U.S. Housing Market BIG Picture, Shiller's Forecasts and Media Propaganda

Housing-Market / US Housing Sep 24, 2010 - 01:47 AM GMTBy: Mike_Stathis

Each month, the media lines up to read the results of the S&P/Case-Shiller Home Price Indices. It’s published the last Tuesday of the month and reports on data 60 days in arrears. This group of indices is generated and published by Standard & Poor's and Fiserv Inc. Keep in mind that these indices are maintained by the Index Committee members drawn from Standard & Poor's, Fiserv CSW, and so-called “leading industry experts.”

Each month, the media lines up to read the results of the S&P/Case-Shiller Home Price Indices. It’s published the last Tuesday of the month and reports on data 60 days in arrears. This group of indices is generated and published by Standard & Poor's and Fiserv Inc. Keep in mind that these indices are maintained by the Index Committee members drawn from Standard & Poor's, Fiserv CSW, and so-called “leading industry experts.”

The objective of these indices is to measure the growth in value of residential real estate regions across the U.S. The total report includes 23 indices - 20 metropolitan regional indices, two composite indices and a national index. Perhaps the most talked about is the 20-city housing price index.

Despite having access to a tremendous amount of data as a primary contributor to these indices, Mr. Shiller seems to be about as lost as Ben Bernanke when it comes to real estate forecasting.

Remember, Shiller’s role in the construction of these indices is that of monthly data analysis, not real estate forecasting. Despite this, the media lines up to report what he has to say regarding forward-looking estimates of the housing market. However, Shiller has flip-flopped numerous times on his housing forecasts.

Here is a brief summary of Shiller’s forecasts during the correction.

April 22, 2008

Shiller: Housing slump may exceed Depression

http://www.msnbc.msn.com/id/24257182/

June 6, 2009

HOME prices in the United States have been falling for nearly three years, and the decline may well continue for some time.

http://www.nytimes.com/2009/06/07/business/economy/07view.html?_r=1&scp=1&sq=Shiller&st=cse

July 28, 2009

U.S. housing recovery seen possible now: Shiller

http://www.reuters.com/article/idUSN2861218520090728

August 26, 2009

U.S. Housing May Be Turning Around, Shiller Says

“We might be seeing a turnaround.”

“Recessions are generally ‘V’ shaped. Probably something like that will happen again,”

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a5tOdeaxYuvI

August 27, 2009

“The sense that something is changing is definitely in the air. “After three years of decline, we might be seeing a turnaround.”

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aAY_HtPYgO7s

January 12, 2010

“The uncertainty is maximal as to where it (the housing market could go from here. I don’t want to be wrong.”

http://blog.oregonlive.com/frontporch/2010/01/no_top_5_today_instead_heres_r.html

January 12, 2010

INTERVIEW-Yale's Shiller sees new drop in US housing prices

"I think it's more likely to be a decline than a rise in the next few months."

http://www.reuters.com/article/idUSN12200896?rpc=21

March 4, 2010

The housing recovery is "in a precarious state."

http://finance.yahoo.com/tech-ticker/housing-is-%22in-a-precarious-state%22-yale%27s-robert-shiller-says-436306.html?tickers=XHB,MAS,LOW,HD,DHI,PHM,LEN&sec=topStories&pos=8&asset=&ccode=

April 20, 2010

Housing Market May Not Be That Weak, Shiller Says

April 20, 2010

Don’t Bet the Farm on the Housing Recovery

http://www.nytimes.com/2010/04/11/business/economy/11view.html

The fact is that it’s basically impossible to give monthly forecasts in housing prices. Shilling knows this himself. However, the media pressures him for such forecasts and he willingly steps up to the plate, although he often covers his tail by adding “but things might be different this time.”

Credible forecasts are made over a several-month or several-year period, and they hold. When adjustments are required, they aren’t made each month, but over a several-month period. While monthly data might be helpful to analysts as a source of knee-jerk activity, such a short-term outlook does nothing to help potential homebuyers who look for trends instead of monthly swings.

Furthermore, monthly forecasts do not provide any value when you alternate between being bearish and bullish. When you see these monthly flip-flops, you should not mistake them as forecasts. They are nothing more than broadcasts. Broadcasts serve no other function than to create confusion within the market place.

There is only one way to forecast the correction of the largest real estate bubble in history and that is to estimate by how much it will decline. While it’s impossible to know exactly when this bottom will occur (due to the various forms of market manipulation by the Federal Reserve and Washington), that does not matter because the days of flipping properties are over.

Estimating a price bottom is important because home buyers want to pay a fair price without the fear of a drop of 10 or 15% in the value of their home. But responsible home buyers also intend to stay in their home for several years, so any short-term decline shouldn’t matter as long as they have bought relatively close to the bottom. It’s a psychological issue more so than anything else.

No one should ever buy real estate because they think they will make money from its appreciation. That may seem obvious now, but I discussed this in detail in my 2006 book.

Under normal conditions, housing appreciation closely follows the rate of inflation. Over time, the money spent on homeownership is unlikely to match the investment returns of a CD, after all expenses have been factored in and after adding the monetary benefits of the mortgage interest tax deduction. I discussed this in America’s Financial Apocalypse.

Shiller has done some admirable work in market valuation and behavioral finance. These are his fortes, not real estate forecasting. But when asked to provide a forecast of the real estate market, he out steps his reach. Instead of flip-flopping month after month, Shiller should just say “I don’t know what’s going to happen.”

One thing Shiller has said that was spot on regarding the housing bubble…

"The reason that so few economists saw this crisis coming is that they completely blocked out from their view anything about human behavior."

Keep in mind that economics is largely a social or behavioral science. In other words, Shiller was basically implying that most economists are incompetent.

In America’s Financial Apocalypse (among other things that have materialized) I forecast a median house price decline of 30% to 35% from peak levels reached in mid-2006. The book was released in late 2006. This is close to where we are today (see reference 1 at the end).

Since 2007, I have insisted the housing market would get worse in coming years. I stand by my original forecasts made in 2006. As you can imagine, there have been no real improvements to the U.S. housing market in 2010, despite claims made by the Establishment (Washington, Wall Street, real estate shills, the media, academic economists and others tied into the system).

The national median existing home price for all housing types was $182,600 in July, up 0.7% from a year ago. Distressed home sales accounted for 32% of transactions in July (unchanged from June), versus 31% in July 2009.

Now let’s have a look at what the real estate industry’s main cheerleader and clown has to say. Quoting Lawrence Yun, chief economist of the National Association of Realtors (NAR)...

“Thanks to the home buyer tax credit, home values have been stable for the past 18 months despite heavy job losses,” Yun said. “Over the short term, high supply in relation to demand clearly favors buyers. However, given that home values are back in line relative to income, and from very low new-home construction, there is not likely to be any measurable change in home prices going forward.”

Once again, Yun is dreaming. Over the past few years, Yun has made a name for himself as the “Jim Cramer” of real estate forecasting (see reference 2 at the end).

While home prices are back in-sync with incomes in a FEW cities, in the vast majority of cities home pricing remains high relative to median incomes. Incidentally, most of these cities never experienced much of a bubble in housing.

Given the persisting high rate of unemployment and absence of job opportunities, combined with the absence of real median wage growth over the past decade, it’s clear that home prices will decline from current levels in many parts of the U.S.

Rather than discuss the reality of housing inventories, Yun sidesteps this very important data by implying that the huge overhang of empty homes is a short-term problem.

Total housing inventory at the end of July increased 2.5% to 3.98 million existing homes for sale. This represents a 12.5-month supply at the current sales pace, up from an 8.9-month supply in June. New home inventory is only 12.9% below the record-high of 4.58 million units reached in July 2008. The normal housing inventory is about 4-6 months of supply.

Furthermore, we cannot forget about the shadow inventory. Not only does this number include a few million homes in the foreclosure process and late delinquencies (a large percentage expected to result in foreclosure), it also includes (by my definition) several million homes owners have wanted to sell but have been waiting for a healthy market. Perhaps you are in that category.

When we combine this huge shadow inventory with an approaching period of rising interest rates, as well as an the influx of baby boomer scale downs to smaller properties and retirement communities, at the very best of situations, real estate pricing will remain flat over the next several years. Thereafter, the appreciation will be very modest.

Now let’s have a look at a recent statement from the president of the NAR...

“NAR President Vicki Cox Golder, owner of Vicki L. Cox & Associates in Tucson, Ariz., said there are great opportunities now for buyers who weren’t able to take advantage of the tax credit. “Mortgage interest rates are at record lows, home prices have firmed and there is good selection of property in most areas, so buyers with good jobs and favorable credit ratings find themselves in a fortunate position.”

A good selection of properties, huh Vicki?

Let’s have a look at Ms. Golder’s “business website” and see what bargains she has to offer in the Tucson area. Looking at the website alone should tell you what kind of expertise she offers. http://vickicox.point2agent.com/blogs/vicki_cox/default.aspx

I’m sure many of you are asking whether this is a joke.

But it gets worse. Below is a recent listing taken from Ms. Golder’s website.

Single Story for Sale in Catalina

• 1,215 sf, 2 bath, 3 bdrm single story $157,900

I don’t know about you, but if given a choice whether to buy a prefab home for $160,000 or rent, I’ll rent.

If “prices have firmed,” as Ms. Golder suggests, then why are people trying to sell mobile homes for $160,000?

Does that sound reasonable to you? Apparently, some people need a reality check.

Now let’s get back to Shiller’s data. For June, the Case-Shiller 20-City Index rose by 1.0%. According to the June data, prices rose in 18 of the 20 cities. It should be obvious that the two tax credits issued by Washington boosted real estate sales, especially during the spring, as buyers rushed to beat the expiration deadline of these tax credits.

The report also identified Las Vegas as the only city with a price decline, while prices in Phoenix were flat. The biggest price increases from the June data occurred all in Midwestern cities. These are generally cities that experienced a much smaller real estate bubble.

Rather than allow real estate to fully correct, Washington has artificially propped up the market with tax subsidies, which has led to false demand in housing during this period of reported “improvements to the housing market.” Meanwhile, the $1.5 trillion purchase of MBS from Fannie and Freddie has lowered mortgage rates month after month, with minimal improvement to home sales.

Combined, this one-two punch of tax dollars has produced very little short-term improvements. Despite the fact that mortgage rates have hit record lows in 10 of the 11 past weeks, buyers remain subdued. We are now seeing the realities of the real estate market, as sales slide. Soon, prices are going to follow.

Keep in mind the previous tax credits provided support primarily for the lower end of the housing market since the credit offered the largest assistance (on a percentage basis) for lower-priced homes. As well, first-time homebuyers typically purchase lower-end to moderately priced homes.

When the tax credits ended in May, mortgage applications collapsed. In addition, the Commerce Department reported a 32.7% decline in new home sales the following month. This represents the sharpest single-month decline since the Great Depression.

With so much economic data reaching levels not seen since the Great Depression, doesn’t it seem strange that Wall Street and the corporate media and other establishment shills continue to report what they are told by Washington; the recession ended last summer? Hopefully, by now, you realize this is pure fabrication. I discussed this is a recent article (see reference 3).

Analysts were blind-sided by the decline in existing home sales for July (which collapsed to the lowest point on record), despite the fact that this data was largely reflected by the May expiration of the tax credits, since closings typically take 6-10 weeks.

This proves that all real estate, Wall Street and Washington analysts and economists are either clueless or else bold-faced liars. Either way, you should realize by now that you cannot rely on them for accurate guidance (see reference 4).

It should be obvious that housing prices will continue to decline through the remainder of 2010, excluding perhaps a very small one-month bump (a normal short-term retracement during a trend of declines) without additional assistance from Washington or the Fed.

As a result, from my estimates, the 20-city index will likely face another 10-13% decline in prices. Most of these declines will erase the previous gains made over the past several months that have come on the heels of interventions made by Washington at the expense of tax payers.

From an absolute sense based on what I see today, I would not expect to see much of a decline after this amount has been reached. However, the big unknown is when and how rapidly the Fed raises rates. I would not expect to see any appreciable rise in short-term rates before the end of 2011.

Even when prices bottom, you should not misinterpret this as a buying opportunity because real estate prices will face a slow climb for many years. In the meantime, you will be exposed to numerous annual holding costs, such as property taxes, home owners insurance, maintenance, and HOA dues. And let’s not forget that 6% sales commission you’ll be paying to your real estate agent when you sell.

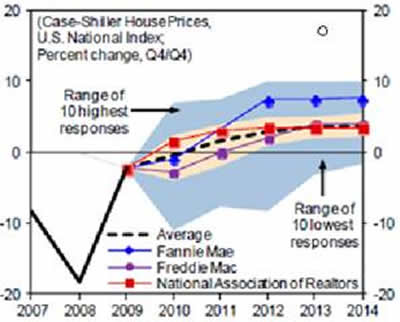

The following chart demonstrates more delusions or cheerleading from Shiller, the NAR and the GSEs. The bottom estimates are the only ones that should be focused on because they are more in-line with reality.

While it is likely that Las Vegas real estate is bottoming, I wouldn’t expect prices to reach previous highs for close to two decades, assuming no additional subsidies of any kind.

As far as the entire U.S., overall housing demand for (at least) the remainder of 2010 is certain to decline further. This is going to drag the economy down even more. In order to quantify this, keep in mind that for Q2 of this year, the housing market added nearly 0.6 percentage points to GDP growth.

Remember, the 2.4% GDP data initially reported for Q2 has since been revised down to 1.6%, as I expected (see reference 5).

Recall that I’ve been warning that GDP data will be revised downward at a later date. I don't expect this trend to end anytime soon because Washington is trying to create optimism, hoping to boost demand.

What does this all mean to investors?

First, GDP estimates have been and will continue to be inflated, as Washington tries to prevent another meltdown in consumer confidence.

Second, despite the numerous radical and unsuccessful attempts to stimulate the housing market as a means to help the economy, we are about to see GDP numbers that better reflect real demand in coming months. And the data is going to be bad. Certainly, these numbers will be inflated as they have in the past. However, the GDP data won’t be propped up with tax payer-funded real estate subsidies.

So, without additional housing stimulus, we are likely to see GDP growth for Q3 that is (at least) 0.6% lower than estimates (note that Q3 data is delayed by a quarter). You can imagine what this is going to do to the stock market.

Meanwhile, the media’s designated “experts” have either been in denial, or else have issued a unilateral direction in their vague forecasts, without knowing how to navigate things. Their purpose is to either restore your confidence in the economy (the Washington and Wall Street hacks) or to make money selling you gold (the extremist perma-bears who have been predicting doom for 20 years).

These extreme sentiments have been designed to cause investors to panic, as they listen to the hacks claim the dollar is headed to 0.

If you aren’t calling the ups and downs of the stock market, the dollar, gold, and so forth, then you are not a credible investment expert. You are a salesman with agendas. And those who listen to these extremists will not fare well. Never forget that.

Now back to reality. In addition to wasting billions of tax dollars, the subsidies have most likely exhausted future real estate purchases to some extent since new home buyers rushed to qualify for the tax credit. These are individuals that might have been around to buy homes in months to come when prices decline. Instead, they are stuck with a home that is most likely overvalued by some 10% on average.

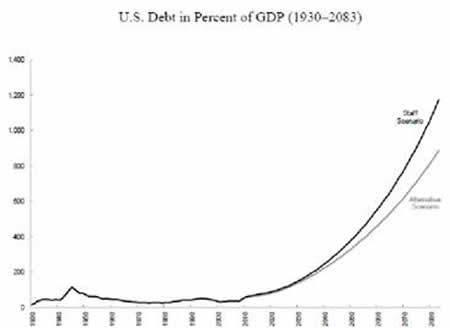

Without further assistance from Washington, we are likely to see very little demand for housing over the next year. In contrast, additional assistance from Washington will only delay the inevitable, all while adding to the nation’s debt burden.

The grave error being made by Washington is thinking that the economy will recover once real estate recovers. This is only true if the tail can wag the wag. A healthy real estate market is reflection of a strong economy. It’s fueled by real demand as the result of low unemployment, good jobs with benefits, and real median wage increases. This is what fuels working-class America, which fuels the economy. The reason why Washington is trying to use the tail to wag the dog is because the economy is being propped up by a bubble, of which real estate has played a significant role.

Washington refuses to address the fundamental problems in the economy (trade policy, healthcare, industry collusion, etc.), so you should expect them to pump the bubble back up so as to create more artificial demand. In fact, as I discussed several months ago, the global bubble has already reflated without ever having a chance to deflate. I will guarantee you this is going to create many more problems in years to come (see reference 6).

Based on the ridiculous outcome of Wall Street reform, it would appear that Washington has created another getaway car for Wall Street once the next bubble implodes.

Americans are sick and tired of the same lip service from those who missed the warning signs of the collapse, as well as those who continue to remain in denial. Americans must demand real solutions from Washington. And they must demand real accountability. Otherwise, this nation will continue to crumble at the hands of the political and corporate criminal elites.

Washington must pull itself out of denial and back into reality. They must ask the critical question: should we let this depression hit hard and fast, or should we spread the effects out gradually over two decades?

It should be clear that Washington intends to continue kicking the can forward, as it tries to delay the inevitable. These useless actions are only serving to pile up enormous levels of debt. As a result, despite how bad things are for many baby boomers, future generations stand to suffer even more as they face the long-term effects of Washington’s irresponsible actions. The best way to run a nation into the ground is to increase long-term debt in order to fuel short-term consumption.

It should be clear that Washington is destroying America’s future, while enriching corporations and their wealthy elite shareholders. They have sold out to Wall Street and corporate interests. As it stands today, Washington represents a national security threat to the people of America because they are destroying the nation’s job base, living standards and freedoms.

Even the short-term solutions are hurting many Americans while benefiting the banks. Taking over where Wall Street left off, Washington has snookered millions into buying homes that were overpriced, using tax dollars.

In reality, the housing subsidies provided more relief to Fannie, Freddie and the banks than to home buyers. With much of the nation’s homeowners underwater, the tax subsidies allowed millions to sell their homes at a reduced rate, rather than send the keys to the bank. This obviously lightened the risk for the banks holding these mortgages.

This represents yet another tax payer bailout for the banks the media never discusses. The larger one of course is due to the near 0% interest rates, which is allowing banks to use YOUR money to buy U.S. Treasuries and collect the spreads.

How is it your money if it’s being supplied by the Fed? By artificially keeping interest rates down, this is interest that should be going to you. But one can never cheat the system. These actions will be felt in consumer prices down the road.

Since the onset of the collapse of the real estate bubble, price declines through the first half of 2009 have wiped out about $7 trillion of the $10 trillion of housing equity created by the bubble.

Over the next year I expect an additional $1 trillion to vaporize. The remaining $2 trillion, when spread out through several years will be absorbed into the housing market.

What does all of this mean?

You should expect growth (if we can even label it that since it has come on the heels of tax subsidies) to continue to slow without further stimulus. Consumption is still quite high relative to incomes. I expect the trend of waning consumption to continue, as the poor effect spreads throughout the nation. This is going to create a chain-reaction, which will reach the stock market…again.

As you know, for over a year I have been insisting that the stimulus plan (ARRA) represents the first of many more stimulus packages to come over the next several years. I have not altered my opinion. Washington intends to adhere to its reckless strategy of trying to print its way out of this mess.

Washington and the Federal Reserve are relying on the ability to export a good deal of inflation to the rest of the world via the dollar-oil link, as they have for many years. Meanwhile, the vulnerability of this link is growing through Washington’s continued unilateral financial, military and political support for Israel.

In the past, Israel provided value as an ally in the Middle East to keep on eye on the enablers of the dollar; the Saudis, who have ensured the dollar’s standing as the universal currency via the dollar-oil link. However, Israel no longer offers any benefit whatsoever to the U.S., now that America has established a permanent military base in Iraq.

As for shorter-term considerations, as I discussed a few months ago, the 5.9% (revised down to 5.6%) GDP growth reported for Q4 2009 was largely the result of restocking inventories. Hence, it did not represent real demand; only anticipated demand.

After factoring the component due to restocking, the real GDP came in at 1.8%. Going forward, GDP is more likely to represent real (or final) demand. Over the next four quarters, without further assistance from Washington, GDP growth could easily fall below 1.0%.

Similar to the case with inflation and employment data, GDP is not to be relied upon for its gauge of the strength of the economy (see references 7 and 8).

As I have been saying for some time now, the first area within the U.S. that will recover (in a relative sense) will be Northern California, specifically the San Francisco Bay Area. As far as real estate, we are seeing early signs of a recovery in the city by the bay. As real estate values continue to remain suppressed or head south in most of the nation, prices in San Francisco have soared by nearly 20% over the past year.

So why do I feel that the San Francisco area will be the first to recover? After all, Governor Schwarzenegger has called a fiscal state of emergency for California many times in the past two years, including his latest plea a few weeks ago, as the state struggles to close a $19 billion deficit.

States by law are required to close all deficits since they cannot print money. And because the fiscal year begins in July for most states, that means one of two things. Either Washington must come to California’s aid, or further cuts must be made. The Governor is asking for more furloughs, this time, 3 days per month at no pay.

San Francisco is much different than the rest of California. Other than San Diego, which I feel will also recover faster than most areas, Southern California’s economy is based largely on the media industry. In contrast, San Francisco is the high-tech capital of the world. As such, when jobs are created they have a multiplier effect. However, you should not gauge the progress made in the San Francisco real estate market as a barometer for the rest of the U.S.

Mortgage rates hit another record low for the fifth time in six weeks (updated now to the tenth time in eleven weeks), all while foreclosures are up in 75% of U.S. cities relative to a year ago, now at 1.65 million for the first half of 2010.

That number was down by 5% from the last half of 2009, but up by 8% from the first half of 2009. In the first half of 2010, 1 out of every 78 households received at least 1 foreclosure filing. I suppose that’s what a “recovery” looks like in the eyes of idiots and liars.

Today, there are an estimated 5 million homes that are seriously delinquent, meaning that it’s likely that most if not all of these will add to the already huge pool of foreclosures.

If Washington or the Federal Reserve adds yet another gimmick to help the housing market, this will only add to the nation’s long-term solvency risk.

Washington can make the same mistake of adding to long-term debt to increase short-term consumption, or it can let the real estate market finish out its correction naturally. By now, you should realize which option they will take.

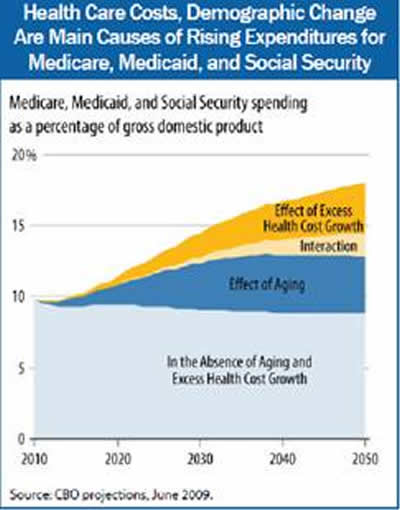

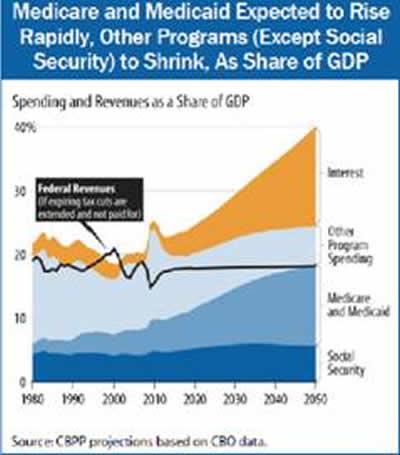

With intense pressure mounting to cut Social Security, Medicare and Medicaid benefits as well as hike taxes across the board, there is hardly any room for further tax payer subsidies to fuel the housing market, especially considering that these programs have been ineffective (see reference 9).

I warned about the entitlement tsunami in America’s Financial Apocalypse. Four years later, the situation is much worse as you can imagine. Since then, I have discussed this huge problem on numerous occasions. In fact, while everyone else was taken in by the financial crisis, I was already warning people that the entitlement problem would be next (see reference 10).

As discussed in the August issue of the AVA Investment Analytics newsletter, pension plans remain underfunded and the severity is increasing due to low interest rates.

With the stock market down by nearly 30% from its 2007 highs, this too is escalating the funding deficits of pensions. I also detailed the pension problems in America’s Financial Apocalypse, however as you can imagine, it’s in much worse shape today. From my estimates, the total amount by which all U.S. pensions (public and private) remain underfunded is about $3 trillion.

The baby boomers pose an additional problem. Not only will they be putting up their homes for sale over the next two decades (serving to keep existing inventories high), they will be faced with lower benefits from Social Security and Medicare (also detailed in America’s Financial Apocalypse).

Moreover, upon any signs of a recovery in the stock market, many of the boomers are likely to withdrawal assets from their 401(k) plans in order to ensure they have enough money to see them through the rest of their lives. As you can imagine, this too will affect the stock market and housing market, but it will have a slow, gradual effect that isn’t likely to be recognized by many.

Furthermore, ObamaCare certainly will not provide any improvements to the mediocre quality of U.S. healthcare. Meanwhile, the massive rate of healthcare inflation will continue (see references 11-14).

In response to healthcare inflation, Washington will continue to slash Medicare and Medicaid benefits while raising payroll taxes and monthly premiums until both programs resemble private insurance. This too will have a gradual but very real effect on the housing market because the ridiculous costs of healthcare will continue to eat up wages of older Americans, many of which will be forced to sell their homes.

I have addressed the problems of U.S. healthcare in previous articles (see reference 15). I have also documented the problems is great detail while offering a viable and cost-effective solution in my new book, America’s Healthcare Solution. But of course, America’s bought-off media monopoly continues to ban me as a way to hide the truth from Americans. http://www.americashealthcaresolution.com/

DO NOT FORGET

We have still seen not one person go to prison for this collapse. Hundreds if not thousands of Wall Street “professionals” should be in prison for committing securities fraud. Instead, as Wall Street’s Puppet-in-Chief, Obama continues to distract the American people with other issues, like the BP oil spill.

Meanwhile, the SEC continues to distract Americans with Bernie Madoff, Allen Stanford and other small players, while refusing to go after the big fraud, such as the illegal seizure of Washington Mutual, criminal acts by JP Morgan and the indictment of Wall Street executives their role in the multi-trillion real estate securities Ponzi scheme.

Fooling the people further, the SEC placed wrist slap on Goldman Sachs after settling for a mere $550 million (from a paltry $1 billion initial lawsuit) for criminal acts largely responsible for the sub-prime crisis. That sounds like a damn good deal to me. Defraud investors by tens of billions of dollars and pay a fine of $550 million with no criminal prosecutions. And, use your insider, U.S. Treasury Secretary Paulson to get a $20 to $30 billion bailout by convincing Washington pinheads to bailout AIG.

As a result of these tricks, Americans have been distracted from demanding justice.

Welcome to the United States of America, land of the sheeple; the most corrupt nation on earth, where white collar crime pays as long as you have friends in Washington; where the media remains as the biggest enemy of the sheeple; and where clowns are positioned as experts within the media, so as to restore your faith in Wall Street when the extremist predictions of the perma-bears fail to pan out.

While Obama had no problem making BP halt its stock dividend and begin criminal investigations as to the cause of the oil spill, he continues to allow the banks to use tax payer funds to pay stock dividends.

Mention of indictment for securities fraud is a no-no, not only in Washington, but also by everyone in the media. If you think the guys in the media club are really on your side, you need to ask them why they have never called for the indictment of Wall Street executives for securities fraud.

None of the members of the media club would ever say anything to upset their media gravy train, for it would threaten to end their link to the sheep who watch. The media’s so-called experts only care about bringing in money, selling their useless books and services. And the best way to do this is to sell out to the media.

Always remember, marketers spend most of their time in marketing activities. Real investment strategists are doing research and servicing clients. This explains the huge differential in my track record and those of the designated “experts” selected by the media. You need to spend more time research track records rather than paying attention to the media. Once you do, you’ll figure out how the game is played.

Once you become familiar with my track record, you will know why the media has banned me. They work for Wall Street, corporate America and Washington. They don’t want you to know the truth.

The media only selects sell-outs who will preserve their agendas. These sell-outs value their own bank accounts much more than the truth. That’s why they have been selected. That’s also why they all have horrendous track records.

I discussed the details of the tricks played by the media in my previous article (see reference 16).

At AVA Investment Analytics, we advise financial institutions, financial advisers, corporations and venture capital firms. We consider any insights we deliver to retail investors as a public service.

If you want the unbiased truth, world-class research and guidance covering economic analysis of the U.S. economy and the global economy, U.S. stock market forecasts for the U.S., China, India, Brazil, securities analysis, foreign currency forecasts, top-notch investor education, you should subscribe to the AVA Investment Analytics newsletter today. We provide one of the most comprehensive and insightful investment newsletters in the world. More important, we get things right, ahead of time. www.avaresearch.com

References

1 http://www.avaresearch.com/article_details-238.html

2 http://www.avaresearch.com/article_details-160.html

3 http://www.avaresearch.com/article_details-605.html

4 http://www.avaresearch.com/article_details-480.html

5 http://www.avaresearch.com/article_details-605.html

6 http://www.marketoracle.co.uk/Article18482.html

7 http://www.avaresearch.com/article_details-133.html

8 http://www.avaresearch.com/article_details-134.html

9 http://www.avaresearch.com/article_details-519.html

10 http://www.avaresearch.com/article_details-83.html

11 http://www.avaresearch.com/article_details-487.html

12 http://www.avaresearch.com/article_details-423.html

13 http://www.avaresearch.com/article_details-380.html

14 http://www.avaresearch.com/article_details-280.html

15 http://www.avaresearch.com/article_details-614.html

16 http://www.avaresearch.com/article_details-605.html

By Mike Stathis

www.avaresearch.com

Copyright © 2010. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.