Gold Stock Fundamentals Now versus 2008

Commodities / Gold & Silver Stocks Jun 11, 2010 - 12:36 PM GMTBy: Jordan_Roy_Byrne

Escalating sovereign debt problems in Europe has prompted some to wonder if another “Lehman” type collapse is on the horizon. As a result, some precious metals observers have grown cautious, fearing a replay of the events of two years ago. While it is always prudent to be cautious with an extremely volatile sector like the gold stocks, the facts illustrate major differences between their fundamentals now and in 2008.

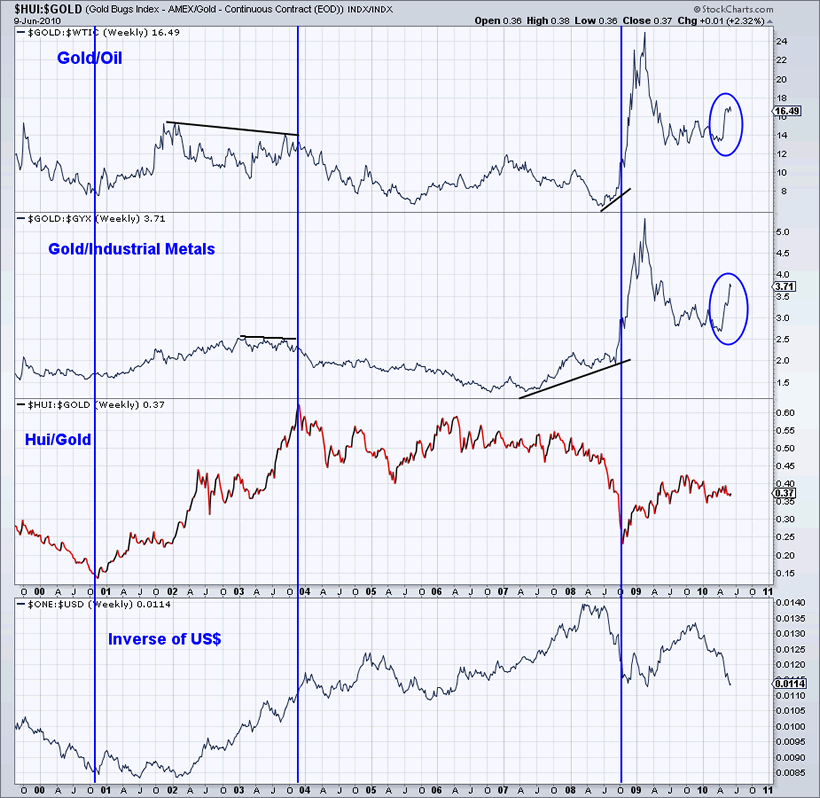

Most notably, the real price of Gold is rising. The real price of gold tends to lead the HUI/Gold ratio and it also provides a positive omen for the gold stocks. We’ve noted in past missives how a simple analysis of Gold/Oil and Gold/Industrial Metals can provide an indication of the future direction in HUI/Gold. As you can see from the chart, the recent soft panic has spurred Gold much higher against both Oil and Industrial Metals.

What is intriguing is that deflation is the catalyst for gold stocks while inflation is actually not a positive for gold stocks. The reason is that in a time of deflationary forces, Gold will rise relative to mining costs such as labor, oil and industrial related costs. Hence, gold stocks performed well from 1931 to 1935, in the 1960s, 2000-2006 and recently in the last 18 months. When inflation hits the economy, it eventually cuts into margins of gold companies. Gold was rising in 2007 and 2008 but high oil prices, a very weak US Dollar and economic demand contributed to rising costs.

Moreover, it’s important to note the differences between a credit crunch in the economy and a sovereign credit crunch. A credit crunch in the economy, as we experienced in 2008 tends to significantly impact risk assets such as stocks and commodities. A credit crunch amongst governments has the most impact on bonds and currencies. Gold and Silver, as currencies, will benefit. Hence, in the last few months, even with downward pressure on most markets, Gold has risen while the leveraged Gold plays (mining stocks and Silver) have held up quite well, unlike in 2008.

Going forward, the macro forces will continue to support the gold stocks for at least a few years. As we’ve written in the past, there is little reason to think Gold won’t continue to outperform in the next few years. This means that the gold and silver stocks have an even brighter future ahead.

Unfortunately too many mainstream investors are too scared of the gold stocks to take advantage of the potential massive gains in the years ahead. Hence, we created a service that provides professional support and guidance so that traders and investors can better navigate what lies ahead. Consider a free no risk 14-day trial, which entitles you to our most recent and future updates.

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.