Greece Financial Markets and Economic Collapse Sinking Euro Zone Economy

Economics / Global Debt Crisis Apr 29, 2010 - 01:26 AM GMTBy: John_Mauldin

This is a special Outside the Box. I got this letter from my good friend Greg Weldon last night and got permission to pass it on to you. I think it illustrates the problems that the world is facing from the sovereign debt crisis that is building in Europe.

This is a special Outside the Box. I got this letter from my good friend Greg Weldon last night and got permission to pass it on to you. I think it illustrates the problems that the world is facing from the sovereign debt crisis that is building in Europe.

There are no good solutions here, only very difficult ones. In order to get financing, Greece must willingly put itself into a multi-year depression. And borrowing more money when it cannot afford to pay back what it has will not solve the problem. 61% of Greeks now favor leaving the euro. How has Greece responded? By banning short selling on its stock market for the next two months. That should make things better. Greeks are responding by rioting and going on strike. But you truly know when a country is dysfunctional when its AIR FORCE goes on strike. Yesterday Reuters reported that hundreds of Greek pilots called in sick in protest. The response from government? The Minister of Defense said he was "profoundly disappointed." Now that had to make the pilots feel bad.

Money is flying from Greek banks, which makes sense, as how can a bankrupt Greek government guarantee Greek bank deposits? I know that Greek bankers may have a different view, but Greek depositors are voting with their feet. And Greg shows us it is not just Greece. It is fast becoming Portugal. And Spain is not far behind in my opinion.

I can well imagine there are private meetings among Greek government officials, banks and other leaders as to what must now be done. Those meetings I am sure can be tense. These things matter, as European banks hold a lot of Greek debt, as well as Portuguese and Spanish debt. European banks have not come close to dealing with their problems and are seriously over-leveraged. There is the potential for yet another banking and credit crisis stemming from European banks. Will world banks see their trust for each other (and especially European banks with large amounts of Club Med bonds) devolve as it did on August of 2008? It is something we must think about. It is possible, in my opinion. I sincerely hope it does not happen, but we must think about it. (Note, this is not something that will happen for awhile, but we should be aware of the problem.)

I want to thank Greg for letting me send this on to you. His website is www.weldononline.com. This letter is typical of his work – thorough and detailed and full of charts. He is the best slicer and dicer of data that I know.

John Mauldin, Editor

Outside the Box

MACRO-EUROPE: The Titanic is SINKING

WELDON'S MONEY MONITOR

We rewind to our February 15th Money Monitor entitled "Three Card Monty", with its focus on the 'early stages' of the now full-blown Greek debt-deficit-debacle, and we replay the quotes we spotlighted at the time ...

Greek Finance Minister George Papaconstantinou ...

... "We are basically trying to change the course of the Titanic. People think we are in a terrible mess. And we are.

We note comments from Jean-Claude Juncker, speaking on behalf of European Finance Ministers following a meeting of top EU officialdom in Brussels this afternoon ...

... "Greece is responsible for the consolidation of its public finances. It is first a Greek problem, and an internal Greek problem."

From European Central Bank President Jean-Claude Trichet ...

... "Everyone needs to respect their commitments. We have a particular Greek problem, but the other countries have their programs and they must be implemented. It is important that all of the heads of state and governments do what is necessary to guarantee the stability of the euro zone."

And from German Chancellor Angela Merkel ...

... "Germans should not pay for the consciously flawed fiscal and budgetary policies of others."

We stated, in our conclusion to that Money Monitor ...

Thinking that the problems of Greece, let alone two dozen other European debt-deficit 'offenders', will be 'solved', without PAIN, quickly ... or that they will be easily and quietly 'papered-over' ... is like playing Three Card Monty with the hustlers of Eighth Avenue in Manhattan.

It is ALWAYS a LOSING proposition.

Now, over two months later ... the Titanic is SINKING ... amid today's credit rating downgrade announced by Standard and Poor's, as it relates to Greece's sovereign debt.

Moreover, in our March 3rd Money Monitor, "It's All Over Now, NOT !!!", we stated the following ...

In short, it is NOT, at all ... "all over now", in Europe.

And, in our April 12th Monitor, "Three Blind Mice" ... published in the wake of the announcement of the (alleged) solution via a loan to Greece, from EU member nations, and the IMF ... we said the following ...

What happens when Italy needs a bailout, or Portugal, or Spain ...

... bailouts-that-are-not-a-bailout that would be significantly LARGER than the 45 billion EUR offered to Greece ... what then ????

Again, as we have stated repeatedly since the 4Q of last year ... Europe's fiscal debt-deficit crisis is FAR from 'over'.

Again, as we have repeatedly stated ... it will not be over, until draconian fiscal austerity measures are implemented ACROSS the region.

It will not be over ... for years to come.

Fast forward to the present ... and the announcement by Standard and Poor's wherein the credit ratings agency cut Greece's sovereign debt rating to JUNK status ... and we shine the spotlight on commentary from today's S+P 'statement' ...

... "We believe that the government's policy options are narrowing because of Greece's weakening economic growth prospects, at a time when pressures for stronger fiscal adjustment measures are rising. Moreover, in our view, medium-term financing risks related to the government's high debt burden are growing, despite the government's already sizable fiscal consolidation plans."

... "Our updated assumptions about Greece's economic and fiscal prospects lead us to conclude that the sovereign credit rating is no longer compatible with an investment grade rating."

Also ...

... "The government's multi-year fiscal consolidation program is likely to be tightened further under the new EMU-IMF agreement. This is likely to further depress Greece's medium-term economic growth."

And ...

... "The government's resolve is likely to be tested repeatedly by trade unions and other powerful domestic constituencies that will be adversely affected by the government's policy."

Adding insult to injury, Standard and Poor's also put Greece's credit 'outlook' on 'negative watch', opening the door for FURTHER downgrades ...

... "The negative outlook reflects the possibility of a further downgrade if the Greek government's ability to implement its fiscal and structural reform program materially weakens, undermined by domestic political opposition at home, or by even weaker economic conditions than we currently assume."

Indeed, the ICEBERG is HUGE ... and the unsinkable ship is sinking !!!

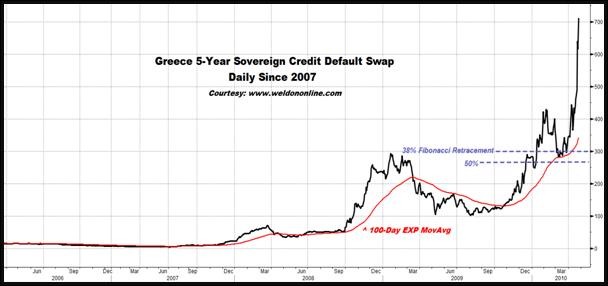

Evidence the rising water levels in the engine room, as represented by the 'price' of default 'protection', evidenced in the chart below plotting Greece's 5-Year Credit Default Swap Rate ... which has SOARED today, easily reaching a NEW ALL-TIME HIGH ... by FAR !!!

In fact, in our March 22nd Money Monitor entitled "Three Card Monty, Revisited", we offered a chart perspective on the 5-Year Greek CDS. We spotlighted the downside correction that took the CDS to the med-term trend defining 100-Day EXP-MA, in line with a text-book Fibonacci retracement (between the 38% and 50% retracement levels) ... suggesting that the downside correction provided a 'buying' opportunity.

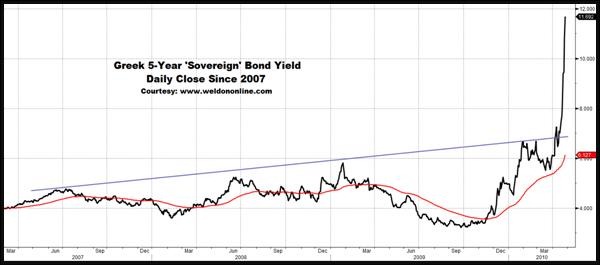

We also 'warned' about the potential for higher interest rates to significantly impact the entire fiscal environment in Greece. Thus we note additional commentary from within the Standard and Poor's statement ...

... "Pressures for more aggressive and wide-ranging fiscal retrenchment are growing, in part because of recent increases in market interest rates."

After today's parabolic rise in the 5-Year Greek Bond yield, as noted below, the word 'increases' becomes a substantial understatement.

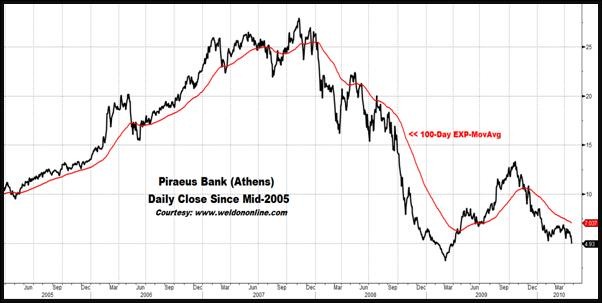

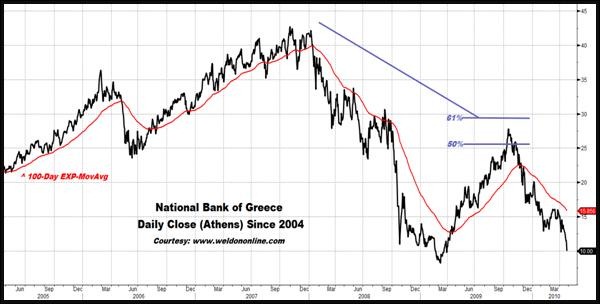

As if this was not enough turbulence, we also note that in line with the downgrade of the Greek government credit rating, Standard and Poor's also marked down the 'rating' on the nation's largest banks ... stating that ...

... "We find that Greece's fiscal challenges are increasing pressure on the banking and corporate sectors. In particular we see continuing fiscal risks from contingent liabilities in the banking sector, which, could, in our view, total at least 5%-6% of GDP in 2010-2011."

Standard and Poor's downgraded the 'long-term counterparty credit ratings on National Bank, Eurobank, Alpha Bank, and Piraeus Bank ... causing share prices to plummet. Evidence the pair of charts on display below in which we plot Piraeus Bank ...

... and, the National Bank of Greece, both of which are breaking down technically, following a rally that mapped out another 'text-book' Fibonacci retracement correction.

Hence we turn the spotlight on the Greek stock market as a whole, represented within the chart below in which we plot the Greek ASE stock index. Indeed, we note another Fibonacci retracement, to the 33% target, followed by this week's renewed technical breakdown.

The ship ... is going DOWN.

We have been bearish on the Eurocurrency since October-November of last year, and after suffering because we were 'early' to this thematic-trade, we have been rewarded for our patience and perseverance ... as evidenced in the longer-term daily chart on display below, revealing today's decline in the EUR to a new move LOW.

Further, we spotlight the bearish technical dynamic, as defined by the negative action in the moving averages, and the slide into bearish territory by the long-term 200-Day Rate-of-Change.

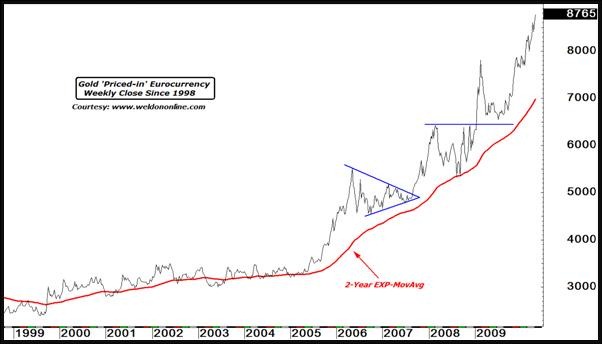

While the Titanic (also known as the Eurocurrency) SINKS ... the price of Gold denominated in the Euro is SOARING, reaching a NEW ALL-TIME HIGH today, in excess of EUR 875 per ounce ...

... as observed in the long-term weekly chart seen below.

We are now watching for a 'confirming' upside breakout in the spot (USD based) price of Gold. Noting the daily chart on display below we focus on the most recent re-acceleration to the upside in the med-term trend defining 100-Day EXP-MA.

An upside violation of the April 12th high of $1169 would constitute a full-blown med-term upside breakout.

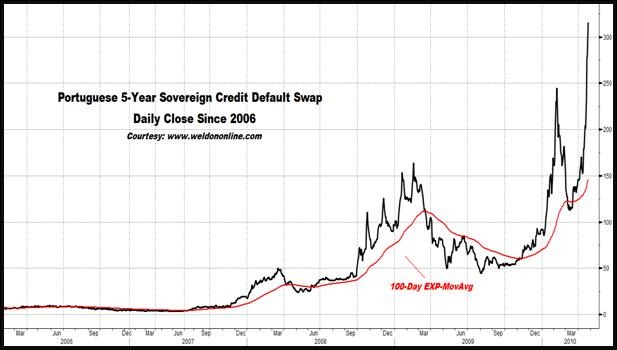

All 'passengers' are going down with the ship ... with a downgrade to Portugal's sovereign credit rating also announced today, as Standard and Poor's marked down Portugal's rating by two notches, from A+ to A-, while placing the country on a negative outlook watch, portending more downgrades in the future.

Subsequently, Portugal's 5-Year Credit Default Swap is SOARING, as noted in the chart below, spiking to a NEW ALL-TIME HIGH ... today.

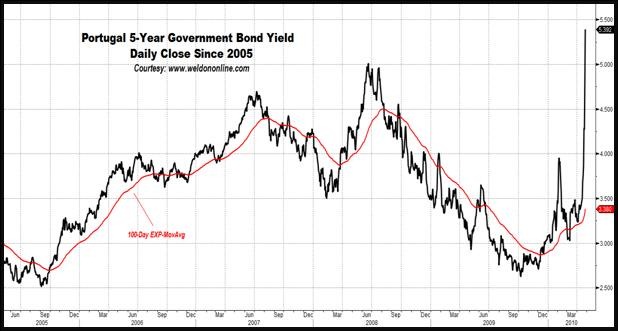

Similarly, Portugal's 5-Year Government Bond yield SOARED to a NEW HIGH, jumping by + 60 basis points today alone, capping a monstrous +215 basis point rise in the month of April, easily violating the February high of 3.95% ... as evidenced in the chart below.

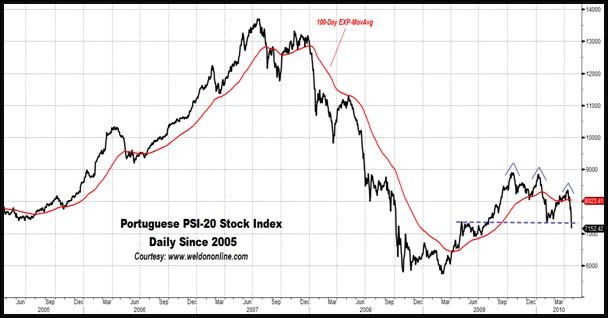

Like the Titanic ... the Portuguese stock market is also ... sinking ...

... as evidenced in the daily chart on display below, replete with technical breakdown, head-and-shoulders pattern, violation of the med-term trend defining 100-Day EXP-MA ... and ... the downside reversal by the moving average itself, directionally speaking.

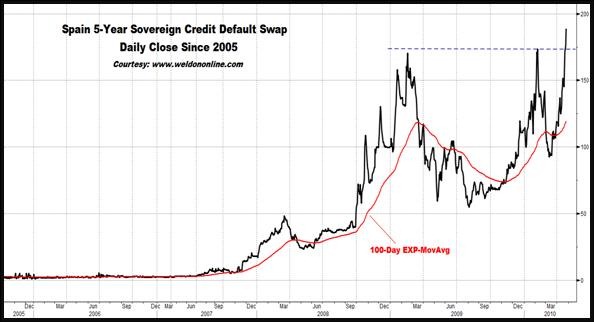

And finally, we have been focused on the downside price action and severe underperformance exhibited by the Spanish stock market (specifically spotlighted as recently as last Friday's ETF Playbook) ...

... and thus we note the chart on display below as Spain begins to unravel too, with the 5-Year Credit Default Swap SOARING to a NEW ALL-TIME HIGH, slicing through the (previous) double-top formed as defined by the February 17th, 2009 high at 170 basis points, and the February 8th, 2010 high at 173 basis points, reaching towards 200 basis points.

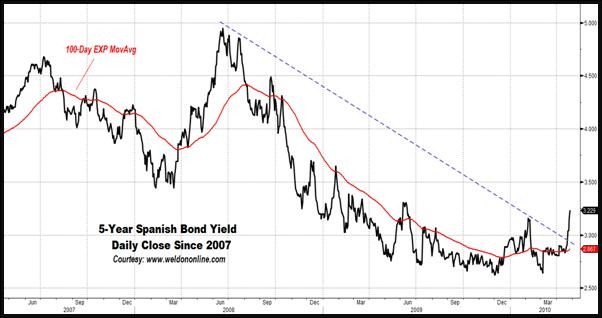

And, we shine the spotlight on the chart below plotting Spain's 5-Year Bond yield, which is breaking out to the upside, today, and doing so 'from' historically low levels below 2.75%, violating the February 5th high of 3.13%.

The Titanic is sinking, and ultimately, ALL passengers will go down with the ship, including Portugal, Spain, Greece, and several other Maastricht Treaty debt-deficit offenders.

We have been anticipating this event for months.

Thus, we remain bearish on the European currencies ....

... and bullish on Gold priced in EUR.

Gregory T. Weldon ---

Subscription Information ... eileen@weldononline.com

Or Visit www.Weldononline.com for a free trial.

John Mauldin

Editor, Outside the Box

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.