Stock Market Turn Up Tuesday, POT Gets Really High

Stock-Markets / Stock Markets 2010 Aug 17, 2010 - 02:56 PM GMTBy: PhilStockWorld

BHP offered to pay $38.4Bn for POT this morning.

BHP offered to pay $38.4Bn for POT this morning.

Is BHP high or is this market seriously undervalued? Well, for one thing, POT turned them down saying the offer ($130/share - CASH) "substantially undervalues PotashCorp and fails to reflect both the value of our premier position in a strategically vital industry and our unparalleled future growth prospects." CEO Dallas Howe continues: "We believe it is critical for our shareholders to be aware of this aggressive attempt to acquire their company for significantly less than its intrinsic value.

The fertilizer industry is emerging from the recent global economic downturn, and we feel strongly that PotashCorp shareholders should benefit from the current and potential value of the Company. We believe the BHP Billiton proposal is an opportunistic effort to transfer that value to its own shareholders."

Considering POT closed at $112 yesterday, so a 16% pop in the offer but POT was at $85 at the beginning of July and hasn’t been over $130 since the 2008 crash, although they did top out at $239.35 so I suppose a very patient investor could imagine that within 5 years, $200 is not an unreasonable goal. Still, is that enough reason to turn down $130 of cash now, with the proverbial 1.3 birds in the hand being worth 2 in the bush?

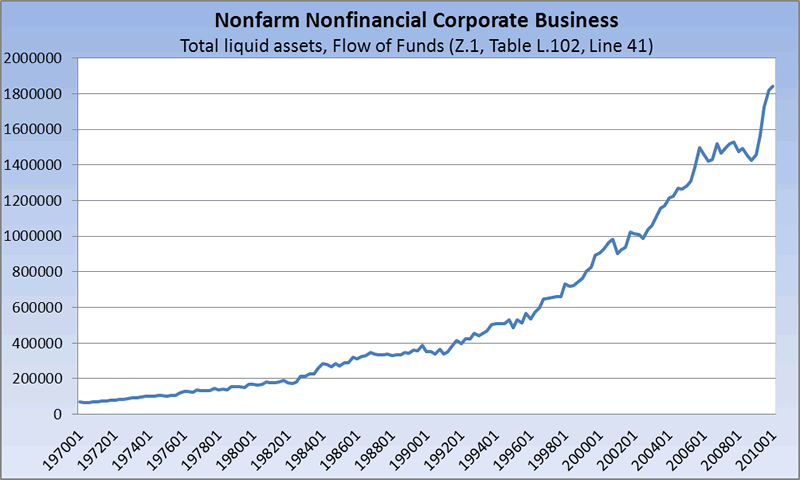

Back on July 12th (when POT was trading at $92.81 and the Dow was at 10,200) my premise for looking for S&P 1,100 and Dow 10,700 was that Corporate America’s Non-Financial companies were sitting on a $2Tn pile of cash and, as an old M&A consultant, it seemed pretty obvious to me what was going to happen to that money.

We’ve had plenty of M&A activity recently. In fact, M&A activity in the first half of 2010 saw 5,345 deals (up 49% from last year), the highest level since 2007, indicating that companies are INCREASING their confidence in the economy despite the BS spin you are getting from politicos who NEED you to believe things are worse than they seem and the MSM, who push fear like heroin to create a NEED for their product.

POT’s board of directors is very confident that they don’t NEED BHP’s money and BHP may NEED POT badly enough to want to sweeten the deal - frankly I’m surprised at the timing because I would have waited for another dip and the fact that BHP (one of the World’s largest resource companies with $50Bn in annual sales) didn’t think they could wait indicates to me that they see the overall economy turning up. Of course they are based in Australia and supply China, India, Singapore and other hot Asian economies but isn’t that one of the big fear sticks the media has been hitting us with - the scary China slowdown?

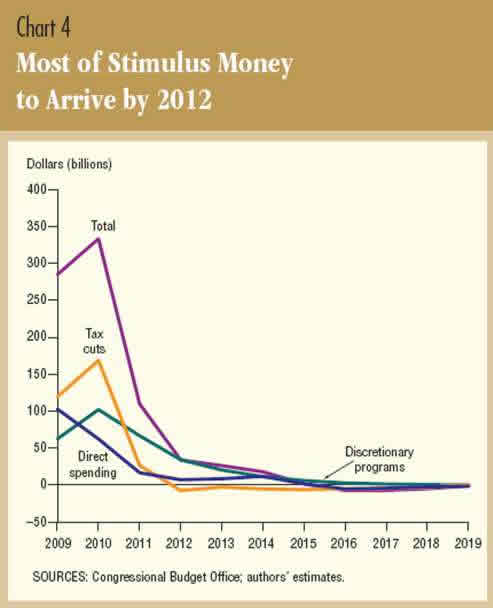

I had a meeting in the Treasury Department yesterday, which I will address later this week in a larger article, but I will say that THEY are not worried about a double-dip recession. That’s not to say that they are blind to the possibility but they certainly don’t see it in any of their models. More to the point, they are very concerned that we are at the point of accidentally unleashing inflation and they are FAR more concerned about that than deflation. Stimulus spending is down about 50% since the beginning of the year so what we are seeing now IS the slowdown on the removal of stimulus and - IT’S NOT THAT BAD!

I had a meeting in the Treasury Department yesterday, which I will address later this week in a larger article, but I will say that THEY are not worried about a double-dip recession. That’s not to say that they are blind to the possibility but they certainly don’t see it in any of their models. More to the point, they are very concerned that we are at the point of accidentally unleashing inflation and they are FAR more concerned about that than deflation. Stimulus spending is down about 50% since the beginning of the year so what we are seeing now IS the slowdown on the removal of stimulus and - IT’S NOT THAT BAD!

As I’ve often pointed out, our Government is very concerned about unemployment and so am I but corporate America is not - THEY LOVE IT! Labor costs are about 1/3 of all Corporate Expenses and Manufacturing Unit Labor Costs fell 6.1% in the second quarter after dropping 6.9% in the previous 4 quarters so 13% lower labor costs since the beginning of 2009 - that’s money in the Corporate Bank folks!

So, even if US consumer spending was off 10% due to high unemployment (it isn’t) and our beloved S&P 500 Corporations didn’t get 50% of their sales from expanding overseas markets (they do), a 13% drop in the cost of production would mean they make more money selling 10% less stuff anyway. I went into detail about this in my "Pile of Cash" article so I won’t rehash it here - this is just the numbers bearing out my theory. Jason Saving of the Dallas Fed has an article today asking "Can the Nation Stimulate It’s Way to Prosperity?" and I’ll be tying this and other Fed and Treasury speak into my overview of the meeting later this week.

I will say that Conservatives should be encouraged that Mr. Geithner did not agree with my "New, New Deal" proposal to redirect support away from the banks and towards the homeowners, in large part because it is politically unfeasible in the current climate. He also questioned whether or not the Treasury had the authority to, in effect, purchase land - to which I responded "Why not, you guys bought Alaska, didn’t you?" It turns out that the purchase of Alaska was initiated by the Secretary of State (Seward’s Folly) and had to be ratified by both Houses of Congress before we were able to buy Alaska for $7.2M. Does this mean I have to go see Hillary now? She seems kind of busy…

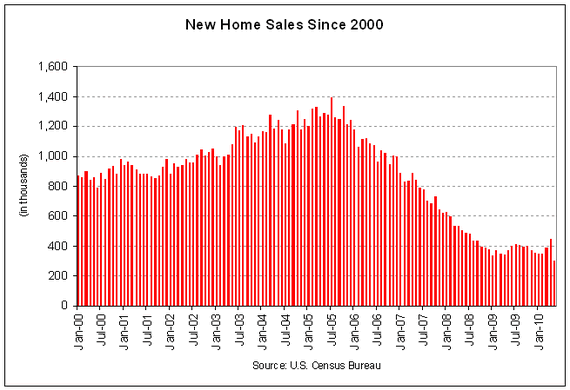

So business will continue as usual with EZ money pouring into the banks who feel no particular reason to lend it out and are, in fact, using the still-developing FinReg to justify their stick-in-the-mud lending policies so we won’t be looking for the housing market to turn this economy around any time soon. In fact, we just got Housing Starts this morning and they were an anemic 546,000 for July with Building Permits doing nothing to cheer us up at 565,000 - both down from June. There are 50 states so 10,000 homes per state and let’s call it 250 working days a year so, on average, there are about 40 homes being built per state, per day.

Somehow, I’m not seeing that as putting a lot of food on the table for construction workers, realtors, mortgage brokers or even the poor Bankers who continue to use the free money the Fed is giving them to buy TBills from Treasury. Heck, they were selling 10-year notes for 2.5% last week - no wonder they are happy with the status quo! Nothing I heard at Treasury shakes me off my position that gold is overpriced but we’re certainly not going to be expecting a "strong dollar" policy either, which means we won’t be expecting any major currency-initiated housing price drops but tepid demand and tight lending means we won’t be seeing "normal" housing activity (800K homes) for quite some time.

Industrial Production came in at 1% for July, far better than last month’s -0.1% and better than the 0.6% expected by economists, who were only off by 66% this month so kudos to them for another job well done. I read a great article in the Financial Times yesterday dissing economics, hopefully I can find it later as it’s well worth reading. Cap Utilization was more in-line with expectations at 74.8%, a small increase from June’s 74.1% so slow and steady continues our improvement.

WMT put up good numbers (International strength, of course) and HD did well this morning. Asia was flat this morning but Europe is up nicely, about 1% ahead of our open and the US Futures are looking bright so we will see what sticks this morning - hopefully we can finally get out of the doldrums this week.

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.