Prime Interest Rates and the Market Value of Gold

Interest-Rates / US Interest Rates Aug 19, 2007 - 12:05 AM GMTBy: Greg_Silberman

Before the Feds Emergency rate cut on Friday the bias was to higher rates across the board. For example the Australian Reserve Bank increased prime interest rates by 0.25% and even now after the stock market pummeling, continues to warn of more to come. This article explains why interest rates are about to go higher at exactly the WORST possible time.

Before the Feds Emergency rate cut on Friday the bias was to higher rates across the board. For example the Australian Reserve Bank increased prime interest rates by 0.25% and even now after the stock market pummeling, continues to warn of more to come. This article explains why interest rates are about to go higher at exactly the WORST possible time.

The question foremost on investors minds is whether a turbulent stock market warrants halting interest rate increases or, in the case of the US, decreasing rates to resuscitate the Real Estate and credit markets.

It never ceases to amaze us that central bankers blame price inflation for increasing interest rates when in fact it is their own money printing that causes price levels to rise. The simple fact is that global printing presses have run too hard for too long for anyone to be able to prevent price levels from breaking out. This leaves jawboning and raising interest rate as the only effective tools in controlling the public perception on inflation. In other words, inflation is now baked in the cake and in the world of central banking (where perception is king) the blame is put on stronger than expected global growth.

Boil it down for us Greg. What does it all mean?

It means we are in for higher interest rates across the entire yield curve at exactly the WORST possible time:

Short Yields:

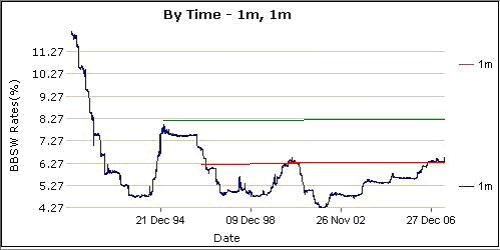

Chart 1 - Australia 1 month Bank Bill prime interest rates

The recent hike in interest rates by the Reserve Bank of Australia caused rates to break above previous support (red line) and painted a target of 8.25% (green line).

Australia has lead the charge on inflation because its economy is so sensitive to underlying commodity price pressures.

Long Yields:

Up until now the treasury market has been the major recipient of a flight to quality. But as chart 2 shows, Bonds are about to hit some headwinds as they approach support in the form of a long-term rising trend line.

Chart 2 - Bonds are approaching Long-term support (lower blue line)

The implications of the above chart is that long-term yields are about to reverse higher. There are 2 possible scenarios we could envisage which would cause Bonds to lose their safe haven status:

1 - The strong global growth scenario regains dominance, perceived market risk decreases and inflation has its way.

2 – The credit market contagion spreads into AAA paper and finally into treasuries causing the US Dollar to drop like a stone.

It seems improbable (to us at least) that scenario 1 will play out due to the extent of the credit market problems. Which leaves scenario 2 as our highest probability outcome.

Needless to say, when the perfect storm hits gold and silver prices per ounce will soar!

More commentary and stock picks follow for subscribers…

By Greg Silberman CFA, CA(SA)

Profession: Portfolio Manager and Research Analyst

Company: Ritterband Investment Management LLC

e-Mail: greg@goldandoilstocks.com

Website: blog.goldandoilstocks.com

I am an investor and newsletter writer specializing in Junior Mining and Energy Stocks.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Greg Silberman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.