California Unemployment Soars, Underemployment at 24%

Economics / Recession 2008 - 2010 Apr 19, 2010 - 05:55 AM GMTBy: Global_Research

Dr Housing Bubble writes: California has reached another unfortunate record. The headline unemployment rate pushed up to a record breaking 12.6 percent. This translates to 2.3 million Californians completely out of work. We also have a large number that are working part-time but would like full-time employment. When we look at the California budget and economy we cannot separate out jobs from the condition of the housing market.

Dr Housing Bubble writes: California has reached another unfortunate record. The headline unemployment rate pushed up to a record breaking 12.6 percent. This translates to 2.3 million Californians completely out of work. We also have a large number that are working part-time but would like full-time employment. When we look at the California budget and economy we cannot separate out jobs from the condition of the housing market.

California’s big error during the decade was that the health of real estate was the health of jobs. That is, many jobs (too many) depended on the housing bubble. As the bubble burst so has the economy. Yet the current strategy seems to rely on real estate recovering again instead of building up jobs in other industries. If we look at the underemployment rate we are quickly approaching 24 percent. We also have many toxic mortgages that are still sitting in the balance sheets of banks but more are making their way to market.

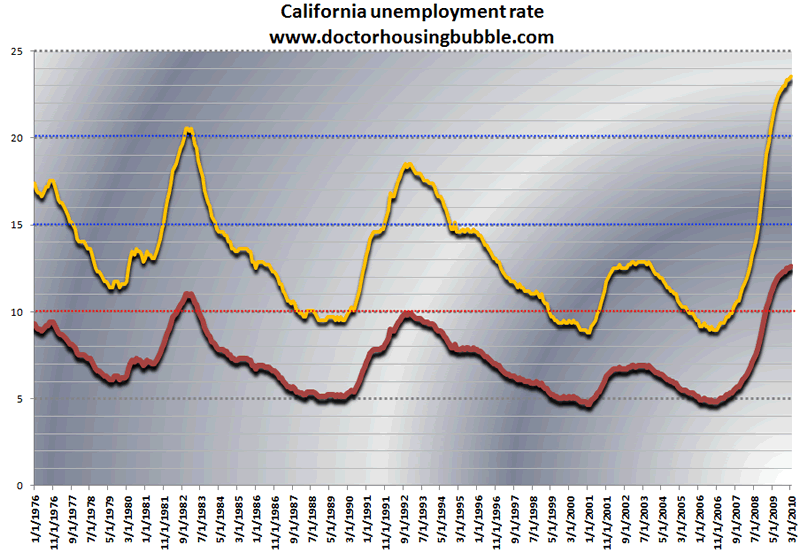

Let us first examine the employment situation in the state:

Source: BLS; Yellow modified U6

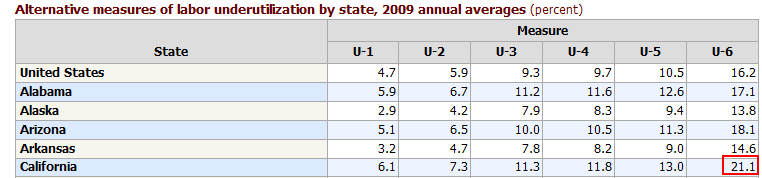

I’ve been putting together this chart for a few years now. The red line is the official BLS headline unemployment rate for California. But with such a large number of Americans working part-time but looking for full-time work, I’ve also added a line that reflects the underemployment rate. This data was created from averaging out the difference over the years between U3 and U6 for the state. The ratio is fairly accurate. In fact, let us look at the official 2009 average for California:

The average U6 rate for the state in 2009 was 21.1 percent. But keep in mind and look at the above chart. The headline rate (U3) has been going up all through 2009 and now in 2010 we’ve had a rate of 12.5, 12.5, and 12.6 percent. In other words, the average is now much higher. And we actually see this in the current part-time rate:

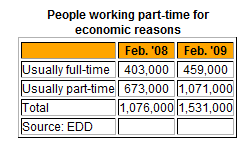

Source: OC Register

In the last year we’ve increased the part-time for economic reasons number by 456,000. It is difficult to envision any housing stability without the employment situation improving. How are people going to afford any sort of mortgage payment if they have no job or are working part-time with lower wages? At the moment, we have seen a movement in home sale activity but much of this seems to come from a couple of unsustainable groups:

-a. Investors

-b. First time buyers using the tax credits (federal currently, state next month)

-c. Low mortgage rate push

-d. Pent up demand

All four groups are currently dominating the market. In most healthy markets sales come from people selling homes to move up/out and first time buyers. We are missing a large healthy group of home sales that come from the move up market. After all, what are you going to move up from when one-third of California mortgage holders are underwater?

What is even more challenging for the current economy is we are reaching the end of the line for many. In the next few weeks we are going to see roughly 100,000 people lose their unemployment insurance:

“(LA Times) Despite hints of an economic turnaround, some of the 2.3 million unemployed in the state found March the toughest month yet. That’s because tens of thousands have been out of work so long that their unemployment checks will be cut off within the next few weeks. They’re not helped by the $18-billion measure signed Thursday by President Obama that extends jobless benefits for many Americans through June 2.”

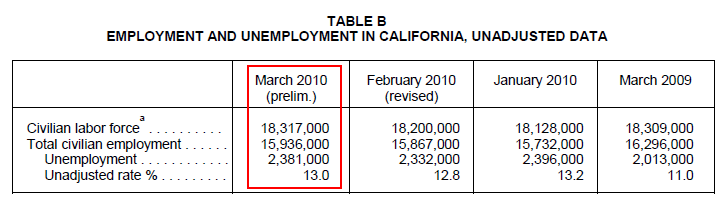

Many of these people are part of the 2.3 million unemployed:

Source: EDD

The recession has been so long and deep, that even 99 weeks of unemployment insurance with combined extensions is not enough for thousands of California residents. A current extension signed by the President will not help this group. And with budget battles looming for cities and the state, it will be a struggle of priorities. Why choose to give a $200 million home buyer tax credit when our employment situation resembles the above is beyond me. It is a purely political move because economically it makes absolutely no sense.

And Southern California is in really tough shape. Many of those investors have been buying out in the Inland Empire:

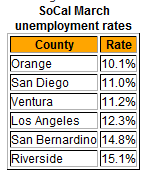

Source: OC Register

The Inland Empire is made up of Riverside and San Bernardino Counties with headline unemployment rates of approximately 15 percent which means their underemployment rate is 25 percent or higher. I’ve been following this market closely and have seen an explosion of rentals hitting the market. Yet the economy is so tough here, that many rentals seem to languish or if they do get rented, investors are finding a hard time collecting rent. This might be because the underemployment rate is 25 percent! It should be obvious to most that we can have no housing recovery without fixing the current employment situation in the state.

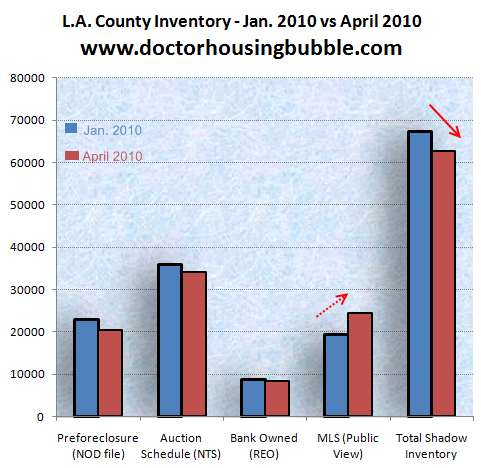

And here in Southern California, we are seeing some shadow inventory move from the dark hidden corners of a bank balance sheet to the MLS:

So what we see is a decrease in shadow inventory and a bump in actual MLS data. This trend has been going on for a few months now. Yet the properties making their way look to be hand selected. For example, banks seem to want to move shadow inventory in the Inland Empire fast and at lower prices. In other areas, not so much (i.e., Beverly Hills, Culver City, etc). It would appear that banks are already giving up on certain areas and crossing their fingers that in other markets, things will recover quick enough and then they can unload properties at face value.

The California budget battle is going to give us two choices. One includes raising taxes to generate more revenues. The other will include cuts which means additional job losses. These are not good choices but this is what we have ahead of us in 2010.

Global Research Articles by Dr Housing Bubble© Copyright Dr Housing Bubble -, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.