Is the U.S. Economy Toast?

Economics / Double Dip Recession Aug 08, 2010 - 09:44 AM GMTBy: Brian_Bloom

Marc Faber thinks the US economy is toast. Richard Russell’s interpretation of the technical behaviour of the US market is that we might just be entering a new Primary Bull phase. (Although he remains wary because of the generous P/E ratios that still prevail).

Marc Faber thinks the US economy is toast. Richard Russell’s interpretation of the technical behaviour of the US market is that we might just be entering a new Primary Bull phase. (Although he remains wary because of the generous P/E ratios that still prevail).

Last week, this analyst had an interesting chat with an associate who happens to be an extremely well connected Institutional player in the currency markets. He meets regularly with central bankers in various countries in this part of the world and, last month, the year-to-date returns on investment of 11% of the fund by which he is employed was halved. He was not a happy chappie.

Is anyone out there bullish? Is there a reason to be bullish? Are the bears stubbornly holding onto their bearish calls for ego reasons?

Recently, another friend was kind enough to send me a link to a YouTube recording of Niall Ferguson giving the Stavros S. Niarcos Foundation lecture. It is well worth watching. Readers can access it – and the Q&A session which followed – at http://www.iie.com/..

Ferguson is an historian as opposed to an economist. If you want to see more of his credentials, go to http://www.niallferguson.com/.. and http://en.wikipedia.org/wiki/Niall_Ferguson

During the Q&A session, some interesting observations emerged and, for ease of reference, I have summarised them below:

- The ratio of sovereign debt service payments to tax revenues seems to be the single most important indicator of a coming market crisis in today's financial world.

- Complex systems are fragile and are extraordinarily vulnerable to "sudden" deterioration

- European Integration is very likely history. One cannot have monetary union without fiscal union and voters (particularly in Germany) will not likely sanction a European fiscal union

- A Geopolitical crisis can be the catalyst to the demise of globalism – as happened once before in history around the time of World War I following Britain’s global exploits which preceded that time.

- India is a more trustworthy international trading partner than China

- Fiat currencies may give way to commodity based currencies

In this morning’s media, it was reported that Fidel Castro is still worrying about a nuclear holocaust and he believes that a failure of the US to recognise the dangers of provoking Iran and/or North Korea may be the catalyst to such a holocaust. This attracted my interest given the fact that I am now fairly deeply into writing my second factional novel, which has nuclear energy and its associated issues as one of its primary themes. I’m not sure if I agree with Castro that America (or any other advanced nation) holds the key. To me, the risks flow from a convoluted matrix of issues which devolve, ultimately, to ego and testosterone. It is not only capitalists who are possessed of testosterone. And it is not only men who suffer from inflated egos.

When I look for what may be positive on the horizon, I find myself focusing on the following:

- Like Ferguson, I think that the entrepreneurial spirit that went into making the United States a powerhouse should not be underestimated. When the going gets tough the tough get going.

- Out of entrepreneurialism flows innovation and out of innovation flows improved productivity. “Productivity” has a triple whammy benefit:

- There is a lower cost of input to arrive at the same output

- Improved standards of living are brought to people who have structurally lower incomes.

- Generally improved standards of living drives revenues, which drives profits, which enables old debts to be repaid. It’s a matter of “time”

- Technological innovation is bubbling along behind the scenes and much of this innovation will enable humanity to work around the emerging shortages in various spheres of life, ranging from food, water, energy and throwaway (wasteful) consumption. The US is still at the forefront of much of this innovation.

- The Internet has certainly changed everyone’s lives. By way of example, what used to take me months to research now takes me hours if not minutes. Information flow – along with waffle and ill informed opinion and disinformation – spreads like wildfire. One positive implication of this is that it’s easier to be pre-emptive in today’s world than at any time in history. Another is that it’s also easier to spot bullshit. Two examples are:

- It is by no means cut and dried that the South Korean frigate, Cheonan, was sunk by a North Korean midget sub.

- Iran is not going to get away with its predisposition to spread lies about the decadency of the West. The recent stated predisposition of the Imams to want to outlaw music – if true – makes that particular country look like it is being governed by a group of dangerously deranged, and unbelievably foolish, people. It seems likely that sensible countries in the Middle East (other than Israel) will eventually lose patience with Mr Ahmadinejad and his puppet masters.

In summary, the internet brings a spotlight of attention on politically disingenuous statements – on both sides of the divide – and those who are predisposed to be cynical have ample ammunition made available to them, typically in the blink of an eye. Both disinformation and truth can be spread virally.

- The Natural Gas industry in Australia (and presumably in other parts of the world) is booming.

Will any/all of the above enable the world to pay down its debt? If so, how long will it take? How far into the future will markets be predisposed to look?

From a risk perspective, what of the bubbles?

In particular, what of the derivatives bubble in the global financial world and what of the property bubble in China? If the confidence bubble is popped, will these two particularly dangerous financial bubbles deflate?

On balance, it seems to me that on a personal level one needs to take a view based on personal preferences:

- If you are a congenital optimist then you will proceed from the base assumption that these financial bubbles will somehow be prevented by the authorities from popping. Even if the world economy contracts by (say) 5% there will still be 95% left and, within that 95%, there will be an unseen churning as old inefficient ways give way to new efficient ways. Opportunities will bubble to the surface to be spotted by those who are looking for them. Unfortunately, given that many of these opportunities will likely emerge in China, and given that China does not respect the Queensbury rules, it will become increasingly difficult for Western investors to capitalise on those opportunities – and be confident of actually realising the notional returns. Competition for emerging opportunities in the West is likely to become intense. Entry prices will rise. Entrepreneurs will likely make large profits.

- If you are prudent person you will take a two way bet. You will recognise that there is a risk of implosion and that there is also a possibility that we might muddle through. The issues are not “black” or “white”. There are shades of grey and life carries on. Of course, this might lead to a schizophrenic and stressful life.

- If you are a risk avers person you will pay off your debts, get your affairs in order, prepare to become self sufficient and get out of harm’s way should “harm” emerge. Of course, if you are wrong then you will have planned for the worst and still be able to benefit if/when any upside materialises – but to a far lesser extent than would have been possible if you were thinking optimistically, because you may not see the opportunities until its too late to do anything about them.

For the record, because of a heart attack that I suffered some years ago and the bypass surgery that followed, I fall into this latter category. That is why I have turned to writing novels and I am exceptionally happy with the way the second one is evolving. The lesson in this is that “flexibility” is an important quality to cultivate in one’s life – particularly in today’s fast moving world. If you are a bear, be careful that you do not become an intransigent bear.

All the above is interesting, but what are the markets saying?

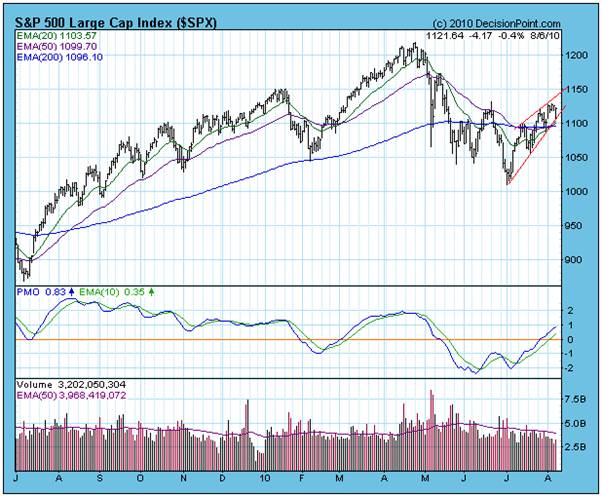

The chart below – of the Standard & Poor 500 – is not a source of comfort to me

(courtesy DecisionPoint.com):

Whilst I don’t trust daily charts because of the computer driven algorithm trading in the background (illegal in my view, but that’s another story) I also don’t like rising wedges which emerge on falling volume. I am also predisposed – because of overvaluations – to view the 200 day Moving average as more of a resistance level than a support level.

When you take a couple of steps back and you view the $SPX from a long term perspective – as can be seen in the following chart – you see a chart which cannot be categorised as “bullish”

At best, one could argue from the above chart that we might have entered a trading range that might continue for well over a decade (during which nimble traders might profit whilst long term holders might become extremely frustrated).

At worst, we might see a pullback to the 400 level or even a collapse of the system if the confidence bubble bursts. What I like least about the chart above is the falling tops and bottoms of the PMO.

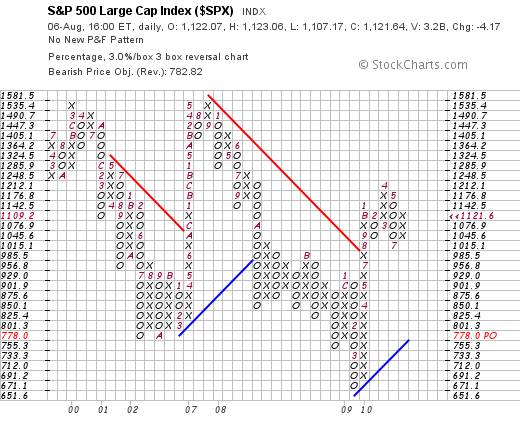

The following Point and Figure chart is also of interest (courtesy stockcharts.com)

Note how in 2007 there was a “high pole” which subsequently more than reversed itself. Then, in 2010 there has been another high pole. To be even handed about it, if the 1212 level is penetrated on the upside then that will evidence one hell of a buy signal and we might expect another 50% rise to new heights. The only thing that I can see that will justify such an explosion would be money supply inflation driving P/E ratios to ever higher levels of stupidity. Such a buy signal will not likely represent a net positive development.

To me – as a conservative, risk averse person – the probability of the high pole reversing itself (and the market returning all the way back to 671) seems far more likely, from a technical perspective.

Conclusion

All things considered, it seems that prudence is the most sensible approach with a bias towards conservatism. Personally, I can’t embrace the idea that the US (or anyone else) is “toast”. There are too many positive developments of extraordinary significance manifesting in the background. The issue will more likely be time related. In this context, it seems likely that it will take longer to mend the consequences of historical excesses than most people would like to believe. My own view is 10-15 years.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.