FOMC Policy Statement, Fed's Level of Uneasiness Up Several Notches, Postpones Action

Interest-Rates / US Interest Rates Sep 22, 2010 - 03:18 AM GMTBy: Asha_Bangalore

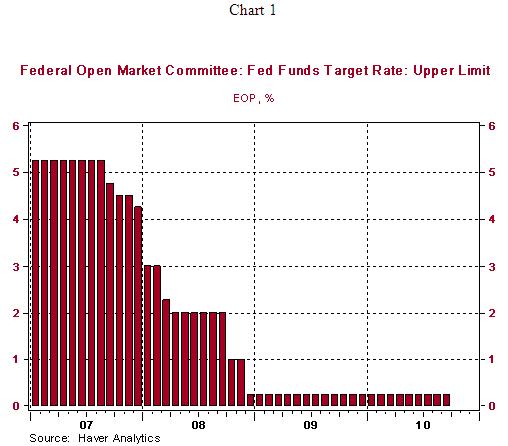

As expected, the target federal funds rate was left unchanged. President Hoenig of Kansas City cast the lone dissenting vote; he has taken the opposing stance in all meetings year-to-date.

As expected, the target federal funds rate was left unchanged. President Hoenig of Kansas City cast the lone dissenting vote; he has taken the opposing stance in all meetings year-to-date.

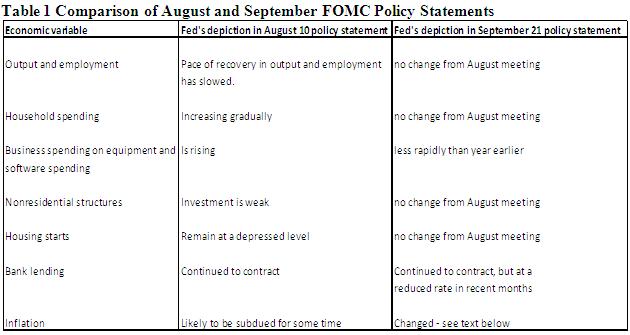

The Fed tweaked its rhetoric slightly with respect to its evaluation of output, employment, spending, and bank lending (see table below). The policy statement presented a major change in the extent of Fed's concern regarding the possibility of a deflationary situation in the economy.

The Fed essentially made it abundantly certain it stands ready to provide on all sorts of support to prevent a deflationary situation from becoming entrenched in the economy. The excerpts below highlight the important change in the policy statement.

Aug.: The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Sep.: The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.

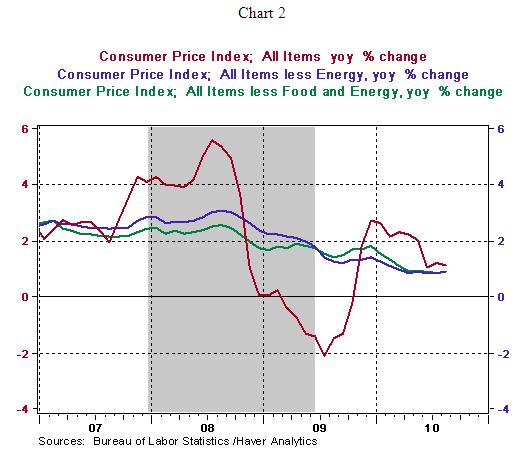

The nature of details seen in the August Consumer Price Index and projections of less than stellar economic growth have prompted the Fed to explicitly convey its intentions to financial markets. The main conclusion is that if economic conditions weaken, the Fed will take action soon.

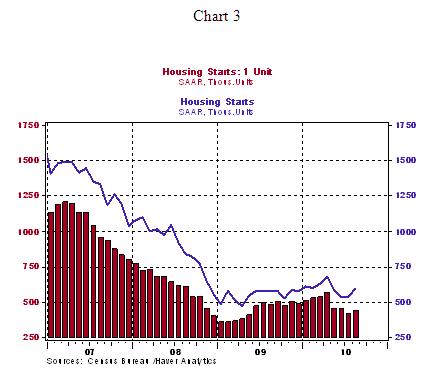

Home Construction - Mixed Message

Construction of new homes increased 10.5% to an annual rate of 598,000 in August vs. 541,000 reading in July. The July estimate was revised down slightly to show a smaller increase than previously estimated (+0.4% vs. +1.4%). Multi-family starts moved up nearly 33% in August and that of single-family homes starts rose 4.3% during August. Construction of multi-family units has risen, while single-family starts have languished for the most part in recent months. On a regional basis, housing starts fell in the Northeast (-24.3%), but moved up in the Midwest (+21.7%), South (+7.0%), and Midwest (+21.7%).

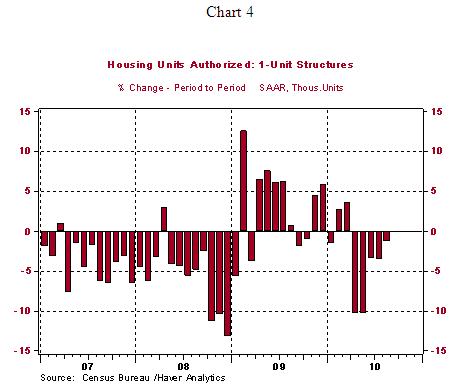

Permits issued for new multi-family homes rose 9.8% to an annual rate of 168,000 in August. More importantly, permit extensions for single-family units declined 1.2% in August, which is the fifth consecutive monthly decline. This trend bodes poorly for future housing starts. The August housing starts report essentially contains a mixed message with a slight bias supporting forecasts of soft growth in construction of new homes in the near term.

The End of the Great Recession - Addendum

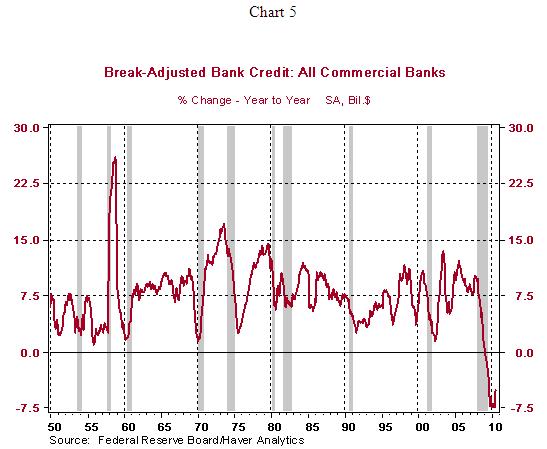

In the daily commentary of September 20, we included a chart to highlight the moderate recovery path of the current upswing in economic activity compared with the situation after the long recessions of 1973-75 and 1981-82. We should have taken this line of thought further because it is important to note that the nature of the 2007-2009 recession is vastly different from other post-war downswings in economic activity. The U.S. economy has experienced a financial crisis of historical dimensions along with the longest and deepest credit crunch (see chart 5) not seen in the post-war period. Recessions combined with financial crisis are typically followed by significantly soft recoveries. Comparing the current recovery with that of those following the 1973-75 and 1981-82 recessions is an incorrect evaluation.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.