’s not yet known if he’ll be able to serve a third, as this will require a constitutional change. But it appears highly probable that either the amendment will be approved or a hand-picked protégé will get his nod for election, keeping Colombia on the path to recovery.

Indeed, as many of its neighbors have made hard Left turns, Colombia is rapidly becoming a bright spot in Latin America with its more free-market approach to its economy. Uribe’s support of private initiative and market institutions, evident in the reforms he engineered, has resulted in impressive economic progress since he took office. Let’s take a brief look at the numbers.

The Colombian economy has fared better than its Latin American peer group. Much of the growth was sponsored by foreign investment, the rate of which decreased as the liquidity crisis unfolded. Nonetheless, foreign investment sows the seeds of future growth, as opposed to foreign aid, which simply wastes money and fosters dependence. Uribe has done a good job in this area, attracting US$8.6 billion gross foreign direct investment (FDI) in 2009.

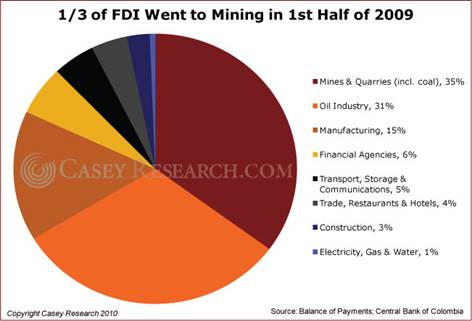

As shown in the chart below, more than a third of total 2009 FDI in Colombia was in the mining sector, and almost another third was in the oil sector. It’s still early days, but with nearly two-thirds of FDI targeting the resource sector, clearly, there’s momentum building in these industries in Colombia.

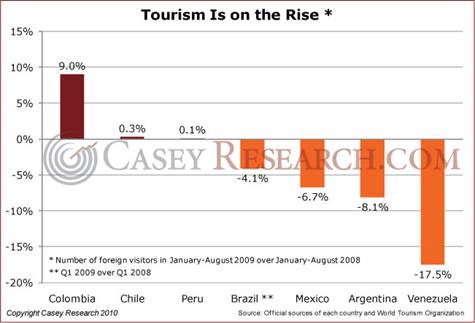

Another indicator of things turning around is the increasing flow of tourists to Colombia. In 2009, the country attracted more than 1.3 million visitors, outpacing its neighbors by quite a margin.

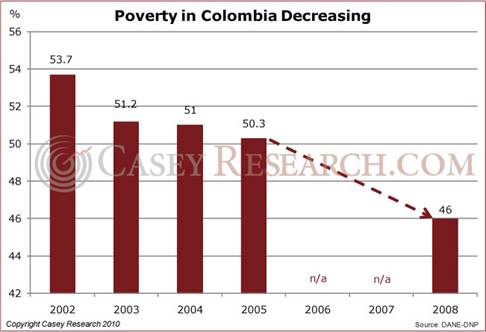

More business means more jobs. Although almost half of the country’s population still lives below the poverty line, the situation has been improving since 2002.

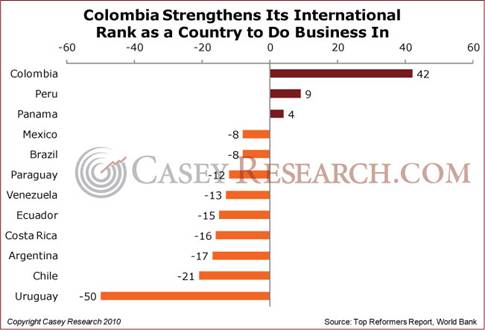

Colombia has been recognized as one of the best pro-business reformers globally in recent years by the World Bank. We're not big fans of the World Bank here at Casey’s International Speculator, but the striking performance of Colombia in its most recent “Doing Business” report probably means something. Colombia's international ranking improved by a whopping 42 positions from 2007 to 2010, far beyond the improvement of any other Latin American country.

Another relevant indicator taken from the Doing Business report is the “Investor Protection” parameter. Good news for Colombia: the country is rated fifth globally, leaving its peers in the dust.

These, and other, indicators make a good case for Colombia. The country is gaining economic stability, and new legislation provides foreign investors with a high degree of legal protection and security. Uribe's approval rating, reported to be as high as 97%, is another major plus.

There has long been a “Colombia discount” applied to the stocks of companies doing business there, but that's fading fast. Companies are starting to get a boost in share price just for saying they are exploring in Colombia. However, unlike other “flavor of the day” plays, there is good reason to expect the Colombia Gold Rush to last. The country really is highly prospective for all sorts of natural resources, and, due to La Violencia, has lacked exploration for decades. In other words, this is “low-hanging fruit” that is not picked over. And as each significant discovery is made, it will add to the premium the market gives Colombia plays.

So, our take is that in spite of the danger of a near-term correction, it's time to examine the most interesting opportunities in Colombia and make sure we have some of the best of the best in our portfolio. Actually, if there is a correction ahead, it could make for fantastic opportunities to load up at pre-gold rush prices.

Unlike many TV talking heads and financial pundits, senior metals analyst Louis James evaluates mining companies by putting his boots on the ground. Kicking rocks in faraway places and personally talking to on-site geologists is how he has managed to bring dozens of winning stock picks to his subscribers… with gains like 289%... 214%... and 455%. Learn more about the secrets of “Indiana James” and how to profit from them, by clicking here.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.