U.S. New Home Sales Housing Market Forecast 2010 to 2020

Housing-Market / US Housing Aug 27, 2010 - 02:29 AM GMTBy: Andrew_Butter

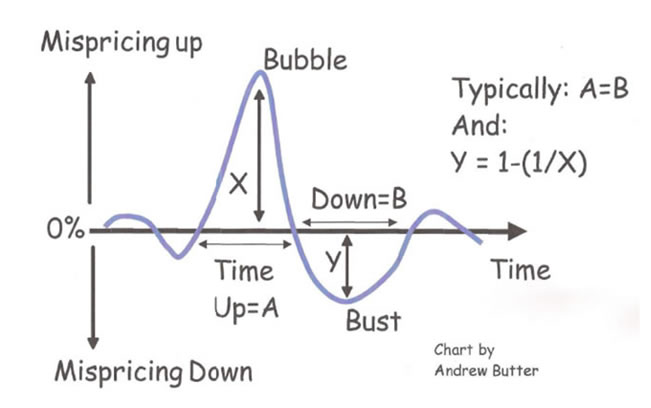

A bubble is like if you have a flat pond, and you throw a pebble in.

A bubble is like if you have a flat pond, and you throw a pebble in.

First there is an “up” wave; that you can ride (if you are smart or lucky); then there is a “down” wave, and the size and the shape of the down that follows the up is predicated by the size and the shape of the preceding up.

That’s nature, and in the end, what’s left is zero-sum less “efficiency” losses. In a market the line of the “flat pond” is sometimes called the “fundamental”, that’s where the equilibrium line ends up when government hooligans and their agents stop throwing pebbles into the pond, to try and disrupt nature.

Working out what is the “fundamental” in a market can be hard, particularly if the history of the market has been “choppy”. But mathematically if it isn’t changing much over time, it’s equal to the square root of the peak of the bubble multiplied by the peak of the trough.

That seems to work pretty well for prices, how about for physical demand for new assets?

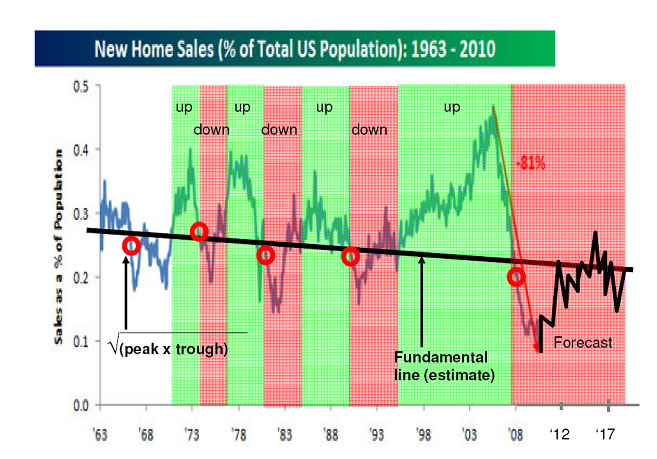

This is a chart from a post by B.I.G. which I have annotated:

http://seekingalpha.com/article/222248-housing-the-lost-half-decade

The little red circles are a calculation of where the “fundamental” sales of houses as a percentage of the population of USA should lie. There is a certain amount uncertainty in those calculations due to “noise”, but the trend line looks like it might be heading slightly down (the black line).

The periods of “up” compared to “down” above and below the “fundamental” are shaded in red (down) and green (up), the periods of up compared to down looks pretty much similar, historically (there is “noise” in there too).

So looking to the future, there was a period of “up” starting about 1995, so if “history repeats” what’s coming next is a period of “down” (the forecast – just the shape of the preceding “down” expanded).

Buy that line, and it looks suspiciously as if, regardless of how much the US government and it’s agent the Fed huff and puff, it could be another ten years before the sales of new houses in USA gets back to the “fundamental” of about 0.22% of the population (I presume that’s per month?).

Of course what happens to the population is another story, for the past twenty years the population of USA has been mainly driven by immigration (legal and illegal).

So one way to “solve” the current malaise might be to start handing out Green Cards to anyone outside the wall that separates the “Good” from the “Evil”, who can come up with a 30% deposit on a new house, rather than exporting those jobs to China.

But the way things appear to be going in Arizona, it looks like the consensus will be to rely on the “tried and tested” huff and the puff strategy to dig America out of the hole that huff and puff created.

Perhaps THIS TIME there will be “Change to Believe In”…chance is a fine thing!!

I think King Canute said that?

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.