United States Economy Caught in the Jaws of Death, Housing Market Mantra

Economics / Double Dip Recession Sep 19, 2010 - 12:31 PM GMTBy: Gordon_T_Long

The United States is facing both a structural and demand problem - it is not the cyclical recessionary business cycle or the fallout of a credit supply crisis which the Washington spin would have you believe.

The United States is facing both a structural and demand problem - it is not the cyclical recessionary business cycle or the fallout of a credit supply crisis which the Washington spin would have you believe.

It is my opinion that the Washington political machine is being forced to take this position, because it simply does not know what to do about the real dilemma associated with the implications of the massive structural debt and deficits facing the US. This is a politically dangerous predicament because the reality is we are on the cusp of an imminent and significant collapse in the standard of living for most Americans.

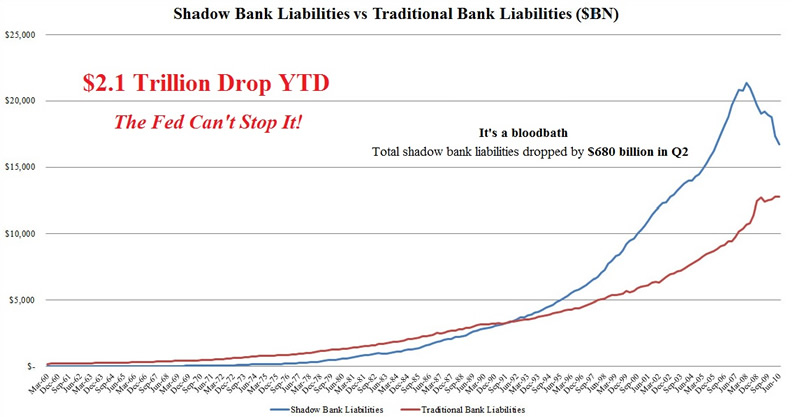

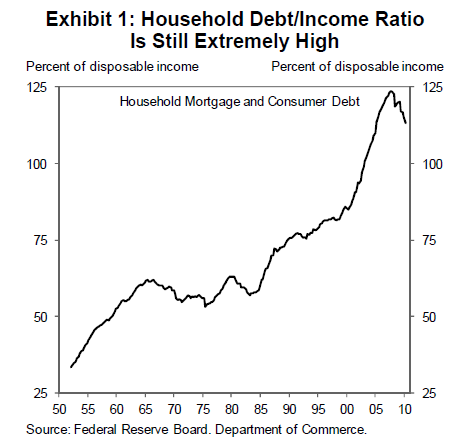

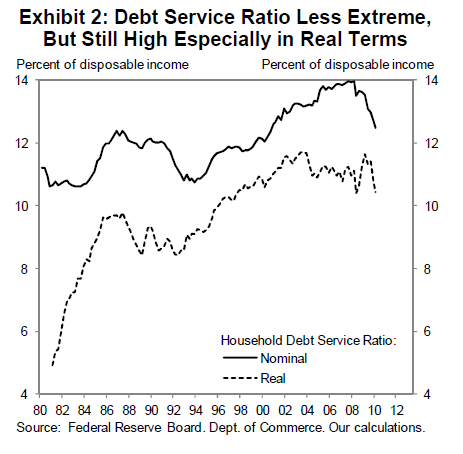

The politicos' proven tool of stimulus spending, which has been the silver bullet solution for decades to everything that has even hinted of being a problem, is clearly no longer working. Monetary and Fiscal policy are presently no match for the collapse of the Shadow Banking System. A $2.1 Trillion YTD drop in Shadow Banking Liabilities has become an insurmountable problem for the Federal Reserve without a further and dramatic increase in Quantitative Easing. The fallout from this action will be an intractable problem which we will face for the next five to eight years, resulting in the 'Jaws of Death' for the American public.

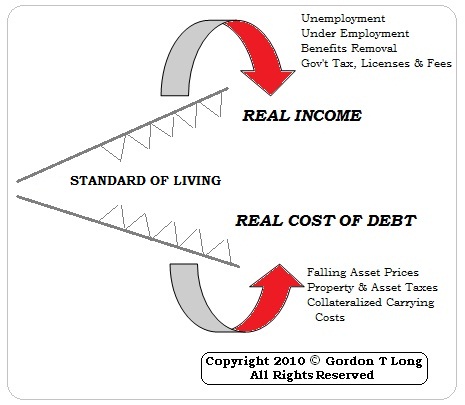

The 'Jaws of Death' is the crushing squeeze of a shrinking gap between incomes and a rising burden of the real cost of debt burdens. Many may say there is nothing new in this, but I would respectfully disagree. There is a widespread misperception of what is actually evolving that stops voters from forcing politicians to address America's substantial underlying dilemma. It also stops investors from positioning themselves correctly.

Any solutions of real substance are presently considered political suicide. It is wiser to wait for a crisis event to unfold. As White House Chief of Staff and a primary Obama political strategist, Rahm Emanuel has said on numerous occasions: "You never want a serious crisis to go to waste". It doesn't take much intelligence to understand this also implies looking for a crisis as a political shield, for example from an almost insurmountable political problem such as a generational reduction in the US standard of living.

Before I delve into misperceptions of the 'Jaws of Death' and a reduced US standard of living, we need to briefly consider for a moment whether this is a planned outcome or just happenstance? President Franklin Roosevelt said:

"Nothing in politics happens by chance".

Being in business I have always been very watchful of a slightly different variation of the same theme:

"Strategy is something that happens to you while you are looking the other way".

Maybe Mark Twain said it better than both of us:

"It ain't what you don't know that gets you into trouble. It's what you know for sure and just ain't so!"

My point is that there is a strong possibility that the 'Jaws of Death' is an orchestrated plan to reposition America's standard of living. A plan not for the good of Americans but for the good of the banks and those that control the $630 Trillion unregulated, off shore, off balance sheet, OTC derivative market. It is no secret that America's standard of living is no longer viable, as evidenced by a continuous and chronic deterioration in the US Balance of Payments, Trade Deficit and Current Account funding. It must be addressed and this may already be happening in a stealth fashion.

What the above suggests is that we need to address what is perceived as 'truisms' but in fact are not; what is perceived as reality versus what is perception. These subtleties are the veils that hide the real dangers from us.

THREE MISPERCEPTIONS

1. Housing

Consider President George W. Bush's 'ownership society' where it was heralded, along with the previous Clinton administration, that every American should own his/her own home. It is fair to say that our society bought into this 'hook, line and sinker'. I used to hear the following statements endlessly, and disputing any of them fell on deaf ears with blank stares, as though you were an idiot to even challenge them.

I can't remember how long it has been since I have heard any of these statements. How quickly accepted fact is found to be mistaken. Without this false mantra being sold to the public we would never have had a CDO driven financial crisis. Consider for a moment who is responsible for orchestrating this false belief system that the financial collapse was built on? Our government's misguided public policy certainly holds some responsibility for this.

2005 |

2010 |

|

|

"The public and majority of investors are always wrong."

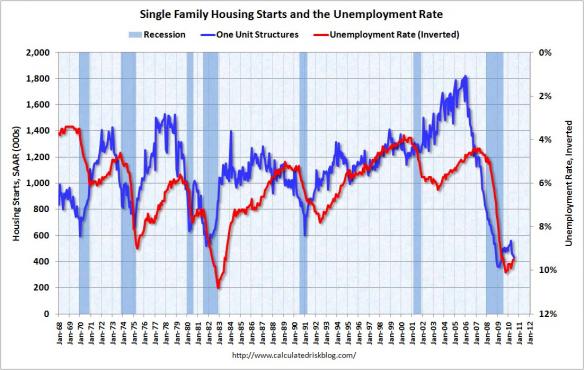

What we now face is the reality that jobs have disappeared and housing has fallen in an almost mirror image of unemployment as shown by housing starts below.

According to a recent 3,400 households' survey by Fannie Mae, a more realistic attitude towards homeownership has emerged as the American dream of owning a home has lost its allure. Only 67% felt housing was any longer a safe investment and 33% said they were likely to rent in the future. The Wall Street Journal recently cited an interesting illustrative example of shifting psychology in which a 26 year graduate student walked away from his down payment to purchase a condo because he felt homeownership was an "economic trap" and "being mobile and adaptable to the job market was far more important than homeownership".

The National Association of Realtors is starting to show signs of panic because this shifting psychology is moving legislators to reconsider federal subsidies for homeownership. It has reacted by launching a campaign on the "value of homeownership". I wonder if the National Association will get the same look I did when I questioned the housing statements listed above. Oh how quickly things change!

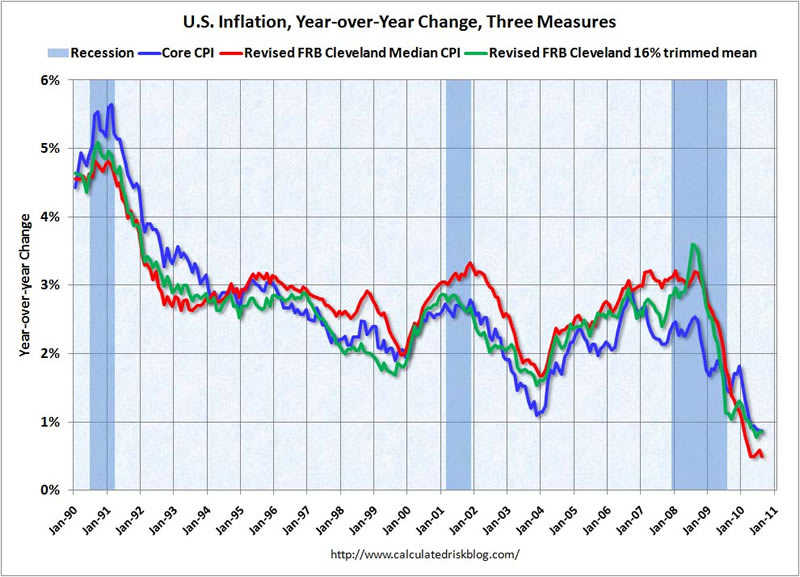

2. Inflation / Deflation

I am continuously troubled by the inflation - deflation debate. One of a number of issues in these debates that concerns me is no one ever defines 'time' in their analysis and predictions. Without time specified we could have inflation, then deflation, (or visa-versa) for exactly the reasons that both opposing views meticulously articulate. Maybe even more blatant is that seldom do analysts consider the possibility that we could have both. This is the school that I am a believer in.

I predict that over the next few years we will have inflation in the things we NEED and USE. These are the items we buy and consume every week, the items we buy and not finance, and the items we need ready and recurring cash for. Food, energy, consumables, and basic services are examples.

We will have deflation in the things we WANT and OWN. These are the items we strive for that we perceive will move our lives to an even higher standard of living. They are primarily assets like: housing, real estate, financial instruments, boats, exotic cars, art, collectibles, etc. - often the items we finance.

It may be as simple as Maslow's Hierarchy of Needs; until our survival needs are met we won't move towards the ultimate state of self actualization. We won't think of luxury goods when we are hungry, cold and tired. But what is pushing us towards the 'survival' end of Maslow's spectrum? If we live on debt and it becomes harder to secure or service, then this will accomplish that shift, despite new debt being cheaper than it previously was.

Money supply which is a driver of monetary inflation and deflation is now negative, as shown by the broader M3 money supply (which is no longer reported by the government). This illustrates that despite massive monetary intervention, forced deleveraging of mal-investments has come home to roost.

3. Credit Availability versus Credit Demand & Debt Servicing

Thirdly, only a few years ago interest rates were considered low and widespread refinancing was occurring. Home equity loans were all the rage to buy new boats, campers, vacation homes and every other imaginable toy that cheap money was felt to afford. Advertising was replete every evening with 0/0/0 financing offers: Zero down payment, zero payments for 48/60 months and zero interest. Who could refrain from taking advantage of these incredible offers?

Well guess what? Interest rates are now significantly lower and the products you bought previously are in most instances now even cheaper; yet few are clamoring for them. At the marina where my boat is moored, you can't give away a boat; where only a few years ago no one could get a mooring or slip for their newly purchased boat. What has changed is we can generally no longer service our debt loads at even present historic 50 year low interest rate levels. Heaven forbid rates should go up!

The central issue may be not about whether rates go up, but rather if the above outlined housing weakness, concurrent inflation/deflation and weak credit demand persist for a protracted period.

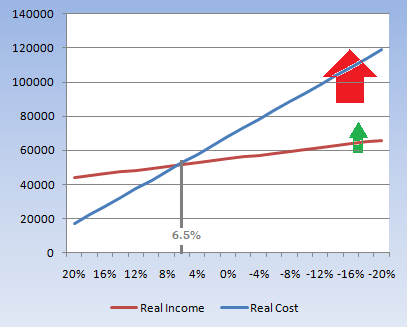

I would like to show you exactly what this means if these trends persist, by using a fictional family as a way of illustrating what is now in store for the public.

THE SMITH FAMILY DILEMMA

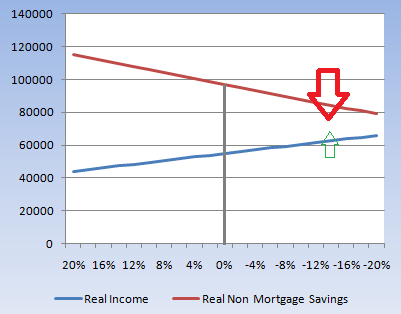

The Smith family bought into all this mantra by purchasing a home. All their peers were doing it. Their family kept asking them why they hadn't bought a home; and if they didn't, they would surely never be able to afford one. They felt pressured to take on the debt obligations. Unlike many, they were relatively conservative and bought a home with a small down payment, securing a $200,000 mortgage at 6.5% fixed for 5 years. The mortgage was possible because they absorbed Private Mortgage Insurance (PMI) payments into their monthly budget. The family income was $50,000 annually. These are all nominal prices. To adjust for real values, we need to subtract the inflation rate from the mortgage rate. Inflation helps the Smith's get ahead over the leveraged housing asset. The higher the inflation rate above 6.5% the more they win. The drawback is that their $50,000 income diminishes in real value. The salary therefore needs to be adjusted for real terms by subtracting the inflation rate from the $50,000. Here are the theoretical results for various Deflation, Inflation and Hyper-Inflation scenarios.

As bad as the above theoretical charts look, it is actually worse in reality. Why? Because as the pressures mount on unemployment, underemployment and competition for jobs, money becomes tougher and harder to earn. As disinflationary pressures shift to deflationary pressures, housing prices fall faster than the overall inflation/deflation rate. As a matter of fact they fall substantially faster. The following table represents the same numbers for the Smith family, but I have adjusted for the variance in house prices falling faster than the overall deflation rate. This is where it gets really scary.

What the charts tell us is that if present Monetary and Fiscal Policy is anything other than totally successful in arresting deflation and creating balanced inflation in both what we USE and OWN, we are in serious troubles. Any imbalances will be a disaster as shown on our charts. A failure to stop deflation will be devastating to those who are in highly leveraged assets.

If after reading the former example of the Smith Family you discarded it because you strongly believe elevated inflation is around the corner and you are a highly leveraged home owner, let me take you through a brief quiz published by The Daily Bell to further test your understanding of reality: "The Great Housing Bamboozle: A Look Behind The Numbers Shows Home Ownership To Be A Horrible Investment".

WHAT ARE THE CHANCES OF HOUSING FALLING FURTHER?

As I mentioned previously, attitudes towards housing as an investment have changed. There has been enough written on the housing decline but surprisingly little on how much further it is likely to go or whether it should be considered an investment at all.

Even after massive assistance in the form of HAMP, over $1T of government purchases of Government Agency debt, 50 year low interest rates and Quantitative Easing, the Federal Reserve's monetary policy and the US fiscal policy has been unsuccessful in reversing the housing decline. New Sales, Housing Starts and Building Permits continue to deteriorate as housing inventories once again resume their climb with untold amounts of 'shadow' inventory still being held back from foreclosure by the banks.

Karl Case, the co-founder of the S&P/Case-Shiller home-price index, believes "a common mistake of the housing bubble years was the desire to own something that goes up in value rather than to own something you can afford". He feels "more Americans need to view homes as durable goods, such as cars, and not primarily as investments".

Housing is not coming back soon and I suspect we are still in the middle stages of a longer term housing correction. Historically, major financial distortions always return to at least retest their long term trend support. By various comparisons we still have a fair ways to go over the next two years.

PEOPLE ARE STILL HURTING - IT ISN'T GETTING BETTER!

A recent convention in Palm Beach Florida (right) attracted over 50,000 people, estimated to be holding 25,000 problem mortgages. This is after the government placed Fannie and Freddie in conservatorship and bought over $1T in agency mortgages to keep the US mortgage system from imploding.

FHA will soon be in a similar untenable position as the government has become the holder of almost all new US mortgage product. If this is not sustained, despite it being a near impossibility to do such, US housing may not just fall further but collapse.

CONCLUSION

"The great enemy of the truth is very often not the lie - deliberate, contrived and dishonest - but the myth - persistent, persuasive and unrealistic." ~ John F. Kennedy, 1962 commencement address at Yale University

A mericans must face the hard reality that the US is now in decline and rapidly relinquishing its hold as the world's dominant industrial power. A serious failure in political leadership to recognize this and act upon it, along with misguided public policy legislation, has hastened the decline.

mericans must face the hard reality that the US is now in decline and rapidly relinquishing its hold as the world's dominant industrial power. A serious failure in political leadership to recognize this and act upon it, along with misguided public policy legislation, has hastened the decline.

What this means is that America's standard of living, which has almost been assumed as a birthright, is now in jeopardy and for the middle class is already in full erosion. America, like all great powers in decline, has become complacent and apathetic with an unjustified sense of entitlement. Americans somehow believe that bad things cannot befall America, as though it is preordained to always be a preeminent power with the corresponding highest standard of living.

The facts are that we are at the precipice of a crushing decline in our standard of living due to fifty years of wasteful spending and bad public policy. We are near or now possibly past the point of no return without bold and rapid change. We need change that can only come from the public's understanding of what change specifically is required and not just a political billboard proclaiming the 'change' mantra at election time.

As we move more and more towards a "have" and "have not" society where the middle class is disappearing and the government is involved in all aspects of our lives and economic well being, we are becoming acutely aware that America is now different. Our perceptions of what America is no longer matches the reality around us on a daily basis. The middle class in America is rapidly disappearing.

Like housing being a good investment, much of what we hear or believe are false perceptions. We are distracted by these contrived and orchestrated misperceptions from the hard reality in taking the actions required to make real needed change. The US Standard of Living is now on the line.

Follow daily Tipping Point developments at Tipping Points

Sign Up for the next release in the Preserve & Protect series: Commentary

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.