Bullish Outlook for European Economies, U.S. QE2 Problems

Economics / Euro-Zone Aug 11, 2010 - 02:02 AM GMTBy: John_Mauldin

This week we look at some mostly bullish analysis from my friends at GaveKal for the Outside the Box. Much of the letter is devoted to looking at why Europe may fare better than many think (which will make uber-European bull David Kotok happy to read!). But be very sure to read the last page as Steve Vannelli analyzes the latest speculation about the Fed and quantitative easing. All those calling for QE2 may not actually do what they think it will. His conclusion?

This week we look at some mostly bullish analysis from my friends at GaveKal for the Outside the Box. Much of the letter is devoted to looking at why Europe may fare better than many think (which will make uber-European bull David Kotok happy to read!). But be very sure to read the last page as Steve Vannelli analyzes the latest speculation about the Fed and quantitative easing. All those calling for QE2 may not actually do what they think it will. His conclusion?

"Once again, if there is no growth in broad money, no increase in velocity and no increase in Fed credit (hybrid money), then the only source to finance growth in the real economy will remain the sale of risky assets. When confidence seems to be stuck in a low plateau and talk of reigning in fiscal deficits is growing louder, a policy of undermining the value of risky assets couldn't be more counterproductive to growth."

I find myself in New York this morning (I once again did Yahoo Tech Ticker) leaving for DC later. Then sadly will have to forego Turks and Caicos, but that does allow for me to go to Baton Rouge for a one day course on the affects of the gulf oil spill on the regional economy, helicopter flyovers, etc. I will report back in this week's letter what I learn.

Have a great week.

Your wishing he was still fishing in Maine analyst,

John Mauldin, Editor

Outside the Box

GaveKal Five Corners

By Francois-Xavier Chauchat, Pierre Gave, Steve Vannelli

Looking at consensus growth forecasts for 2010-12, most believe that Germany’s current export boom will fail to translate into a convincing improvement for the domestic economy. Needless to say, this issue is of crucial importance for the sustainability of growth in Europe, and for its much-needed rebalancing. Simply put, Europe needs Germany to be more than an export power-house.

Fortunately, the inability of most to see beyond Germany’s exporting prowess (see, for example, every other Martin Wolf column) may just reflect the extrapolation of the previous economic upswing of 2003-2008. Indeed, the previous German export boom did not trigger an increase in domestic consumer spending (annual growth of private consumption averaged, over that period, a discouraging +0.25%). But looking forward, things may be different for the following reasons:

• To start with the obvious, domestic growth is not just about consumption; it is also about investment. Fixed capital formation grew very strongly in Germany from late 2005 to 2008, after a decade of sustained weakness, and contributed to no less than 40% of German GDP growth over that period. The same could easily happen from late 2010 to 2012. Interestingly, for the first time since early 2008, German banks are now reporting higher loan demand by companies for investment needs.

• From 2003 onwards, the sustained rise of the Euro and the overall inflexibility of the corporate environment made companies unable, and unwilling, to sacrifice their emerging profitability. Among other things, this resulted in nonexistent wage growth. But today, corporate Germany is competitive and profitable, the Euro has declined by -10% since last year, and unemployment has reached an 18-year low. As such, capping wage growth is no longer useful, nor is it feasible.

• The consolidation of government accounts from 2000 to 2007 hurt households considerably. Social contributions were hiked, social spending and pensions were cut, and the VAT was raised by a significant 3 percentage points in January 2007. For the years 2011-2014, the government plans a series of gradual spending cuts and tax increases on banks and utility companies. This time around, households should be spared. Meanwhile, the Ricardian effect of fiscal consolidation will likely be quite powerful as this could be the last push before Germany finally achieves the solid budgetary stability that it enjoyed before the country’s unification.

• Finally, evidence is increasing that former East Germany is emerging from a twenty year lethargy that cost some 3% of GDP each year in budget transfers from the West (see Green Shoots in the East German Desert). According to the latest IFO survey, companies of all kinds in the New Landers—from industrials to retailers—have the best assessment of the economic situation in the region’s History. Unemployment in DDR is also decreasing fast. Thus, for the first time since reunification, East Germany is no longer a headwind. For the above reasons, and even though the German economy will remain extremely dependent on global trade, the case for a gradual and sustained revival of investment and consumption in the biggest economy of Europe is probably more compelling than what most believe. After a decade of near-deflation comes normalization. And this normalization, coming on the heels of years of stagnation, could well look like a boom.

A US$2,000bn Rebalancing

As we have argued repeatedly in numerous reports, the Western World faces two distinct challenges:

• Over-extended banks that have over-collateralized real estate linked assets.

• Governments with massive unfunded liabilities (pensions, healthcare, etc…)

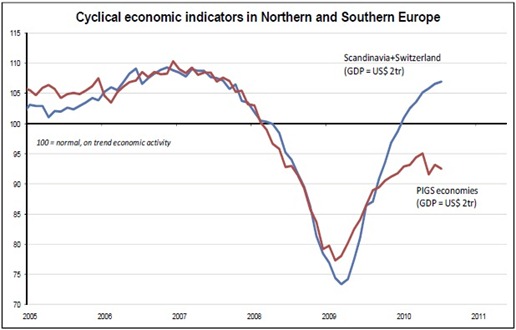

But needless to say, the picture is not uniform across the OECD and some nations are actually in fine shape (see The Nordic Hedge). Scandinavia or Switzerland, for example, will enjoy very favorable monetary conditions and rapidly recovering economic growth for the foreseeable future. In fact, these economies are already seeing their export boom morph into a strong pick-up in domestic demand, a recovery enhanced by rising consumer confidence and falling unemployment rates. According to the Swiss national bank and to the Swedish Riksbank, the domestic macro-situation justifies a continued normalization of monetary policy. However, with Euro, US$ and Sterling interest rates bound to remain close to zero for the foreseeable future, the SEK or CHF risk going to the roof if monetary policy is tightened significantly.

This constraint upon monetary policy in fiscally-sound countries (see The Riksbank Dilemma) implies that interest rates in these economies will very likely remain well below neutral over the next few years. The flipside is that the boom of domestic growth in Scandinavia and Switzerland thus has much further to go. For the Eurozone, this is significant as Scandinavia and Switzerland are even larger clients (12.7% of Euroland exports) than the US (11.6%) or China (5.8%). Interestingly, and importantly for the debate about Europe, the size of these economies almost exactly matches that of Portugal, Ireland, Greece and Spain (roughly US$2,000bn). So while the deflationary forces in these latter countries will remain a drag on European growth, the dynamism in Scandinavia and Switzerland could very well counter the downside pressures emanating from the PIGS.

The regional rebalancing of growth within continental Europe remains one of our central themes for the area (see Euroland’s Growth Prospects and Europe’s Outperformance and Strong Data). In the coming quarters, monitoring this rebalancing will be of crucial importance to assess the nature and the magnitude of risks attached to European financial assets. In our view, the ability of fiscally healthy countries in Europe to compensate for the very poor economic performance of the PIGS is one, usually underestimated, element of comfort.

Breaking the Curse?

A year ago, most opinion polls had the Social democrat party comfortably in the lead and it seemed a given that the Swedish Left would sweep this September’s elections. In other words, we were looking at another one-term reign by the Swedish Right (the last time a incumbent non-socialist party was re-elected in Sweden was in 1979). One could also argue that to find a true ‘rightwing’ party (i.e., non-centrist), Swedish voters have to look all the way backto 1932.

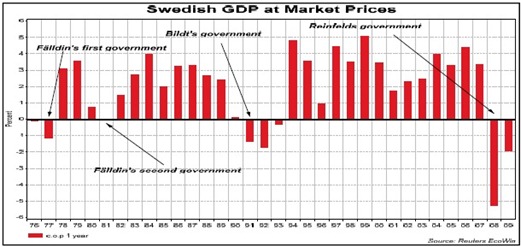

One of the reasons Sweden’s right-wing parties rarely get to handle the levers of power is their unfortunate habit of coming to power at the worst possible times. In 1976, for example, when Torbjorn Fälldin’s centrist-led government came to power, the nation promptly fell into recession and GDP dropped by –1.6% in 1977. Fälldin came back to power in 1979, just in time for the second oil shock and another recession. In 1991, Carl Bildt arrived to power just in time to see the SEK forced out of the ERM, the Swedish banking system implode and three years of contracting GDP. This time around, Reinfeltd’s government had to handle the worst global recession since the 1930s.

But maybe it will be different this time, as Europe’s sovereign debt crisis has

actually triggered a bounce in the polls for the sitting government. All of a sudden, unrestrained welfare spending and excessive government debt are no longer fashionable, whether in Europe or in Scandinavia!

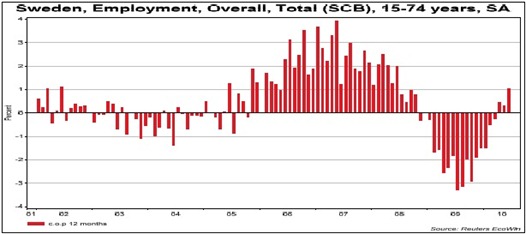

Of course, the big issue of the election campaign has been jobs, or the lack thereof. The opposition, as one would expect, is focusing on this weakness of Reinfeldt’s term in office but it seems that, for reasons reviewed on the prior page, Sweden may be experiencing an important turn on this front:

The reality is that the economy, which has always been the Achilles' heel of any

Swedish right-wing government, is now booming and jobs are coming back. As such, it seems likely that Reinfeldt, and his supply-side agenda, will return to Rosenbad after the elections. The SEK should cheer this news.

Back to Work

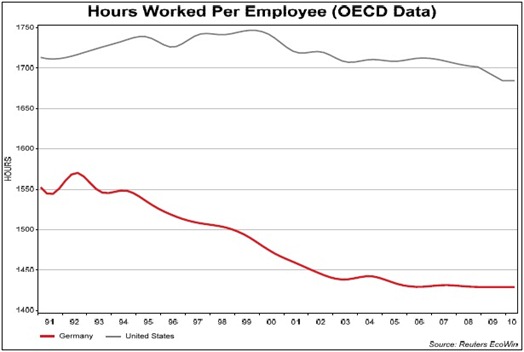

Current economic comparisons between the US and Europe mostly hinge on assessments of fiscal policy, monetary policy, and the like. While these are no doubt important issues, there is also another very important dimension to the debate. Specifically, if we take a step back and think about the foundations of economic growth, the differences between Europe and the US are clear to see. An increase in output is simply labor productivity * labor utilization (hours worked * employment). So when comparing output between say the US and Germany, a simple truth is quickly revealed: the US works more than Germany does. In the chart below we compare the hours worked per employee in the business sectors of Germany and the US. This difference of some 20% is the biggest reason for the divergent per capita output of the two countries. Assuming a 52-week year, the average American works 32.4 hours per week, while his German counterpart works a far more leisurely 27.5 hours per week.

Of course, the rate of labor productivity varies, as does the level of employment (e.g., European countries tend to prefer to maximize employment and cut down on hours worked, e.g., 35-hour week in France, kurzabeit plan in Germany). However, when thinking about structural growth rates, the biggest difference is often a direct consequence of the utilization of labor. For Germany this is—in a round-about way—good news for growth going forward.

Indeed, the above chart shows that the German deterioration in labor utilization of the 1990s has given way to greater stability in the 2000s. Will the 2010s be the decade where Germans go back to work? If so, it could have powerfully positive consequences for growth, wealth, and the fiscal situation.

Over the last 20 years, German labor productivity and real GDP growth have averaged around 1%, which implies a long term stagnation in labor utilization (employment * hours worked). The US, by contrast, has been able to grow approximately at a rate of 1% in excess of its labor productivity, implying structural growth in labor utilization.

If, over the next decade, hours worked in Germany increase to match the current amount of hours worked in the US (granted, this is a very big if), they will increase by roughly 1.66% per year. All else equal, this would give Germany tremendous scope to increase its structural rate of growth from something of around 1.25% to something closer to 3%.

The Tug of Rope

The stock market appeared to pivot last week after Federal Reserve President Bullard opined that the Fed should consider further asset purchases if growth continues to falter. President Bullard advocated buying a large quantity of Treasury bonds to pre-empt what, in his opinion, are mounting deflationary forces. This is in-line with our own belief that, while the private sector is still deleveraging and bank loan books contracting, the Fed cannot stop—let alone reverse—asset purchases (as is the current policy direction, given that proceeds from MBS and agency debt holdings are not being reinvested).

However, while we think further asset purchases are warranted, we are of the belief that they should take the form of more private assets—e.g., securities backed by mortgage, auto or consumer credit; unfortunately, recent comments by the Fed would seem to convey no further scope for such ‘credit easing’ (see Lessons from Bernanke’s Testimony). And Bullard’s comments seemed to suggest that not only should the Fed stop ‘credit easing’, it should move straight on to outright ‘quantitative easing’ (which is what the purchase of further UST would likely be, depending on how they are financed). Thinking about the current dynamic in a Fisheresque MV=PQ framework:

1. Velocity is not increasing, a function of contracting commercial loan books.

2. Money is not increasing either because of the massive government deficits. While private sector gross savings—a product of personal savings and undistributed corporate profits—have surely improved over the last year, they have been overwhelmed by the soaring deficits in Washington. The result is that the net national savings rate is below zero. No money saved, no increase in money…sometimes, it’s just that simple.

With neither money nor velocity increasing, and assuming a steady preference for liquidity, how then do we finance a marginal dollar of nominal GDP growth—the P*Q part of the equation? The answer is simple and not all that constructive: the money has to come out of other risky assets. This, in many ways, explains why the stock market has been fairly tepid in so far this year despite very attractive valuations, why real estate prices cannot seem to find a bottom despite record affordability, and why the economy seemed to decelerate each month in the second quarter. Risky assets and economic growth are at odds with each other, playing a game of tug of rope.

The only variable of adjustment has been the Fed’s purchase of MBS, which stopped in April. With the program, the Fed was supplying credit directly to the household sector. This credit was not a component of V as it was created by the public sector. And, it was not a component of M because base money represents a claim on the Federal government itself (M is bank money, e.g., M2). So, this brings us to a new Fisher equation: (M * V)+FRB credit = P*Q.

Thus, unless or until commercial banks are in a position to increase their claims on the private sector, or the private non-bank sector decides to increase its claims on itself (the shadow banking system), the Fed needs to fill the void by increasing its claims on the private sector. In other words, the Fed needs to change course, and discussions revolving around a lower rate paid on excess reserves, on asset sales, on the purchase of UST… are nothing but counter-productive noise.

Once again, if there is no growth in broad money, no increase in velocity and no increase in Fed credit (hybrid money), then the only source to finance growth in the real economy will remain the sale of risky assets. When confidence seems to be stuck in a low plateau and talk of reigning in fiscal deficits is growing louder, a policy of undermining the value of risky assets couldn’t be more counterproductive to growth.

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.