Why the Fed's US Interest Rates Policy Will Fail

Interest-Rates / US Interest Rates Oct 01, 2007 - 08:28 AM GMTBy: Gerard_Jackson

It was only it was last August that I told readers not to be surprised if the fed cuts the funds rate. (US financial markets rocked — what is really happening ). Lo and behold, on September 18 the fed cut by 50 bps, reducing the funds rate to 4.75 per cent. The cut immediately ignited share prices, with the Dow Jones industrial average surging by 335 points. The only surprising thing is that anyone was actually surprised. That the first effect of a credit expansion is usually felt on the stock market seems to have eluded the commentariat 1 .

It was only it was last August that I told readers not to be surprised if the fed cuts the funds rate. (US financial markets rocked — what is really happening ). Lo and behold, on September 18 the fed cut by 50 bps, reducing the funds rate to 4.75 per cent. The cut immediately ignited share prices, with the Dow Jones industrial average surging by 335 points. The only surprising thing is that anyone was actually surprised. That the first effect of a credit expansion is usually felt on the stock market seems to have eluded the commentariat 1 .

There is no doubt in my mind that the inability of financial and economic commentators to get it right on so many economic issues boils down to a combination of lousy economics and an ignorance of economic history. Now economic history is not much help unless you have the economic theory to go with it. So let us once again take a trip down memory lane to the year 1927. It was July and the inter-central bank conference in New York was winding up when Benjamin Strong, Governor of the Federal Reserve Bank of New York, told Charles Rist, Deputy Governor of the Bank of France, that he was going to give the US economy a boost.

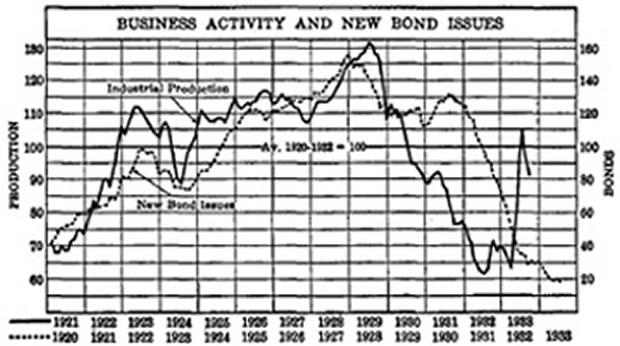

I'm not as hard on Strong as some people. The man — like so many then and now, including Bernanke — had bought into the price-stabilization fallacy. So when the productivity-induced fall in prices made its appearance in 1925 and into 1926 Strong felt the need to do something. Hence his comment to Charles Rist. To get a perspective on the consequences of Strong's monetary policy we should note that the Standard and Poor index 2 for June 1921 stood at 65.5. By June 1927 the index had risen to 148.9, a 127 per cent increase. Thanks to Strong's lack of economics his “injection of liquidity” sent the index zooming from 148.9 to 313.0 in September 1929 — an increase of 52.4 per cent in about 2 years. The following chart will give you some idea of just how quickly the stock market was affected by Strong's monetary meddling.

|

| Source: The Cleveland Trust Company Bulletin, October 15, 1932, Vol. 14, No. 10. Cited in C. A. Phillips, T. F. McManus and R. W. Nelson's A Study of the Great Depression in the United States , The Macmillan Company, 1937. |

So much for the “New Era” and “permanent prosperity”.

Strong's monetary policy was described by Keynes as a “triumph” — a triumph whose economic and political denouement was the Great Depression. Yet Keynes became the hero while Fisher — who had also agreed with Keynes that the boom-bust cycle had been conquered — lost his fortune and his credibility while Keynes was praised for his “economic wisdom” and “genius” .

(There is a cruel irony here. Irving Fisher argued that “stock prices have reached what looks like a permanently high plateau”. Now in his paper Is There Inflation in the United States?, 1 September 1928, Keynes enthusiastically endorsed Fisher's optimism, only to admit in 1930 that he had been mistaken about inflation. Yet Keynes' views were simply flushed down the memory hole by his rapidly-growing band of disciples).

The 1930s economic tragedy brings us to the present. Despite the lessons of the past the fallacy of a stable price level is still strongly held by the overwhelming majority of economic commentators including professional economists. This is due to the peculiar belief that falling prices are by definition deflationary and will thus depress business activity and raise unemployment. This view makes no distinction between a money-induced fall in prices caused by a monetary contraction and falling prices caused by rising productivity.

This argument is frequently used by the likes of Tom Nugent and Lawrence Kudlow who believe that so long as prices are comparatively stable there is nothing to worry about. But as soon as increased productivity begins to lower prices they call for an expansion of the money supply to meet the additional “demand for money”. But as Lord King rightly pointed out in 1803:

...it must follow that there is no method of discovering a priori the proportion of the circulating medium which the occasions of the community require; that it is a quantity which has no assignable rule or standard ; and that its true amount can be ascertained only by the effective demand [emphasis added]. ( A Selection of Speeches and Writings of the Late Lord King , Longman, Brown, Green, and Longmans, 1844, p.72).

What today's commentariat has not grasped — with the exception of the Austrians — is that falling prices due to rising productivity benefits everyone by spreading the fruits of increased investment more in line with market-induced changes in the value of factors' productivity, particularly labour. By attempting to stabilise the price level and hence the purchasing power of the monetary unit the fed effectively distorts this process. In doing so it Inadvertently denies many American workers the increases in real incomes that they would have otherwise enjoyed. It was the dangerous policy of stabilisation that drove Phillips, McManus and Nelson to charge that

the end-result of what was probably the greatest price stabilisation experiment in history proved to be, simply, the greatest depression. (Ibid. p.176).

Sound economics and economic history teach us is that these monetary injections eventually work themselves out leaving the market to liquidated the malinvestments and the over-valued shares. Of course, the fed can make further monetary injections, but this would not merely delay the unavoidable adjustment process it would make it even more painful. Unfortunately, fed officials and the majority of politicians are not in the market for an alternative economic analysis.

1. Credit expansion does not always stimulate output. No matter how low interest rates may be, so long as there is no apparent prospect of profits very little investment will take place. This is exactly what happened in the 1930s thanks to the ‘economic policies' of Hoover and Roosevelt.

2. Taken from Standard and Poor's and Cowles data monthly series on stock prices, dividends, The original price index was multiplied by ten.

Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.