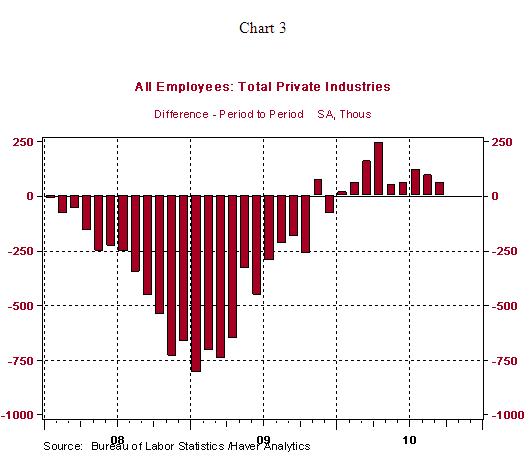

September Employment Situation Data Reinforces Expectations of QE2 on November 3rd

Economics / Employment Oct 09, 2010 - 04:07 AM GMTBy: Asha_Bangalore

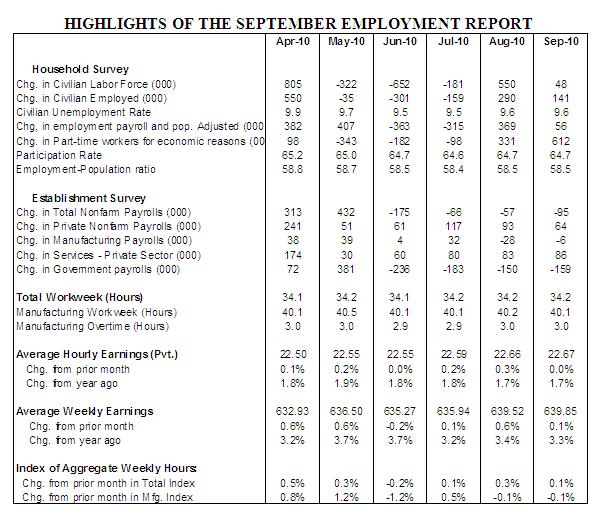

Civilian Unemployment Rate: 9.6% in September, virtually steady for four straight months. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low for the expansion that ended in December 2007 is 4.4% in March 2007.

Civilian Unemployment Rate: 9.6% in September, virtually steady for four straight months. The unemployment rate was 5.0% in December 2007 when the recession commenced. Cycle high for recession is 10.1% in October 2009 and the cycle low for the expansion that ended in December 2007 is 4.4% in March 2007.

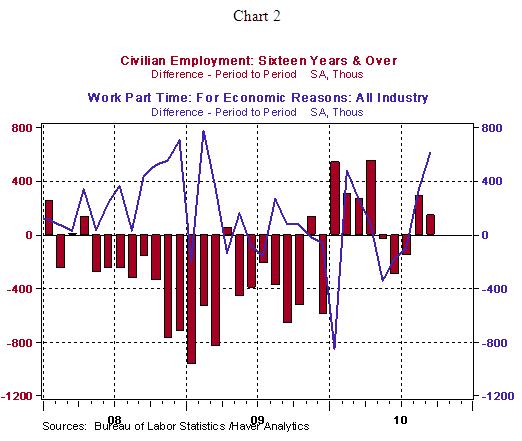

Payroll Employment: -95,000 in September vs. -57,000 in the prior month. Private sector payrolls rose 64,000 in September after an upwardly revised gain of 93,000 in August. A net gain of 36,000 private sector jobs after revisions of payroll estimates for July and August.

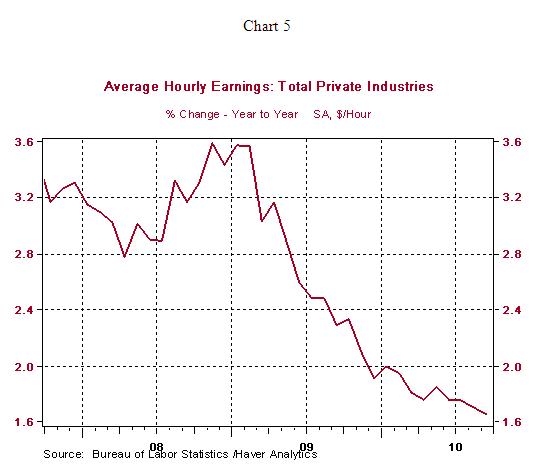

Private Sector Hourly Earnings: $22.67 in September vs. $22.66 in August, 1.7% yoy increase in September matching the August gain.

Household Survey - The unemployment rate held steady at 9.6% in September. The jobless rate has failed to budge noticeably in the last two quarters (see chart 1).

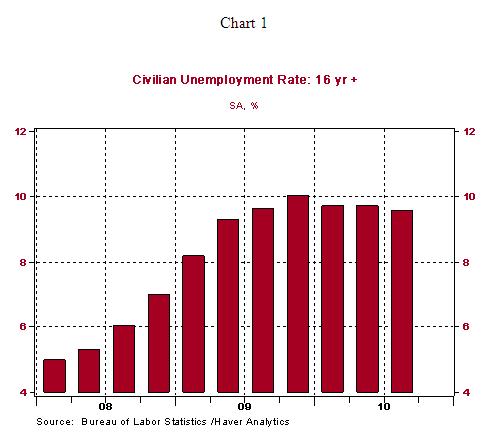

In September, the steady unemployment rate resulted from a large increase in part-time employment (see chart 2). The number of persons employed part time for economic reasons increased 612,000 during September, raising the level to 9.5 million. During the August-September period this tally has risen by 943,000. The broad measure of unemployment increased to 17.1% in September from 16.7% in August.

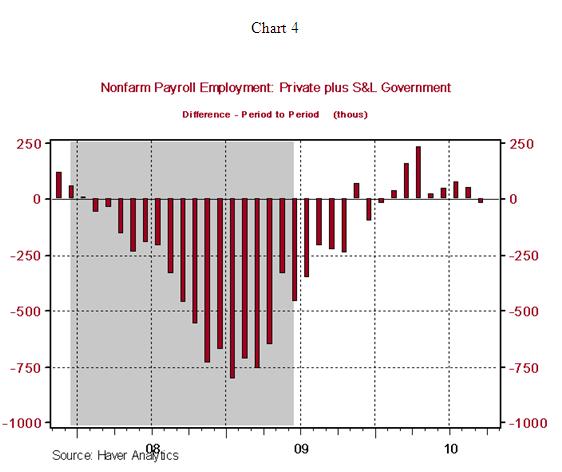

Establishment Survey - Total nonfarm payrolls fell 95,000 in September vs. a loss of 57,000 jobs in August. The headline number continues to reflect changes in temporary Census-related employment. Private sector payrolls rose 64,000 in September after an upwardly revised increase of 93,000 in the prior month. In the third quarter, private sector hiring has risen 91,000, on average vs. an increase of 118,000 private sector jobs in the second quarter. This decelerating trend of hiring is an important factor supporting further easing of monetary policy as early as the November 2-3 FOMC meeting.

In addition to the loss of 77,000 temporary Census 2010 workers from federal payrolls in September, 76,000 local government employees and 7,000 state government employees lost jobs. The budgetary pressure of state and local governments has translated into a significant paring back of their payrolls. In the last three months, state and local government employment has declined 162,000, with the largest toll recorded in September. Consequently, nonfarm employment measured by private sector jobs and state and local government jobs fell 19,000 in September vs. advancing in the February-August 2010 period (see chart 4). This measure of employment excludes the temporary impact of the Census-related employment. Essentially, the supply side of the labor market is beset with pressures from a loss of jobs in the private sector and state and local government sector.

Other details of the September payroll data are listed below:

Construction: -21,000 vs. +31,000 in August

Manufacturing: -6,000 vs. 28,000 in August

Autos: +600 vs. -22,200 in August

Private sector service employment: +83,000 vs. +86,000 in August

Retail employment: +6,000 vs. -2,000 in August

Professional and business services: +14,000 vs. +28,000 in August

Temporary help: +16,900 vs. +17,700 in August

Financial activities: -1,000 vs. -3,000 in August

Health care employment: +23,900 vs. +30,600 in August

In September, the average workweek held steady, while the factory workweek was slightly shorter (40.1 hours vs. 40.2 hours in August). The shorter factory workweek and drop in employment suggest a decline in industrial production during September. Average hourly earnings rose 1 cent in September to $22.67; this combined with a drop in overall payrolls is indicative of a small drop in personal income during September. The downward trend of the year-to-year increase in hourly earnings supports the Fed's concern of inflation holding at levels below price stability.

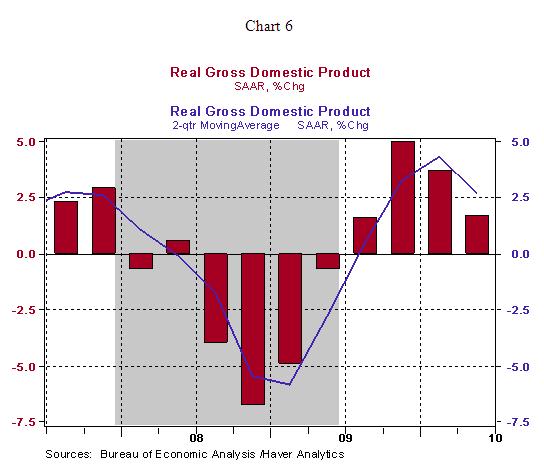

Conclusion - The Fed is widely expected to engage in another round of quantitative easing (QE) at the close of November 2-3 FOMC meeting, with the September employment data offering support for this prediction. QE2 is justified on the grounds that the economic activity has probably shifted to a snail's pace in the second-half of 2010. The economy grew at an average pace of 3.3% in the last two quarters of 2009 followed by a 2.7% increase in the first-half of 2010, with a significantly smaller increase predicted for the second half of 2010.

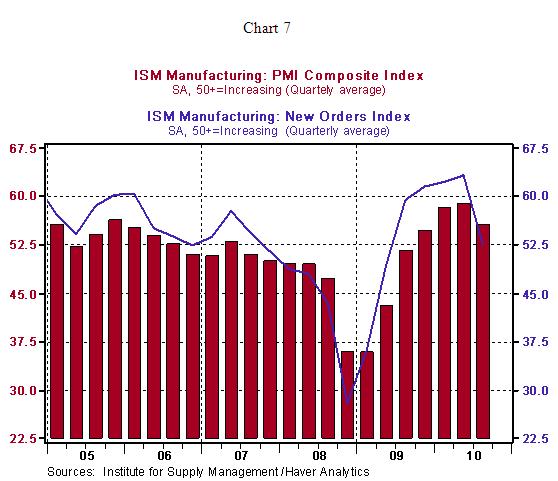

The ISM manufacturing survey results, particularly new orders, indicate that factory activity advanced at a slower pace in September compared with August and the third quarter averages of both the composite and new orders indexes have fallen short of even matching the second quarter numbers.

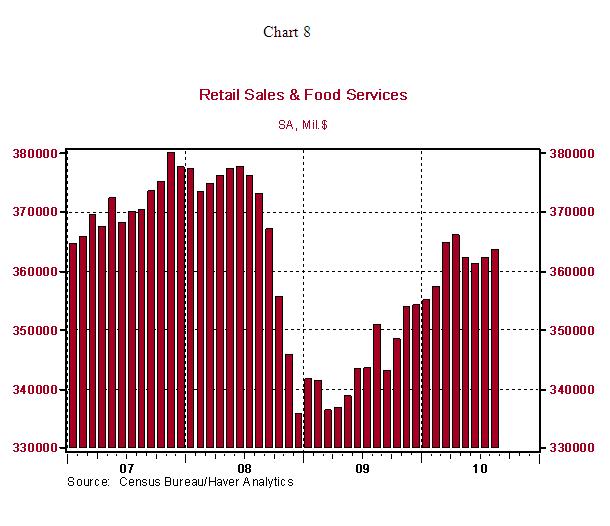

The details of the September employment report send a similar message of more sluggish hiring conditions in the third quarter compared with the second quarter. Retail sales in the July-August period show a tepid gain, while the tally for September will be published on October 15. The small increase in auto sales during the third quarter (11.6 million vs. 11.4 million in Q2) is noteworthy but inadequate. With the exception of an increase in the Pending Home Sales Index in July and August, housing market indicators present a source of significant concern. In sum, QE2 is on the table for November 2-3 FOMC meeting. The nature of QE2 is uncertain; it most likely the Fed will tie the magnitude and duration of QE2 to the performance of key economic variables that reflect its dual mandate of full employment and price stability.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.