We Cannot Afford a Double Dip Economic Recession

Economics / Recession 2008 - 2010 Jun 24, 2010 - 01:35 AM GMTBy: Casey_Research

By Alex Daley, Senior Editor, Casey Research writes: Talk of a double-dip recession is seemingly increasing these days. Home sales have dropped like a brick since the end of the special tax breaks for buyers. Weekly job reports are showing much larger rises in unemployment claims than previously expected by whoever it is that decides what exactly is expected - 427,000 new filings in just the last weekly report.

By Alex Daley, Senior Editor, Casey Research writes: Talk of a double-dip recession is seemingly increasing these days. Home sales have dropped like a brick since the end of the special tax breaks for buyers. Weekly job reports are showing much larger rises in unemployment claims than previously expected by whoever it is that decides what exactly is expected - 427,000 new filings in just the last weekly report.

The problem this time around, however, is not just the economy itself. The problem is that our supposed saviors are all out of tools to help the economy climb out of the deep, dark hole we now find it in. The tool belt of any monetary regime is limited to begin with. Nothing more than loosening up the debt purse strings with unrestrained interest rate policy and some additional lending from the central coffers to add to liquidity. These tools are the economic equivalent of performing reconstructive dentistry with a sledgehammer and monkey wrench, effective but not exactly precise.

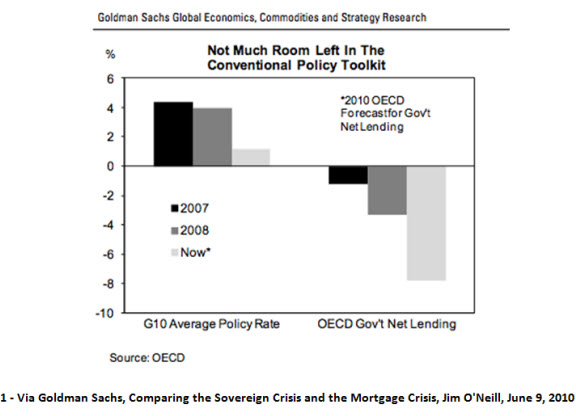

And as Goldman Sachs recently pointed out to a number of its clients, the world's leading developed nations have all but exhausted the few tools available to them:

Interest rates in the top 10 economic nations are hovering just above zero, and it's not like they can go any lower than that, as much as banks would welcome having to pay back less than they borrow.

And government net lending has increased so dramatically that government debt is spiraling from out-of-control to just plain ridiculous. All at a time when revenues are dropping from the slowdown and creditors, having been burned a little by Greece and afraid of what's to come with Spain, Italy, Ireland, California, New York, and others, are starting to raise red flags to the borrow-and-spend policies of our collective governing bodies.

For the first time in a long time, developed governments in Europe and the U.S. face the specter of sub-AAA credit ratings and rapidly rising costs of borrowing more (ratings that, frankly, had they been put in place by the inept agencies years ago when they were initially deserved may have had repercussions that would have helped us avoid many of today's problems). Between rising borrowing costs, the already hefty budgetary burden of paying prior debt interest, and the ever-expanding rolls of government employees, legislators can hardly keep up on the bills these days, let alone inject any more into the economy.

The irony, of course, is that by unloading a full clip from the assault rifle when trying to "save" the economy, the governments of the OECD nations have actually created a catch-22 situation. One wherein they not only have no tools left to manipulate the markets against a further slowdown, but also where they have created monetary policy so extreme that undoing it would be more disastrous than the fallout would have been had they not stepped in in the first place.

Austerity budgets from Greece and Spain have included massive layoffs of government rank and file, severe wage cuts, or both, potentially reducing tax revenues and consumer spending. California is following suit with its proposed 23,000 teacher layoffs, which are arriving on the back of 30,000 previous layoffs just last year. New Jersey is furloughing tens of thousands of state workers and capping raises. NY is furloughing 100,000 more and needs to cut $9.2 billion from the budget still.

As the walking bankrupt states and cities continue their budget slashing - down from criminally high levels such as Miami, where the average city worker nets $76,000/year compared to the $29,000 average for private citizens of the metropolis - it will only exacerbate the returning slowdown. Fewer households with cash to spend in the private sector. Rising mortgage defaults and foreclosures as the workers face the grim reality that a state paycheck doesn't come with a 30-year guarantee these days. Declining tax revenues at all levels. And more people on the already busting-at-the-seams federal unemployment files, which remain at all-time highs.

Speaking of the U.S. federal government, their guaranties of Fannie and Freddie Mac loans are now estimated to cost anywhere from $250 billion to $1 trillion to taxpayers in the end, far above the net cost of any of the other bailout measures and potentially more than is possible to pay. The price tag is so steep, many conservatives are starting to call for repealing the institutions' charters altogether and letting the private market have at them. The U.S. federal government is simply buried over its head in obligations.

The government is all tapped out. And yet the economy continues to slow.

If you are among the camp who wished the government would have never stepped in to begin with and called out the seemingly obvious truth that they could only worsen the situation by flailing so wildly to contain it - the double dip is coming, and you are about to be proven right and get your wish at the same time.

It's the price we are all about to pay for letting our politicians get away with budgetary murder year after year, including letting them try to "save" us the last time around.

Betting on rising interest rates is a slam-dunk opportunity if there ever was one. Learn what Casey Chief Economist Bud Conrad has to say on this topic and which investments will profit once interest rates start going up. Click here for more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.