Hyperinflation Multi-Trillionaires and Commodity Bubbles

Stock-Markets / HyperInflation Oct 15, 2010 - 01:34 PM GMTBy: PhilStockWorld

Is it time to throw fundamentals out the window?

Is it time to throw fundamentals out the window?

The boy from Zimbabwe is a multi-Trillionaire and those Trillions should be just enough to buy him a loaf of bread if he hurries to the store before they change the prices this morning. This is what is happening to our own economy, only on a smaller scale (so far). Our government, like Zimbabwe, has gotten into so much debt that they can never hope to repay it but new bills keep coming in every day so - What is a government to do?

Why print more money of course!

Now, when a bill comes in, they just crank up the presses and drop the fresh bills in an envelope. Unfortunately, after a while, the people who provide goods and services paid for by you and your government, begin to catch on that those bills are suddenly very easy to come by, and they begin to demand more and more of them as exchange. It’s a little hard to picture unless you run it into the abstract but think of it like an auction, where 5 people have $5 each to bid on 5 items. Well those items (commodities) will get somewhere between $0 and $5 from the bidders, right? Now, what happens if one of the bidders prints himself up $45 additional dollars? Now he can bid $10 on each item and the other bidders will get nothing.

That’s what the top 1% are doing with commodities and other assets right now. The assets are the same assets they were last year and the year before that. There has been very little variation between supply and demand and demand has probably gone down a bit during the recession but that doesn’t matter as 1% of the people have MUCH more money than the other 99% and they are all racing to snap up the commodities (gold, oil, homes, wheat, stock certificates, copper…) before even more money is printed as they fear THEY may get squeezed out of the bidding by whoever gets their hand on the next round of newly minted cash.

This only works as long as you stay inside your little vacuum of a profligate nation. Should our friend from Zimbabwe try to take his Trillions over to your house in America, he will be very surprised to find that a loaf of bread in America is $2 and not 0.20 (US) that he’s used to paying at home. Not only is he not a Trillionaire in America - he can’t even afford enough bread to make a sandwich! This, to a smaller extent, is what happens to us when we go to Europe or Japan.

It was fairly horrifying for us to read a Fed report where they make the following statements:

- the pace of the economic expansion slowed in recent months

- Housing activity weakened further, and nonresidential construction remained depressed

- Capacity utilization… was still substantially below its longer-run average

- Real disposable personal income declined a bit in July

- The personal saving rate edged down in July

- home prices moved down in July

- Sales of existing homes fell substantially in July

- consumer confidence remained downbeat in August and early September

There’s more but it’s just too depressing to go on! Clearly July sucked but it doesn’t seem like things turned around much in August or September either. That’s not the distressing part. The distressing part is that all this TERRIBLE economic data leads the Fed to conclude that the best solution for this would be to create more money. Perhaps if they gave it to the American people that would be a good idea but they are not doing that! They are using that money to buy TBills and to buy bad assets from their Bankster buddies - this is money the Treasury already owes and money the Banksters already lost - it doesn’t flow into the economy - it only flows to pay off existing debts by devaluing your own money (12.5% since May!) as a stealth tax on all Americans.

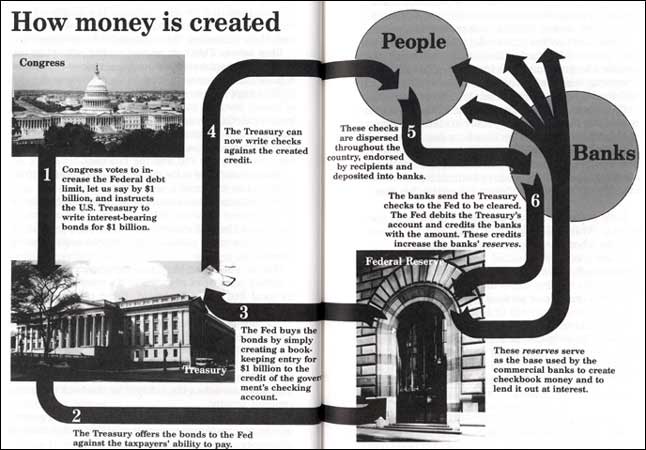

As I illustrated Tuesday, not only is this money NOT moving through the economy but it’s slowing down - effectively, the $2Tn the Fed created in the past two years and however many hundreds of Billions of Dollars they plan to create now is barely enough to keep transactions of all kinds from grinding to a halt in America. In the above chart - the missing step is giving money to the people. We aren’t doing that at all. The Fed is giving money to banks who already lost the money and they are giving it to the Treasury who use it to fund a massive deficit and to refinance their own $15Tn debt.

The less people money is given to (and increased wages or tax redistribution are the only ways to get money to the working class - neither one being very popular with Capitalists), the more the wealth gap increases.

Going back to the auction model - if our 5 items are 5 meals and the 5 workers used to work 1 day to make $5, they all get to eat. But if that one person ends up with $50 inflated dollars and the other workers don’t have the opportunity to get the same, then one person can buy 5 meals for $10 each and the other 4 starve. After missing a few meals, the other 4 people may demand more than $5 for a day’s wages as they clearly need $10 to buy a meal, right?

Well, that only works if the guy with $50 shows restraint. If the other 4 men show up the next day with $10 each and our rich friend still has $50, he could bid $11 for 4 meals and leave one meal for the other 4 men to fight over. Until they have $17 each (a 240% rise in their salaries) then 2 of the 4 workers will continue to starve every day while the rich man consumes 3 meals. If, during the time the workers go from $5 to $17 the rich man gets an "inflation-adjusted" increase of 240% as well, he will have $170 to spend and now, not only can he pay $18 each and take all 5 meals, but he has greatly benefited from inflation as he now has $80 LEFT OVER, where at $50 he had none.

So inflation does not benefit those who have no assets to begin with - it only serves to greatly widen the wealth gap and right now our Government and the Fed is pursuing an insane strategy of prioritizing paying off bondholders (generally the rich) and inflating assets (generally held by the rich) and ignoring commodity inflation (only noticed by the poor) in order to extend and pretend with their own very bad debt situation.

The reality of our situation is that we owe more money than we can afford to pay so we have to restructure our debts and come up with a more realistic budget that would demand sacrifices from everyone - and that would include having those that have more pay more while those who have less would have to get less from the government as well. Should we default, then people who lend us money in the future will probably demand a higher rate of return in the future, as a reward for taking the risk of lending us money. That would naturally push rates up but the restructuring and balancing of our economy would make our currency strong again and all who hold or earn dollars would benefit.

That’s not going to happen, of course. What is happening is the Fed is probably going to create another $500Bn out of thin air and the $6Tn of cash that is held by the American people will devalue another 10% in purchasing power. Will that be enough to send stocks (an asset that is exchanged for dollars) up another 10%? That remains to be seen but we have to allow for the possibility as the last $2Tn the Fed pumped in was good for a run in the S&P from 800 to 1,200 (50%). Of course, adding $2Tn to $4Tn is not the same as adding $500Bn to $6Tn so we get to a point of diminishing returns but, as members of the top 10% - we sure don’t want to get thrown into the bottom 90% as we miss the inflationary boat!

How low can the Dollar go (see Dave Fry’s chart)? 88 to 77 in 5 months is an AMAZING 2.5% PER MONTH decline in the purchasing power of the money you worked your your whole life to accumulate. Adding insult to injury, the one asset class that isn’t rising with the rest is your home - for middle class America, that is their main and often ONLY asset. Possibly you can argue that 12.5% inflation in 5 months has stopped homes from falling 12.5% so Yay!, I guess…

So our "bullish" premise is that the Fed will shower the economy with money and, based on that, of course it’s logical to buy Netflix for 55 times this year’s projected earnings. We are literally holding our nose and buying at these levels but we do seem to find things to buy - the hard part is not to take too many short positions - tempting though they may be. The key is not to fool ourselves - we are well aware that the stock gains are generally an illusion.

In the auction we talked about - what happens to the "value" of the $10 food if the guy with $50 fails to show up and then you have 4 guys with $10 bidding on 5 items? That’s the way our "value" vanished so quickly in 2008 - the Emperor had no clothes and as soon as one little boy pointed his finger and laughed - demand literally went from all to nothing overnight.

So let’s keep a very close eye on that dollar index and also note that about $500Bn worth of QE2 is already priced into the markets so anything less than that will likely be a disappointment. How much and how fast will the Fed come to our rescue remains to be seen but, in the meantime - let’s be careful out there.

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.